Connecticut Standstill Agreement of Gross mans, Inc. is an internal agreement specifically designed to regulate the relationship between the shareholders of a single company. It sets forth certain provisions and restrictions to ensure that all parties involved maintain a stable and predictable environment. This agreement is essential for preventing abrupt changes in ownership and potential disruptions within the company's management structure. Key provisions of the Connecticut Standstill Agreement include restrictions on the transfer of shares, limitations on voting rights, and guidelines for the nomination and election of directors. The purpose is to maintain the stability and prevent any sudden shifts in control that could negatively impact the business operations of Gross mans, Inc. There are different types of Connecticut Standstill Agreements that can be categorized based on their duration and specific provisions. Some of them include: 1. Short-term Standstill Agreement: This type of agreement is typically valid for a short period, such as one to three years. It imposes restrictions on the transfer of shares and voting rights, effectively impeding any attempt to change the company's ownership structure during this period. 2. Long-term Standstill Agreement: Unlike the short-term agreement, this type extends for a longer duration, often five to ten years. It restricts shareholders from transferring their shares or making significant changes in voting power, providing stability and continuity to the company's operations and governance. 3. Comprehensive Standstill Agreement: This agreement encompasses a wide range of provisions, including restrictions on share transfers, voting rights, board representation, and takeover defenses. A comprehensive standstill agreement is geared towards protecting the company from hostile takeovers and ensuring the shareholders' interests remain aligned. In all variations of the Connecticut Standstill Agreement, the primary objective is to provide a framework for cooperation, transparency, and predictability among the shareholders of Gross mans, Inc. It is a crucial internal document that minimizes the risk of sudden ownership changes, enhances corporate governance, and fosters a favorable business environment.

Connecticut Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company

Description

How to fill out Connecticut Standstill Agreement Of Grossmans, Inc. - Internal Agreement Regarding Shareholders Of Single Company?

US Legal Forms - one of many greatest libraries of authorized varieties in the United States - gives a wide range of authorized papers layouts it is possible to acquire or printing. While using website, you can find 1000s of varieties for business and individual reasons, categorized by categories, suggests, or key phrases.You can get the most recent types of varieties such as the Connecticut Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company in seconds.

If you have a membership, log in and acquire Connecticut Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company from your US Legal Forms library. The Acquire option will show up on each develop you see. You gain access to all in the past downloaded varieties within the My Forms tab of your own bank account.

If you wish to use US Legal Forms the first time, listed below are simple recommendations to help you started:

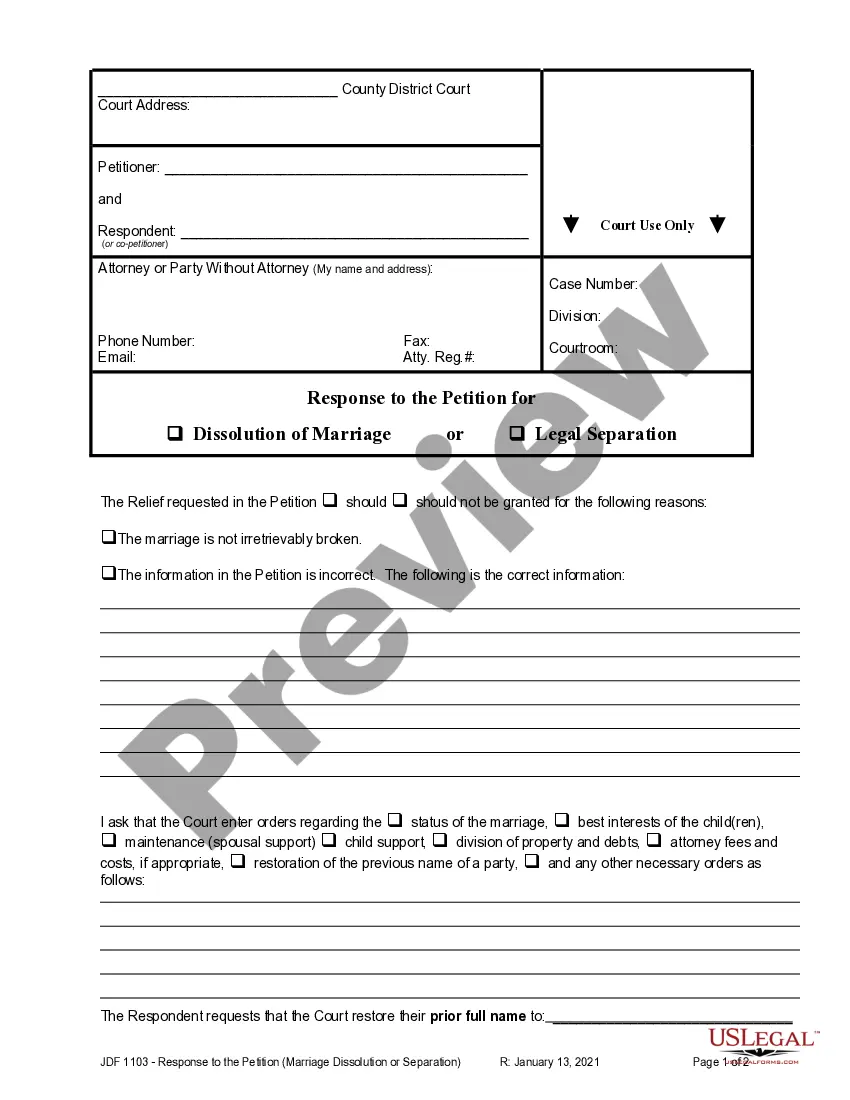

- Make sure you have picked the right develop to your metropolis/area. Click the Preview option to analyze the form`s content material. Look at the develop information to ensure that you have selected the appropriate develop.

- If the develop doesn`t match your needs, use the Research discipline towards the top of the screen to obtain the one who does.

- When you are content with the form, verify your decision by visiting the Buy now option. Then, pick the costs strategy you want and offer your references to register on an bank account.

- Procedure the purchase. Make use of bank card or PayPal bank account to accomplish the purchase.

- Pick the format and acquire the form on your own system.

- Make changes. Load, modify and printing and signal the downloaded Connecticut Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company.

Every single design you included with your account lacks an expiration date and it is yours forever. So, in order to acquire or printing yet another copy, just go to the My Forms portion and click on in the develop you require.

Gain access to the Connecticut Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company with US Legal Forms, probably the most comprehensive library of authorized papers layouts. Use 1000s of professional and status-distinct layouts that meet up with your organization or individual requires and needs.

Form popularity

FAQ

An agreement in which a hostile bidder agrees to limit its holdings in a target company. A standstill agreement stops the takeover bid from progressing for a period of time.

A standstill agreement was an agreement signed between the newly independent dominions of India and Pakistan and the princely states of the British Indian Empire prior to their integration in the new dominions. The form of the agreement was bilateral between a dominion and a princely state.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

A standstill agreement prevents a party from issuing proceedings during the currency of that agreement. As such a standstill agreement is a voluntary contractual arrangement between the parties to pause limitation for an agreed length of time (typically 3-6 months).