Connecticut Proxy Statement of Bank of Montana System

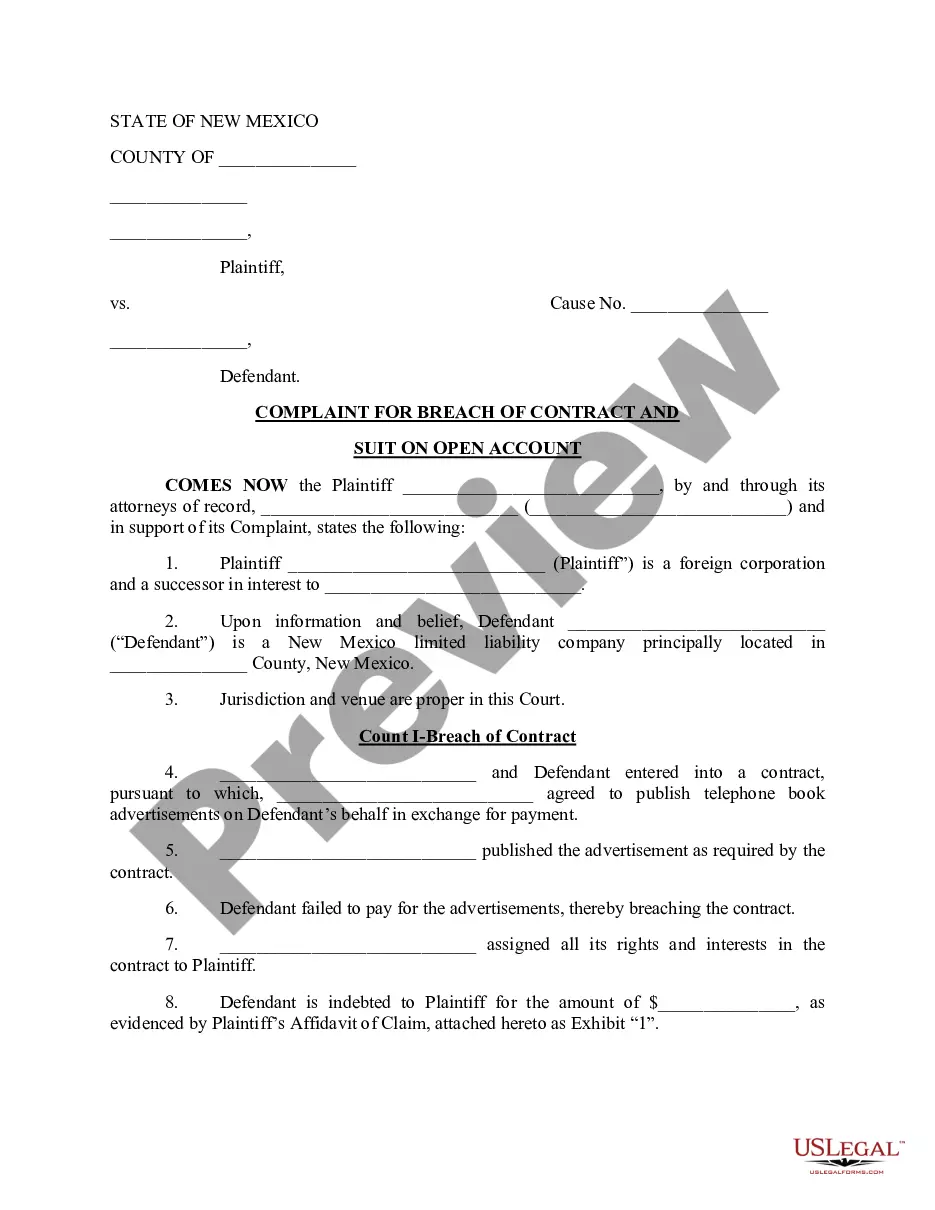

Description

How to fill out Proxy Statement Of Bank Of Montana System?

US Legal Forms - one of several greatest libraries of authorized varieties in the States - offers an array of authorized document web templates you are able to acquire or print out. While using site, you can find a large number of varieties for organization and individual reasons, sorted by groups, suggests, or key phrases.You can get the newest types of varieties like the Connecticut Proxy Statement of Bank of Montana System within minutes.

If you currently have a registration, log in and acquire Connecticut Proxy Statement of Bank of Montana System in the US Legal Forms local library. The Download key will show up on each and every kind you view. You get access to all previously acquired varieties inside the My Forms tab of your own bank account.

If you wish to use US Legal Forms initially, here are straightforward recommendations to get you started off:

- Ensure you have picked the right kind for your area/area. Go through the Review key to examine the form`s articles. Look at the kind description to ensure that you have selected the proper kind.

- When the kind doesn`t suit your demands, make use of the Look for field on top of the display screen to get the one who does.

- Should you be pleased with the form, confirm your decision by visiting the Purchase now key. Then, choose the rates program you prefer and provide your qualifications to sign up for an bank account.

- Process the financial transaction. Use your credit card or PayPal bank account to perform the financial transaction.

- Select the format and acquire the form on the gadget.

- Make alterations. Load, edit and print out and signal the acquired Connecticut Proxy Statement of Bank of Montana System.

Each and every web template you included with your money lacks an expiry time and is also the one you have for a long time. So, in order to acquire or print out yet another backup, just proceed to the My Forms portion and then click around the kind you want.

Get access to the Connecticut Proxy Statement of Bank of Montana System with US Legal Forms, probably the most comprehensive local library of authorized document web templates. Use a large number of specialist and express-certain web templates that satisfy your organization or individual requires and demands.