Connecticut Proposal to Approve Adoption of Employees' Stock Option Plan

Description

How to fill out Proposal To Approve Adoption Of Employees' Stock Option Plan?

If you wish to complete, down load, or print lawful papers web templates, use US Legal Forms, the most important assortment of lawful forms, that can be found on the Internet. Make use of the site`s easy and handy look for to discover the files you require. Different web templates for business and individual functions are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to discover the Connecticut Proposal to Approve Adoption of Employees' Stock Option Plan with a few click throughs.

In case you are currently a US Legal Forms buyer, log in for your accounts and click the Down load switch to have the Connecticut Proposal to Approve Adoption of Employees' Stock Option Plan. You may also entry forms you earlier delivered electronically within the My Forms tab of your respective accounts.

If you are using US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for that appropriate town/country.

- Step 2. Utilize the Review choice to examine the form`s information. Do not overlook to read the outline.

- Step 3. In case you are unsatisfied with all the kind, use the Research industry on top of the screen to discover other versions in the lawful kind design.

- Step 4. After you have identified the shape you require, select the Buy now switch. Select the rates strategy you like and add your references to sign up for the accounts.

- Step 5. Method the financial transaction. You may use your bank card or PayPal accounts to finish the financial transaction.

- Step 6. Choose the file format in the lawful kind and down load it on the gadget.

- Step 7. Complete, revise and print or sign the Connecticut Proposal to Approve Adoption of Employees' Stock Option Plan.

Every single lawful papers design you acquire is your own property eternally. You might have acces to each and every kind you delivered electronically in your acccount. Click the My Forms segment and decide on a kind to print or down load once again.

Compete and down load, and print the Connecticut Proposal to Approve Adoption of Employees' Stock Option Plan with US Legal Forms. There are many professional and express-particular forms you can use for the business or individual requirements.

Form popularity

FAQ

You may retire on the first of any month on or following your 70th birthday, if you have at least five years of service. If you leave state service with less than five years of service at age 70 or older, no retirement benefits are payable.

Age 63 is the normal retirement age if you have at least 25 years of vesting service; age 65 is the normal retirement age if you have at least 10 but less than 25 years of vesting service.

Participation in MyCTSavings is completely voluntary for employees, but mandatory for businesses that don't sponsor a qualified retirement plan and have more than five employees who each earn more than $5,000 in a calendar year.

You can opt out at any time online, by calling 1-833-811-7436, or by mailing in a completed Opt-Out Form( opens in a new window ) to the program.

If your employer is registered for the program, you can save through automatic payroll contributions from your paycheck. The default savings rate for a MyCTSavings account is 3% of your gross pay (the amount you earn before taxes or any other deductions). You can change your savings rate at any time.

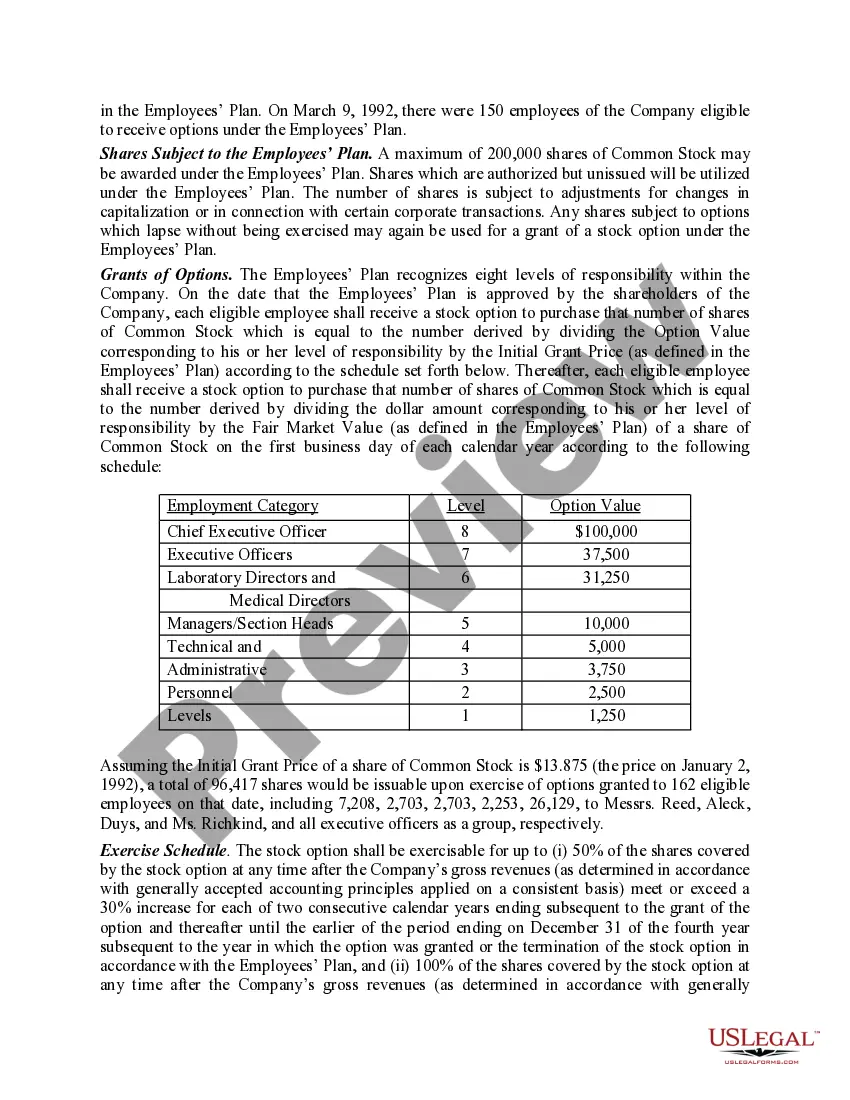

Employee Stock option plan or Employee Stock Ownership Plan (ESOP) is an employee benefit scheme that enables employees to own shares in the company. These shares are purchased by employees at price below market price, or in other words, a discounted price.

Employers in CT who have five or more employees that each earn more than $5,000 in a calendar year must either participate in MyCTSavings or sponsor another qualified retirement plan through the private market. Businesses that don't comply may be penalized.

To address this urgent need, the Connecticut Legislature passed a law that created MyCTSavings to make it easier for more workers to save for their retirement. The program uses automatic enrollment and savings through payroll deductions to help employees save.