Connecticut Plan of Merger is a legally binding agreement between two corporations based in the state of Connecticut that outlines the terms and conditions of their merger. This plan is crucial in ensuring a smooth and legally compliant consolidation of these entities. A Connecticut Plan of Merger typically includes several key elements and can be categorized into various types based on the involved corporations and the nature of the merger. 1. Standard Connecticut Plan of Merger: This type of plan is applicable when two corporations of any industry or size decide to merge and form a new entity or absorb one of the entities into the other. It entails a detailed description of the merger process, such as the effective date, names of the entities involved, and the overall objectives of the merger. 2. Horizontal Connecticut Plan of Merger: When two corporations operating in the same industry and at the same level of the supply chain merge, a horizontal merger takes place. This type of merger requires a specific plan that includes mutually agreed-upon strategies to ensure fair competition, market expansion, cost optimization, and customer retention. 3. Vertical Connecticut Plan of Merger: In instances where two corporations operating at different levels of the supply chain merge, a vertical merger is formed. This type of merger plan should highlight the potential benefits of combining resources, such as enhanced supply chain efficiency, reduced costs, improved distribution, and streamlined operations. 4. Conglomerate Connecticut Plan of Merger: When two corporations from unrelated industries merge, it is considered a conglomerate merger. This merger plan must emphasize the synergies that can be achieved through diversification, such as increased market reach, shared resources, expanded customer base, and potential for cross-selling opportunities. 5. Cash-out Connecticut Plan of Merger: In cases where a corporation acquires another by offering cash to the shareholders of the target corporation, a cash-out merger occurs. This type of merger plan should lay out the financial aspects, including the purchase price, payment terms, and the process of cashing out the shares. 6. Stock-for-stock Connecticut Plan of Merger: When a corporation acquires another by offering its stock in exchange for the target corporation's shares, a stock-for-stock merger is formed. This merger plan should include details such as the exchange ratio, valuation methodology, and the treatment of stock options and other equity-based instruments. Overall, a Connecticut Plan of Merger is a comprehensive document that outlines the terms, conditions, and strategies for the successful merger of two corporations. It ensures transparency, compliance with legal requirements, and clear communication between the parties involved.

Connecticut Plan of Merger between two corporations

Description

How to fill out Connecticut Plan Of Merger Between Two Corporations?

Are you currently inside a place the place you will need paperwork for both enterprise or specific purposes nearly every day time? There are tons of lawful file themes available online, but getting kinds you can depend on is not easy. US Legal Forms offers 1000s of kind themes, like the Connecticut Plan of Merger between two corporations, which can be written to satisfy state and federal requirements.

When you are previously knowledgeable about US Legal Forms internet site and have a merchant account, merely log in. Following that, you can obtain the Connecticut Plan of Merger between two corporations design.

Should you not provide an accounts and want to start using US Legal Forms, abide by these steps:

- Find the kind you want and ensure it is to the appropriate area/region.

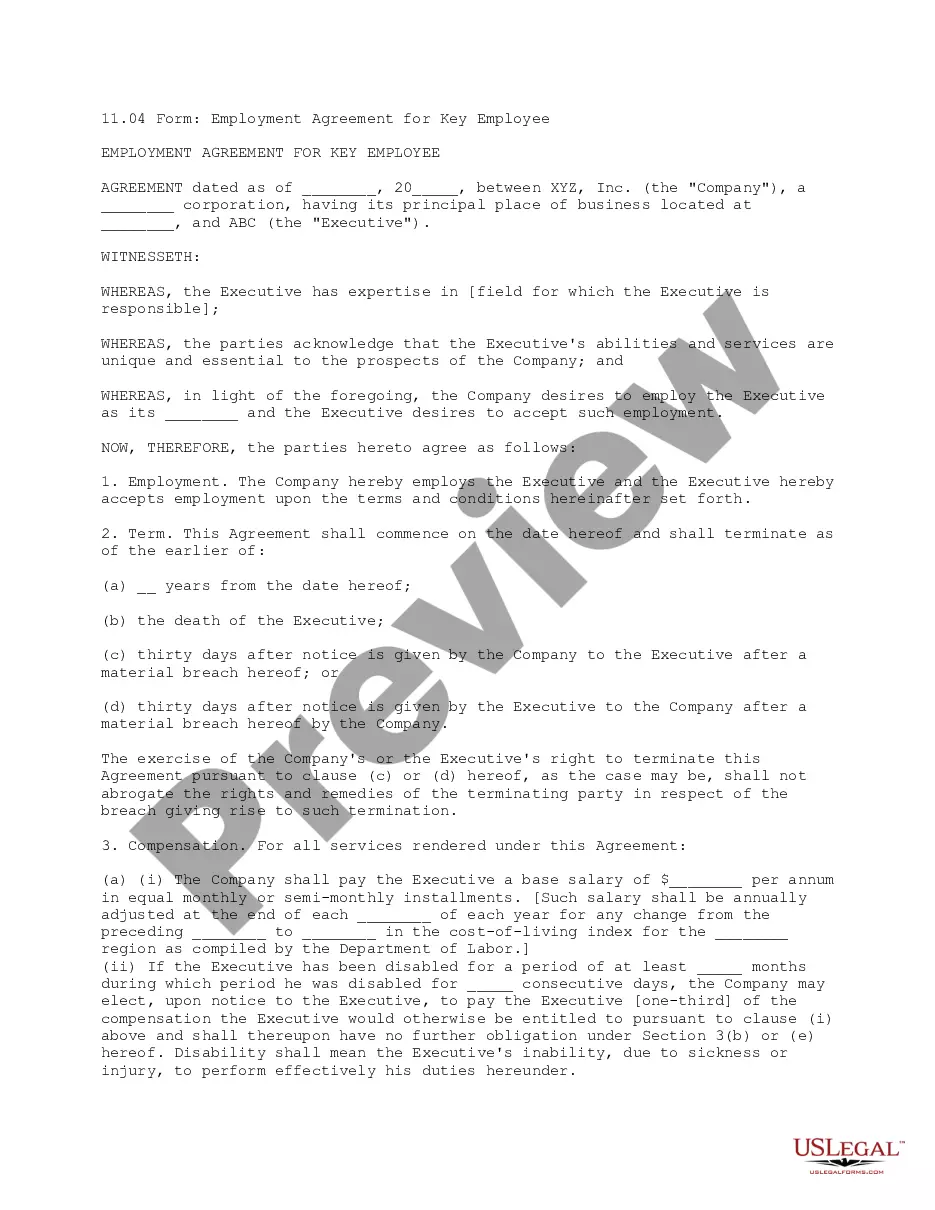

- Take advantage of the Review option to analyze the shape.

- Look at the information to actually have selected the correct kind.

- When the kind is not what you`re searching for, use the Look for field to get the kind that meets your requirements and requirements.

- Whenever you find the appropriate kind, simply click Purchase now.

- Select the pricing plan you desire, fill out the necessary information to produce your bank account, and pay money for the transaction making use of your PayPal or charge card.

- Select a practical file structure and obtain your copy.

Discover each of the file themes you might have purchased in the My Forms food list. You can get a extra copy of Connecticut Plan of Merger between two corporations whenever, if necessary. Just click on the needed kind to obtain or produce the file design.

Use US Legal Forms, probably the most extensive selection of lawful forms, in order to save time and steer clear of errors. The services offers skillfully produced lawful file themes which you can use for an array of purposes. Produce a merchant account on US Legal Forms and begin making your life a little easier.