Connecticut Ballot for Accepting or Rejecting Plan of Reorganization - Form 14 - Pre and Post 2005 Act

Description

How to fill out Ballot For Accepting Or Rejecting Plan Of Reorganization - Form 14 - Pre And Post 2005 Act?

Finding the right legal document web template can be quite a struggle. Obviously, there are tons of themes available online, but how would you obtain the legal develop you need? Use the US Legal Forms web site. The assistance offers a huge number of themes, such as the Connecticut Ballot for Accepting or Rejecting Plan of Reorganization - Form 14 - Pre and Post 2005 Act, that you can use for enterprise and personal requires. Each of the forms are checked by pros and meet federal and state demands.

When you are previously registered, log in to your profile and click the Download key to get the Connecticut Ballot for Accepting or Rejecting Plan of Reorganization - Form 14 - Pre and Post 2005 Act. Make use of your profile to appear from the legal forms you may have bought in the past. Go to the My Forms tab of your own profile and get an additional backup in the document you need.

When you are a brand new end user of US Legal Forms, listed below are straightforward guidelines that you should adhere to:

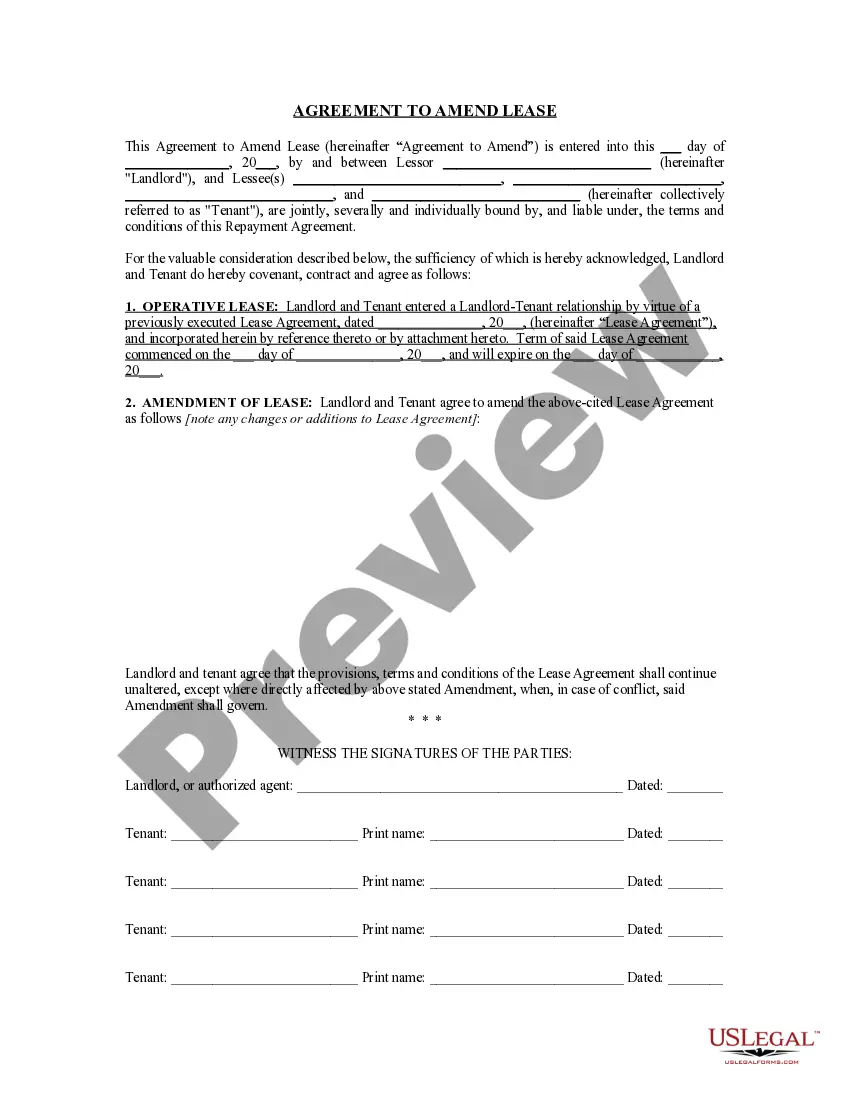

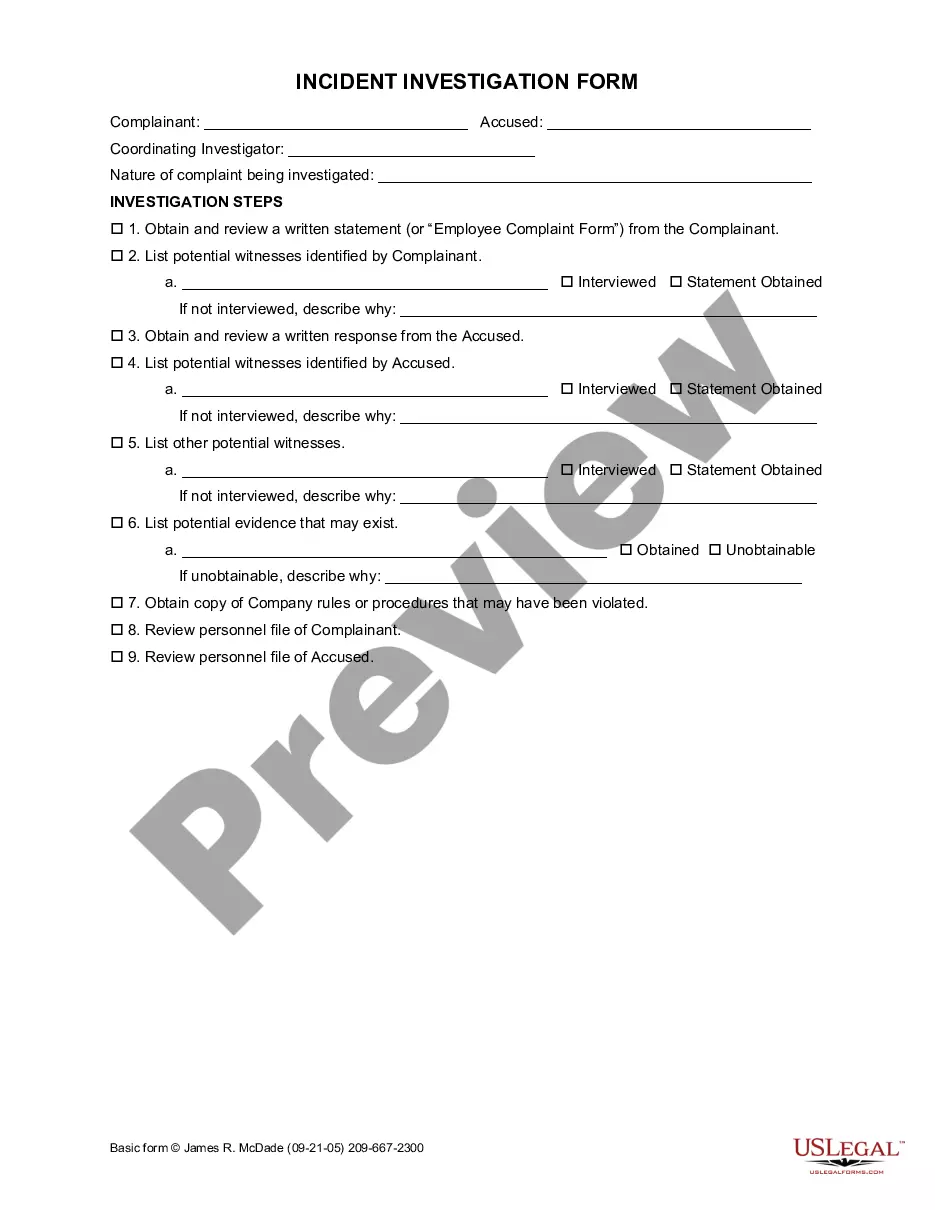

- Initially, make certain you have chosen the proper develop for the town/area. You can check out the form while using Review key and study the form description to make sure it will be the best for you.

- If the develop fails to meet your requirements, use the Seach discipline to get the correct develop.

- Once you are positive that the form is acceptable, click the Purchase now key to get the develop.

- Select the costs plan you want and type in the needed information. Design your profile and pay for the order utilizing your PayPal profile or Visa or Mastercard.

- Select the file file format and down load the legal document web template to your device.

- Comprehensive, change and print and sign the acquired Connecticut Ballot for Accepting or Rejecting Plan of Reorganization - Form 14 - Pre and Post 2005 Act.

US Legal Forms is the most significant library of legal forms in which you will find a variety of document themes. Use the company to down load professionally-created papers that adhere to express demands.

Form popularity

FAQ

A plan of reorganization is proposed, creditors whose rights are affected may vote on the plan, and the plan may be confirmed by the court if it gets the required votes and satisfies certain legal requirements.

In order to obtain approval of a plan of reorganization, all claims against the debtor are divided into classes of creditors, e.g., secured, priority, etc. A plan will generally be approved if it is accepted by creditors representing at least two-thirds in amount and one-half of all claims, within each class.

Voting on the Chapter 11 Plan All impaired classes are entitled to vote on the plan of reorganization.

Form 14 means a printed form made available by the state department of health or the state department of education to record a child's immunizations and health record.

The bankruptcy court and creditors must approve the plan before it can become effective and be executed. For more information on plans of reorganization, see Practice Notes, Drafting Chapter 11 Plans: Overview and Chapter 11 Plan Process: Overview and Timeline of the Chapter 11 Plan Process.