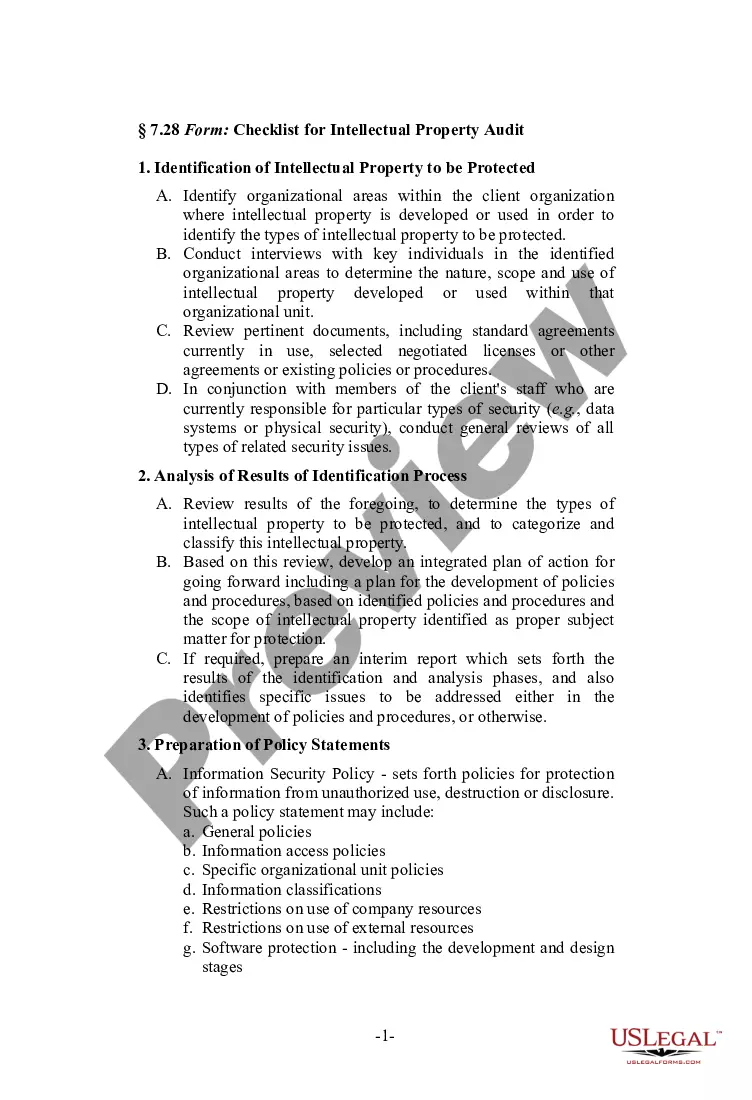

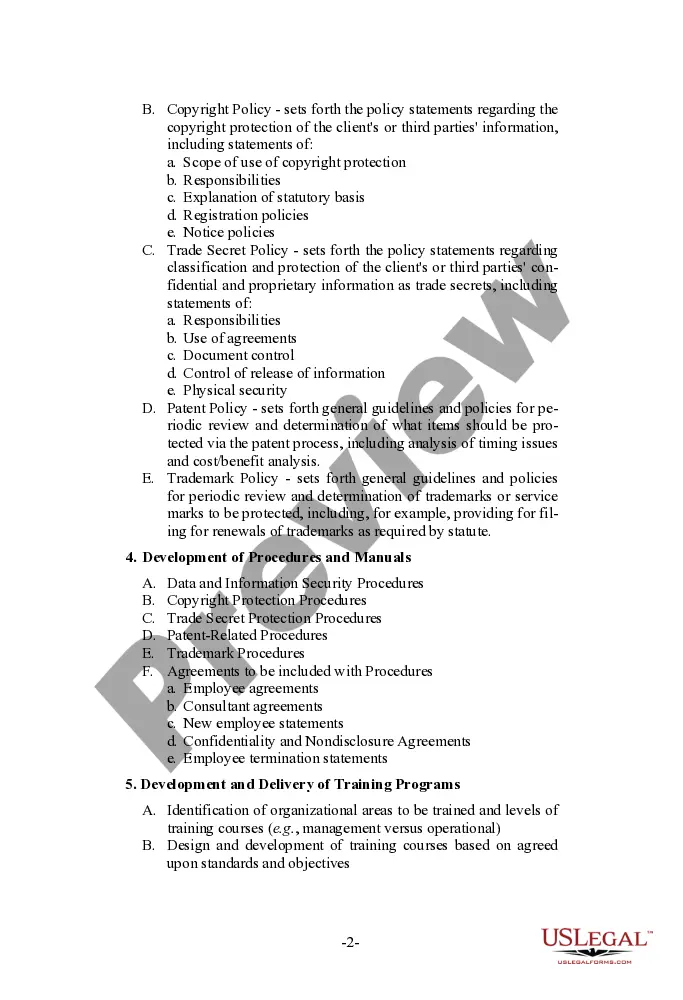

Connecticut Intellectual Property Audit Checklist An intellectual property audit helps businesses in Connecticut and beyond to evaluate and protect their intellectual property assets. This process involves conducting a thorough investigation and analysis of all intellectual property-related aspects within an organization. By conducting an IP audit, businesses can identify potential risks, ensure compliance with legal requirements, and leverage their intellectual property for maximum advantage. Here is a detailed description of the Connecticut Intellectual Property Audit Checklist. 1. Trademarks: — Review and analyze all registered trademarks, including logos, taglines, and symbols. — Check for potential trademark infringement issues. — Assess the current status of trademark maintenance and renewal. — Evaluate whether trademarks are being used properly and consistently. 2. Patents: — Identify any patents owned by the company and confirm their scope and coverage. — Determine if these patents are being utilized effectively. — Review the current patent filing process, including documentation and legal requirements. — Analyze the potential value of pending patent applications. 3. Copyrights: — Examine all copyrightable materials, including written content, software, designs, and artwork. — Ensure that all copyrighted materials are properly registered and protected. — Assess any potential risks of copyright infringement. — Review copyright ownership and licensing agreements. 4. Trade Secrets: — Identify trade secrets and determine if they are being adequately protected. — Ensure that proper measures are in place to maintain trade secret confidentiality. — Review confidentiality agreements with employees and business partners. — Assess the overall protection of proprietary business information. 5. Licensing Agreements: — Review all current licensing agreements, including terms and conditions. — Confirm compliance with licensing obligations and renewal requirements. — Evaluate the licensing strategy for maximum use of intellectual property assets. — Assess the financial impact of licensing agreements. 6. Employee Intellectual Property: — Evaluate employee contracts and agreements to ensure intellectual property ownership is clearly defined. — Review non-disclosure agreements and non-competition clauses to safeguard proprietary information. — Assess employee training and awareness regarding intellectual property rights. — Determine the potential risk of intellectual property theft or misuse by current or former employees. Types of Connecticut Intellectual Property Audit: 1. Digital Intellectual Property Audit: — Focused on assessing the digital footprint and online presence of a business. — Analyzes website content, social media accounts, and online advertising materials. — Evaluates potential risks associated with online intellectual property infringement. 2. Licensing and Royalties Audit: — Primarily focuses on analyzing licensing agreements, royalty payments, and contract compliance. — Assesses the financial impact and efficiency of licensing agreements. 3. Mergers and Acquisitions Intellectual Property Due Diligence: — Conducted during mergers or acquisitions to evaluate the value and legal status of intellectual property assets. — Analyzes potential risks, redundancies, and synergies between the merging companies. In conclusion, the Connecticut Intellectual Property Audit Checklist includes comprehensive evaluations of trademarks, patents, copyrights, trade secrets, licensing agreements, and employee intellectual property rights. Conducting an IP audit in Connecticut helps businesses identify and protect their valuable intellectual property assets, ensuring legal compliance and maximizing their competitive advantage.

Connecticut Checklist For Intellectual Property Audit

Description

How to fill out Connecticut Checklist For Intellectual Property Audit?

Are you currently in a placement in which you need documents for sometimes company or personal uses just about every working day? There are plenty of authorized file layouts available online, but finding ones you can trust is not effortless. US Legal Forms provides a large number of form layouts, such as the Connecticut Checklist For Intellectual Property Audit, which are published to satisfy federal and state specifications.

In case you are previously acquainted with US Legal Forms website and possess your account, simply log in. Afterward, you can obtain the Connecticut Checklist For Intellectual Property Audit template.

Unless you come with an bank account and need to begin to use US Legal Forms, abide by these steps:

- Discover the form you want and make sure it is for your proper city/region.

- Utilize the Review key to analyze the form.

- Look at the explanation to ensure that you have selected the proper form.

- When the form is not what you`re seeking, use the Lookup area to get the form that meets your requirements and specifications.

- When you obtain the proper form, click on Acquire now.

- Select the rates plan you desire, fill out the required info to generate your account, and buy your order making use of your PayPal or Visa or Mastercard.

- Pick a practical data file structure and obtain your version.

Find all of the file layouts you possess purchased in the My Forms menus. You may get a extra version of Connecticut Checklist For Intellectual Property Audit whenever, if required. Just select the needed form to obtain or print out the file template.

Use US Legal Forms, probably the most extensive selection of authorized types, to save efforts and stay away from faults. The service provides professionally manufactured authorized file layouts which you can use for a selection of uses. Generate your account on US Legal Forms and commence making your daily life easier.