Connecticut Equipment Maintenance Agreement with an Independent Sales Organization

Description

How to fill out Equipment Maintenance Agreement With An Independent Sales Organization?

If you have to total, obtain, or produce legal record web templates, use US Legal Forms, the largest variety of legal varieties, that can be found on the web. Take advantage of the site`s simple and hassle-free search to find the documents you will need. A variety of web templates for company and specific uses are categorized by classes and suggests, or key phrases. Use US Legal Forms to find the Connecticut Equipment Maintenance Agreement with an Independent Sales Organization in just a number of mouse clicks.

If you are previously a US Legal Forms customer, log in to your profile and click on the Down load button to have the Connecticut Equipment Maintenance Agreement with an Independent Sales Organization. You can even gain access to varieties you earlier saved inside the My Forms tab of your profile.

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape for that appropriate city/country.

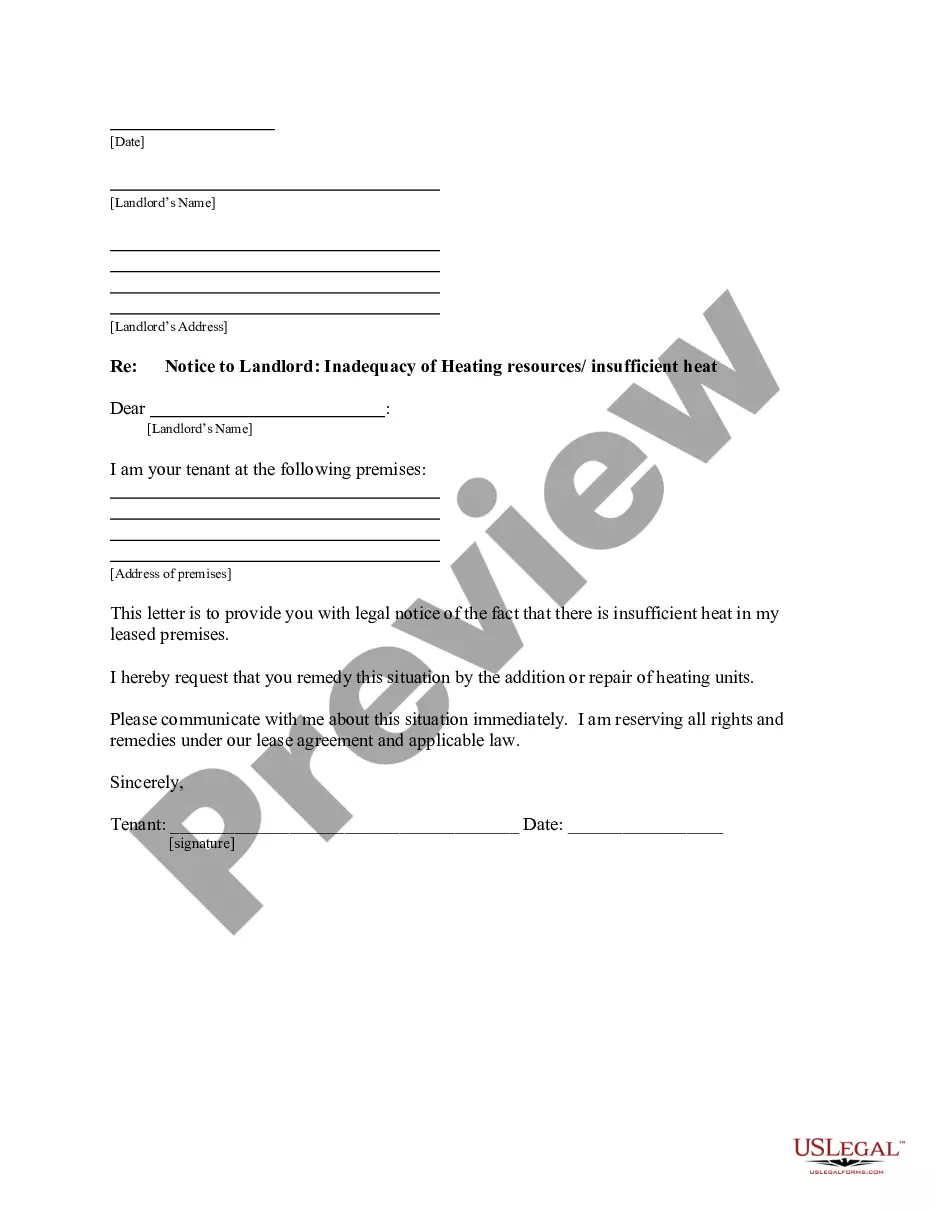

- Step 2. Utilize the Preview method to look through the form`s articles. Don`t neglect to read the outline.

- Step 3. If you are unsatisfied with all the develop, take advantage of the Search discipline near the top of the display screen to find other versions of your legal develop template.

- Step 4. After you have discovered the shape you will need, select the Buy now button. Select the pricing strategy you prefer and add your references to register for the profile.

- Step 5. Approach the purchase. You can utilize your bank card or PayPal profile to accomplish the purchase.

- Step 6. Choose the format of your legal develop and obtain it on your own device.

- Step 7. Full, edit and produce or indication the Connecticut Equipment Maintenance Agreement with an Independent Sales Organization.

Every legal record template you acquire is your own property eternally. You possess acces to each develop you saved inside your acccount. Select the My Forms segment and choose a develop to produce or obtain again.

Remain competitive and obtain, and produce the Connecticut Equipment Maintenance Agreement with an Independent Sales Organization with US Legal Forms. There are many expert and express-distinct varieties you may use for the company or specific demands.

Form popularity

FAQ

There are many services that are taxable in Connecticut: Advertising and public relations services. Business analysis, management, management consulting and public relations services. Cable and satellite television services. Car wash services, including coin-operated car washes.

Typically, professional services are not taxable in the state of Connecticut unless it includes manufacturing a product for sale. How are professional services corporations taxed?

Connecticut building contractors and out-of-state contractors performing services in Connecticut are generally required to collect sales tax on their sales. Moreover, such contractors are required to pay sales or use tax on their purchases.

Typically, the gross receipts of contractors are not subject to sales or use tax. However, in Connecticut, real property contractors are considered to be retailers of services and must collect sales tax on their taxable services.

Tax-exempt goods Some goods are exempt from sales tax under Connecticut law. Examples include bicycle helmets, most non-prepared food items, medicines, and some medical devices and supplies.

REPAIR SERVICES ARE TAXED, WHETHER OR NOT VEHICLES ARE USED IN A TRADE OR BUSINESS: Since October 1, 1991, motor vehicle repair services have been treated as sales subject to the Sales and Use Taxes Act, whether or not the motor vehicle is used in a trade or business.

Go to myconneCT, under Business Registration, click New Business/Need a CT Registration Number? There is a $100 fee for registering to collect sales and use tax. After registering, you will receive a Sales and Use Tax Permit that should be displayed conspicuously for your customers to see.

Services in Connecticut are generally not taxable. However, iif the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Tangible products are taxable in Connecticut, with a few exceptions.