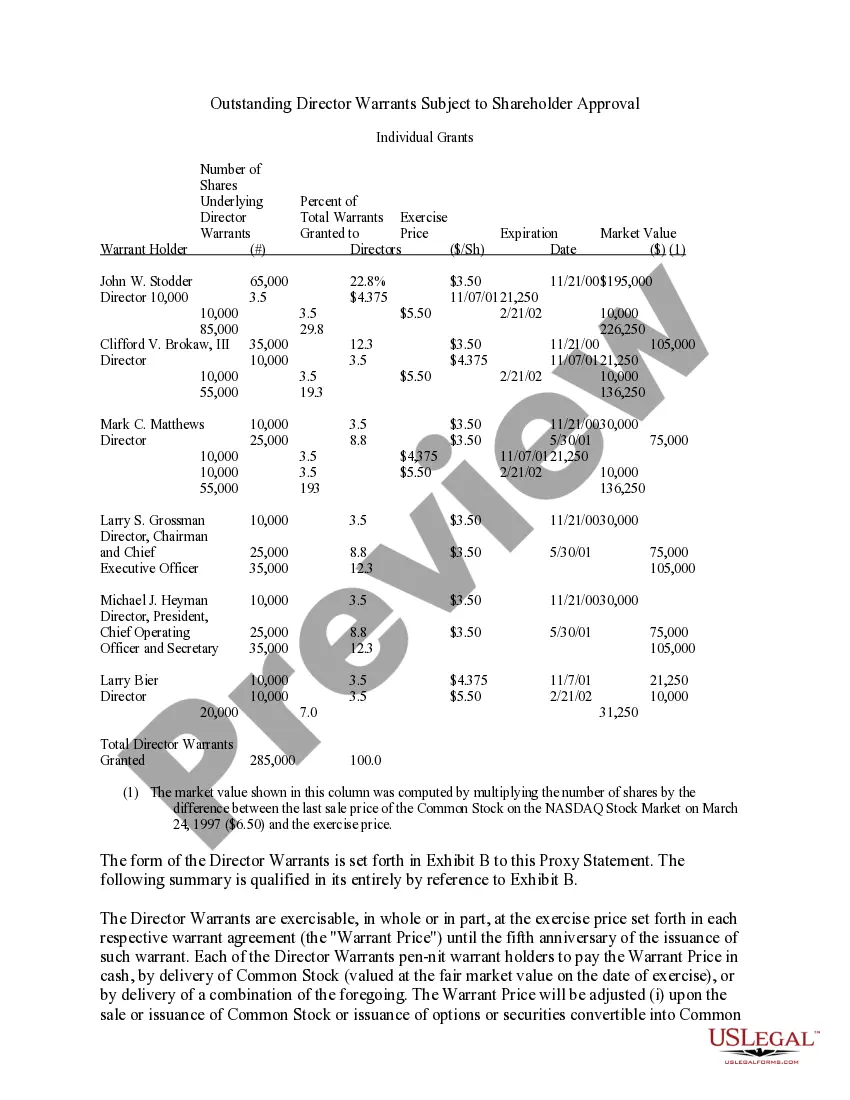

Connecticut Approval of Director Warrants: A Comprehensive Overview In Connecticut, the approval of director warrants refers to the process by which a company's board of directors permits the issuance of warrants to its own directors. Warrants are financial instruments that grant the holder the right, but not the obligation, to purchase a specified number of shares at a predetermined price within a certain time frame. These warrants are considered as an additional form of compensation for directors, serving to align their interests with those of shareholders and incentivize their commitment to the company's long-term success. The approval of director warrants aims to strike an optimal balance between rewarding directors and protecting shareholder interests. Keywords: — Connecticut: Connecticut state law governs the approval of director warrants, providing specific guidelines and regulations that companies must follow. — Approval: Companies are required to obtain approval from their board of directors to issue warrants to their directors. — Director Warrants: These are warrants issued exclusively to directors, allowing them to purchase company shares at a predetermined price. — Board of Directors: This is a group of individuals elected by shareholders to oversee the management and strategic direction of a company. — Compensation: Director warrants are a form of compensation that supplements directors' regular salaries and benefits. — Shareholders: These are individuals who own shares in a company and have a vested interest in its success. — Incentives: Director warrants provide directors with additional motivation to act in the best interest of the company and its shareholders. — Long-Term Success: By granting director warrants, companies aim to encourage directors to make decisions that result in sustained growth and value creation. Types of Connecticut Approval of Director Warrants: 1. Non-Qualified Director Warrants: Non-qualified warrants do not meet certain Internal Revenue Service (IRS) requirements. As a result, the holder of these warrants may be subject to ordinary income tax rates upon exercise or sale. 2. Incentive Director Warrants: Incentive warrants, also known as qualified warrants, satisfy specific IRS rules and may offer favorable tax treatment to the warrant holder. If certain conditions are met, the holder may qualify for long-term capital gains tax rates upon exercise or sale. 3. Restricted Director Warrants: Restricted warrants are subject to specific terms and restrictions. For example, a company may impose a vesting schedule that determines when directors become eligible to exercise their warrants fully. Additionally, restricted warrants may have limitations on transferability or require the fulfillment of performance-based criteria. 4. Standard Director Warrants: Standard or traditional warrants typically have straightforward terms and conditions, allowing directors to exercise their warrants at any time during the warrant's exercise period. It is essential for companies and directors to adhere to Connecticut state laws and consult legal professionals to ensure compliance when adopting an approval process for director warrants.

Connecticut Approval of director warrants

Description

How to fill out Connecticut Approval Of Director Warrants?

Are you inside a placement where you need to have files for either business or person reasons almost every time? There are a variety of authorized file templates available online, but locating kinds you can rely on isn`t effortless. US Legal Forms provides 1000s of develop templates, much like the Connecticut Approval of director warrants, which can be created to fulfill federal and state specifications.

When you are currently acquainted with US Legal Forms site and possess a free account, just log in. After that, it is possible to down load the Connecticut Approval of director warrants template.

Unless you provide an account and want to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you want and make sure it is for your proper city/state.

- Use the Preview option to review the form.

- See the outline to actually have selected the correct develop.

- In case the develop isn`t what you are seeking, make use of the Look for discipline to obtain the develop that meets your needs and specifications.

- Once you get the proper develop, click Purchase now.

- Select the pricing prepare you want, complete the desired details to create your bank account, and pay for the order utilizing your PayPal or bank card.

- Choose a practical document format and down load your duplicate.

Discover every one of the file templates you may have purchased in the My Forms food selection. You can aquire a more duplicate of Connecticut Approval of director warrants any time, if required. Just select the necessary develop to down load or printing the file template.

Use US Legal Forms, probably the most considerable collection of authorized kinds, in order to save some time and prevent faults. The services provides skillfully created authorized file templates which can be used for a range of reasons. Make a free account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

Section 33-920. - Authority to transact business required. (a) A foreign corporation, other than an insurance, surety or indemnity company, may not transact business in this state until it obtains a certificate of authority from the Secretary of the State.

A: Pursuant to Connecticut General Statute (?CGS?) Sec 12-162, a Tax Collector may issue a tax/alias tax warrant/execution to seize money in an account at any financial institution. We first must demand payment from you pursuant to CGS Sec 12-155.

Tax collectors are permitted to seize property, including bank accounts, as well as to garnish wages for delinquent taxes. Marshals serving an alias tax warrant by extension have these same powers. Marshals may also conduct tax sales on behalf of the tax collector.

Per State Statute 12-129, taxpayers must apply for the refund (a true overpayment of the amount due in the rate book) within three years of the due date of the tax bill. A few exceptions apply. A copy of this application form can be viewed under the Refunds tab on the home page of the Tax Collector's website.

The sales tax is a state tax and the personal property tax is a local tax. Connecticut law has required owners of taxable personal property to annually report property owned by them on October 1 to the municipal Assessor since 1949.

12-126. Abatement or refund of tax on tangible personal property assessed in more than one municipality. Sec. 12-127.