A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are legal process.

Connecticut Notice to Debt Collector - Falsely Representing a Document is Legal Process

Description

How to fill out Connecticut Notice To Debt Collector - Falsely Representing A Document Is Legal Process?

If you wish to total, acquire, or produce legitimate file layouts, use US Legal Forms, the most important variety of legitimate types, that can be found online. Make use of the site`s basic and handy look for to discover the papers you need. Numerous layouts for enterprise and individual reasons are sorted by classes and suggests, or keywords. Use US Legal Forms to discover the Connecticut Notice to Debt Collector - Falsely Representing a Document is Legal Process in a number of clicks.

Should you be already a US Legal Forms client, log in in your account and click the Obtain option to obtain the Connecticut Notice to Debt Collector - Falsely Representing a Document is Legal Process. Also you can gain access to types you earlier acquired from the My Forms tab of the account.

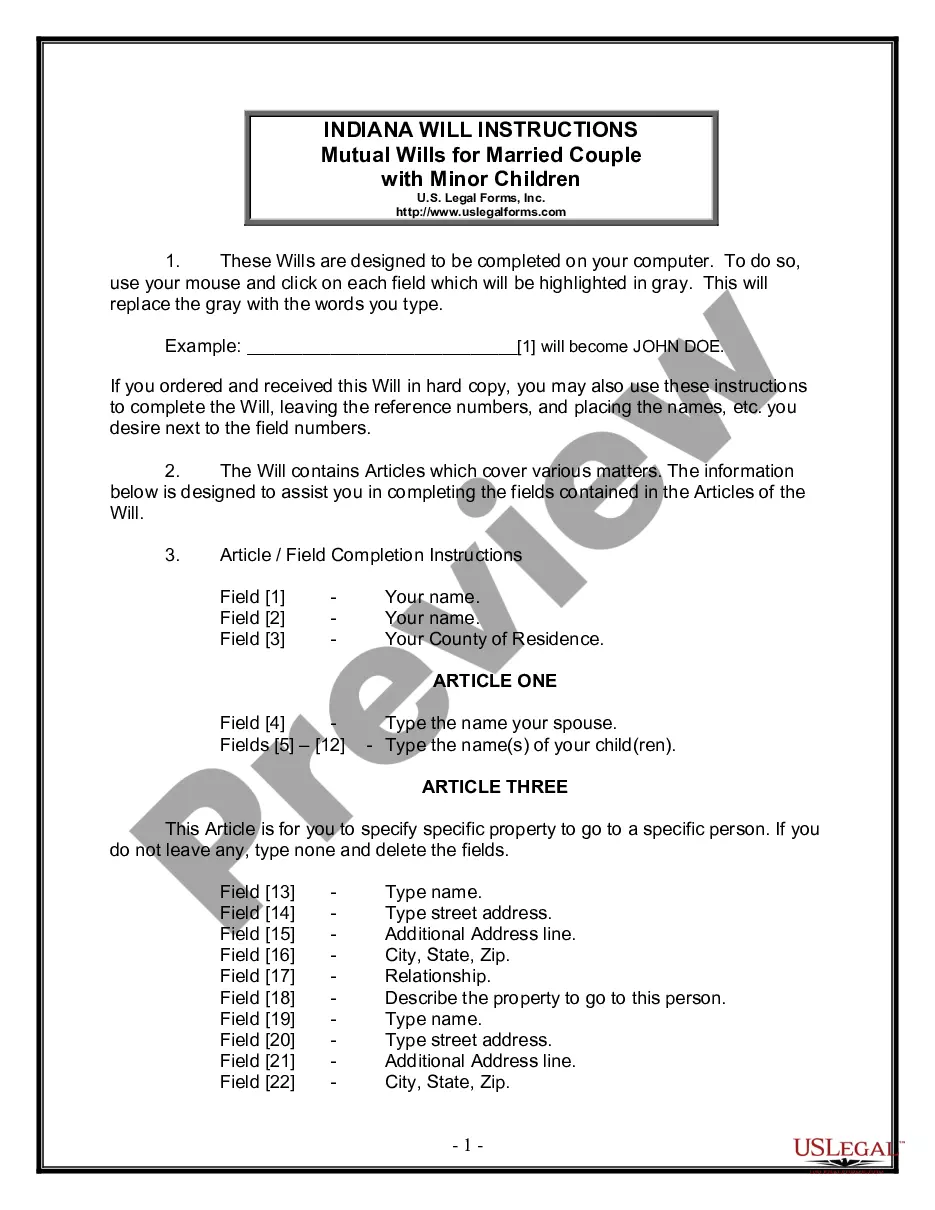

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape to the right area/region.

- Step 2. Take advantage of the Review solution to look over the form`s information. Don`t forget to see the outline.

- Step 3. Should you be unhappy with the develop, take advantage of the Look for industry near the top of the display to get other versions from the legitimate develop format.

- Step 4. Once you have identified the shape you need, go through the Purchase now option. Opt for the pricing prepare you prefer and put your references to register for an account.

- Step 5. Method the transaction. You may use your credit card or PayPal account to accomplish the transaction.

- Step 6. Find the format from the legitimate develop and acquire it on your own gadget.

- Step 7. Total, modify and produce or sign the Connecticut Notice to Debt Collector - Falsely Representing a Document is Legal Process.

Every single legitimate file format you buy is your own forever. You might have acces to each develop you acquired in your acccount. Click on the My Forms area and decide on a develop to produce or acquire again.

Remain competitive and acquire, and produce the Connecticut Notice to Debt Collector - Falsely Representing a Document is Legal Process with US Legal Forms. There are thousands of skilled and status-specific types you can utilize to your enterprise or individual needs.

Form popularity

FAQ

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

You can sue a company for sending you to collections for a debt that you don't owe. If a debt collector starts calling you out of the blue, but you know perfectly well that you made the payment in question, the law gives you the right to file an action in court against the company.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

There are 3 ways to remove collections without paying: 1) Write and mail a Goodwill letter asking for forgiveness, 2) study the FCRA and FDCPA and craft dispute letters to challenge the collection, and 3) Have a collections removal expert delete it for you.

Under the Fair Credit Reporting Act (FCRA) (15 U.S.C. § 1681 and following), you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

The creditor has to prove who the borrower is These include: Where there is a dispute as to the identity of the borrower or hirer or as to the amount of the debt, it is for the firm (and not the customer) to establish, as the case may be, that the customer is the correct person in relation to the debt.