Connecticut Supplemental Employee Stock Ownership Plan (CT AESOP) is a unique retirement program offered by SIX Corporations, a leading global supplier of engineered products and technologies. The company has established this plan to provide eligible employees with an opportunity to share in the ownership of the company and participate in its long-term growth. The primary purpose of Connecticut AESOP is to enhance employee retention, motivation, and loyalty by granting them an additional stock ownership stake in addition to their regular retirement savings. This plan is specifically designed to comply with the Connecticut state laws and regulations governing employee stock ownership plans. By participating in the CT AESOP, employees can accumulate shares of SIX Corporations common stock over time that will be held in an individual account on their behalf. These shares are allocated to employees based on their compensation and length of service with the company. The plan is designed to provide a tax-advantaged way for employees to build their retirement assets while aligning their interests with the long-term success of SIX Corporations. One of the notable features of CT AESOP is its flexibility, allowing employees to choose the investment options that suit their preferences and risk tolerance. The plan offers a range of investment options, including SIX Corporation stock, mutual funds, and other investment funds. This diversity allows employees to customize their investment strategy while benefiting from the potential growth of the company. Furthermore, the CT AESOP can provide significant tax advantages for both employees and the company. Contributions made by employees to the plan are deducted from their taxable income, reducing their overall tax liability. Additionally, the contributions made by SIX Corporations to the plan on behalf of employees are tax-deductible for the company. It is important to note that there may be different variations or tiers of the CT AESOP offered by SIX Corporations, catering to different employee groups or levels within the organization. These may include executive-level plans, mid-level management plans, and plans for general employees. The differences among these plans are typically based on eligibility requirements, contribution limits, and allocation formulas. In summary, the Connecticut Supplemental Employee Stock Ownership Plan of SIX Corporation (CT AESOP) is a carefully structured employee benefit program that aims to foster employee loyalty, align interests, and facilitate retirement savings through stock ownership. By offering tax advantages, investment flexibility, and long-term growth potential, the CT AESOP provides an attractive incentive for employees to participate and plan for a financially secure future.

Connecticut Supplemental Employee Stock Ownership Plan of SPX Corporation

Description

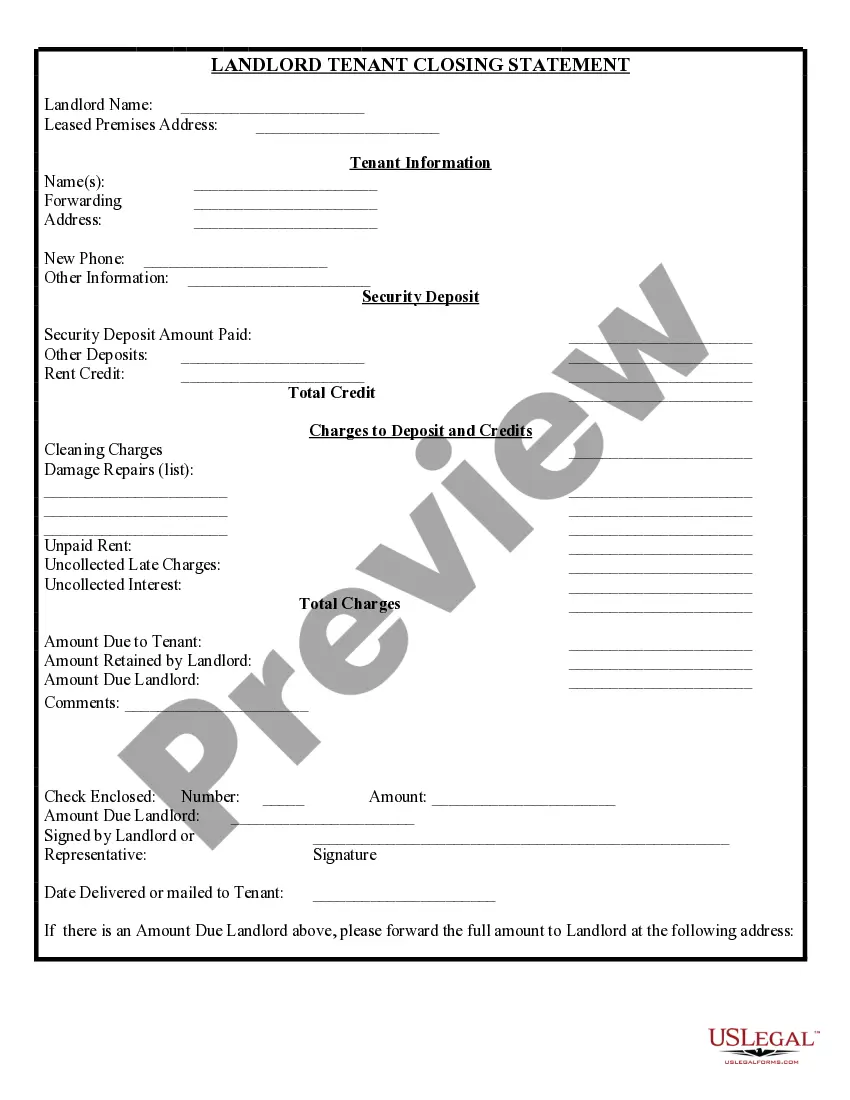

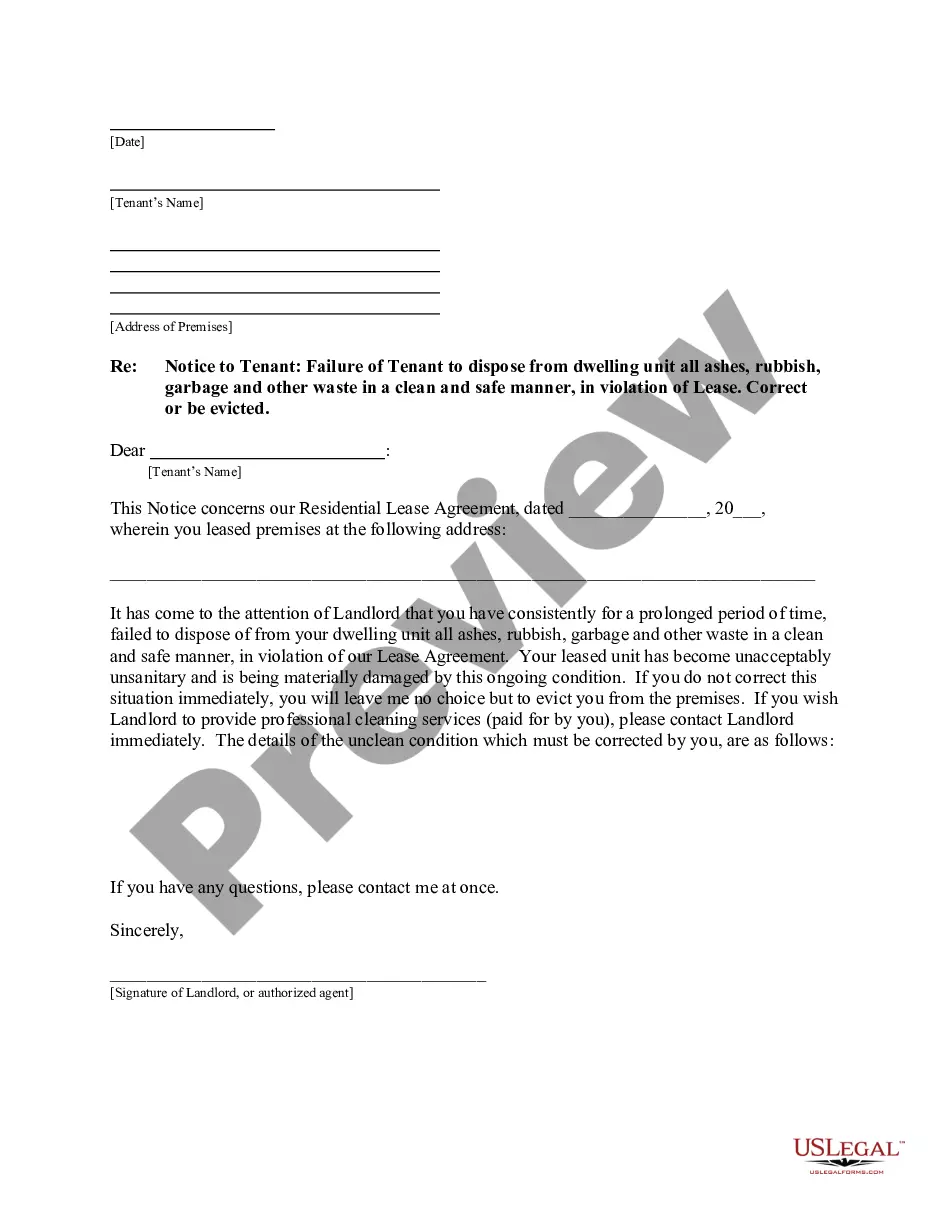

How to fill out Supplemental Employee Stock Ownership Plan Of SPX Corporation?

US Legal Forms - one of the largest libraries of lawful types in the United States - provides a wide range of lawful record templates it is possible to acquire or print. Utilizing the web site, you will get 1000s of types for enterprise and personal uses, categorized by groups, states, or key phrases.You can get the most recent models of types much like the Connecticut Supplemental Employee Stock Ownership Plan of SPX Corporation in seconds.

If you currently have a subscription, log in and acquire Connecticut Supplemental Employee Stock Ownership Plan of SPX Corporation from the US Legal Forms catalogue. The Down load switch can look on every single kind you perspective. You get access to all previously acquired types in the My Forms tab of your own accounts.

If you wish to use US Legal Forms the first time, allow me to share easy directions to help you started out:

- Be sure to have picked the right kind for the area/county. Select the Review switch to check the form`s information. Read the kind explanation to actually have chosen the proper kind.

- In case the kind does not match your needs, use the Lookup field at the top of the screen to get the one that does.

- In case you are content with the form, confirm your selection by clicking on the Get now switch. Then, pick the costs program you want and supply your references to register on an accounts.

- Procedure the financial transaction. Use your bank card or PayPal accounts to perform the financial transaction.

- Find the formatting and acquire the form in your device.

- Make alterations. Load, modify and print and sign the acquired Connecticut Supplemental Employee Stock Ownership Plan of SPX Corporation.

Each and every format you put into your money does not have an expiration day and is the one you have permanently. So, if you want to acquire or print yet another version, just check out the My Forms area and then click around the kind you want.

Get access to the Connecticut Supplemental Employee Stock Ownership Plan of SPX Corporation with US Legal Forms, probably the most substantial catalogue of lawful record templates. Use 1000s of professional and condition-certain templates that meet up with your small business or personal needs and needs.

Form popularity

FAQ

At SPX, our values of Integrity, Accountability, Excellence, Teamwork and Results are core elements that drive the way we engage with each other, our customers, our partners and the community. Consistent with these values, we set high standards for social responsibility.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

The company markets its products through independent manufacturing representatives, third-party distributors, and retailers, as well as direct to customers. The company was formerly known as SPX Corporation and changed its name to SPX Technologies, Inc. in August 2022.

One Company, Established Brands Customers may know us by one of our trusted name brands: Marley, Recold and SGS.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

Employee stock ownership, or employee share ownership, is where a company's employees own shares in that company (or in the parent company of a group of companies).

CHARLOTTE, N.C., Aug. 15, 2022 (GLOBE NEWSWIRE) ? SPX Technologies, Inc. (?SPX Technologies?) (NYSE:SPXC), as the successor registrant to SPX Corporation, announced today that it has finalized the reorganization of its corporate legal structure, pursuant to Section 251(g) of the Delaware General Corporation Law.

SPX Technologies (NYSE: SPXC) is, along with its subsidiaries, a diversified, global supplier of infrastructure equipment with scalable growth platforms in heating, ventilation and air conditioning (HVAC), and detection and measurement.