Connecticut Registration Rights Agreement, also known as a "Connecticut ERA," is a legal contract that defines the rights and obligations related to the registration of securities between Alexander and Alexander Services, Inc. (hereinafter referred to as "AAS") and Purchasers. This agreement plays a crucial role in facilitating the efficient and effective registration process, ensuring compliance with applicable securities laws and regulations. Under the Connecticut ERA, Alexander and Alexander Services, Inc. grants certain registration rights to the Purchasers, allowing them to demand and participate in the registration of the securities they hold. These registration rights are usually provided to protect the interests of the Purchasers and to provide them with liquidity and flexibility when it comes to selling their securities in the public market. Some key provisions and features of the Connecticut Registration Rights Agreement include: 1. Demand Registration Rights: This provision grants the Purchasers the right to request that AAS register their securities with the appropriate regulatory authorities. These demands are typically subject to specific conditions and limitations outlined in the agreement, such as minimum transaction size or waiting periods between demands. 2. Piggyback Registration Rights: Piggyback rights enable the Purchasers to include their securities in any registration statements that AAS may file with the regulatory authorities. This allows the Purchasers to sell their securities alongside AAS, benefiting from the marketing and underwriting efforts of the company. 3. Registration Expenses: The agreement clarifies how the registration expenses will be allocated between AAS and the Purchasers. Typically, AAS bears the expenses associated with filing fees, legal fees, and other external costs related to the registration process. 4. Indemnification: This provision safeguards the Purchasers against any potential liabilities or losses resulting from the registration process. AAS agrees to indemnify and hold the Purchasers harmless from any such claims or actions arising due to false or misleading information provided by AAS. 5. Lock-up Periods: In some cases, the agreement might include lock-up periods during which the Purchasers are restricted from selling their securities. This restriction helps maintain stability and prevent unnecessary volatility in the market following the registration. It's important to note that while the overall structure and provisions remain similar across different Connecticut Registration Rights Agreements, the specific terms may vary depending on the negotiated agreement between Alexander and Alexander Services, Inc. and the Purchasers. These agreements can be modified to accommodate the unique requirements of both parties and the specific nature of the securities being registered. Different types of Connecticut Registration Rights Agreements between Alexander and Alexander Services, Inc. and Purchasers might include variations in the registration rights granted, the size of the securities offering, the duration of the agreement, and any additional provisions agreed upon between the parties to meet their specific needs and circumstances. In conclusion, the Connecticut Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers is a legally binding contract that establishes the rights and obligations related to the registration of securities. By providing registration rights, this agreement enables Purchasers to smoothly navigate the process of selling their securities in the public market while ensuring compliance with applicable securities laws and regulations.

Connecticut Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers

Description

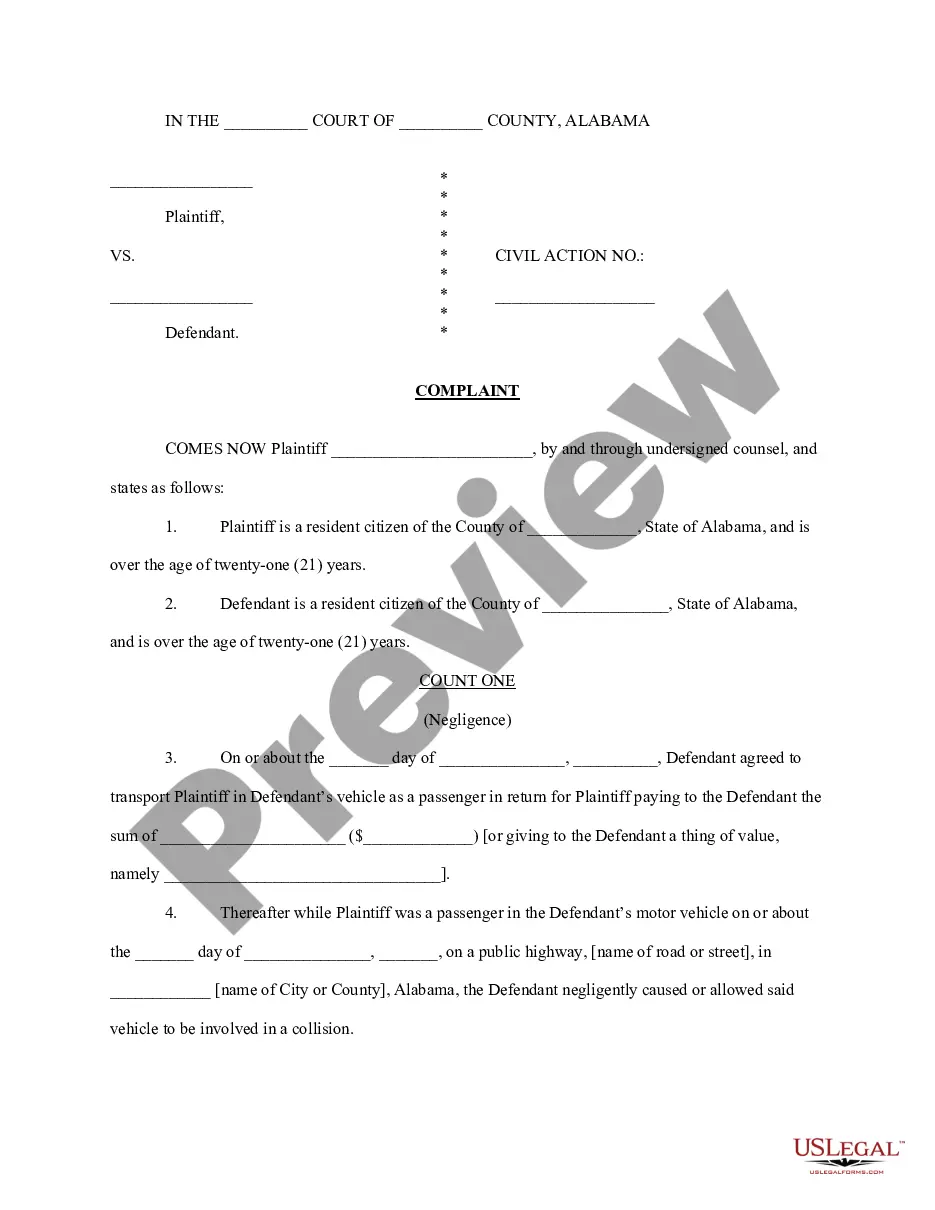

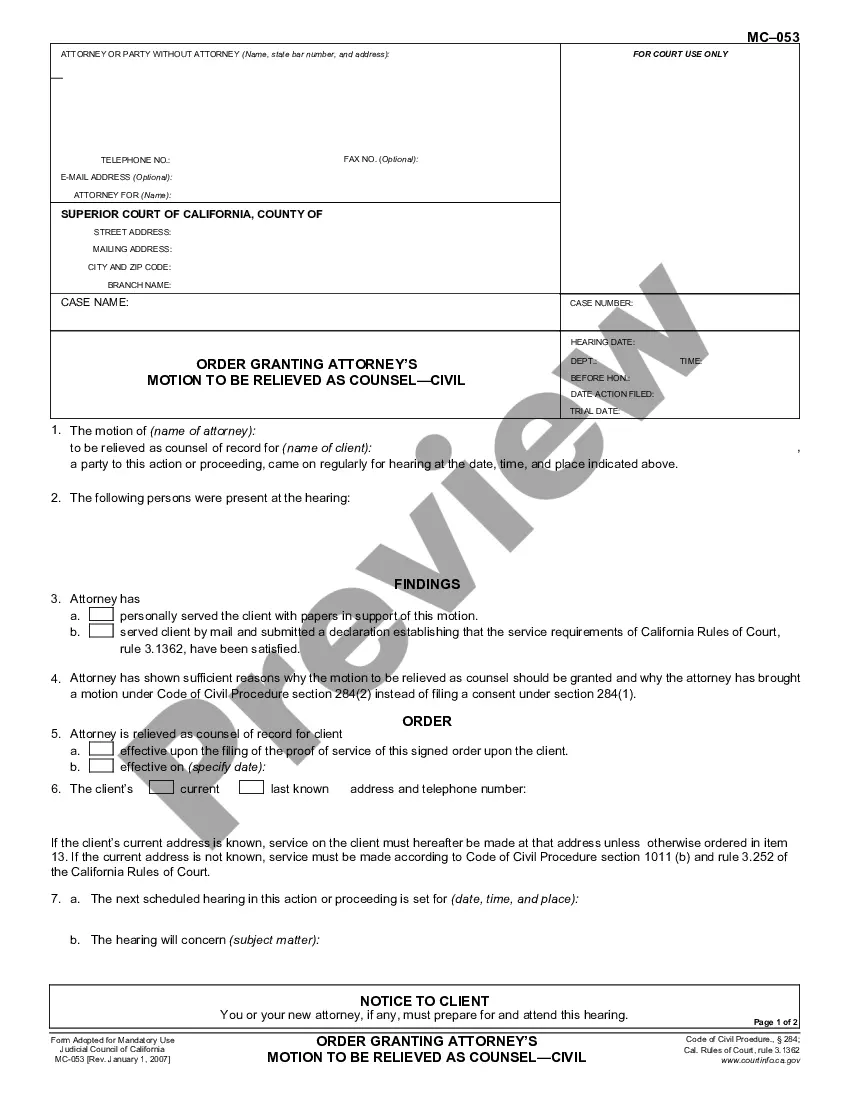

How to fill out Connecticut Registration Rights Agreement Between Alexander And Alexander Services, Inc. And Purchasers?

If you have to comprehensive, obtain, or printing lawful papers web templates, use US Legal Forms, the most important selection of lawful types, that can be found on-line. Take advantage of the site`s basic and practical lookup to discover the papers you want. Different web templates for organization and person purposes are sorted by types and claims, or keywords. Use US Legal Forms to discover the Connecticut Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers in a number of click throughs.

When you are previously a US Legal Forms buyer, log in in your bank account and click the Obtain key to get the Connecticut Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers. You may also access types you previously delivered electronically from the My Forms tab of your bank account.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have chosen the shape for your appropriate city/land.

- Step 2. Make use of the Preview method to look through the form`s content. Don`t overlook to read the information.

- Step 3. When you are unsatisfied together with the develop, utilize the Lookup industry on top of the screen to discover other variations from the lawful develop design.

- Step 4. Once you have identified the shape you want, click on the Get now key. Pick the pricing program you choose and add your credentials to register for the bank account.

- Step 5. Process the deal. You can utilize your credit card or PayPal bank account to finish the deal.

- Step 6. Select the structure from the lawful develop and obtain it on your device.

- Step 7. Total, edit and printing or indicator the Connecticut Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers.

Every lawful papers design you buy is your own property for a long time. You possess acces to every single develop you delivered electronically with your acccount. Select the My Forms section and decide on a develop to printing or obtain once again.

Compete and obtain, and printing the Connecticut Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers with US Legal Forms. There are thousands of skilled and express-distinct types you may use to your organization or person demands.

Form popularity

FAQ

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).

Related Content. In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).

?Definition? A registration rights provision in a term sheet allows an investor to require a company to register the investor's shares with the SEC when certain conditions are met, ensuring that the investor has the opportunity to sell their shares in the public market.

Demand registration rights, where an investor can force a company to file a registration statement to register the holder's securities so the investor can sell them in the public market without restriction.