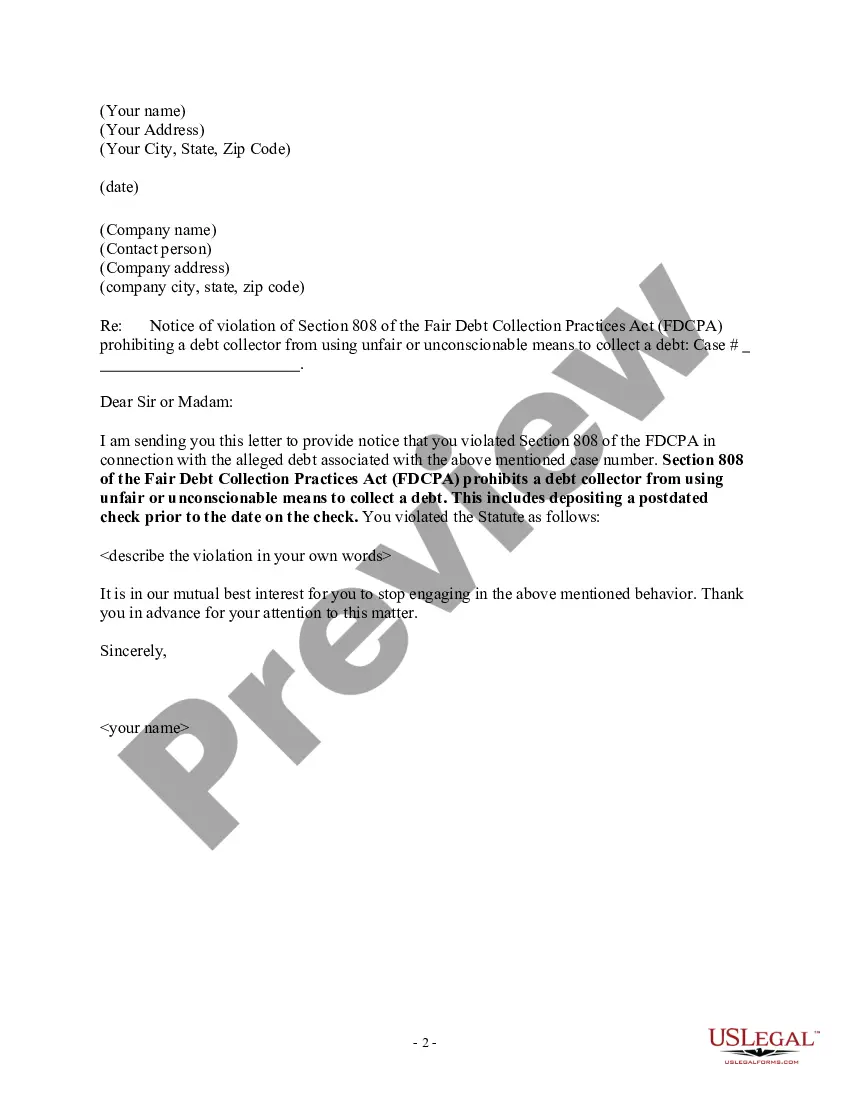

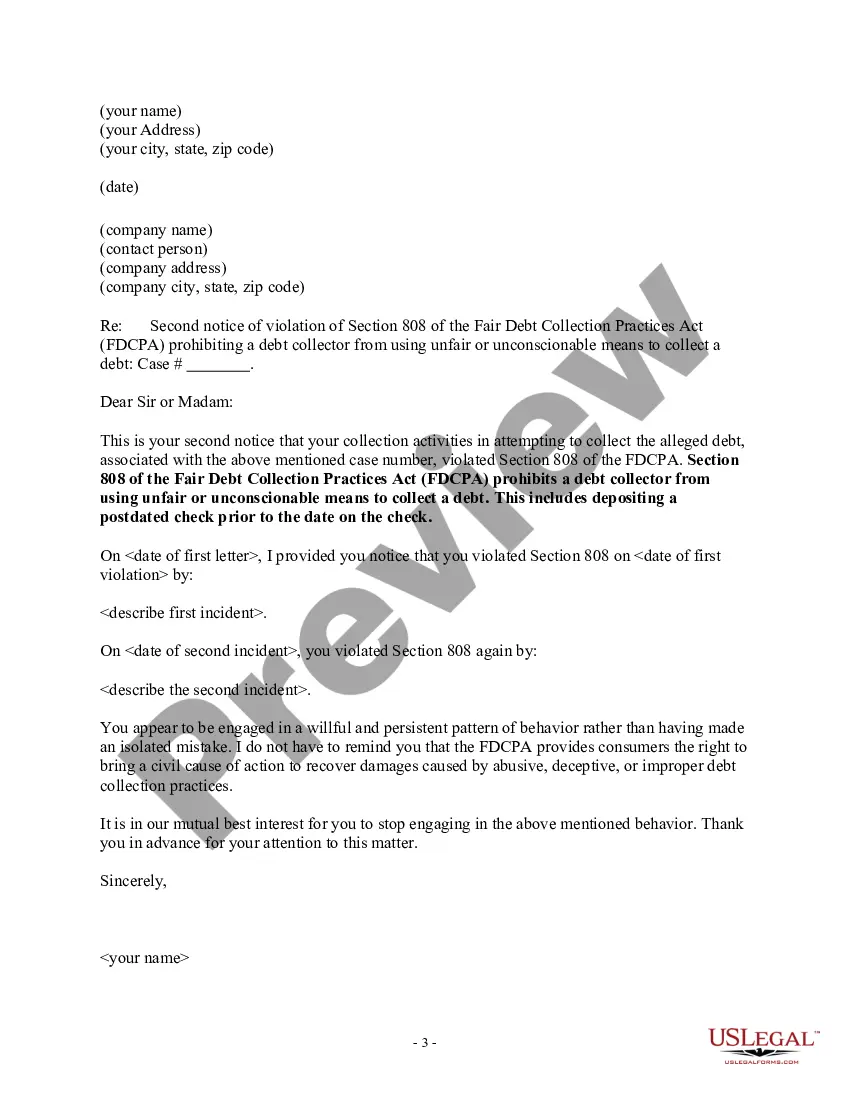

A debt collector may not use unfair or unconscionable means to collect a debt. This includes depositing a postdated check prior to the date on the check.

Connecticut Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check

Description

How to fill out Connecticut Notice To Debt Collector - Depositing A Postdated Check Prior To The Date On The Check?

If you have to complete, down load, or print lawful record web templates, use US Legal Forms, the most important collection of lawful varieties, that can be found on-line. Use the site`s simple and convenient lookup to get the papers you want. Numerous web templates for enterprise and individual reasons are categorized by groups and says, or keywords and phrases. Use US Legal Forms to get the Connecticut Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check within a few click throughs.

If you are currently a US Legal Forms client, log in for your account and click on the Download option to have the Connecticut Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check. You can also gain access to varieties you formerly downloaded in the My Forms tab of your account.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for the appropriate town/region.

- Step 2. Take advantage of the Review choice to look through the form`s content material. Do not forget to see the explanation.

- Step 3. If you are not satisfied using the type, use the Research area on top of the monitor to find other models in the lawful type design.

- Step 4. After you have discovered the form you want, click on the Buy now option. Choose the costs plan you favor and add your references to register on an account.

- Step 5. Method the purchase. You can utilize your charge card or PayPal account to accomplish the purchase.

- Step 6. Select the file format in the lawful type and down load it on the gadget.

- Step 7. Complete, modify and print or indication the Connecticut Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check.

Every single lawful record design you purchase is the one you have permanently. You may have acces to each type you downloaded inside your acccount. Go through the My Forms area and decide on a type to print or down load yet again.

Remain competitive and down load, and print the Connecticut Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check with US Legal Forms. There are many professional and status-specific varieties you may use for your personal enterprise or individual needs.

Form popularity

FAQ

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

The validation notice must be provided either (1) in the debt collector's initial communication to the consumer or (2) within 5 calendar days after the initial communication.

From a criminal law perspective, there is nothing inherently illegal about postdating a check, says Eric Hintz, a criminal defense attorney in Sacramento, California. Hintz says that only criminal intent, such as intentionally not having enough money for a payment, can be grounds for check fraud.

Federal law restricts what a debt collector can and cannot do with your postdated check. Specifically, under the Fair Debt Collection Practices Act (FDCPA), a debt collector cannot: coerce you into making a postdated payment by threatening or instituting criminal prosecution.

Generally, state law provides that if you notified your bank or credit union about a post-dated check a reasonable time before it received the check, your notice is valid for six months. During that time, the bank or credit union should not cash the check before the date you wrote on the check.

Assume that today is 27th Jan and you are writing a cheque. Generally, if you write a cheque, you will write the current date of the cheque i.e., 27th Jan. But when you write a date which is later than the current date, say you write a date of a cheque as 3rd Feb, this is when it becomes post-dated cheque.

Postdating a check is done by writing a check for a future date instead of the actual date the check was written. This is typically done with the intention that the check recipient will not cash or deposit the check until the future indicated date.

It usually takes about two business days for a deposited check to clear, but it can take a little longerabout five business daysfor the bank to receive the funds.

Postdated checks can usually be cashed or deposited at any time unless the person who wrote the check specifically told their bank not to honor the check until a certain date. Rather than writing a postdated check, it may be better to use online payment services or coordinate with your biller to move back the due date.

Postdated checks are checks written with a future date. Postdated checks can usually be cashed or deposited at any time unless the person who wrote the check specifically told their bank not to honor the check until a certain date.