Connecticut Proxy Statement - University National Bank and Trust Co.

Description

How to fill out Proxy Statement - University National Bank And Trust Co.?

If you have to complete, download, or print legitimate document layouts, use US Legal Forms, the biggest collection of legitimate varieties, that can be found online. Use the site`s easy and practical look for to obtain the papers you want. Various layouts for organization and person functions are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to obtain the Connecticut Proxy Statement - University National Bank and Trust Co. in a couple of mouse clicks.

Should you be presently a US Legal Forms consumer, log in for your accounts and click the Obtain switch to obtain the Connecticut Proxy Statement - University National Bank and Trust Co.. You can even gain access to varieties you previously delivered electronically within the My Forms tab of your respective accounts.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Make sure you have selected the shape for the proper town/land.

- Step 2. Utilize the Preview choice to look through the form`s content material. Never forget about to see the outline.

- Step 3. Should you be not happy together with the form, use the Lookup industry towards the top of the display to get other versions from the legitimate form design.

- Step 4. Once you have located the shape you want, select the Buy now switch. Pick the costs program you prefer and add your accreditations to register for the accounts.

- Step 5. Approach the deal. You should use your credit card or PayPal accounts to finish the deal.

- Step 6. Choose the format from the legitimate form and download it on your own product.

- Step 7. Total, edit and print or indicator the Connecticut Proxy Statement - University National Bank and Trust Co..

Each and every legitimate document design you get is the one you have for a long time. You may have acces to each and every form you delivered electronically inside your acccount. Click the My Forms portion and choose a form to print or download again.

Contend and download, and print the Connecticut Proxy Statement - University National Bank and Trust Co. with US Legal Forms. There are many expert and state-distinct varieties you can utilize for the organization or person requirements.

Form popularity

FAQ

Proxies make payments simpler by doing away with the need to know beneficiary bank details ? all you need is their mobile number or email address. QR codes for paying businesses are another example of proxies - you don't need to know bank details, just scan the code and the payment will reach its destination.

Companies use mailed notices to direct shareholders to publicly accessible websites where they can find proxy statements. The SEC also makes proxy statements available through its EDGAR database. Most retail investors, however, learn about the availability of proxy statements through an email from their brokerage firm.

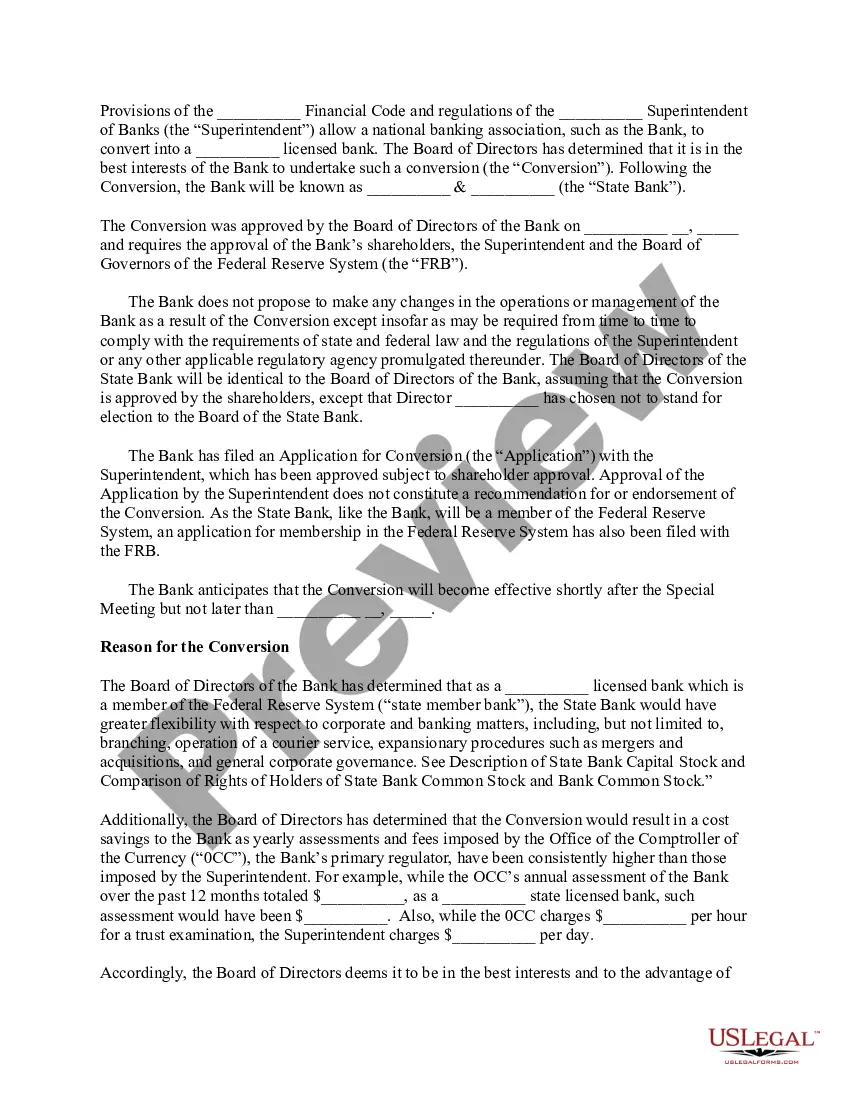

A proxy statement is a document that public companies must provide their shareholders prior to a shareholder meeting. The Securities and Exchange Commission (SEC) requires companies to file their proxy statement in compliance with Schedule 14A. Companies file proxy statements on a Form DEF 14A.

Proxy statements are documents that the Securities and Exchange Commission requires companies to give to shareholders so they can weigh in on important company issues. Proxy statements offer shareholders information about changes on the board and other important decisions the board needs to make.

Proxies allow users to use an account (it can be in cold storage or a hot wallet) less frequently but actively participate in the network with the weight of the s in that account. Proxies are allowed to perform a limited amount of actions related to specific substrate pallets on behalf of another account.