Connecticut Loan Agreement between Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston is a legally binding contract that outlines the terms and conditions of a loan agreement between these parties. This agreement specifies the obligations, rights, and responsibilities of each party involved in the financial transaction. The Connecticut Loan Agreement is a vital document in facilitating borrowing arrangements between Lacked Gas Co., a leading gas utility company, and the lending institutions, namely Mercantile Bank National Assoc., one of the renowned national banks, Bank of America, a prominent multinational banking corporation, and Credit Suisse First Boston, a premier global financial services provider. Keywords: Connecticut Loan Agreement, Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, Credit Suisse First Boston, loan terms, loan conditions, financial transaction. There may be different types of Connecticut Loan Agreements between these parties, which can be categorized based on their specific purposes and arrangements: 1. Term Loan Agreement: This type of agreement sets the terms and conditions for a loan with a predetermined repayment schedule. Lacked Gas Co. may secure funding from Mercantile Bank National Assoc., Bank of America, or Credit Suisse First Boston through a term loan agreement. 2. Revolving Credit Agreement: A revolving credit agreement provides a flexible line of credit to the borrower, allowing them to borrow, repay, and re-borrow as needed within the agreed limits. Lacked Gas Co. might enter into such an agreement with any of the lending institutions to manage its ongoing financial requirements effectively. 3. Syndicated Loan Agreement: In complex financing scenarios, Lacked Gas Co. may secure a significant loan amount by collaborating with multiple lenders. The syndicated loan agreement outlines the terms and conditions of this joint lending arrangement involving Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston. 4. Construction Loan Agreement: If Lacked Gas Co. intends to undertake significant construction or expansion projects, it may require a specialized loan agreement to finance these endeavors. This type of agreement would outline the specific terms and conditions relating to the construction loan, such as draw schedules and disbursement terms. 5. Secured Loan Agreement: Lacked Gas Co. may enter into a secured loan agreement whereby the loan is backed by collateral, such as the company's assets or property. This agreement would specify the collateral, its valuation, and the rights and obligations of the involved parties concerning the security provided. Please note that the specific types of Connecticut Loan Agreements between Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston may vary based on the nature and purpose of the loan, as well as the negotiations and terms agreed upon by the parties involved.

Connecticut Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston

Description

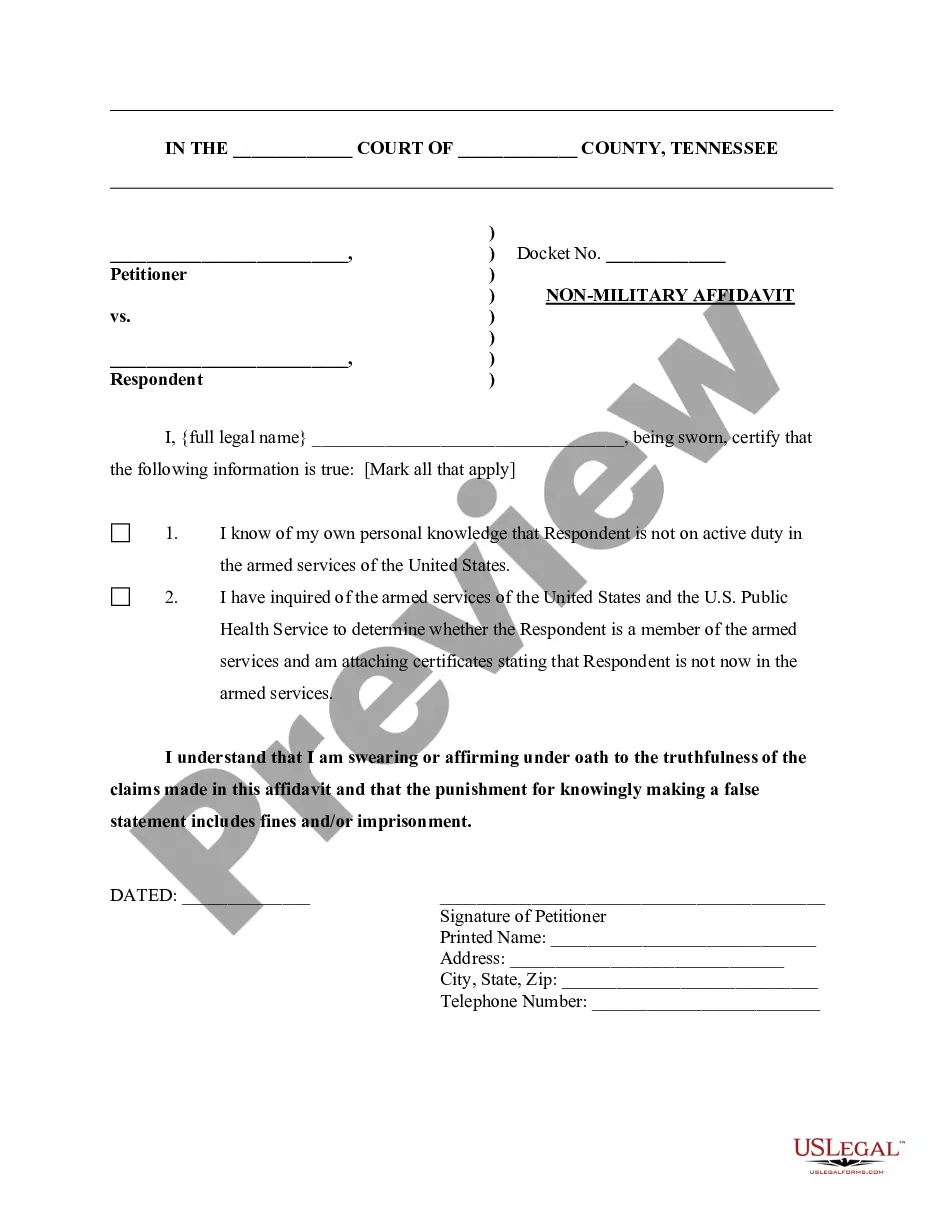

How to fill out Connecticut Loan Agreement Between Laclede Gas Co., Mercantile Bank National Assoc., Bank Of America And Credit Suisse First Boston?

If you need to full, down load, or print lawful record templates, use US Legal Forms, the most important variety of lawful kinds, that can be found on the Internet. Take advantage of the site`s easy and convenient look for to find the papers you want. Numerous templates for enterprise and specific functions are sorted by groups and says, or search phrases. Use US Legal Forms to find the Connecticut Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston with a handful of click throughs.

In case you are currently a US Legal Forms customer, log in to the profile and then click the Down load switch to get the Connecticut Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston. Also you can access kinds you earlier delivered electronically within the My Forms tab of the profile.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the shape for the right metropolis/nation.

- Step 2. Make use of the Review solution to look over the form`s information. Do not forget to learn the outline.

- Step 3. In case you are not satisfied with the type, make use of the Research discipline towards the top of the monitor to locate other types of your lawful type design.

- Step 4. Upon having found the shape you want, go through the Buy now switch. Pick the costs strategy you favor and put your accreditations to sign up on an profile.

- Step 5. Process the transaction. You may use your bank card or PayPal profile to accomplish the transaction.

- Step 6. Find the structure of your lawful type and down load it in your system.

- Step 7. Full, revise and print or indicator the Connecticut Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston.

Each lawful record design you get is yours eternally. You have acces to every single type you delivered electronically within your acccount. Go through the My Forms portion and choose a type to print or down load again.

Contend and down load, and print the Connecticut Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston with US Legal Forms. There are millions of specialist and state-distinct kinds you may use for the enterprise or specific requirements.