Connecticut Approval of savings plan for employees

Description

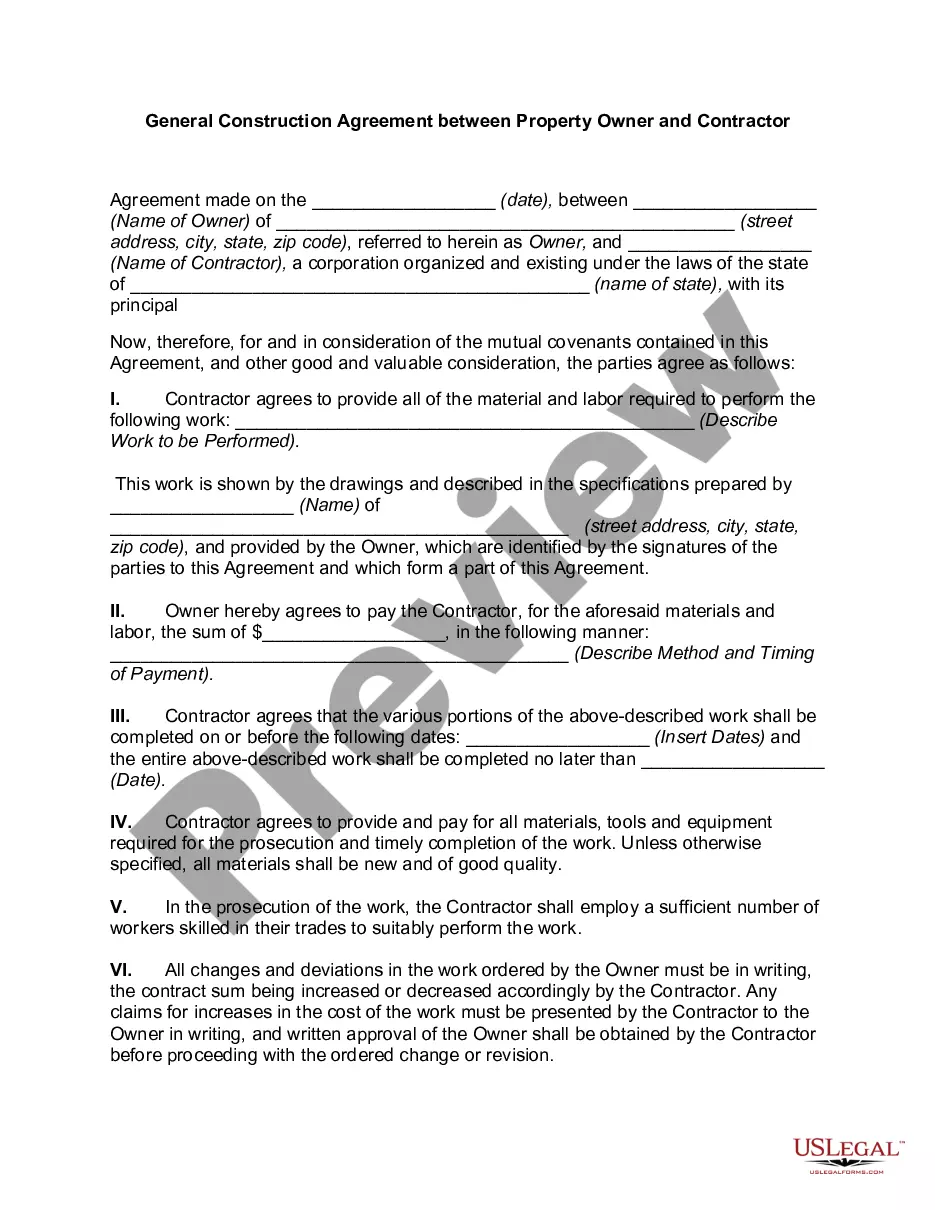

How to fill out Approval Of Savings Plan For Employees?

Are you presently inside a situation the place you need papers for possibly organization or personal purposes just about every day? There are a lot of legitimate record layouts available on the Internet, but getting kinds you can depend on isn`t effortless. US Legal Forms gives a large number of form layouts, just like the Connecticut Approval of savings plan for employees, which are composed to fulfill federal and state specifications.

In case you are currently informed about US Legal Forms internet site and also have an account, simply log in. Next, it is possible to download the Connecticut Approval of savings plan for employees template.

If you do not have an accounts and wish to begin using US Legal Forms, adopt these measures:

- Obtain the form you will need and make sure it is for that proper area/area.

- Use the Preview key to examine the shape.

- See the outline to ensure that you have chosen the correct form.

- If the form isn`t what you`re looking for, utilize the Lookup industry to get the form that meets your needs and specifications.

- When you get the proper form, click on Buy now.

- Opt for the prices program you would like, complete the desired information to produce your account, and buy your order making use of your PayPal or Visa or Mastercard.

- Choose a handy file formatting and download your version.

Discover each of the record layouts you may have purchased in the My Forms food list. You can aquire a further version of Connecticut Approval of savings plan for employees any time, if necessary. Just click on the required form to download or printing the record template.

Use US Legal Forms, probably the most extensive collection of legitimate kinds, to conserve time as well as avoid errors. The services gives appropriately produced legitimate record layouts that can be used for a variety of purposes. Create an account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

A 457 plan is a type of retirement plan offered to non-profit and government employees. They allow you to defer income, invest in various assets, and grow your wealth for retirement. Keep in mind, though: They do have lower limits than some other retirement plans, so make sure to explore all your options.

Employers in CT who have five or more employees that each earn more than $5,000 in a calendar year must either participate in MyCTSavings or sponsor another qualified retirement plan through the private market. Businesses that don't comply may be penalized.

Since most government employees already have a pension, a defined contribution plan such as a 457(b) is considered a supplemental savings plan, and so an employer match is uncommon.

The State of Connecticut Deferred Compensation 457 Plan (457 Plan) is a voluntary retirement program that is available to any common law employee or any individual performing services for the State either by appointment or election (including members of the General Assembly).

CalPERS 457 Plan The plan is a voluntary savings program that allows employees to defer any amount, subject to annual limits, from their paycheck on a pretax basis. In addition, employee contributions and their earnings, if any, can benefit from the power of tax-deferred compounding.

You may retire on the first of any month on or following your 70th birthday, if you have at least five years of service. If you leave state service with less than five years of service at age 70 or older, no retirement benefits are payable.

The 403(b) is a tax-advantaged plan. Employees may choose how much to contribute and whether to contribute on a pre-tax basis, on an after-tax basis (Roth), or with a combination of the two methods.

The State of Connecticut Deferred Compensation 457 Plan (457 Plan) is a voluntary retirement program that is available to any common law employee or any individual performing services for the State either by appointment or election (including members of the General Assembly).