Connecticut Amendment to the articles of incorporation to eliminate par value

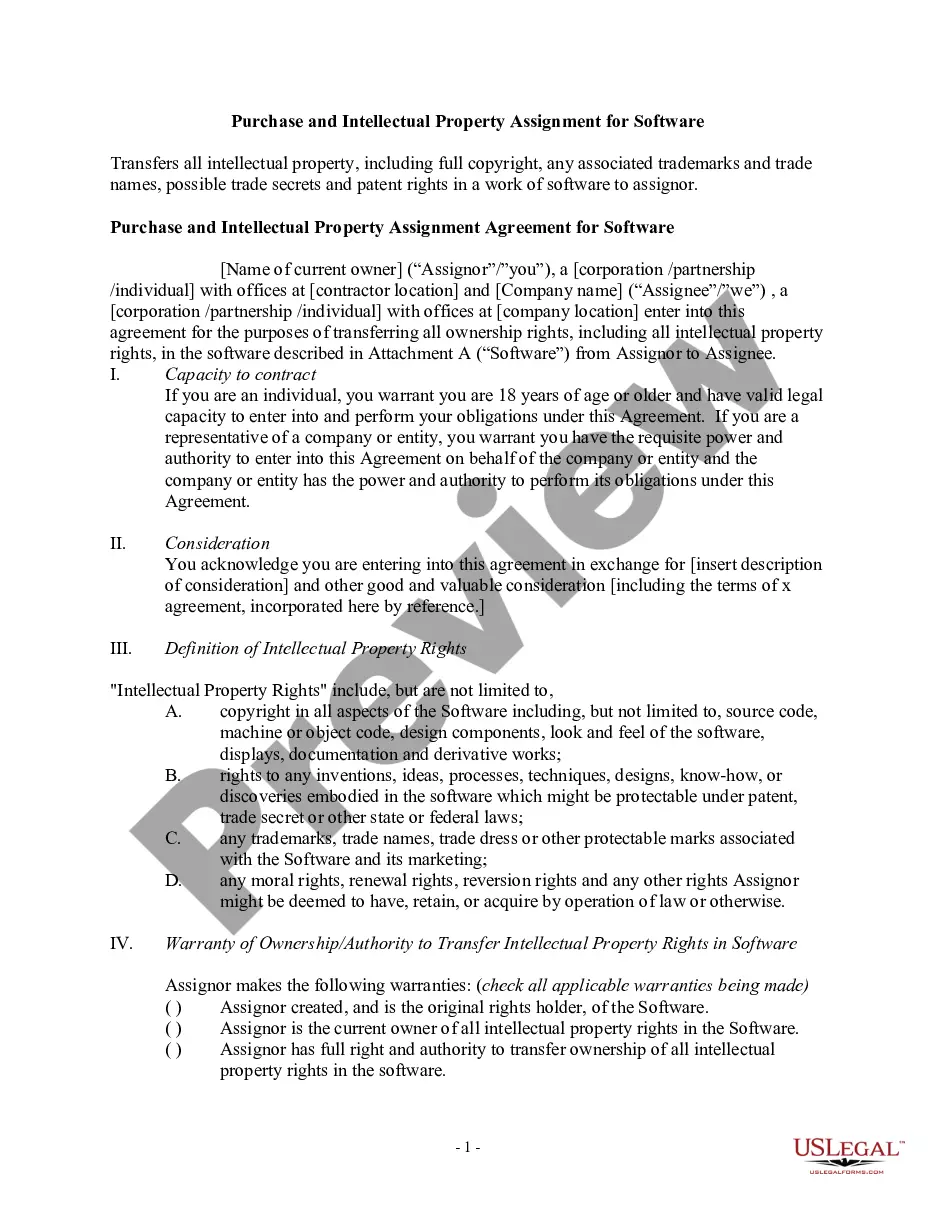

Description

How to fill out Amendment To The Articles Of Incorporation To Eliminate Par Value?

Choosing the best legal papers design might be a have a problem. Of course, there are tons of web templates available on the net, but how can you discover the legal kind you need? Utilize the US Legal Forms web site. The service delivers thousands of web templates, like the Connecticut Amendment to the articles of incorporation to eliminate par value, that you can use for enterprise and private demands. All of the types are checked by specialists and satisfy federal and state demands.

Should you be previously signed up, log in for your account and then click the Down load option to find the Connecticut Amendment to the articles of incorporation to eliminate par value. Use your account to look with the legal types you possess acquired earlier. Visit the My Forms tab of your account and have yet another version from the papers you need.

Should you be a fresh customer of US Legal Forms, allow me to share simple guidelines that you can follow:

- First, make certain you have chosen the right kind to your town/county. You can look over the form using the Review option and study the form outline to make sure this is basically the right one for you.

- When the kind will not satisfy your needs, take advantage of the Seach industry to obtain the proper kind.

- Once you are positive that the form is suitable, go through the Get now option to find the kind.

- Choose the costs plan you need and type in the necessary info. Design your account and buy the transaction making use of your PayPal account or charge card.

- Pick the file file format and down load the legal papers design for your device.

- Complete, modify and print out and indication the acquired Connecticut Amendment to the articles of incorporation to eliminate par value.

US Legal Forms is the biggest collection of legal types for which you can discover different papers web templates. Utilize the service to down load expertly-manufactured files that follow express demands.

Form popularity

FAQ

Hence, limited period of existence and centralized management are not typical characteristics of a corporation.

Answer and Explanation: c) Unlimited liability is not an advantage of a corporation. Unlimited liability is a disadvantage of a sole proprietorship or partnership where personal assets are exposed to risk.

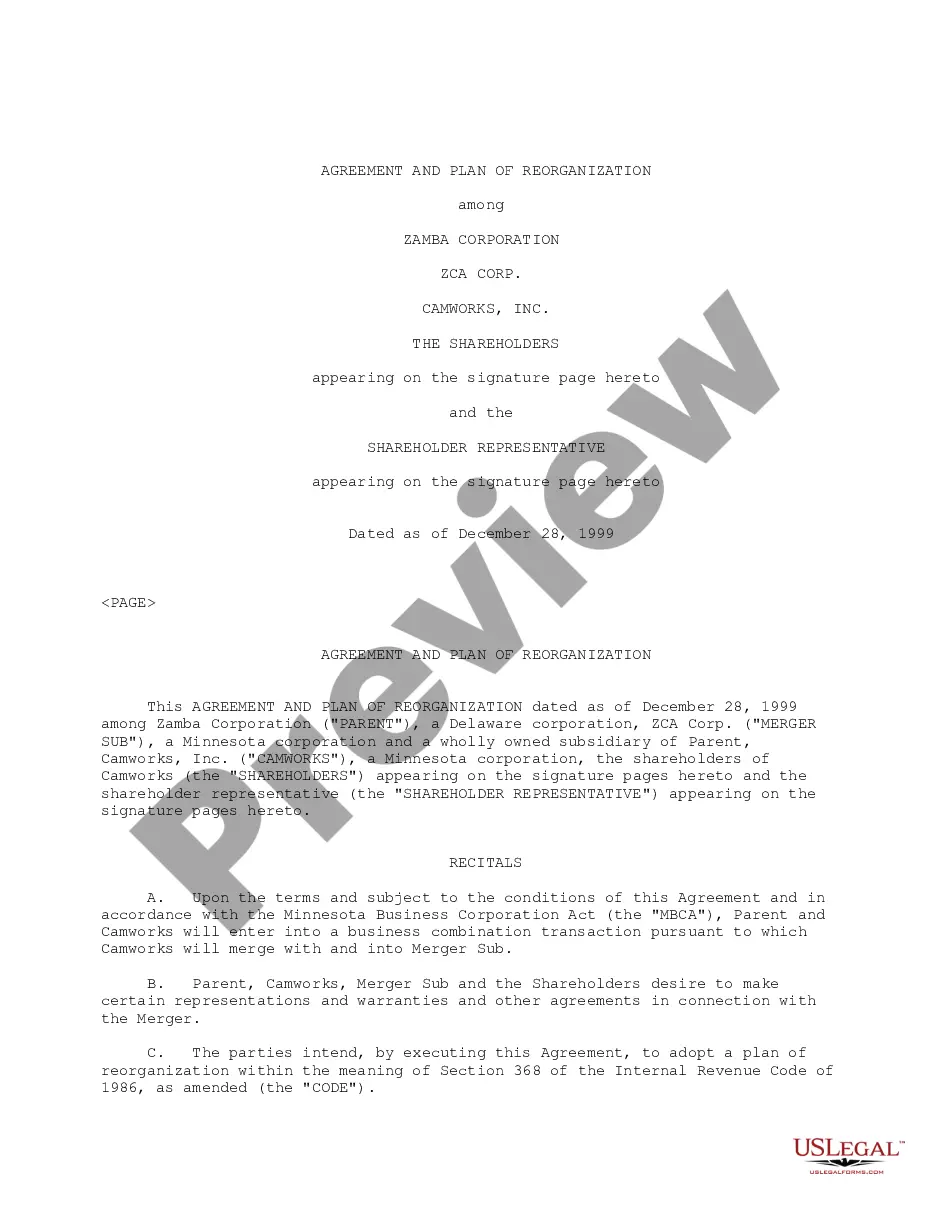

A corporation, sometimes called a C corp, is a legal entity that's separate from its owners. Corporations can make a profit, be taxed, and can be held legally liable. Corporations offer the strongest protection to its owners from personal liability, but the cost to form a corporation is higher than other structures.

Incorporators and Board of Directors in the Philippines Where the capital stock consists of no-par value shares, the subscriptions must be paid in full. The minimum paid-up capital is P5,000.

5), the modern corporation has all five of the following characteristics: separate legal personality. limited liability of its shareholders. centralised delegated management under a board structure. transferable shares (in the case of listed companies: freely tradable shares) absentee investor ownership.

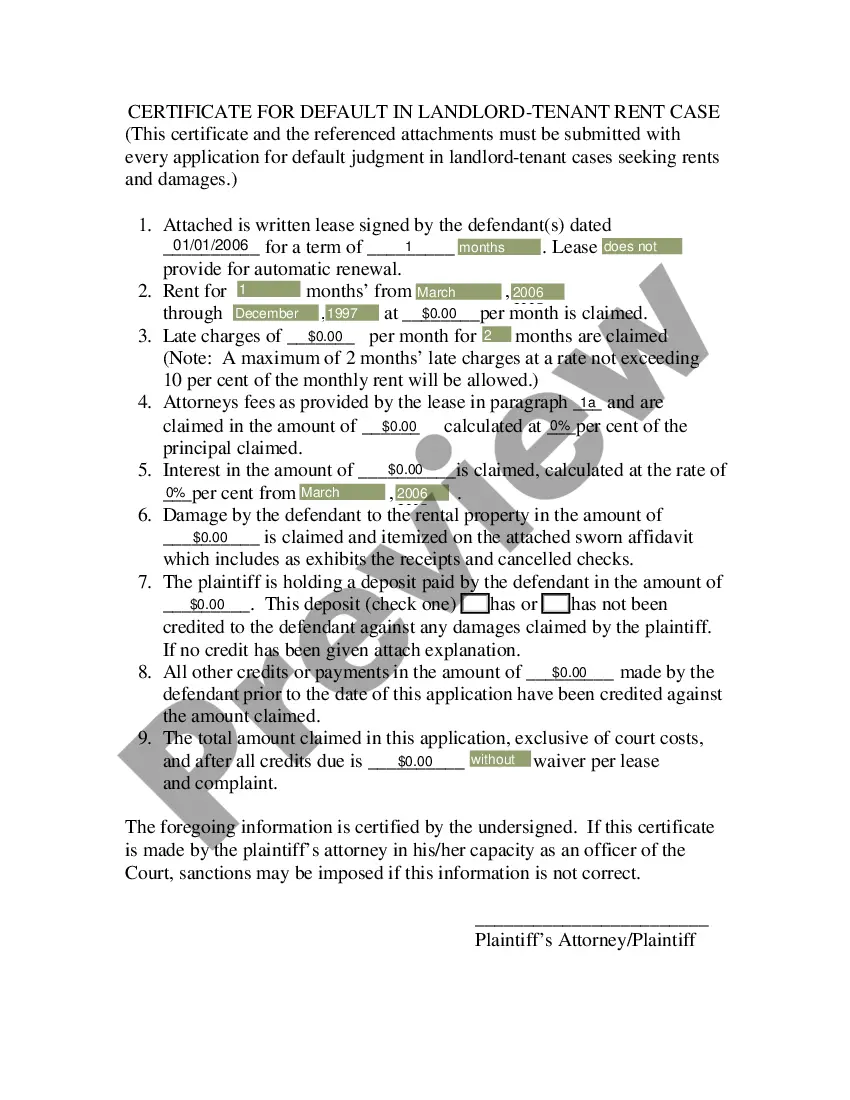

Section 33-920. - Authority to transact business required. (a) A foreign corporation, other than an insurance, surety or indemnity company, may not transact business in this state until it obtains a certificate of authority from the Secretary of the State.

What is a Company? ParticularsCompanyManagementManaged directly by owners.Legal entity statusNot considered a separate legal entity.LifespanExists for the duration owners are involved.Financing and capitalRaised from personal investments of owners.3 more rows ?