Connecticut Self-Employed Independent Contractor Questionnaire: A Comprehensive Guide The Connecticut Self-Employed Independent Contractor Questionnaire is an essential document utilized by the State of Connecticut Department of Labor to determine whether an individual working as an independent contractor meets the criteria for self-employment. This questionnaire plays a crucial role in classifying workers and distinguishing between employees and independent contractors. It helps solidify the employment relationship, ensuring compliance with state regulations and obligations. Keywords: Connecticut, self-employed, independent contractor, questionnaire, Department of Labor, workers, compliance, regulations, employment relationship Types of Connecticut Self-Employed Independent Contractor Questionnaires: 1. Standard Self-Employed Independent Contractor Questionnaire: This version of the questionnaire is the most commonly used and encompasses a range of questions designed to assess the nature of the working relationship, level of control exercised by the worker, financial aspects, and other relevant factors. The questionnaire focuses on the individual's scope of work, autonomy, provision of their own tools and equipment, risk-taking, and potential for profit or loss. 2. Industry-Specific Independent Contractor Questionnaire: Connecticut recognizes that different industries may have unique characteristics influencing the classification of independent contractors. Certain sectors, such as construction, nursing, or information technology, have specific guidelines to determine proper classification. The industry-specific independent contractor questionnaire tailors the questions to the specific industry, thus providing a more accurate evaluation of the individual's status and compliance. 3. Non-Profit Organization Independent Contractor Questionnaire: For individuals working as independent contractors within the non-profit sector in Connecticut, a specialized questionnaire has been developed. This questionnaire takes into account the distinct characteristics of non-profit organizations, such as volunteer involvement, grant-funded projects, or work performed for charitable purposes. It assists in assessing if the individual qualifies as an independent contractor or if they should be classified as an employee. 4. Routine Audit Independent Contractor Questionnaire: In case of routine audits conducted by the Connecticut Department of Labor, a separate version of the self-employed independent contractor questionnaire is used to ensure compliance with state regulations. This questionnaire emphasizes the accuracy and completeness of previously submitted forms, along with capturing any changes that may have occurred since the original filing. 5. Misclassification Investigation Independent Contractor Questionnaire: In instances where a misclassification investigation is initiated, either upon a complaint or randomly selected, the Department of Labor employs a specific questionnaire tailored to uncover possible instances of worker misclassification. This comprehensive questionnaire focuses not only on the worker's circumstances but also on the employer's practices, contractual agreements, and other relevant factors that may impact the proper classification of workers. It is important for both individuals and employers in Connecticut to thoroughly understand and complete the appropriate self-employed independent contractor questionnaire to ensure compliance with state regulations and avoid potential legal and financial consequences. The precise evaluation of an individual's employment status helps maintain a fair working environment and protects the rights and benefits of workers across various industries.

Connecticut Self-Employed Independent Contractor Questionnaire

Description

How to fill out Connecticut Self-Employed Independent Contractor Questionnaire?

US Legal Forms - one of the largest libraries of lawful types in America - gives a wide range of lawful papers templates you are able to acquire or print out. While using website, you will get a huge number of types for company and person functions, sorted by classes, says, or keywords.You can get the newest types of types like the Connecticut Self-Employed Independent Contractor Questionnaire in seconds.

If you already possess a registration, log in and acquire Connecticut Self-Employed Independent Contractor Questionnaire through the US Legal Forms collection. The Download option will show up on each and every type you look at. You get access to all in the past delivered electronically types from the My Forms tab of the profile.

In order to use US Legal Forms the very first time, listed here are straightforward recommendations to help you get started:

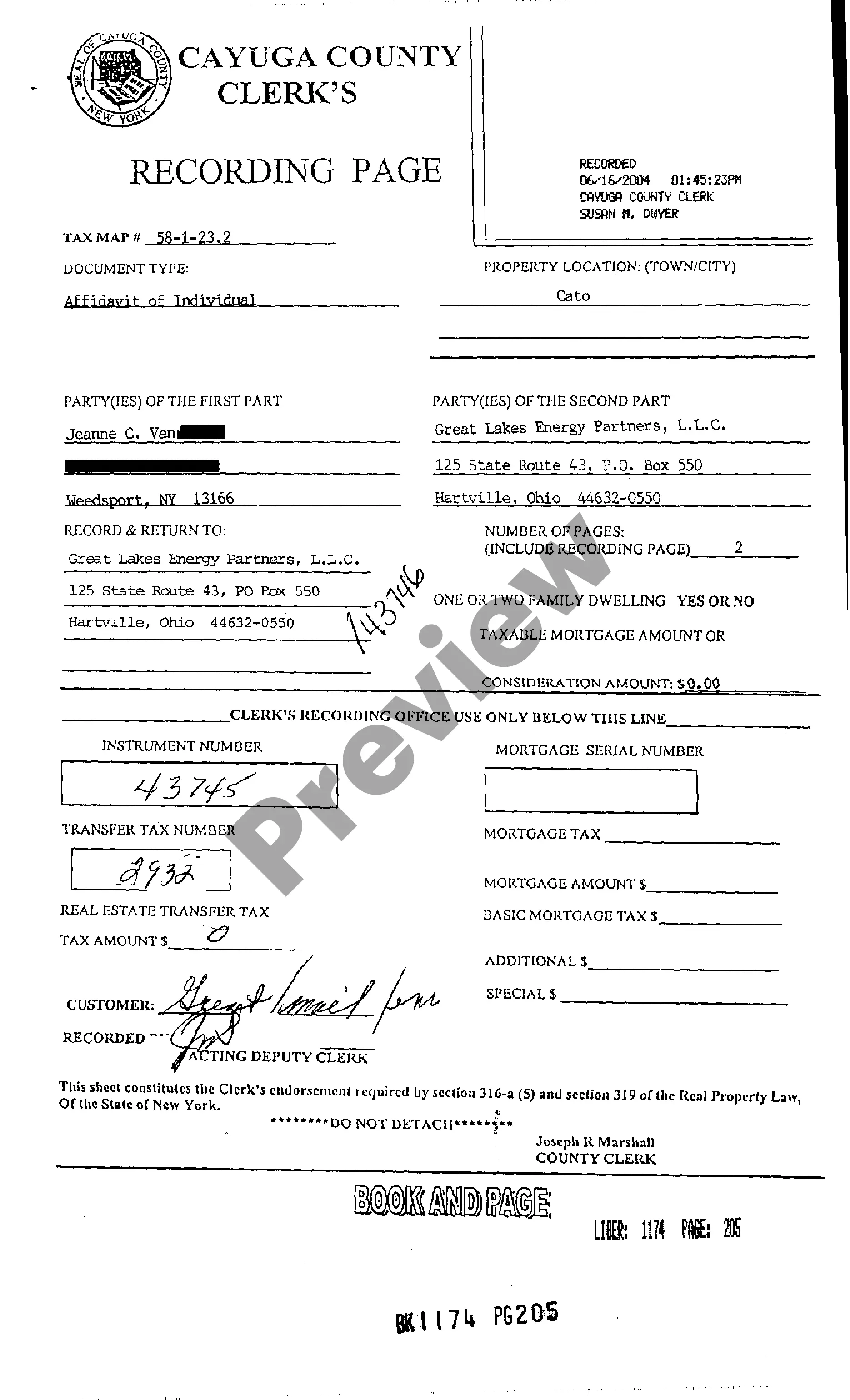

- Make sure you have selected the proper type to your city/county. Go through the Preview option to analyze the form`s content material. See the type explanation to actually have selected the proper type.

- In the event the type doesn`t match your requirements, utilize the Search area at the top of the display screen to obtain the one that does.

- When you are satisfied with the shape, validate your selection by clicking on the Buy now option. Then, select the rates program you want and supply your credentials to sign up to have an profile.

- Procedure the deal. Make use of charge card or PayPal profile to perform the deal.

- Select the formatting and acquire the shape on your product.

- Make modifications. Load, change and print out and indication the delivered electronically Connecticut Self-Employed Independent Contractor Questionnaire.

Every single web template you included with your account does not have an expiration date and is your own permanently. So, if you want to acquire or print out yet another duplicate, just visit the My Forms portion and click in the type you need.

Gain access to the Connecticut Self-Employed Independent Contractor Questionnaire with US Legal Forms, by far the most comprehensive collection of lawful papers templates. Use a huge number of skilled and status-particular templates that meet your company or person requires and requirements.