Connecticut Employee Stock Ownership Plan of Franklin Savings Bank — Detailed The Connecticut Employee Stock Ownership Plan (ESOP) of Franklin Savings Bank is a comprehensive employee benefit plan that provides eligible employees with an ownership stake in the bank. This plan offers a unique opportunity for employees to become shareholders of the institution they work for, aligning their interests with the success and growth of the bank. Through the ESOP, employees are able to acquire shares of Franklin Savings Bank's stock gradually and accumulate ownership over time. The ESOP is specifically designed to benefit employees, as it offers various advantages such as tax benefits, retirement savings, and a sense of ownership and engagement within the company. The Connecticut ESOP of Franklin Savings Bank operates by allocating a portion of the bank's stock to each eligible employee account based on their compensation, length of service, and other predetermined factors. These allocations are made annually and allow employees to build up their ownership stake over their employment tenure. Participants in the ESOP have the option to hold onto their allocated shares until they retire or leave the company, at which point they can sell their shares back to the bank. Alternatively, employees can also choose to diversify their investments within the ESOP by reinvesting their shares into a range of diversified investment options offered by the plan. One notable feature of the Connecticut ESOP of Franklin Savings Bank is that it allows employees to indirectly participate in the bank's performance and profit through their stock ownership. As the bank grows and becomes more profitable, the value of the employees' shares also increases, thereby encouraging a positive work culture and incentivizing employees to contribute to the bank's success. It is important to note that while the Connecticut ESOP of Franklin Savings Bank is primarily focused on employee stock ownership, there may also be additional retirement benefits available to employees through other retirement plans, such as a 401(k) plan, pension plan, or profit-sharing plan. These plans may provide further opportunities for employees to save for their retirement and enhance their overall financial well-being. In conclusion, the Connecticut Employee Stock Ownership Plan of Franklin Savings Bank offers employees the unique opportunity to become shareholders of the bank, aligning their interests with the institution's success. This comprehensive plan provides numerous benefits, such as tax advantages, retirement savings, and a sense of ownership, thereby fostering a positive work environment and encouraging employees to contribute to the bank's growth.

Connecticut Employee Stock Ownership Plan of Franklin Savings Bank - Detailed

Description

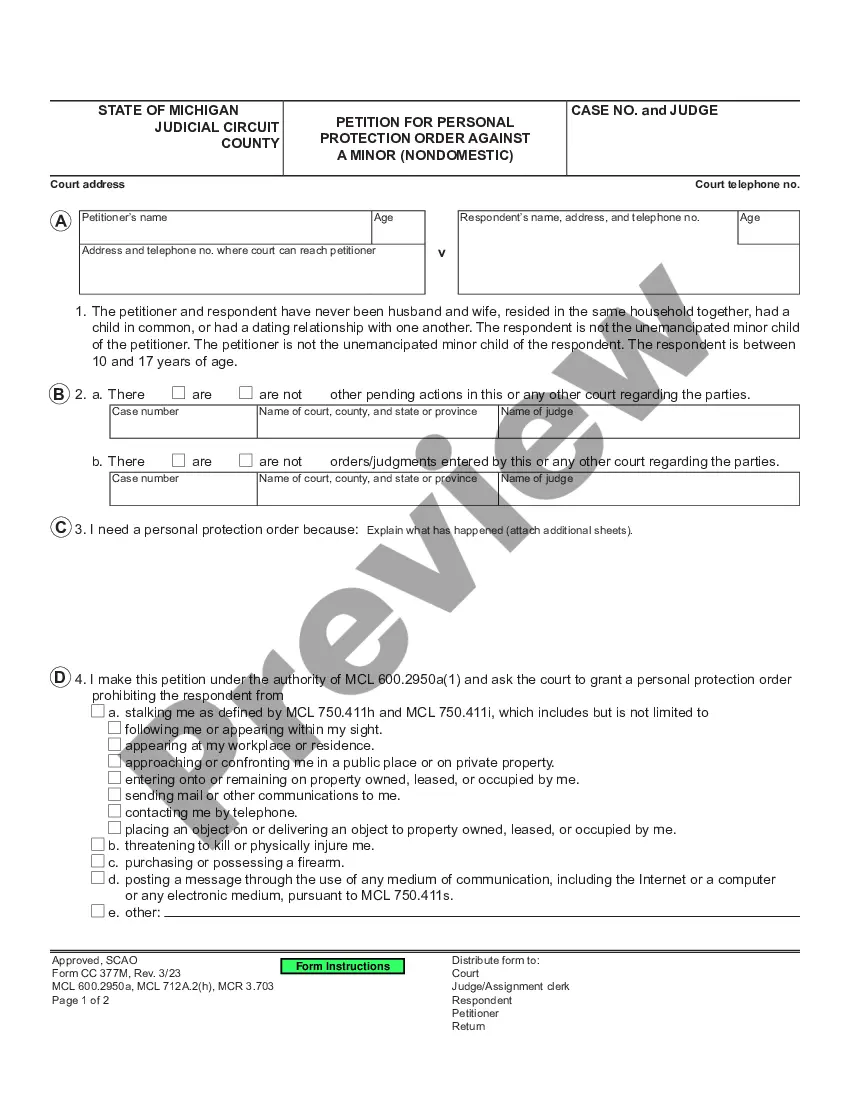

How to fill out Connecticut Employee Stock Ownership Plan Of Franklin Savings Bank - Detailed?

Are you presently in the position that you need to have papers for sometimes company or personal functions almost every time? There are a lot of legitimate record themes available online, but locating types you can rely isn`t easy. US Legal Forms offers a huge number of develop themes, like the Connecticut Employee Stock Ownership Plan of Franklin Savings Bank - Detailed, that happen to be composed in order to meet federal and state demands.

Should you be presently informed about US Legal Forms internet site and possess your account, simply log in. After that, it is possible to down load the Connecticut Employee Stock Ownership Plan of Franklin Savings Bank - Detailed format.

Unless you offer an accounts and want to start using US Legal Forms, adopt these measures:

- Find the develop you need and make sure it is for that proper area/area.

- Utilize the Preview button to examine the form.

- Browse the description to ensure that you have selected the proper develop.

- In the event the develop isn`t what you are looking for, use the Search industry to find the develop that meets your requirements and demands.

- If you find the proper develop, click on Acquire now.

- Opt for the rates plan you desire, submit the desired information to produce your account, and pay for your order using your PayPal or charge card.

- Decide on a handy paper format and down load your duplicate.

Get every one of the record themes you have purchased in the My Forms menus. You may get a extra duplicate of Connecticut Employee Stock Ownership Plan of Franklin Savings Bank - Detailed anytime, if required. Just click the required develop to down load or print out the record format.

Use US Legal Forms, the most substantial variety of legitimate types, to save some time and steer clear of blunders. The assistance offers skillfully made legitimate record themes which you can use for a selection of functions. Generate your account on US Legal Forms and initiate making your lifestyle a little easier.

Form popularity

FAQ

Total assets ended 2022 at nearly $1.3 billion, growing $47 million over 2021. Our loan portfolio grew by 11.7% to $725 million. In 2022, the bank originated $340 million in loans to individuals, businesses and municipalities across our market.

For additional information contact Darrell Rains, Chief Financial Officer, at (803) 641-3000. >> Total assets increased $80.2 million, or 6.2%, during the year to $1.4 billion at December 31, 2022.

Two exceptional employees who exemplify capability, dedication and optimism. We closed out fiscal year 2023 with assets reaching $1.6 billion and solid deposit balances of $1.2 billion. Net income came in at $7.8 million and GSB's retained earnings topped $149 million.

Our assets grew by 3%, reaching over $578m at fiscal year-end 2022 and our lending teams; commercial, residential and consumer, remained active in expanding existing relationships and developing new ones.

Franklin Savings Bank ended 2019 with total assets of $457.0 million and net income of $3.9 million.