Connecticut Proposal to amend certificate of incorporation to authorize a preferred stock

Description

How to fill out Proposal To Amend Certificate Of Incorporation To Authorize A Preferred Stock?

If you need to complete, obtain, or print out legal document templates, use US Legal Forms, the largest selection of legal types, which can be found on-line. Take advantage of the site`s basic and convenient lookup to find the paperwork you need. Numerous templates for organization and person uses are sorted by classes and claims, or search phrases. Use US Legal Forms to find the Connecticut Proposal to amend certificate of incorporation to authorize a preferred stock within a number of mouse clicks.

If you are previously a US Legal Forms client, log in to the bank account and click on the Obtain button to find the Connecticut Proposal to amend certificate of incorporation to authorize a preferred stock. You can also gain access to types you previously downloaded inside the My Forms tab of your respective bank account.

If you are using US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form to the right area/nation.

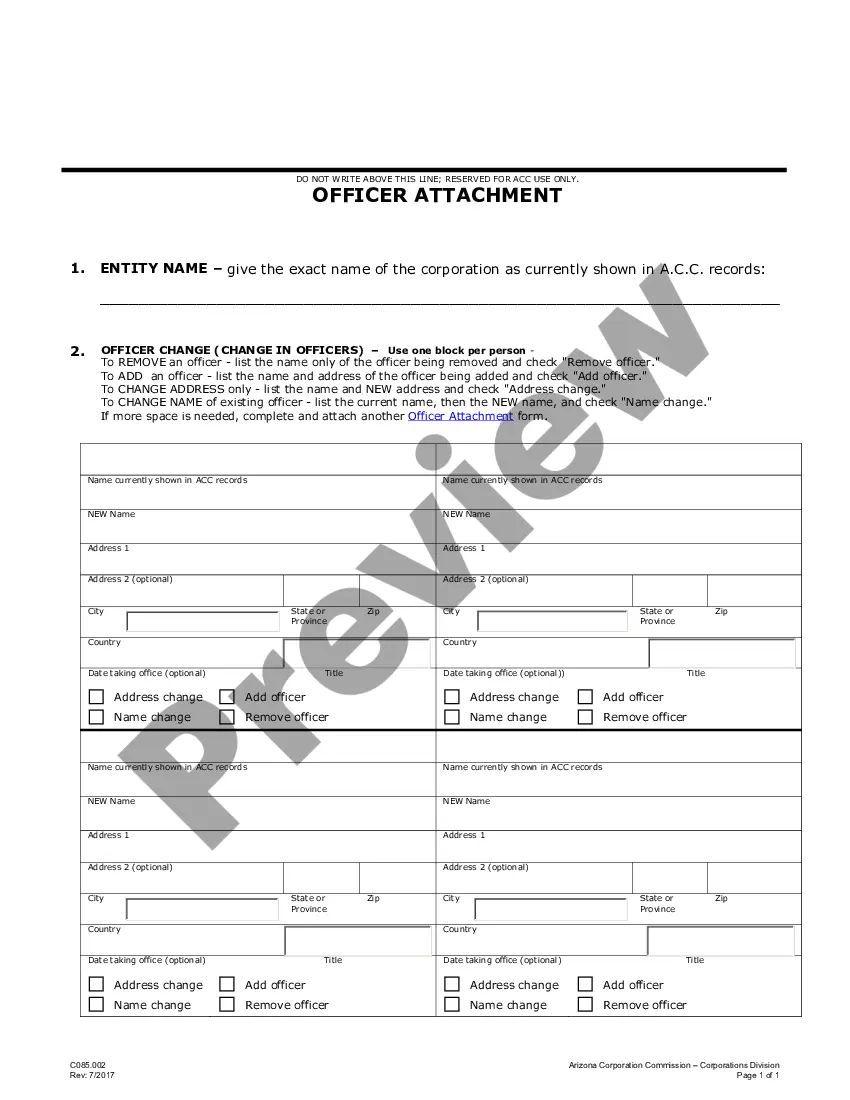

- Step 2. Use the Review option to examine the form`s articles. Don`t forget to see the outline.

- Step 3. If you are unsatisfied with all the type, take advantage of the Look for field towards the top of the monitor to locate other versions in the legal type format.

- Step 4. After you have identified the form you need, click the Purchase now button. Choose the costs prepare you choose and include your references to register on an bank account.

- Step 5. Procedure the transaction. You may use your charge card or PayPal bank account to complete the transaction.

- Step 6. Select the format in the legal type and obtain it on the gadget.

- Step 7. Full, change and print out or indicator the Connecticut Proposal to amend certificate of incorporation to authorize a preferred stock.

Every single legal document format you purchase is yours permanently. You may have acces to each and every type you downloaded with your acccount. Click on the My Forms portion and pick a type to print out or obtain again.

Be competitive and obtain, and print out the Connecticut Proposal to amend certificate of incorporation to authorize a preferred stock with US Legal Forms. There are thousands of skilled and condition-certain types you can use for the organization or person requires.

Form popularity

FAQ

Section 33-920. - Authority to transact business required. (a) A foreign corporation, other than an insurance, surety or indemnity company, may not transact business in this state until it obtains a certificate of authority from the Secretary of the State.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

Articles of Incorporation refers to the highest governing document in a corporation. It is also known known as the corporate charter. The Articles of Incorporation generally include the purpose of the corporation, the type and number of shares, and the process of electing a board of directors.

To amend the Certificate of Organization for your Connecticut LLC, you'll need to file a Certificate of Amendment with the Connecticut Secretary of State. Along with the amendment, you'll need to pay a $120 filing fee.