Connecticut Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust

Description

How to fill out Agreement And Plan Of Reorganization And Liquidation By Niagara Share Corp. And Scudder Investment Trust?

It is possible to invest time online trying to find the authorized file web template which fits the state and federal needs you will need. US Legal Forms gives 1000s of authorized varieties that happen to be analyzed by professionals. It is simple to download or print out the Connecticut Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust from my assistance.

If you currently have a US Legal Forms profile, you can log in and click the Down load switch. Afterward, you can complete, revise, print out, or indicator the Connecticut Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust. Each and every authorized file web template you acquire is your own forever. To get one more version of any bought form, check out the My Forms tab and click the corresponding switch.

If you are using the US Legal Forms website the very first time, stick to the simple directions beneath:

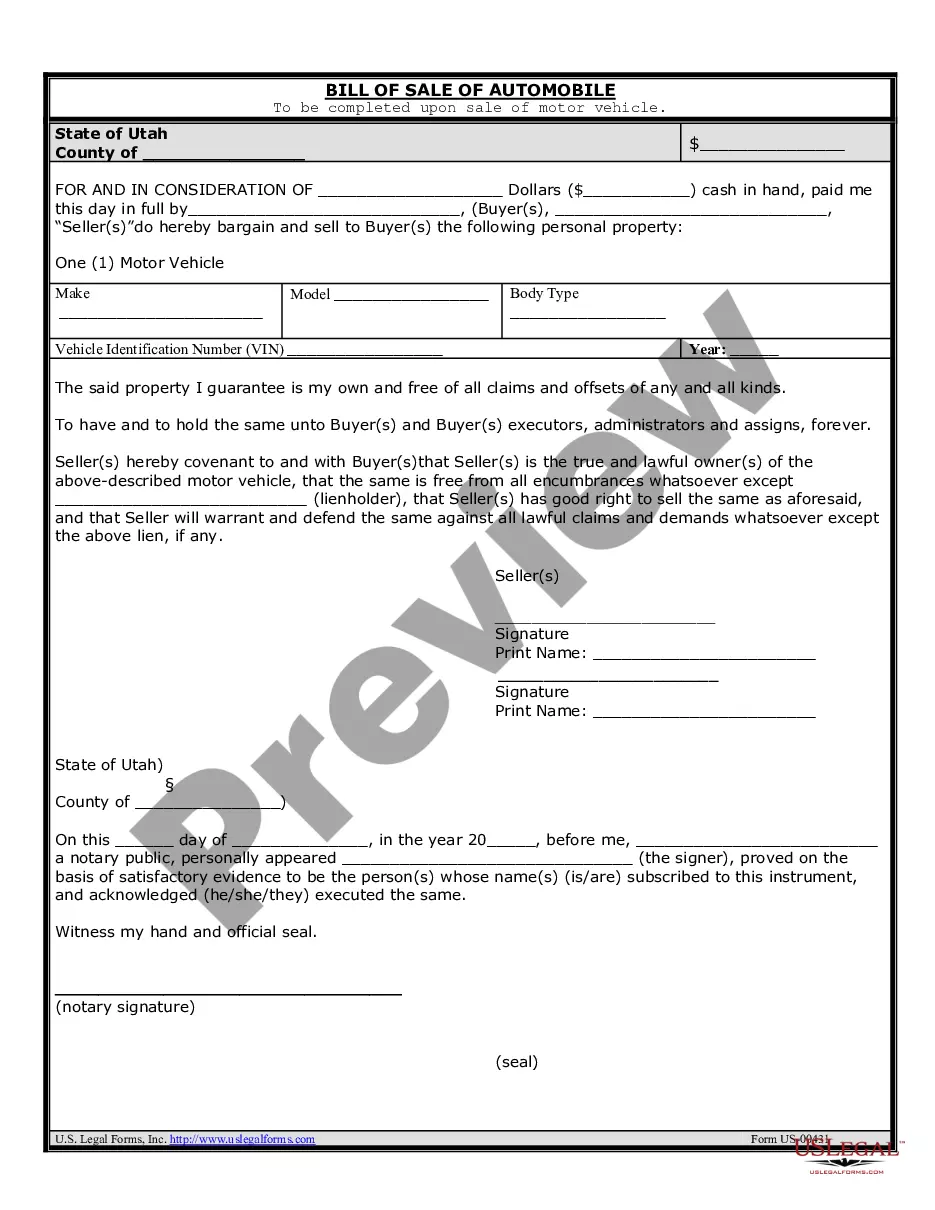

- Initially, make sure that you have selected the proper file web template for your region/metropolis of your liking. See the form explanation to make sure you have picked out the appropriate form. If offered, make use of the Review switch to search with the file web template as well.

- In order to get one more edition from the form, make use of the Look for area to obtain the web template that suits you and needs.

- After you have located the web template you would like, just click Get now to continue.

- Find the costs strategy you would like, type in your accreditations, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You should use your credit card or PayPal profile to cover the authorized form.

- Find the format from the file and download it to the system.

- Make modifications to the file if necessary. It is possible to complete, revise and indicator and print out Connecticut Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust.

Down load and print out 1000s of file templates using the US Legal Forms site, which provides the most important collection of authorized varieties. Use professional and state-certain templates to deal with your organization or personal demands.