Connecticut Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc

Description

How to fill out Plan Of Merger Between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc?

US Legal Forms - one of several most significant libraries of legitimate forms in the States - delivers a wide range of legitimate papers layouts it is possible to down load or printing. While using site, you can get thousands of forms for organization and personal functions, categorized by groups, says, or keywords and phrases.You can find the most up-to-date types of forms such as the Connecticut Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc within minutes.

If you have a membership, log in and down load Connecticut Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc in the US Legal Forms catalogue. The Down load option will show up on each develop you look at. You have access to all previously acquired forms from the My Forms tab of your respective profile.

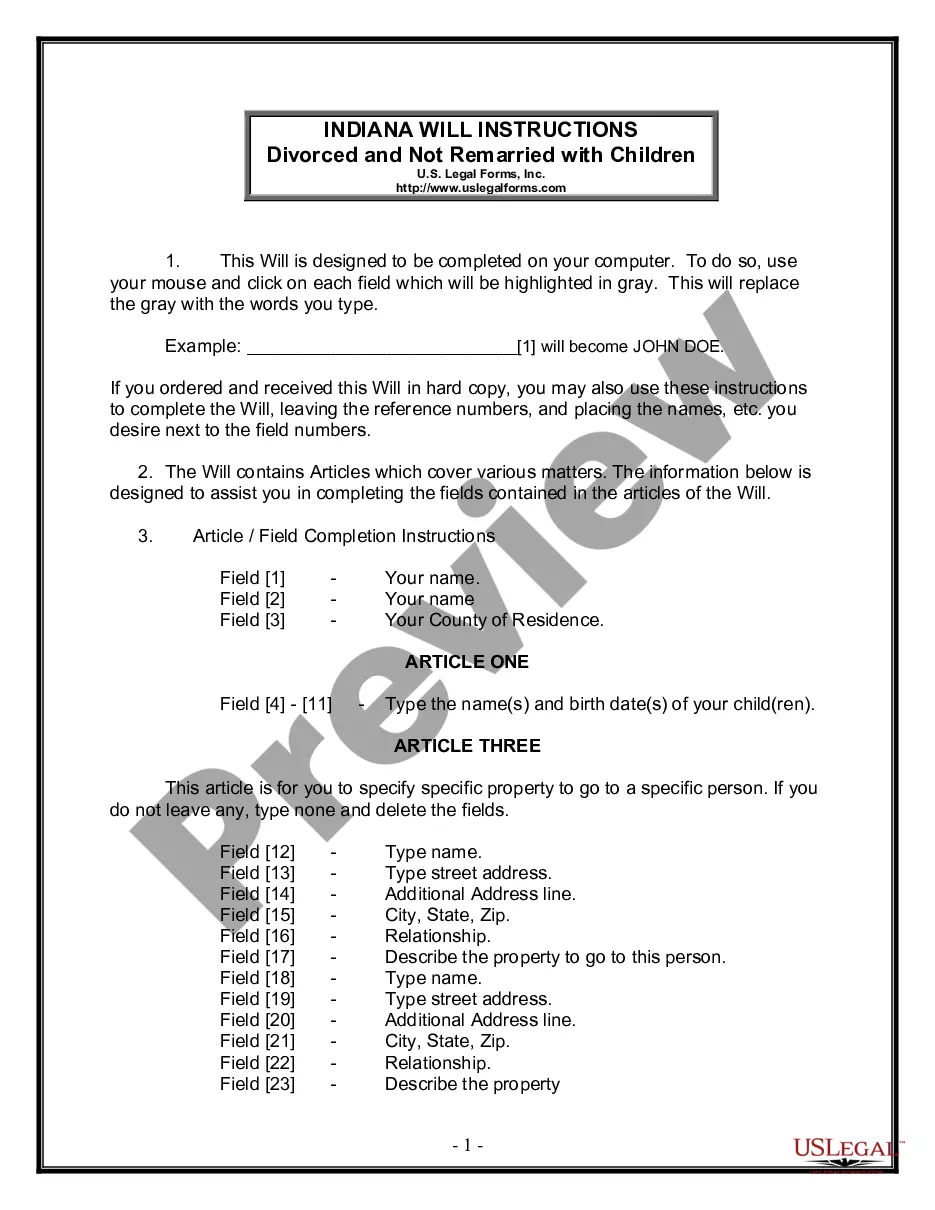

If you wish to use US Legal Forms the first time, here are easy directions to obtain began:

- Be sure you have chosen the right develop for your personal city/region. Click the Preview option to check the form`s content. See the develop explanation to ensure that you have chosen the right develop.

- In case the develop does not match your needs, use the Lookup area towards the top of the display screen to discover the one which does.

- If you are pleased with the shape, affirm your selection by clicking the Buy now option. Then, select the costs strategy you favor and offer your credentials to sign up for the profile.

- Procedure the transaction. Use your bank card or PayPal profile to complete the transaction.

- Select the formatting and down load the shape on your own gadget.

- Make alterations. Fill out, edit and printing and indicator the acquired Connecticut Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc.

Each and every design you added to your bank account lacks an expiration date and it is your own property eternally. So, if you would like down load or printing an additional backup, just check out the My Forms portion and click about the develop you will need.

Get access to the Connecticut Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc with US Legal Forms, the most substantial catalogue of legitimate papers layouts. Use thousands of expert and condition-particular layouts that meet up with your business or personal needs and needs.