Connecticut Stock Purchase Plan with exhibit of Bancorporation

Description

How to fill out Stock Purchase Plan With Exhibit Of Bancorporation?

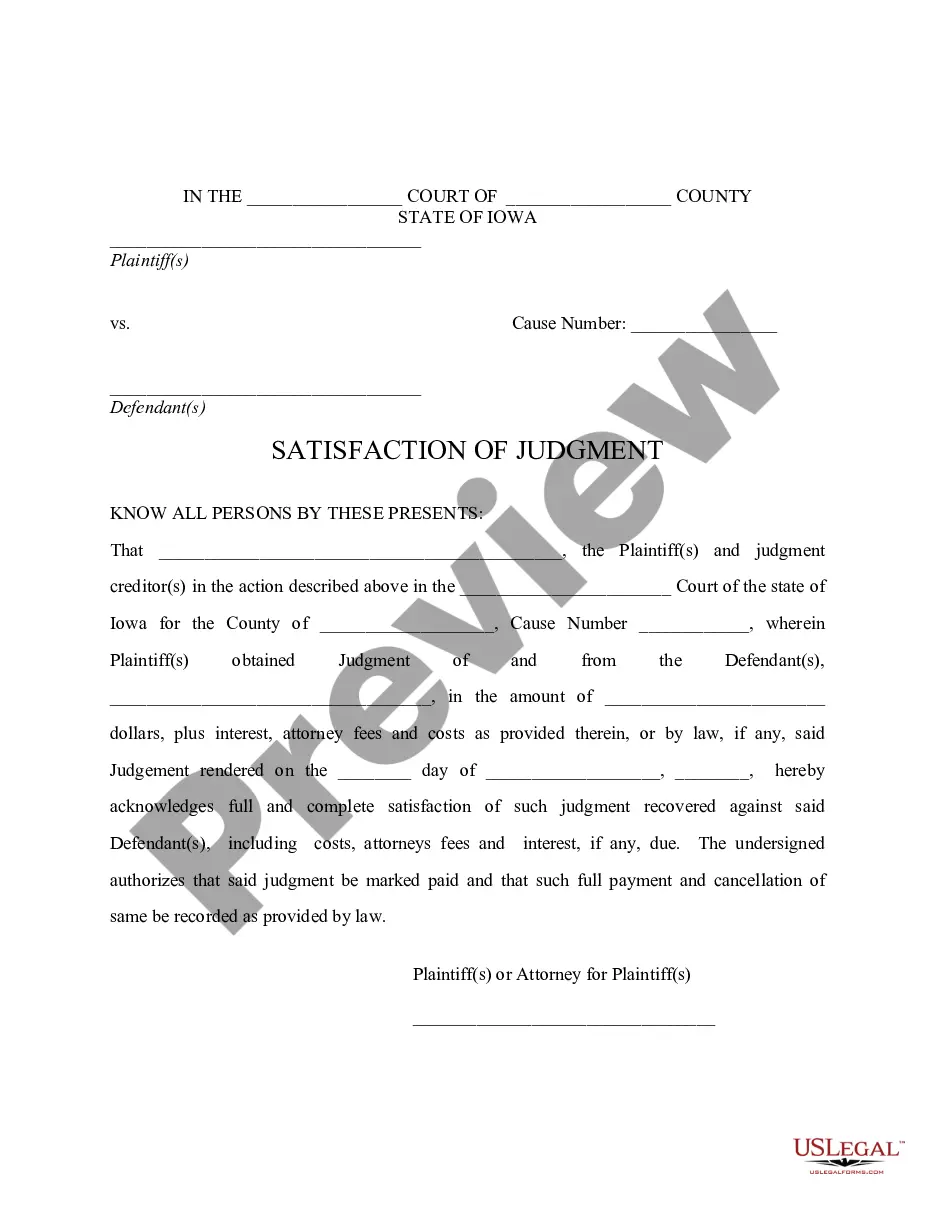

It is possible to devote hrs on-line attempting to find the legal record web template that suits the state and federal needs you require. US Legal Forms provides thousands of legal varieties which can be examined by experts. It is possible to obtain or produce the Connecticut Stock Purchase Plan with exhibit of Bancorporation from your service.

If you already have a US Legal Forms accounts, it is possible to log in and then click the Acquire switch. After that, it is possible to complete, edit, produce, or signal the Connecticut Stock Purchase Plan with exhibit of Bancorporation. Every single legal record web template you acquire is your own eternally. To have one more version for any bought develop, proceed to the My Forms tab and then click the related switch.

If you work with the US Legal Forms site initially, follow the simple instructions below:

- Initially, ensure that you have selected the right record web template for that area/town of your liking. Browse the develop information to make sure you have chosen the appropriate develop. If accessible, use the Preview switch to appear throughout the record web template too.

- If you want to get one more version from the develop, use the Look for area to find the web template that meets your requirements and needs.

- After you have found the web template you desire, click on Get now to continue.

- Select the rates plan you desire, key in your accreditations, and register for an account on US Legal Forms.

- Total the financial transaction. You can utilize your bank card or PayPal accounts to pay for the legal develop.

- Select the format from the record and obtain it for your product.

- Make modifications for your record if necessary. It is possible to complete, edit and signal and produce Connecticut Stock Purchase Plan with exhibit of Bancorporation.

Acquire and produce thousands of record layouts utilizing the US Legal Forms Internet site, that offers the most important selection of legal varieties. Use skilled and express-particular layouts to tackle your business or individual requirements.

Form popularity

FAQ

Qualifying disposition: You sold the stock at least two years after the offering (grant date) and at least one year after the exercise (purchase date). If so, a portion of the profit (the ?bargain element?) is considered compensation income (taxed at regular rates) on your Form 1040.

An employee stock purchase plan (ESPP) is a company-run program in which participating employees can purchase company stock directly, at a discounted price. Employees contribute to the plan through payroll deductions which build up between the offering date and the purchase date.

An offering period is the six months period of time you are contributing for a stock purchase. The first payroll deduction (at the beginning of the first offering period) will be included in the first paycheck of July each year.

How does a withdrawal work in an ESPP? With most employee stock purchase plans, you can withdraw from your plan at any time before the purchase. Withdrawals are made on Fidelity.com or through a representative. However, you should refer to your plan documents to determine your plan's rules governing withdrawals.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.

Limited Liquidity: In some cases, ESPPs may have restrictions on when employees can sell their shares, making it difficult to access the funds in an emergency or for other purposes. This lack of liquidity can be a drawback, especially for employees who may need to sell their shares quickly.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.

A: Yes. You may withdraw from the ESPP by notifying Fidelity and completing a withdrawal election. When you withdraw, all of the contributions accumulated in your account will be returned to you as soon as administratively possible and you will not be able to make any further contributions during that offering period.