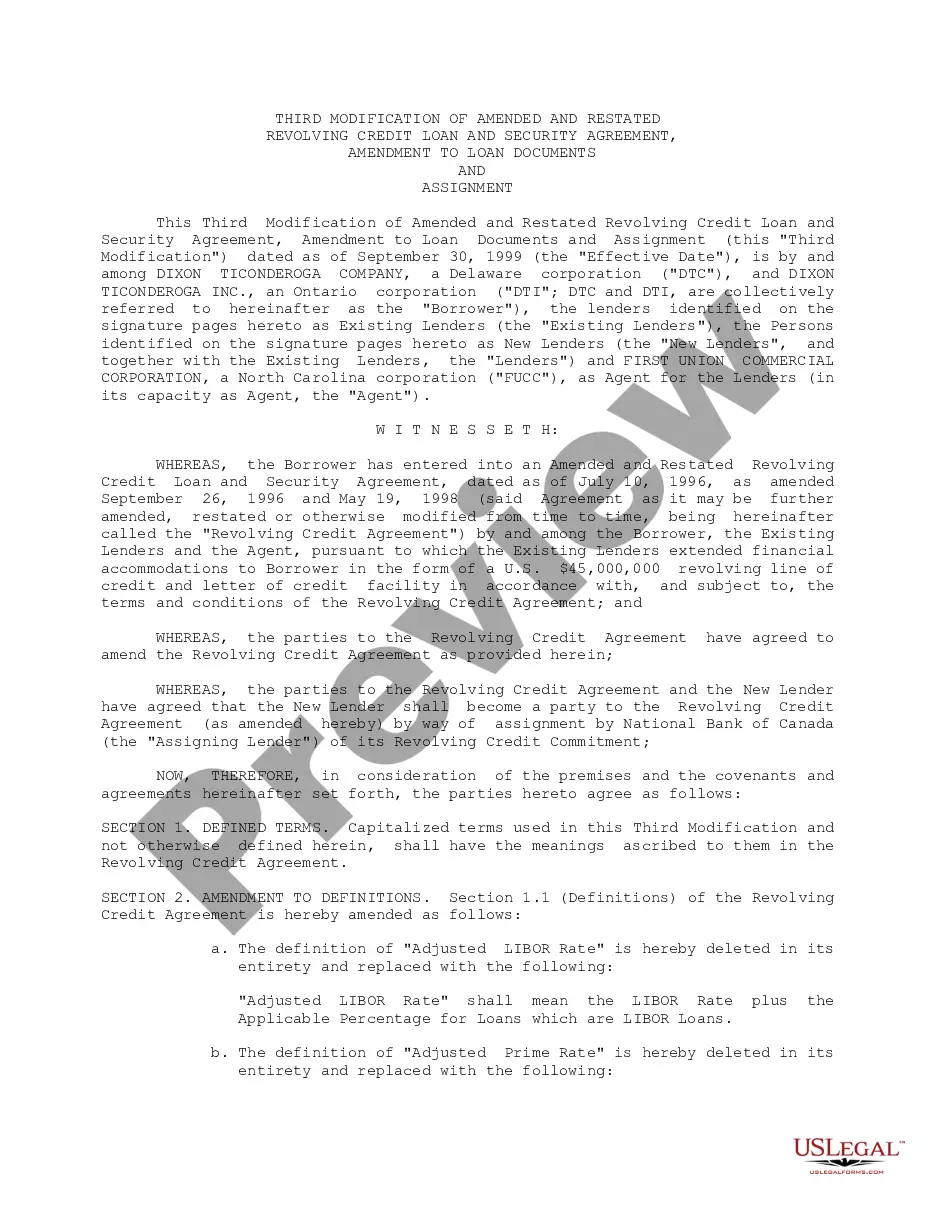

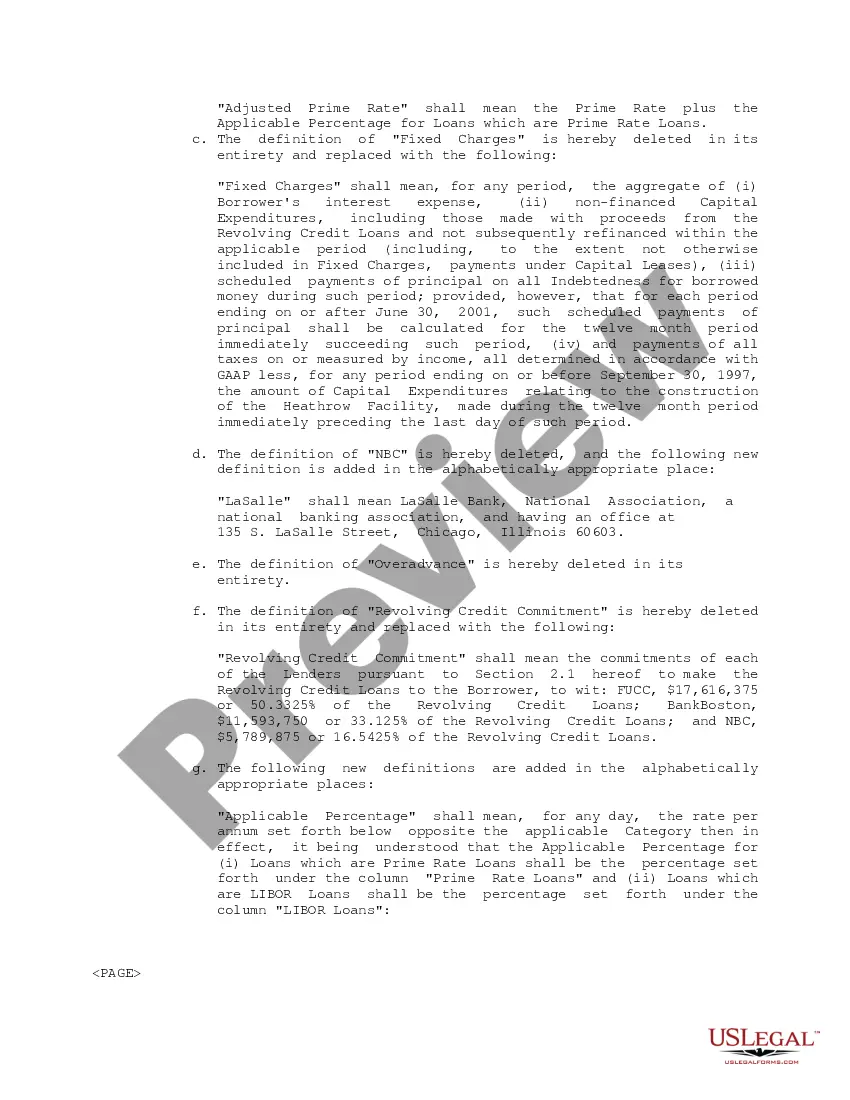

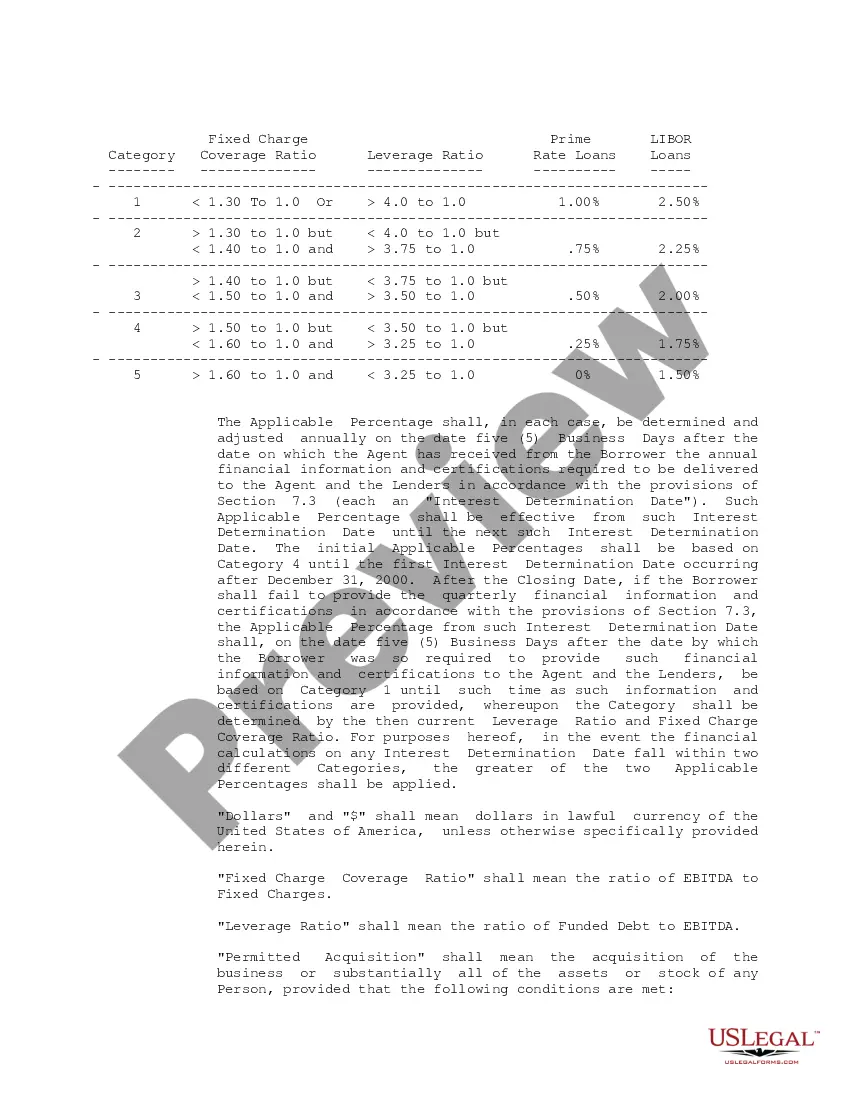

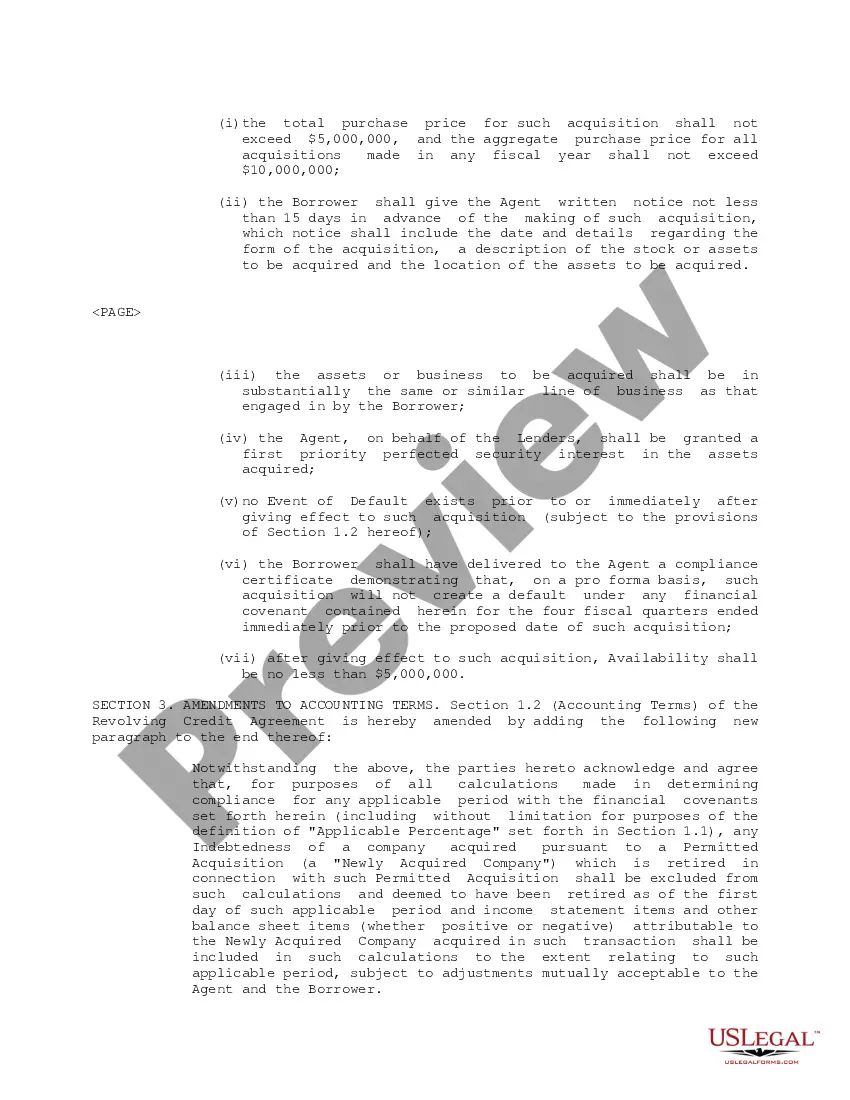

Connecticut Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc.

Description

How to fill out Revolving Credit Loan And Security Agreement Between Dixon Ticonderoga Co. And Dixon Ticonderoga, Inc.?

Choosing the right legitimate file template can be a struggle. Needless to say, there are plenty of layouts available on the net, but how do you obtain the legitimate develop you require? Take advantage of the US Legal Forms internet site. The support offers a large number of layouts, including the Connecticut Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc., which can be used for business and personal needs. Every one of the kinds are checked out by experts and meet up with federal and state requirements.

In case you are currently registered, log in in your accounts and click the Acquire button to find the Connecticut Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc.. Utilize your accounts to look throughout the legitimate kinds you may have purchased earlier. Proceed to the My Forms tab of the accounts and acquire one more version in the file you require.

In case you are a whole new end user of US Legal Forms, allow me to share straightforward directions so that you can follow:

- First, be sure you have chosen the proper develop for your city/area. You can look through the shape using the Review button and read the shape description to make certain this is the best for you.

- If the develop will not meet up with your expectations, utilize the Seach field to get the appropriate develop.

- When you are certain that the shape is suitable, click the Purchase now button to find the develop.

- Pick the prices strategy you want and enter the essential information. Design your accounts and pay for your order using your PayPal accounts or charge card.

- Opt for the file file format and download the legitimate file template in your gadget.

- Comprehensive, change and print and signal the obtained Connecticut Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc..

US Legal Forms will be the largest library of legitimate kinds that you can see different file layouts. Take advantage of the company to download skillfully-manufactured paperwork that follow express requirements.