This form is a due diligence questionnaire that pertains to the preparation and filing of the Registration Statement. It is necessary that the company be supplied with answers to the questions in this questionnaire from the holders of at least 5 percent of the outstanding securities of the company in business transactions.

Connecticut Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent

Description

How to fill out Connecticut Comprehensive Questionnaire For Shareholders Including Officers And Directors Holding At Least Five Percent?

Are you in a position where you need to have papers for possibly organization or person functions virtually every time? There are a lot of lawful papers layouts accessible on the Internet, but discovering ones you can trust is not easy. US Legal Forms gives thousands of kind layouts, such as the Connecticut Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent, which can be composed to meet federal and state requirements.

In case you are previously knowledgeable about US Legal Forms site and also have a merchant account, just log in. After that, it is possible to acquire the Connecticut Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent web template.

If you do not offer an accounts and need to start using US Legal Forms, follow these steps:

- Obtain the kind you require and ensure it is for your proper city/state.

- Use the Review option to check the shape.

- Browse the explanation to actually have selected the appropriate kind.

- In the event the kind is not what you`re seeking, make use of the Lookup discipline to obtain the kind that meets your needs and requirements.

- If you obtain the proper kind, click Buy now.

- Select the pricing prepare you need, submit the necessary info to make your bank account, and pay money for an order using your PayPal or Visa or Mastercard.

- Decide on a handy document file format and acquire your version.

Find all the papers layouts you might have purchased in the My Forms food list. You can get a additional version of Connecticut Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent at any time, if necessary. Just click the essential kind to acquire or print out the papers web template.

Use US Legal Forms, the most extensive assortment of lawful types, to conserve some time and prevent blunders. The services gives expertly manufactured lawful papers layouts that you can use for a range of functions. Generate a merchant account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

It does not matter that a director is also an officer--it does not give him/her an extra vote. If the board consists of five directors, it has one for each director.

D&O questionnaires are needed to ensure that the company is able to accurately comply with its proxy disclosure requirements and regulatory oversight obligations.

Members are sometimes confused by the difference between officers and directors. Directors are elected by the membership, while officers are named by the board to keep minutes, oversee financials, etc. Officers are required by statute but being an officer does not give one the power to vote.

In US companies, officers are elected by the Board of Directors, and usually consist of a president and/or a Chief Executive Officer, one or more vice presidents, a secretary, and a treasurer or Chief Financial Officer. In larger enterprises, there may be many officers each with varying duties and responsibilities.

When comparing an officer vs. director, a director is the person who takes part in managing important business affairs, while officers oversee daily aspects of a business. Officers are also directly involved in the daily management affairs of the business.

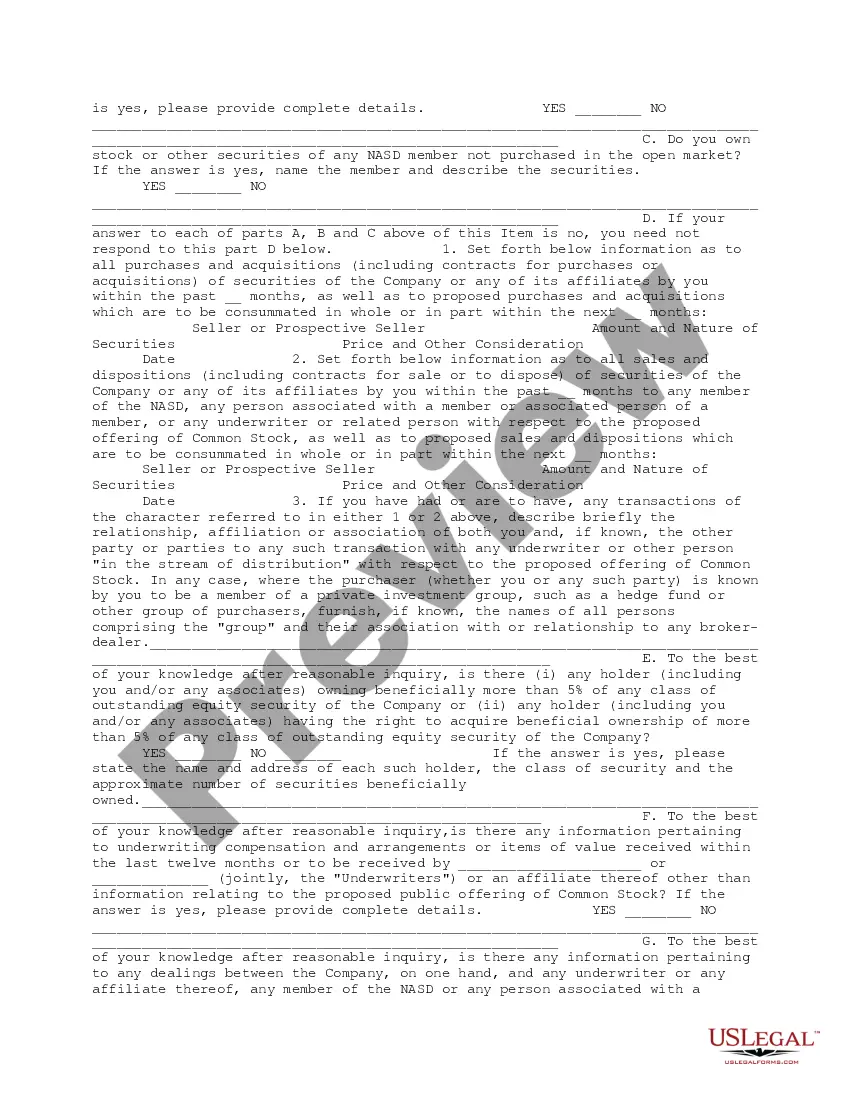

This Questionnaire is being distributed to (i) all persons who are directors (and nominees for election of directors, if any) of the Company, (ii) all persons who are or will be officers of the Company, (iii) each person who will own of record or beneficially more than 5% of any class of voting securities of the

When directors cast votes, they may incidentally be officers but when they vote, they vote as directors, not officers. The president, vice president, secretary and treasurer are allowed to vote if they are directors--but they are doing so as directors, not officers.

Generally, the board of directors is responsible for making major business and policy decisions and the officers are responsible for carrying out the board's policies and for making the day-to-day decisions.

This Questionnaire is being distributed to (i) all persons who are directors (and nominees for election of directors, if any) of the Company, (ii) all persons who are or will be officers of the Company, (iii) each person who will own of record or beneficially more than 5% of any class of voting securities of the

The answers to the questionnaire provide information about an individual's background and experience, securities ownership, independence, insider transactions and compensation, which permits the company and its counsel to provide and confirm accurate disclosure in its registration statements or Form 10-K reports and

More info

TS OWNERSHIP (CHAPTER COMPANY OWNERSHIP) The shareholders of a corporation will hold its shares as it owns them. The corporation will maintain two classes of common interests: common interests held by shareholders and common interests held by officers and directors of the corporation. Class A common interests (which are held by all shareholders) are not transferable. Class B common interests (which are held by non-shareholders) are transferable. Class A common interests include (1) any common interest held by a director, executive officer, or principal stockholder of the corporation, (2) any common interest held by the holders of the corporation's preferred securities, (3) any common interest held by shareholders or directors of another corporation in which the corporation has an interest in, as a beneficial owner thereof, or (4) any special interests held by officers, directors, or the corporation as a general partner.