Connecticut Option to Purchase Common Stock

Description

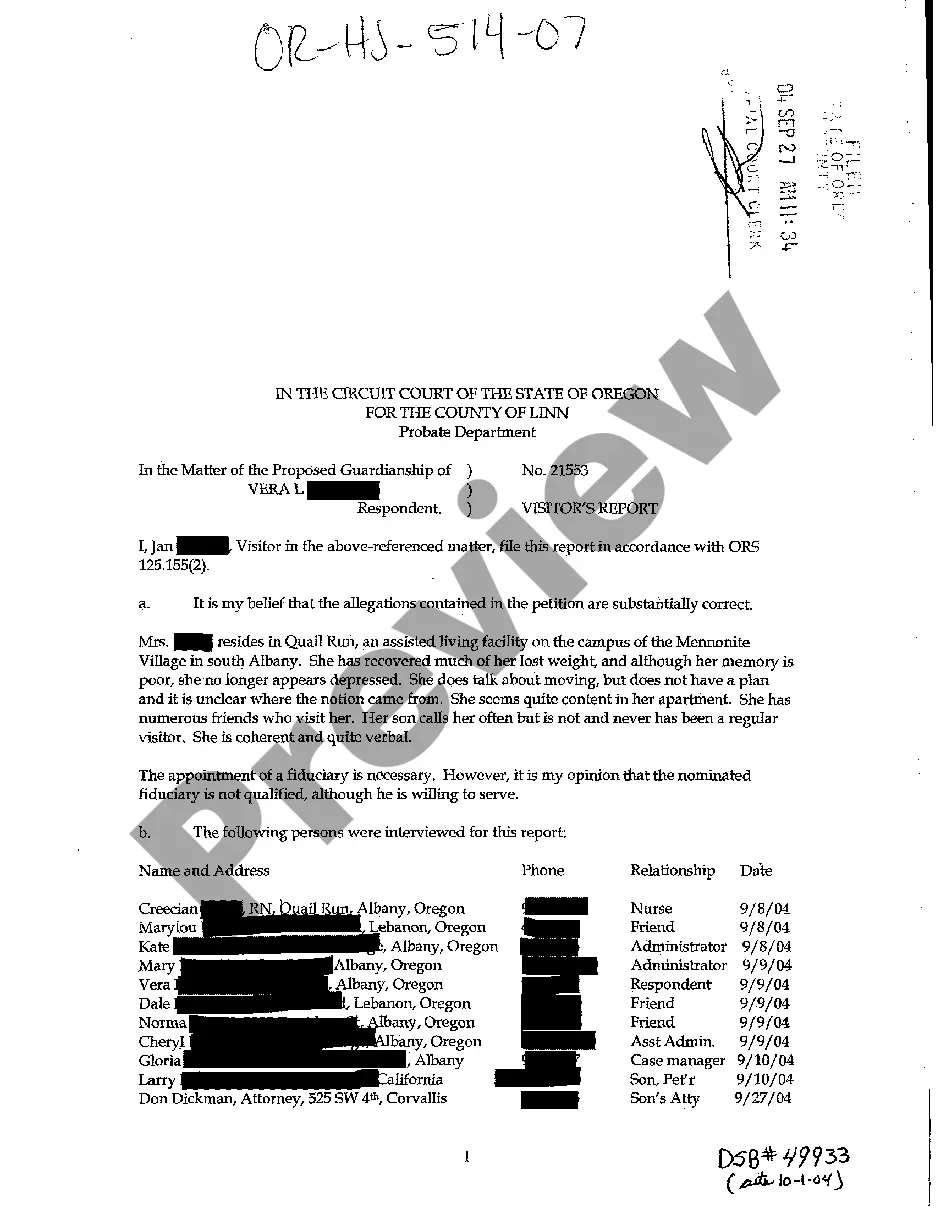

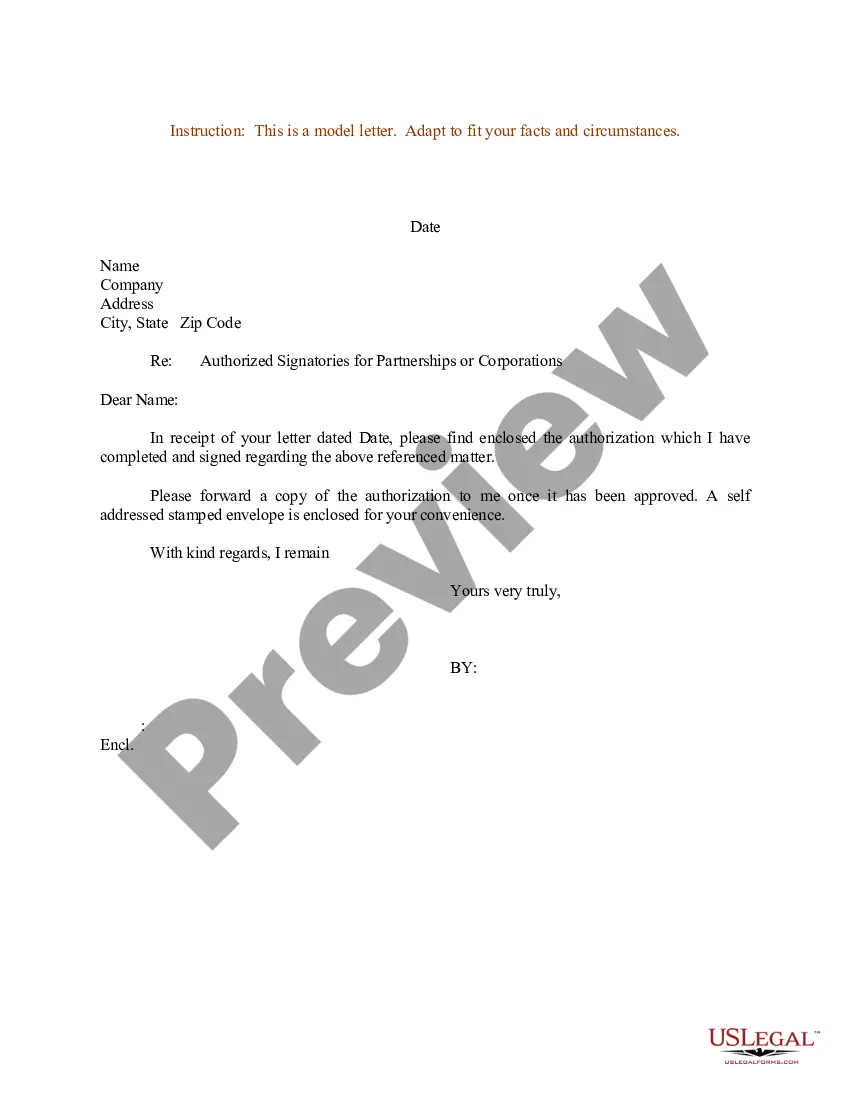

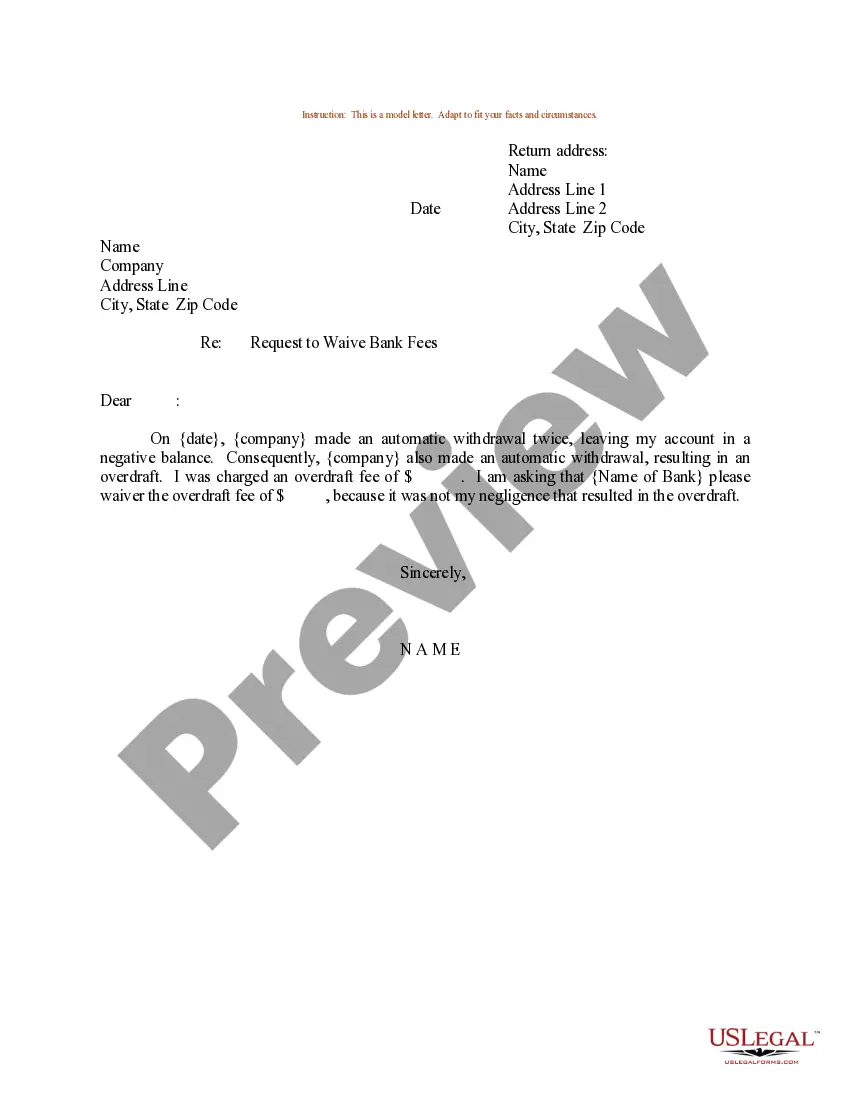

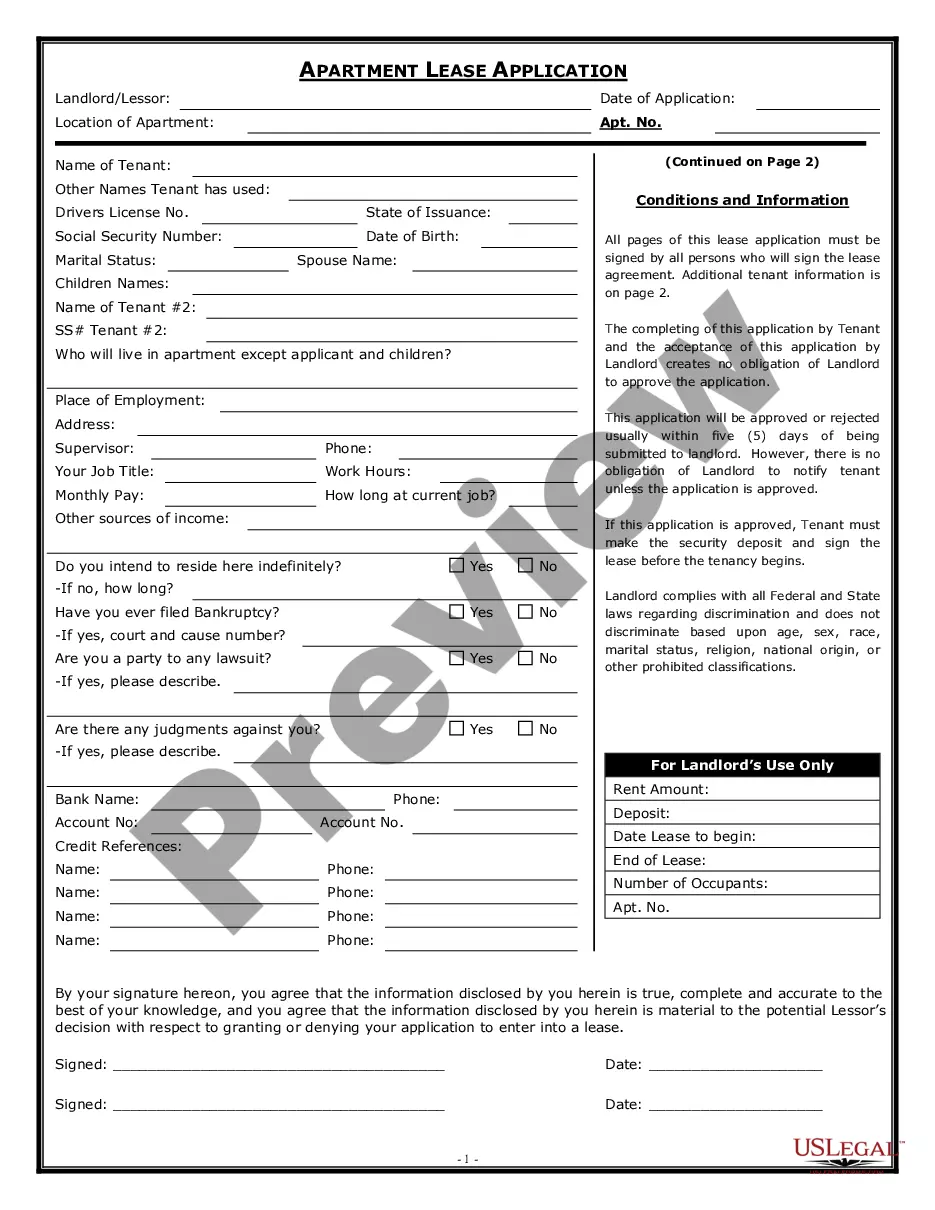

How to fill out Option To Purchase Common Stock?

If you have to total, obtain, or print legitimate record themes, use US Legal Forms, the most important selection of legitimate forms, which can be found on-line. Make use of the site`s simple and easy handy research to discover the papers you require. A variety of themes for company and person uses are sorted by classes and states, or keywords. Use US Legal Forms to discover the Connecticut Option to Purchase Common Stock in a few mouse clicks.

In case you are previously a US Legal Forms customer, log in for your bank account and click on the Download switch to have the Connecticut Option to Purchase Common Stock. Also you can accessibility forms you earlier delivered electronically inside the My Forms tab of your respective bank account.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form to the right metropolis/country.

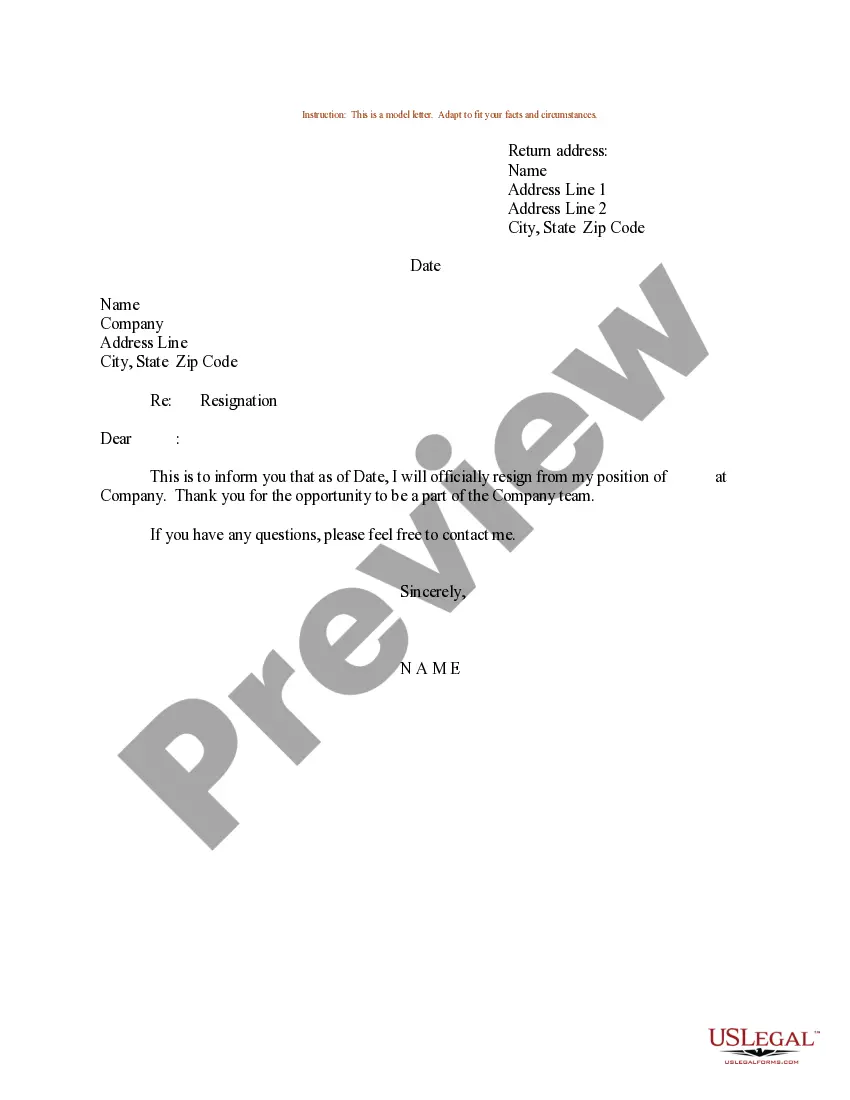

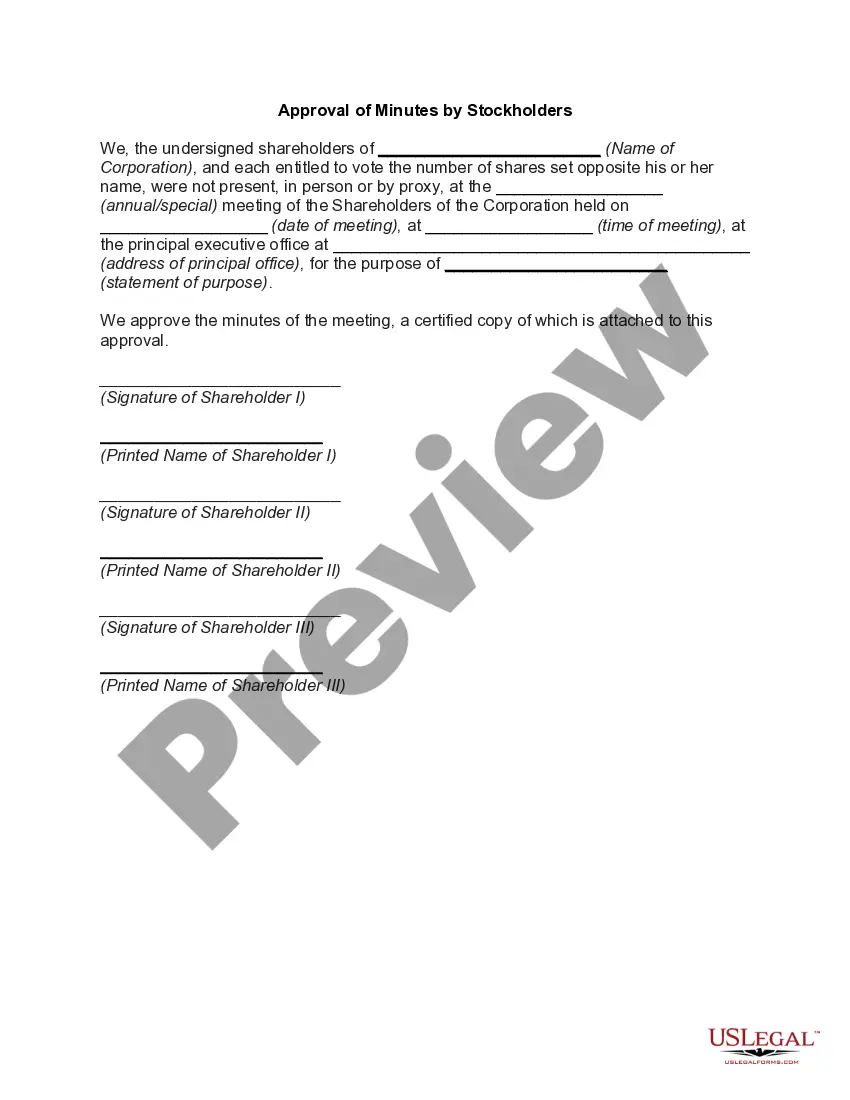

- Step 2. Make use of the Review choice to look over the form`s content. Do not forget to see the information.

- Step 3. In case you are unsatisfied using the type, make use of the Lookup industry towards the top of the display to locate other versions of the legitimate type template.

- Step 4. Once you have identified the form you require, go through the Purchase now switch. Pick the costs plan you choose and add your qualifications to sign up for the bank account.

- Step 5. Process the deal. You can use your bank card or PayPal bank account to perform the deal.

- Step 6. Pick the structure of the legitimate type and obtain it on the device.

- Step 7. Complete, revise and print or indicator the Connecticut Option to Purchase Common Stock.

Each and every legitimate record template you acquire is the one you have for a long time. You may have acces to every type you delivered electronically inside your acccount. Click the My Forms section and choose a type to print or obtain once again.

Remain competitive and obtain, and print the Connecticut Option to Purchase Common Stock with US Legal Forms. There are millions of professional and state-particular forms you can use for your company or person demands.

Form popularity

FAQ

General Pension and Annuity Exemption The law fully exempts qualifying pension and annuity income from income tax for taxpayers with federal AGIs below (1) $75,000 for single filers, married people filing separately, and heads of household or (2) $100,000 for married people filing jointly.

States that have enacted or proposed Pass-Through Entity Tax Alabama. Arizona (effective in 2022) Arkansas (effective in 2022) California. Colorado (retroactive to 2018) Connecticut (mandatory) Georgia. Idaho.

Form CT-1041 K-1T/Schedule K-1: 1041 Connecticut (CT) There are two types of K-1s for Connecticut state purposes: Schedule K-1 and Schedule K1-T. Schedule K-1 lists both the federal and the Connecticut-sourced portion of income items and includes Schedule CT-IT, which reports the credits allocated to the beneficiaries.

Connecticut follows the IRS standards for estimated payments. If you will owe $1000 or more in tax for the current year, you are required to make 90% of the tax due, over quarterly payments. It has to be at least 100% of the previous year, even if you think you won't make as much in the current year.

Connecticut has a state sales tax rate of 6.35%, and there is no local sales tax. However, certain municipalities may impose a tax on meals and beverages. Connecticut also has a use tax that applies to out-of-state purchases.

On June 12, 2023, Connecticut made sweeping changes to its pass-through entity tax (PTET) legislation with the passing of House Bill No. 6941. Under the state's current legislation, the PTE tax is mandatory, but under the new law, for tax years beginning on or after January 1, 2024, the tax will be elective.

The employer is required to withhold Connecticut income tax on wages paid to the nonresident employee in the same proportion the employee's wages derived from or connected with sources within Connecticut relate to the employee's total wages.

You have two options for filing and paying your Connecticut sales tax: File online File online at the Connecticut Department of Revenue Services. You can remit your payment through their online system. ... AutoFile ? Let TaxJar file your sales tax for you. We take care of the payments, too.