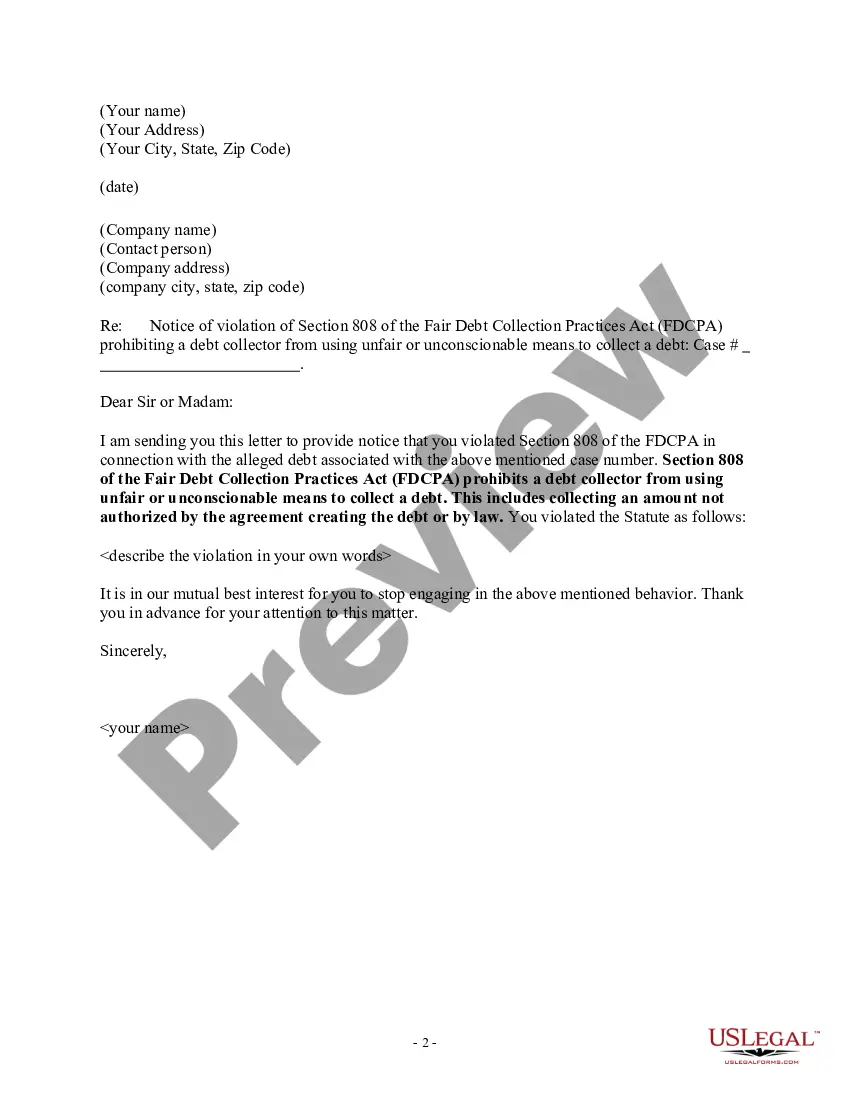

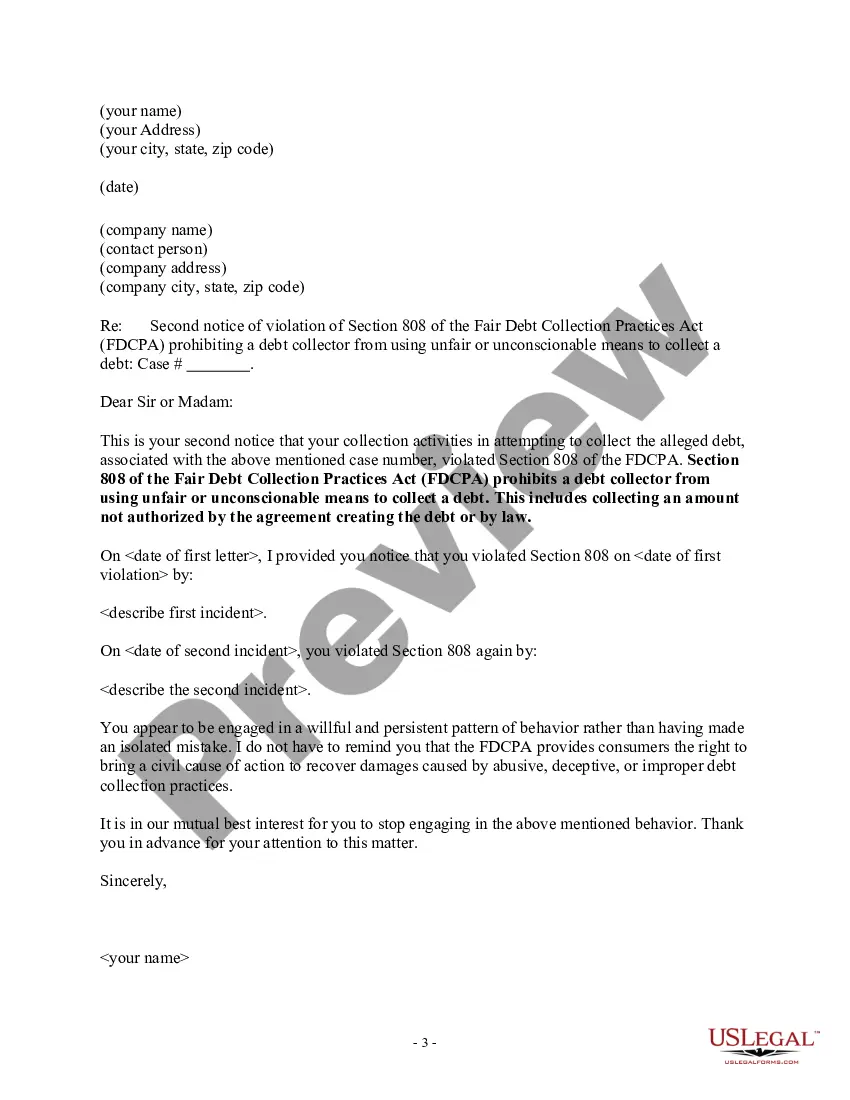

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Connecticut Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

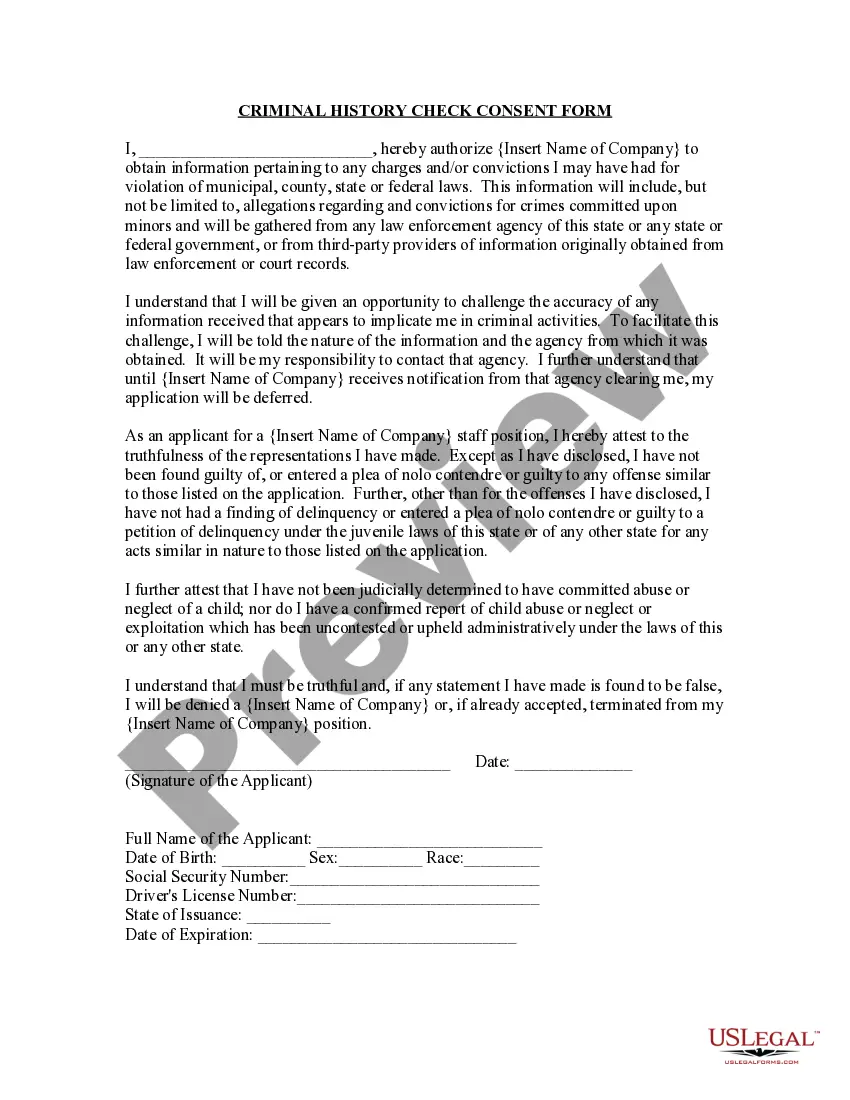

How to fill out Connecticut Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

You can commit several hours on the web searching for the legal file web template that fits the state and federal demands you want. US Legal Forms offers a large number of legal varieties which are analyzed by experts. It is simple to obtain or print out the Connecticut Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law from our services.

If you already have a US Legal Forms bank account, you may log in and click the Download switch. Afterward, you may full, modify, print out, or indicator the Connecticut Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law. Each legal file web template you get is yours permanently. To acquire yet another backup of any obtained form, check out the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms website the very first time, follow the easy recommendations beneath:

- First, make certain you have selected the correct file web template for that area/city of your choice. See the form information to make sure you have selected the appropriate form. If accessible, make use of the Preview switch to appear through the file web template as well.

- If you would like get yet another version in the form, make use of the Look for field to obtain the web template that meets your requirements and demands.

- After you have identified the web template you need, click on Get now to move forward.

- Select the pricing prepare you need, enter your qualifications, and sign up for an account on US Legal Forms.

- Full the deal. You should use your Visa or Mastercard or PayPal bank account to purchase the legal form.

- Select the file format in the file and obtain it to the gadget.

- Make adjustments to the file if required. You can full, modify and indicator and print out Connecticut Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

Download and print out a large number of file themes using the US Legal Forms web site, that offers the greatest selection of legal varieties. Use professional and condition-distinct themes to handle your company or person requirements.

Form popularity

FAQ

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

Limitations on debt collection by state The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

Can a Debt Collector Take Money From Your Account Without Permission? Usually, a debt collector must obtain a court order before accessing your bank account. However, certain federal agencies, including the IRS, may be able to access your bank account without permission from a court.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Connecticut has a six-year statute of limitations for debt collection actions resulting from simple and implied contracts (CGS § 52-576; attachment 1). Medical bills generally are simple or implied contracts and thus the SOL is six years.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Repeated calls. Threats of violence. Publishing information about you. Abusive or obscene language.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.