Connecticut Release of All Auto Accident Claims

Description

How to fill out Release Of All Auto Accident Claims?

Have you been in the situation the place you need papers for either enterprise or specific purposes nearly every working day? There are a variety of authorized file themes available on the Internet, but getting versions you can depend on is not straightforward. US Legal Forms offers 1000s of develop themes, like the Connecticut Release of All Auto Accident Claims, which are published to satisfy federal and state demands.

When you are presently informed about US Legal Forms website and have a merchant account, just log in. Afterward, you are able to download the Connecticut Release of All Auto Accident Claims template.

Should you not have an profile and wish to begin using US Legal Forms, adopt these measures:

- Find the develop you will need and make sure it is to the proper area/state.

- Make use of the Review key to review the shape.

- See the outline to actually have selected the correct develop.

- In case the develop is not what you are trying to find, take advantage of the Research industry to obtain the develop that meets your requirements and demands.

- If you obtain the proper develop, simply click Get now.

- Select the costs strategy you want, fill out the specified information and facts to produce your money, and pay for the transaction with your PayPal or Visa or Mastercard.

- Decide on a convenient file structure and download your version.

Locate each of the file themes you possess bought in the My Forms menu. You can obtain a extra version of Connecticut Release of All Auto Accident Claims at any time, if necessary. Just go through the required develop to download or printing the file template.

Use US Legal Forms, by far the most considerable selection of authorized kinds, to conserve some time and stay away from mistakes. The services offers skillfully manufactured authorized file themes that you can use for a range of purposes. Create a merchant account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

Connecticut is no longer a no-fault state for automobile insurance, but was before 1994. The term no-fault automobile insurance often refers to automobile insurance that permits a person to recover financial losses from his or her own insurance company regardless of who caused the loss.

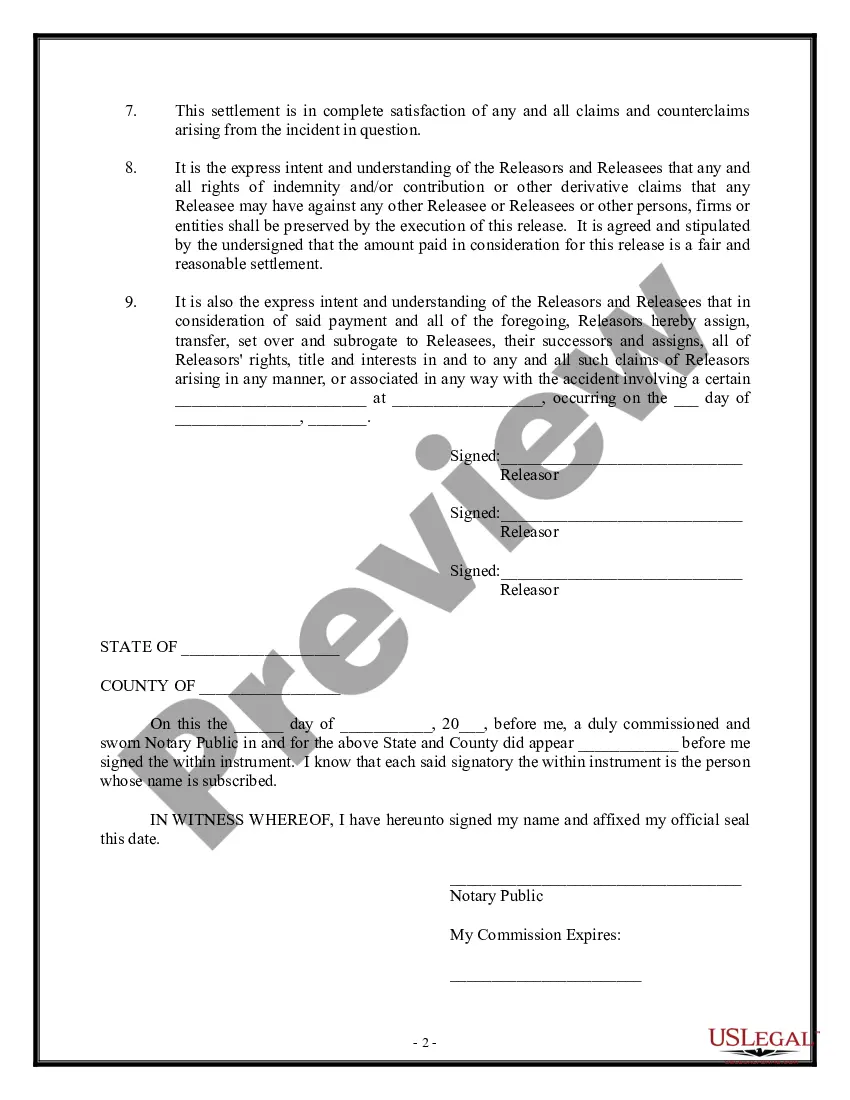

A settlement agreement is a legally-binding document both parties sign, agreeing to end the dispute and dismiss their claims. It's also customary to sign a release in a settlement agreement.

One of the easiest options is to check with the DMV. You can use your car's vehicle identification number (VIN) to get a record of the car's past insurers. Then, you can contact the providers to find out the car's insurance history and claims information.

The release of claims is an agreement between an employer and a worker whose employment has been terminated. Employees typically sign the document in return for a severance package. The release is meant to limit potential litigation for reasons such as discrimination.

A release of all claims form is exactly what it sounds like: it is a document that absolves the parties of any liability for an accident. Once this form is signed, it is no longer possible for an injured accident victim to pursue a personal injury claim against the at-fault driver.

The simplest method of checking your car insurance claims history is to request it directly from the insurance company you were with when you made the claim. They should be able to tell you when the incident happened, what type of claim you made, and what the outcome was - including whether anyone was injured.

The easiest may be to ask your existing car insurance provider for details of any claims you've made in the past. This information could include the date of any claims, the type of claims, how much was paid out, and details of any injuries. Alternatively, you could contact the Claims and Underwriting Exchange (CUE).

Also known as a general release or release. A written contract in which one or more parties agree to give up legal causes of action against the other party in exchange for adequate consideration (that is, something of value to which the party releasing the legal claims is not already entitled).

A release of all claims form releases the responsible party (the other driver who was at fault and their insurance company) from any liability and obligation to pay you for the damages associated with the accident. Insurance companies usually ask you to sign the release form before making any payments.

The easiest may be to ask your existing car insurance provider for details of any claims you've made in the past. This information could include the date of any claims, the type of claims, how much was paid out, and details of any injuries. Alternatively, you could contact the Claims and Underwriting Exchange (CUE).