Connecticut Proposal to approve adoption of stock purchase assistance plan

Description

How to fill out Proposal To Approve Adoption Of Stock Purchase Assistance Plan?

Choosing the best legal file format might be a struggle. Needless to say, there are tons of templates available online, but how do you discover the legal kind you need? Use the US Legal Forms site. The assistance provides 1000s of templates, such as the Connecticut Proposal to approve adoption of stock purchase assistance plan, that you can use for business and personal requirements. Every one of the types are checked by pros and fulfill federal and state needs.

When you are currently registered, log in in your profile and click on the Down load switch to have the Connecticut Proposal to approve adoption of stock purchase assistance plan. Utilize your profile to check throughout the legal types you might have acquired formerly. Visit the My Forms tab of your profile and obtain an additional version of your file you need.

When you are a brand new consumer of US Legal Forms, allow me to share simple directions for you to stick to:

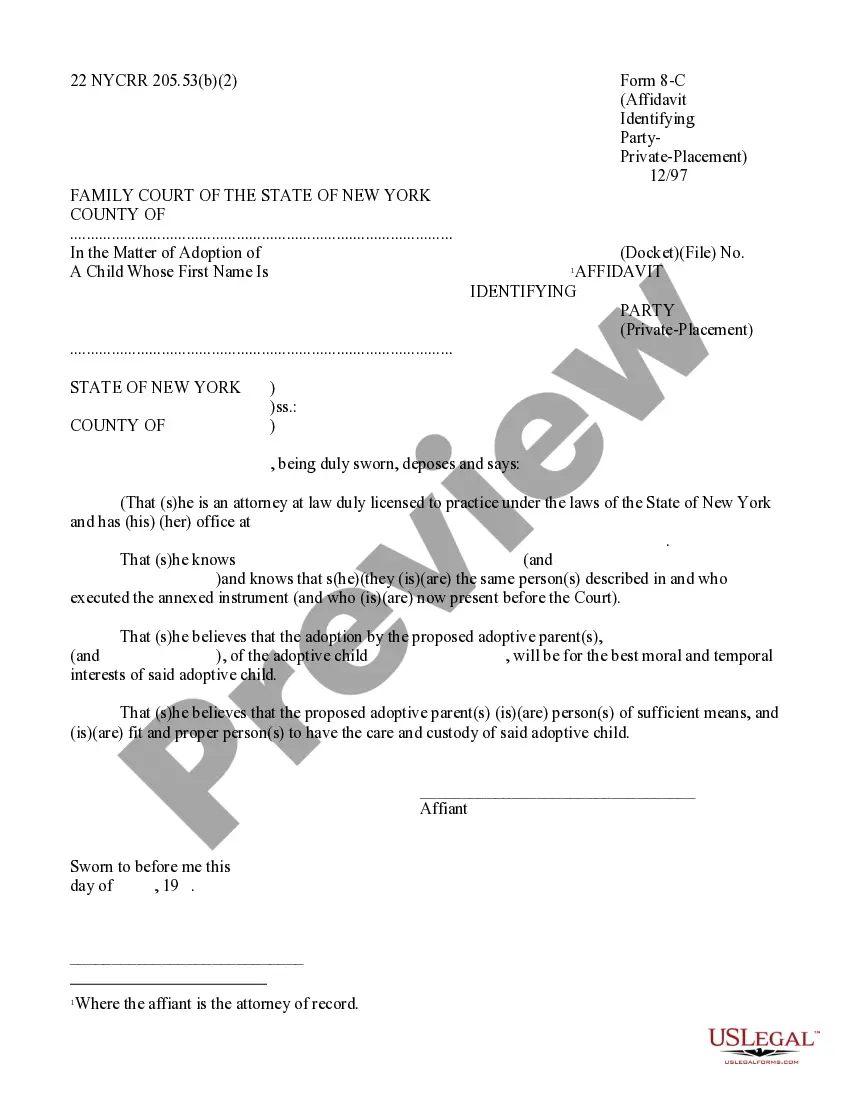

- Initially, make sure you have chosen the proper kind for your area/state. It is possible to look over the form while using Preview switch and study the form outline to make sure this is the best for you.

- When the kind is not going to fulfill your needs, make use of the Seach discipline to find the correct kind.

- When you are certain that the form is acceptable, click the Purchase now switch to have the kind.

- Select the pricing plan you need and enter the required details. Design your profile and pay money for your order making use of your PayPal profile or credit card.

- Select the submit format and download the legal file format in your product.

- Total, modify and print out and indicator the obtained Connecticut Proposal to approve adoption of stock purchase assistance plan.

US Legal Forms may be the largest library of legal types that you can see different file templates. Use the company to download appropriately-manufactured paperwork that stick to condition needs.

Form popularity

FAQ

To foster parent or adopt from foster care in Connecticut, you must: Be 21 years of age or older. Be able to provide a loving, safe home. Have sufficient income to meet your own financial needs. Pass background checks with both local police and the FBI. Attend a 10-week training program. Complete an adoption home study.

An individual development account (IDA) is a type of savings account designed to help low-income individuals build assets and achieve financial stability and long-term self-sufficiency. People use IDAs to save money to start a business, pay for education, or buy a home.

Individual Development Accounts (IDAs) are savings accounts for people with modest incomes that provide public and private matching funds when families save. Eligible families receive extensive financial education and training so they can achieve identified goals such as buying a home or beginning a business.

What are the laws and qualifications for adopting a child in Connecticut? Any adult may adopt in Connecticut. The sexual orientation of the prospective adoptive parent(s) may be considered when placing a child for adoption. A husband and wife must adopt jointly unless an exception is made by the court.

The Individual Development Accounts (IDA) Program helps refugees and other ORR-eligible populations save toward an asset that will help increase financial independence. The program helps refugees understand what assets are, how the U.S. financial system works, and how to manage their money.

Many might think you need to own a home, be married, have already parented, or have a medical background to become an adoptive parent; but none of that is true. The process is free and only ?costs? your time and commitment. DCF provides training and support throughout the process.

Established in 1960, IDA aims to reduce poverty by providing zero to low-interest loans (called ?credits?) and grants for programs that boost economic growth, reduce inequalities, and improve people's living conditions.

The Interim Disability Assistance (IDA) Program provides temporary financial assistance to those who are unable to work due to a disability and have a high probability of receiving federal Supplemental Security Income (SSI). IDA payments are issued until SSI eligibility is approved or denied.