Connecticut Incentive Stock Plan of Chaparral Resources, Inc.

Description

How to fill out Incentive Stock Plan Of Chaparral Resources, Inc.?

Are you presently in the situation the place you need to have paperwork for either organization or individual purposes virtually every working day? There are tons of legitimate file templates available online, but finding ones you can rely isn`t effortless. US Legal Forms provides 1000s of type templates, like the Connecticut Incentive Stock Plan of Chaparral Resources, Inc., that are published to meet federal and state specifications.

Should you be previously familiar with US Legal Forms internet site and have a merchant account, merely log in. Afterward, it is possible to acquire the Connecticut Incentive Stock Plan of Chaparral Resources, Inc. template.

Should you not offer an bank account and need to begin to use US Legal Forms, adopt these measures:

- Discover the type you will need and ensure it is for your proper town/region.

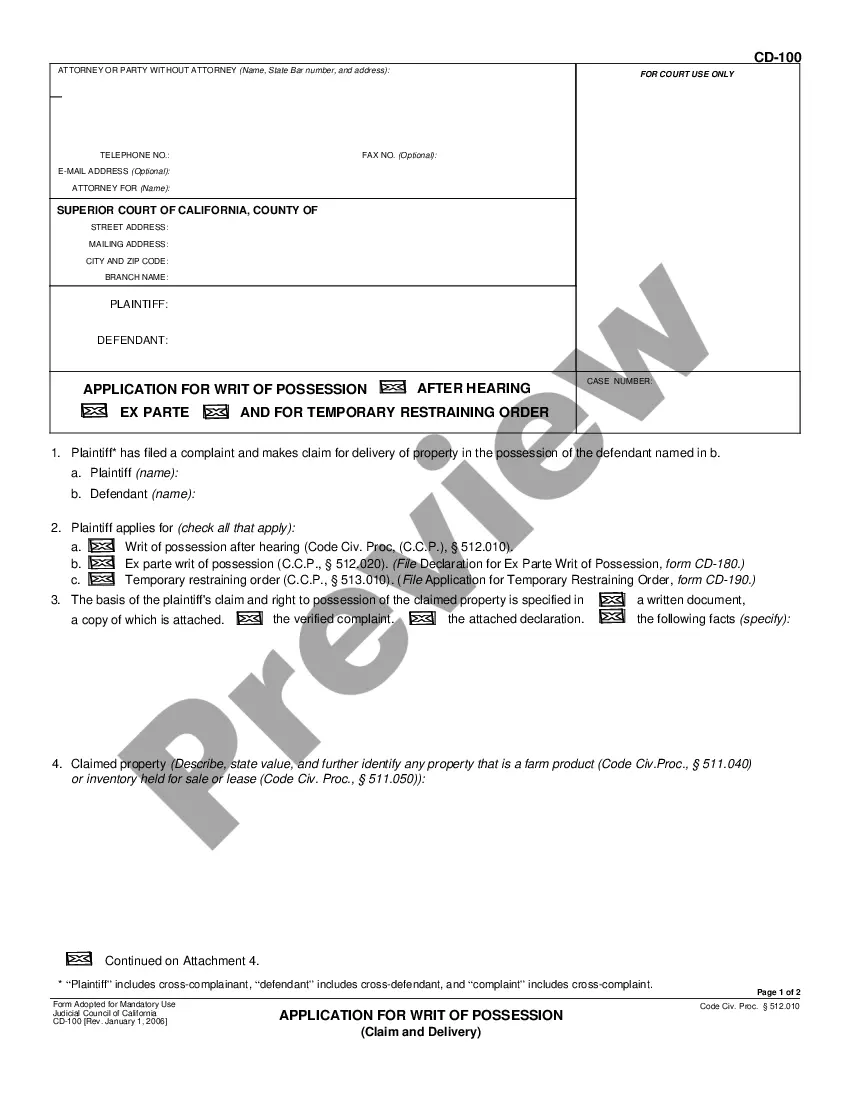

- Use the Review option to examine the shape.

- Look at the explanation to actually have chosen the right type.

- If the type isn`t what you`re seeking, use the Research industry to obtain the type that meets your needs and specifications.

- Whenever you find the proper type, just click Purchase now.

- Choose the pricing program you desire, fill in the specified details to generate your money, and purchase your order using your PayPal or credit card.

- Select a hassle-free file structure and acquire your duplicate.

Find all of the file templates you might have bought in the My Forms menus. You can obtain a extra duplicate of Connecticut Incentive Stock Plan of Chaparral Resources, Inc. whenever, if needed. Just click on the needed type to acquire or produce the file template.

Use US Legal Forms, one of the most comprehensive variety of legitimate forms, to save time and stay away from faults. The service provides professionally manufactured legitimate file templates which you can use for a selection of purposes. Generate a merchant account on US Legal Forms and commence generating your life easier.