Connecticut Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

How to fill out Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

Are you currently in a situation that you will need paperwork for sometimes business or person reasons almost every working day? There are a variety of authorized record layouts accessible on the Internet, but discovering kinds you can depend on is not simple. US Legal Forms offers a large number of type layouts, like the Connecticut Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P., that are created in order to meet federal and state requirements.

In case you are already knowledgeable about US Legal Forms site and have a free account, basically log in. Next, it is possible to acquire the Connecticut Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. design.

Should you not offer an profile and need to start using US Legal Forms, follow these steps:

- Find the type you will need and make sure it is to the correct town/area.

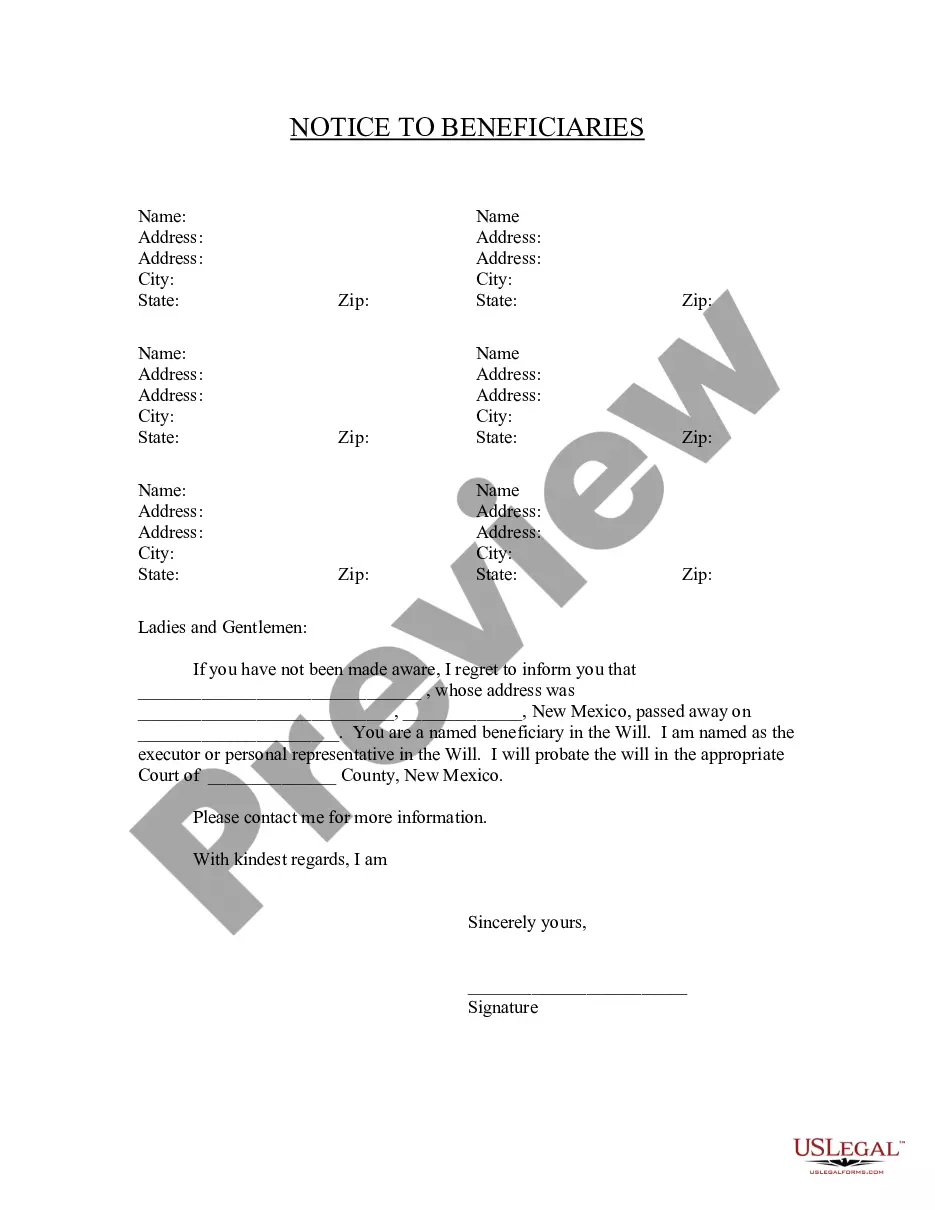

- Use the Review key to check the form.

- See the description to actually have selected the right type.

- If the type is not what you are searching for, use the Lookup field to find the type that suits you and requirements.

- If you discover the correct type, simply click Acquire now.

- Opt for the rates prepare you want, fill in the desired info to produce your money, and buy the transaction making use of your PayPal or credit card.

- Decide on a practical file structure and acquire your version.

Discover every one of the record layouts you might have bought in the My Forms menus. You can aquire a additional version of Connecticut Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. at any time, if required. Just go through the required type to acquire or printing the record design.

Use US Legal Forms, the most substantial selection of authorized varieties, to save some time and steer clear of blunders. The service offers expertly created authorized record layouts that can be used for a variety of reasons. Make a free account on US Legal Forms and commence creating your lifestyle easier.