Connecticut Separation Notice for 1099 Employee

Description

How to fill out Separation Notice For 1099 Employee?

Choosing the best authorized file template can be a struggle. Of course, there are a variety of themes accessible on the Internet, but how will you get the authorized form you will need? Utilize the US Legal Forms web site. The services delivers a huge number of themes, for example the Connecticut Separation Notice for 1099 Employee, which you can use for company and private requirements. All the varieties are checked by professionals and satisfy federal and state specifications.

When you are presently signed up, log in to the account and click on the Down load option to obtain the Connecticut Separation Notice for 1099 Employee. Use your account to check from the authorized varieties you may have acquired previously. Proceed to the My Forms tab of your own account and have an additional version from the file you will need.

When you are a new customer of US Legal Forms, listed below are straightforward guidelines for you to stick to:

- Very first, make sure you have selected the appropriate form for your metropolis/area. You may examine the shape utilizing the Review option and browse the shape information to make certain it will be the best for you.

- When the form does not satisfy your requirements, take advantage of the Seach area to obtain the right form.

- Once you are certain the shape would work, click on the Get now option to obtain the form.

- Choose the rates plan you would like and enter in the necessary info. Make your account and pay money for the order making use of your PayPal account or charge card.

- Select the data file structure and obtain the authorized file template to the product.

- Total, edit and print and sign the obtained Connecticut Separation Notice for 1099 Employee.

US Legal Forms will be the greatest catalogue of authorized varieties in which you will find various file themes. Utilize the company to obtain appropriately-produced documents that stick to state specifications.

Form popularity

FAQ

Are termination letters required? Most companies are not required by law to give employees letters of termination. The exceptions are those located in Arizona, California, Illinois and New Jersey. Most employers, however, do provide termination letters as a professional courtesy and a legal record.

I'm self-employed or an independent contractor. Am I eligible for unemployment benefits during the coronavirus crisis? On , the Connecticut Department of Labor made active the filing site so those who are self-employed can complete filing applications for Pandemic Unemployment Assistance (PUA).

This form is a Quarterly Combination Correction for to be used to correct an EMPLOYER CONTRIBUTION RETURN (Form Conn. UC-2) and EMPLOYEE QUARTERLY EARNINGS REPORT (Form UC-5A), which you have previously filed with this department. Submit the original and keep a copy for your files.

Section 2102 of the CARES Act creates a new temporary federal program called Pandemic Unemployment Assistance (PUA) that in general provides up to 39 weeks of unemployment benefits, and provides funding to states for the administration of the program.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

If you sign a release of claims in return for severance pay, you may collect unemployment benefits for the same period of time as your severance payments.

Connecticut is an "at will" state. This means that employers have the right to fire or terminate an employee at anytime without providing a reason, as long as it is not illegal.

Log into your PUA account by entering your User ID and Password. Verify your email address. To file your PUA application, click Unemployment Claim 2192 Pandemic Assistance (PUA) 2192 File PUA Claim.

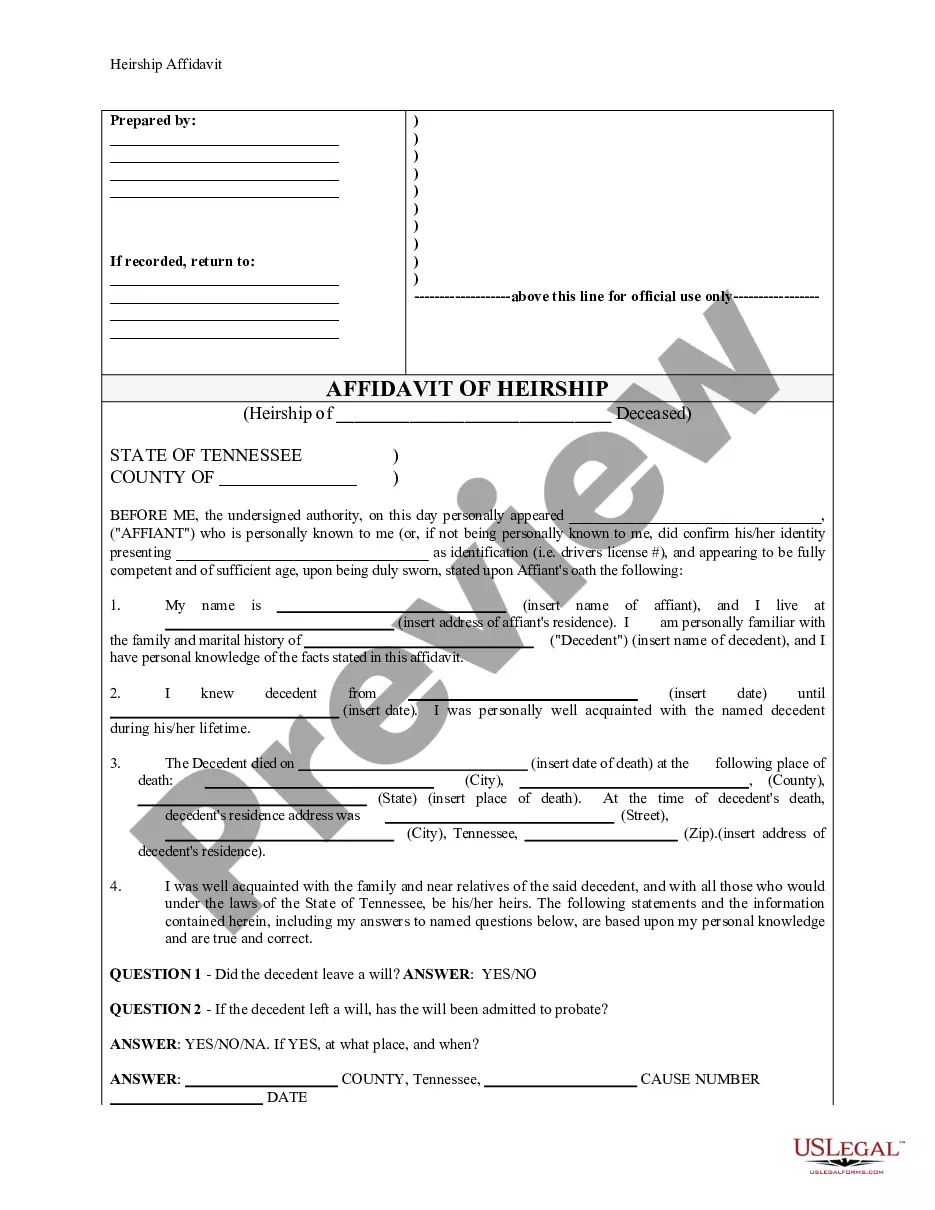

All Connecticut employers must provide a Separation Packet, which includes a Separation Notice (UC-61) and instructions to the worker immediately upon termination of employment or indefinite layoff. The notice should be provided regardless of whether the termination is voluntary or involuntary.

Visit us today! The Connecticut Department of Labor today began accepting claim applications for the self-employed, many of whom are eligible to collect unemployment insurance benefits under the federal Pandemic Unemployment Assistance (PUA) Program.