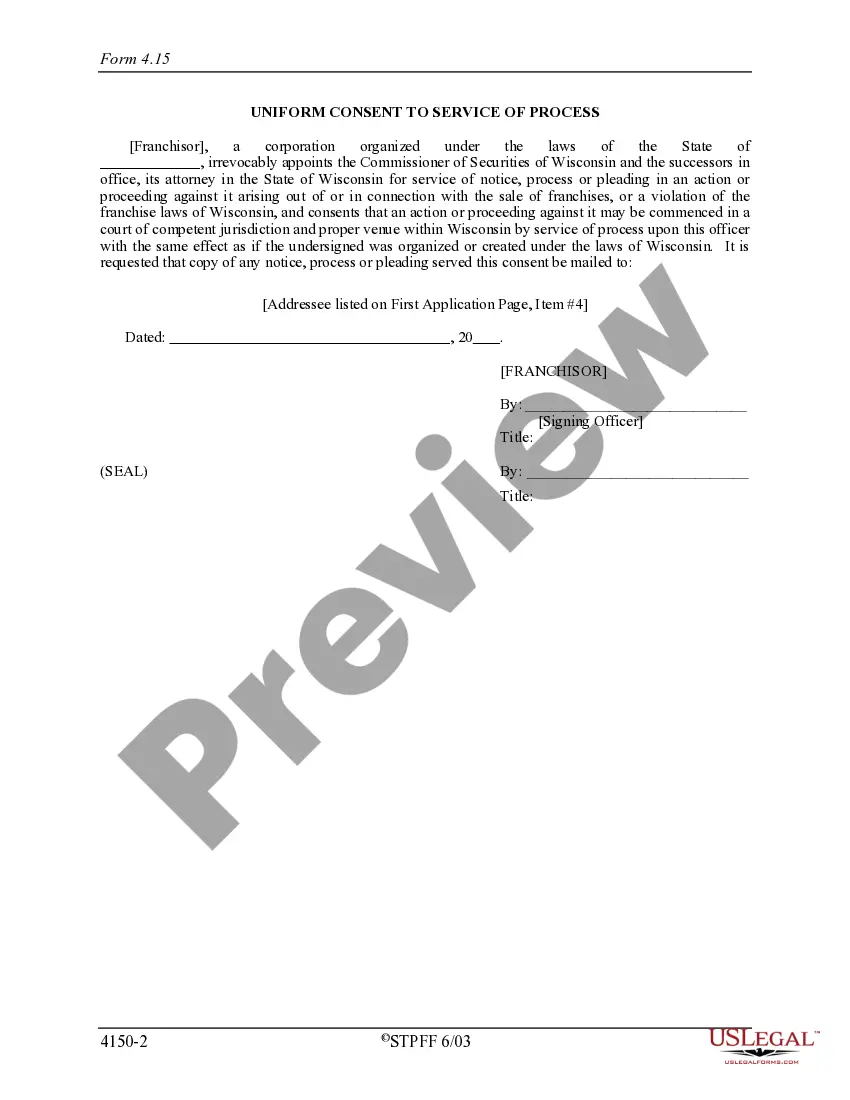

Connecticut and Wisconsin Franchise Registration Application: Detailed Description and Types Connecticut and Wisconsin are two states in the United States that require franchise sellers to register their franchises before offering or selling them within their jurisdictions. This process is facilitated through the Connecticut and Wisconsin Franchise Registration Application. The franchise registration application is a legal document that franchise sellers must complete and submit to the respective state authorities, namely the Connecticut Department of Banking (Connecticut) and the Wisconsin Department of Financial Institutions (Wisconsin). The Connecticut Franchise Registration Application, also known as the "Connecticut Franchise Offering Circular (CFC) Application," is designed to provide comprehensive information about the franchise being offered within the state. The application requires detailed documentation, including financial statements, disclosure documents, franchise agreements, marketing materials, and any other relevant information related to the franchise offering. It aims to ensure that franchise sellers provide potential franchisees with accurate and complete information, promoting transparency and protecting the interests of franchisees in Connecticut. Similarly, the Wisconsin Franchise Registration Application, referred to as the "Wisconsin Franchise Investment Law Application," serves the same purpose within the state. Franchise sellers must complete this application to register their franchises with the Wisconsin Department of Financial Institutions. The application requires extensive details about the franchise being offered, such as franchise agreements, disclosure documents, financial statements, and information about the franchisor's business operations. The goal is to ensure potential franchisees in Wisconsin have access to all necessary information before making an informed business decision. Key elements covered in both the Connecticut and Wisconsin Franchise Registration Applications include: 1. Franchisor Details: Contact information of the franchisor, including name, address, phone number, and email. 2. Financial Statements: The applicant must attach audited financial statements or unaudited financial statements prepared according to generally accepted accounting principles (GAAP). 3. Franchise Agreement: A copy of the franchise agreement must be submitted along with the application, including any changes or amendments made to the agreement. 4. Disclosure Documents: Franchise sellers must provide potential franchisees with a Franchise Disclosure Document (ADD) or Uniform Franchise Offering Circular (UFOs), as required by federal regulations. These documents detail important information about the franchisor, fees, obligations, and other relevant aspects. 5. Litigation History: Franchise sellers must disclose any past or pending litigation involving the franchisor or any of its affiliates. 6. Marketing and Advertising Materials: Samples of marketing materials, brochures, and advertisements related to the franchise offering must be provided to ensure compliance with state regulations. It is important to note that the Connecticut and Wisconsin Franchise Registration Applications may have additional requirements and specifications, which must be carefully reviewed and fulfilled by franchise sellers. Failure to complete the application accurately or provide the requested information may result in delays or denial of franchise registration. In summary, the Connecticut and Wisconsin Franchise Registration Applications play a crucial role in the franchise registration process within these states. They serve to protect potential franchisees by ensuring they receive accurate and comprehensive information to make informed decisions. Franchise sellers must adhere to the specific requirements outlined in the applications to successfully register their franchises in Connecticut and Wisconsin.

Connecticut and Wisconsin Franchise Registration Application: Detailed Description and Types Connecticut and Wisconsin are two states in the United States that require franchise sellers to register their franchises before offering or selling them within their jurisdictions. This process is facilitated through the Connecticut and Wisconsin Franchise Registration Application. The franchise registration application is a legal document that franchise sellers must complete and submit to the respective state authorities, namely the Connecticut Department of Banking (Connecticut) and the Wisconsin Department of Financial Institutions (Wisconsin). The Connecticut Franchise Registration Application, also known as the "Connecticut Franchise Offering Circular (CFC) Application," is designed to provide comprehensive information about the franchise being offered within the state. The application requires detailed documentation, including financial statements, disclosure documents, franchise agreements, marketing materials, and any other relevant information related to the franchise offering. It aims to ensure that franchise sellers provide potential franchisees with accurate and complete information, promoting transparency and protecting the interests of franchisees in Connecticut. Similarly, the Wisconsin Franchise Registration Application, referred to as the "Wisconsin Franchise Investment Law Application," serves the same purpose within the state. Franchise sellers must complete this application to register their franchises with the Wisconsin Department of Financial Institutions. The application requires extensive details about the franchise being offered, such as franchise agreements, disclosure documents, financial statements, and information about the franchisor's business operations. The goal is to ensure potential franchisees in Wisconsin have access to all necessary information before making an informed business decision. Key elements covered in both the Connecticut and Wisconsin Franchise Registration Applications include: 1. Franchisor Details: Contact information of the franchisor, including name, address, phone number, and email. 2. Financial Statements: The applicant must attach audited financial statements or unaudited financial statements prepared according to generally accepted accounting principles (GAAP). 3. Franchise Agreement: A copy of the franchise agreement must be submitted along with the application, including any changes or amendments made to the agreement. 4. Disclosure Documents: Franchise sellers must provide potential franchisees with a Franchise Disclosure Document (ADD) or Uniform Franchise Offering Circular (UFOs), as required by federal regulations. These documents detail important information about the franchisor, fees, obligations, and other relevant aspects. 5. Litigation History: Franchise sellers must disclose any past or pending litigation involving the franchisor or any of its affiliates. 6. Marketing and Advertising Materials: Samples of marketing materials, brochures, and advertisements related to the franchise offering must be provided to ensure compliance with state regulations. It is important to note that the Connecticut and Wisconsin Franchise Registration Applications may have additional requirements and specifications, which must be carefully reviewed and fulfilled by franchise sellers. Failure to complete the application accurately or provide the requested information may result in delays or denial of franchise registration. In summary, the Connecticut and Wisconsin Franchise Registration Applications play a crucial role in the franchise registration process within these states. They serve to protect potential franchisees by ensuring they receive accurate and comprehensive information to make informed decisions. Franchise sellers must adhere to the specific requirements outlined in the applications to successfully register their franchises in Connecticut and Wisconsin.