Title: Exploring the Connecticut Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York Introduction: In the financial realm, investment advisory agreements play a crucial role in establishing a framework for collaboration between investment management firms and their clients. This article provides a detailed description of the Connecticut Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York (BNY), highlighting its significance, key components, and possible variations. Keywords: Connecticut Investment Advisory Agreement, BNY Hamilton Large Growth CRT Fund, The Bank of New York, investment management, financial collaboration, client agreement. 1. Understanding the Connecticut Investment Advisory Agreement: The Connecticut Investment Advisory Agreement is a legally binding contract that governs the relationship between BNY Hamilton Large Growth CRT Fund (the client) and The Bank of New York (the adviser). It establishes the terms and conditions under which BNY will provide investment advisory services to the fund. 2. Key Components of the Agreement: a. Scope of Services: The agreement outlines the specific investment advisory services that BNY will offer, such as portfolio management, financial planning, asset allocation, risk assessment, and performance monitoring. b. Fee Structure: It details the fees, commissions, or compensation arrangement that BNY will receive for its services. This may include management fees, performance-based fees, or a combination of both. c. Investment Objectives and Restrictions: The agreement defines the investment objectives of BNY Hamilton Large Growth CRT Fund, which could be capital appreciation, income generation, or a specific investment strategy. It also includes any investment restrictions or limitations imposed by the client. d. Reporting and Communications: The agreement specifies the frequency and format of investment reports, client meetings, and other communications between BNY and the client. It ensures transparency and keeps the client informed about the fund's performance. e. Termination and Amendment: The agreement outlines the conditions under which either party can terminate the agreement and the procedures for amending its terms. It also includes any notice periods required for termination or changes. 3. Types of Connecticut Investment Advisory Agreements: a. Basic Investment Advisory Agreement: This is the standard agreement that outlines the general provisions and terms between BNY Hamilton Large Growth CRT Fund and The Bank of New York. b. Customized Investment Advisory Agreement: In certain cases, clients may have unique requirements or prefer tailored investment solutions. BNY may offer customized agreements that reflect specific investment objectives, restrictions, or fee structures. c. Supplemental Agreements: Depending on the evolving needs of the client, supplemental agreements may be added to modify or enhance specific provisions of the basic agreement. These may include addendums addressing additional services, reporting requirements, or fee adjustments. d. Renewal and Extension Agreements: When the initial term of the agreement expires, both parties may opt for renewal or extension, updating terms or conditions as required. Conclusion: The Connecticut Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York serves as the foundation for a collaborative relationship in investment management. By clearly defining the services, fees, objectives, and reporting mechanisms, the agreement aims to ensure a transparent and mutually beneficial arrangement between the asset manager and the client. Keywords: Connecticut Investment Advisory Agreement, BNY Hamilton Large Growth CRT Fund, The Bank of New York, investment management, financial collaboration, client agreement.

Connecticut Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York

Description

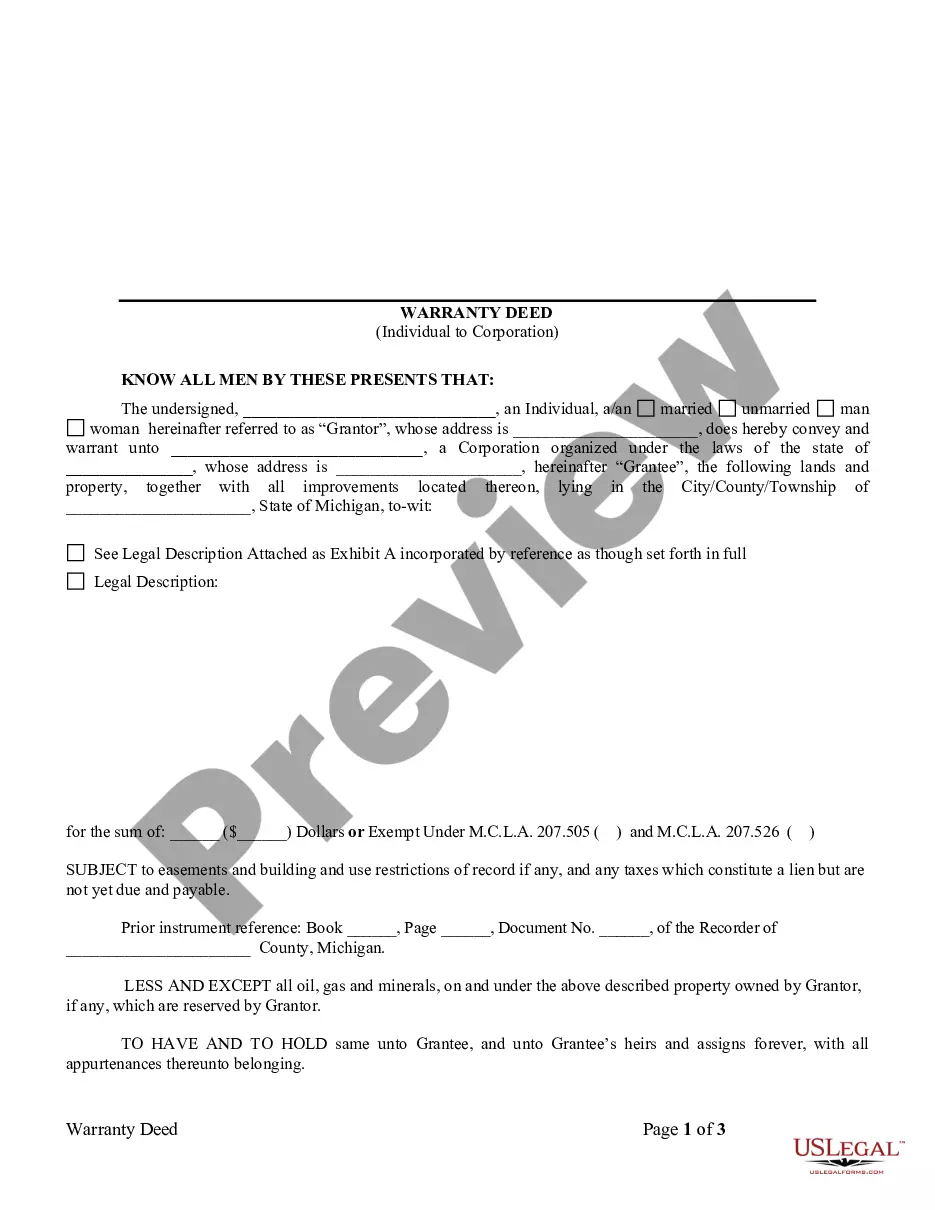

How to fill out Investment Advisory Agreement Between BNY Hamilton Large Growth CRT Fund And The Bank Of New York?

Discovering the right lawful record design could be a have a problem. Of course, there are plenty of layouts available online, but how do you obtain the lawful type you require? Use the US Legal Forms web site. The service gives thousands of layouts, for example the Connecticut Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York, that can be used for business and private requirements. All the types are checked by pros and meet up with state and federal demands.

If you are already listed, log in to the profile and click on the Obtain option to obtain the Connecticut Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York. Make use of your profile to look with the lawful types you might have ordered in the past. Check out the My Forms tab of your profile and get another backup in the record you require.

If you are a brand new end user of US Legal Forms, here are simple guidelines for you to comply with:

- Initially, ensure you have chosen the proper type for your personal area/county. You can examine the form while using Review option and read the form information to make sure this is the right one for you.

- In the event the type is not going to meet up with your expectations, make use of the Seach area to obtain the right type.

- When you are certain that the form is acceptable, go through the Get now option to obtain the type.

- Choose the costs prepare you need and enter the needed information and facts. Make your profile and pay money for your order utilizing your PayPal profile or credit card.

- Select the document file format and acquire the lawful record design to the gadget.

- Total, change and produce and sign the acquired Connecticut Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York.

US Legal Forms is the biggest library of lawful types where you can find various record layouts. Use the service to acquire appropriately-made papers that comply with condition demands.