Connecticut Amendments to Certificate of Incorporation: A Comprehensive Overview In Connecticut, the process of amending a certificate of incorporation plays a crucial role in ensuring the smooth functioning and adaptability of a corporation. This legal procedure allows businesses to make changes to their founding documents, reflecting evolving circumstances, growth, acquisitions, or alterations in corporate objectives. This article will provide a detailed description of Connecticut Amendments to the certificate of incorporation, covering its significance, requirements, and the different types of amendments that can be made. Why Connecticut Amendments to Certificate of Incorporation Matter: Amending a corporation's certificate of incorporation is essential for keeping the business in compliance with current legal regulations and maintaining an accurate reflection of its structure and policies. It allows corporations to update their purpose, modify share structures, adjust the decision-making process, or revise any other provisions contained within the original filing. Requirements for Connecticut Amendments to Certificate of Incorporation: To amend the certificate of incorporation in Connecticut, corporations must follow certain guidelines and meet specific legal requirements. The process typically involves submitting a formal proposal to the Secretary of State, who will review and evaluate the amendment. It is crucial to ensure that the proposed changes align with Connecticut statutes and are consistent with the corporation's overall objectives. Different Types of Connecticut Amendments to Certificate of Incorporation: 1. Name Change Amendment: Corporations may opt to change their legal name due to rebranding efforts, mergers, or acquiring a new identity that aligns better with their current strategies or target markets. This amendment ensures that the certificate of incorporation correctly represents the corporation's identity. 2. Purpose Amendment: Sometimes, a corporation may wish to modify its stated purpose to broaden or narrow its scope of operations. For example, a software development company that expands into the telecommunications sector might need to amend its purpose clause to reflect this new venture. 3. Capital Structure Amendment: Corporations may decide to modify their capital structure by adjusting the number of authorized shares or altering the classes and rights associated with those shares. This amendment allows for flexibility in financing options, equity issuance, or changes in ownership percentages. 4. Registered Agent Amendment: If there is a change in the registered agent responsible for accepting legal documents on behalf of the corporation, an amendment is required to reflect this modification. This ensures that the corporation's legal notifications are delivered to the correct representative. 5. Director or Officer Amendment: Sometimes, corporations may need to amend their certificate of incorporation to reflect changes to the board of directors or officer positions. This amendment ensures the accurate representation of individuals responsible for making major corporate decisions. 6. Provisions Amendment: Corporations might need to revise provisions related to voting rights, preemptive rights, or other governance-related matters. This amendment allows for adjustments to bylaws, benefiting the corporation's functioning in light of evolving legal requirements or corporate needs. In conclusion, Connecticut Amendments to the certificate of incorporation offers a flexible and adaptable framework that allows corporations to adjust their founding documents as necessary. Whether it involves name changes, purpose modifications, capital structure alterations, registered agent updates, changes to the board or officers, or provisions amendment, this process ensures accurate representation, legal compliance, and ongoing corporate operations in Connecticut.

Connecticut Amendments to certificate of incorporation

Description

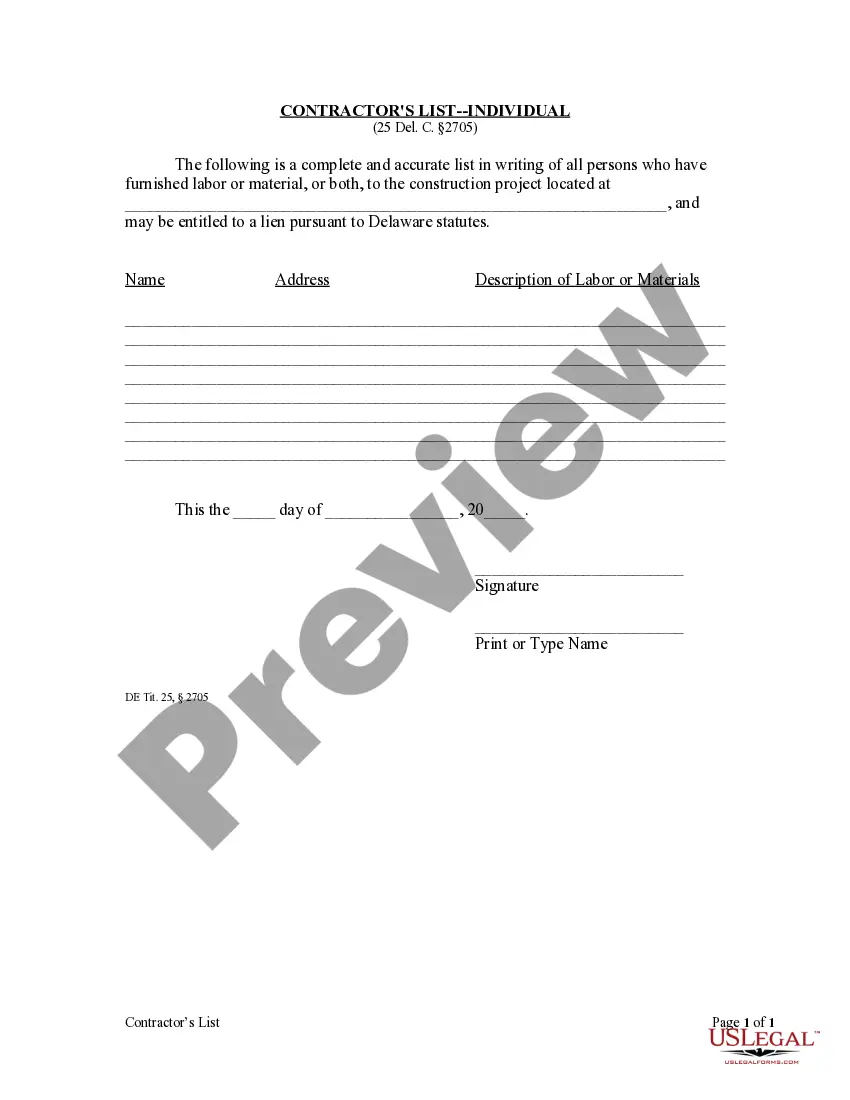

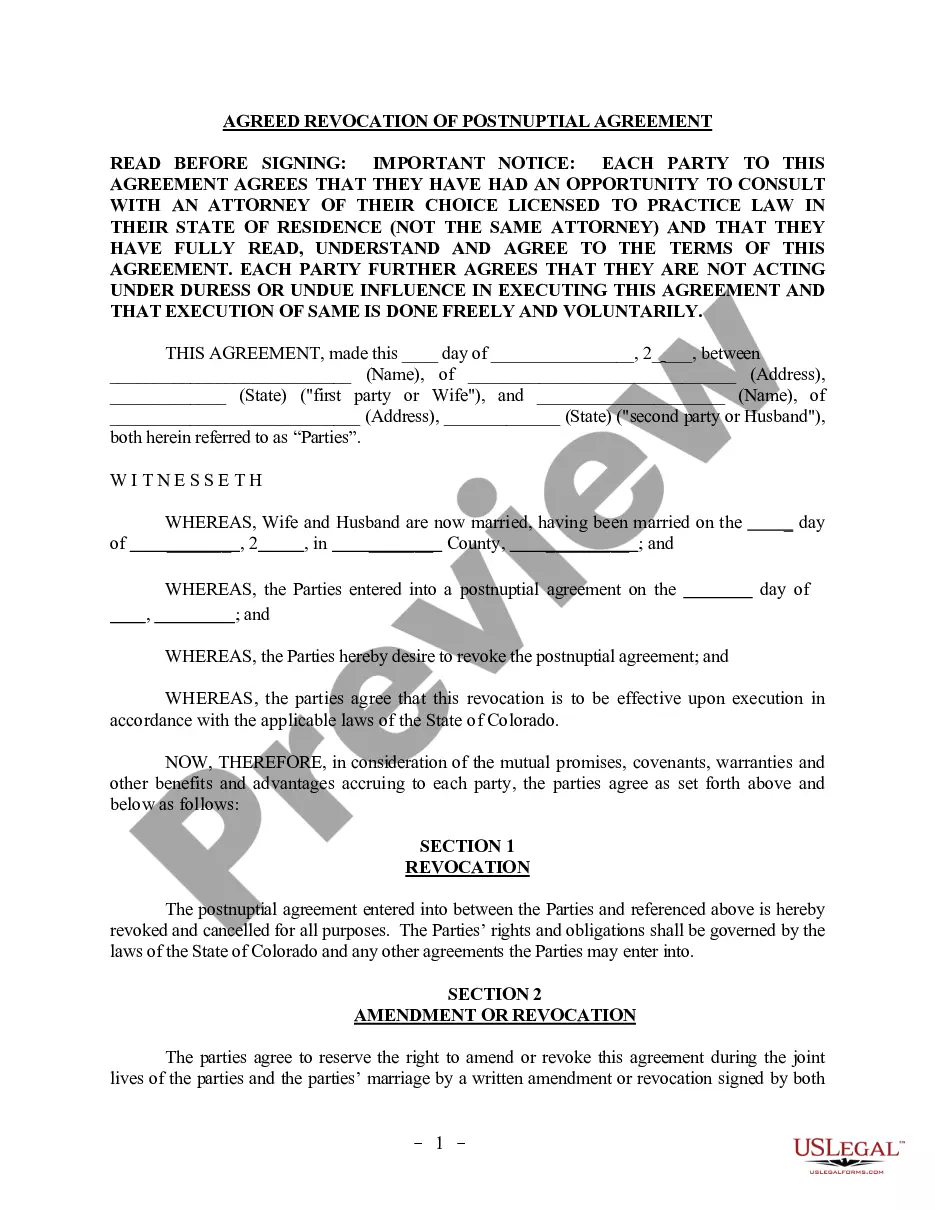

How to fill out Connecticut Amendments To Certificate Of Incorporation?

It is possible to devote several hours on-line trying to find the legitimate record template that fits the federal and state specifications you need. US Legal Forms offers a huge number of legitimate types that happen to be evaluated by professionals. It is simple to obtain or printing the Connecticut Amendments to certificate of incorporation from our assistance.

If you currently have a US Legal Forms account, you may log in and then click the Acquire button. After that, you may comprehensive, edit, printing, or indication the Connecticut Amendments to certificate of incorporation. Each legitimate record template you acquire is your own permanently. To obtain one more version for any bought form, check out the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms website the first time, adhere to the basic directions below:

- First, ensure that you have chosen the right record template for the region/area that you pick. See the form description to ensure you have picked the correct form. If available, take advantage of the Review button to search through the record template as well.

- In order to discover one more model of your form, take advantage of the Search area to obtain the template that fits your needs and specifications.

- Once you have identified the template you want, simply click Get now to proceed.

- Select the pricing prepare you want, key in your credentials, and sign up for an account on US Legal Forms.

- Full the deal. You can utilize your Visa or Mastercard or PayPal account to purchase the legitimate form.

- Select the formatting of your record and obtain it in your system.

- Make adjustments in your record if necessary. It is possible to comprehensive, edit and indication and printing Connecticut Amendments to certificate of incorporation.

Acquire and printing a huge number of record web templates making use of the US Legal Forms Internet site, which offers the largest collection of legitimate types. Use expert and express-distinct web templates to take on your company or person requirements.

Form popularity

FAQ

You can receive copies of all the documents you file with us either online, from our office directly, or upon request via fax or mail. If you file online, a copy of the document is automatically emailed to you.

Locate the Correspondence group and click Request a Status Letter. myconneCT will assess whether or not you are eligible to receive a letter of good standing. In order to obtain a letter of good standing, you must file and pay all overdue periods.

The Articles of Amendment, also sometimes called a Certificate of Amendment, is a document filed with your state of incorporation (or any states in which your company has foreign qualified to transact business), to enact a specific change to the information included in your company's incorporation or qualification ...

Any company registered in Connecticut can order certified copies of its official formation documents from the Connecticut Secretary of the State. Processing time is typically 3-5 business days plus mailing time.

How to Order a Certified Copy of Articles of Organization or a Certified Copy of Articles of Incorporation From the State of Connecticut. A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, email or in person, but we recommend faxing.

When changing the legal name of your Connecticut LLC, you need to file a Certificate of Amendment with the Connecticut Secretary of the State, Commercial Recording Division and pay a $120 filing fee. Learn more about filing a Connecticut Certificate of Amendment.

Fees & Payment Options Filing MethodFiling Fee & Minimum Franchise Tax (MFT)Expedited ServiceMail$250Filing Fee & MFT+ $50In-Person$250Filing Fee & MFT+ $50Fax$250Filing Fee & MFT+ $50Online$250Filing Fee & MFT+ $50

To amend the Certificate of Organization for your Connecticut LLC, you'll need to file a Certificate of Amendment with the Connecticut Secretary of State. Along with the amendment, you'll need to pay a $120 filing fee.