Connecticut Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc.

Description

How to fill out Investment Advisory Agreement Between First American Insurance Portfolios, Inc. And U.S. Bank National Assoc.?

Are you in the placement the place you need to have documents for possibly organization or personal functions nearly every time? There are a variety of legal papers layouts accessible on the Internet, but getting kinds you can trust is not straightforward. US Legal Forms delivers thousands of form layouts, much like the Connecticut Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc., that happen to be created to satisfy state and federal specifications.

If you are presently knowledgeable about US Legal Forms website and possess your account, just log in. Following that, you may down load the Connecticut Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. web template.

Should you not offer an accounts and would like to begin using US Legal Forms, follow these steps:

- Find the form you need and ensure it is for that correct city/state.

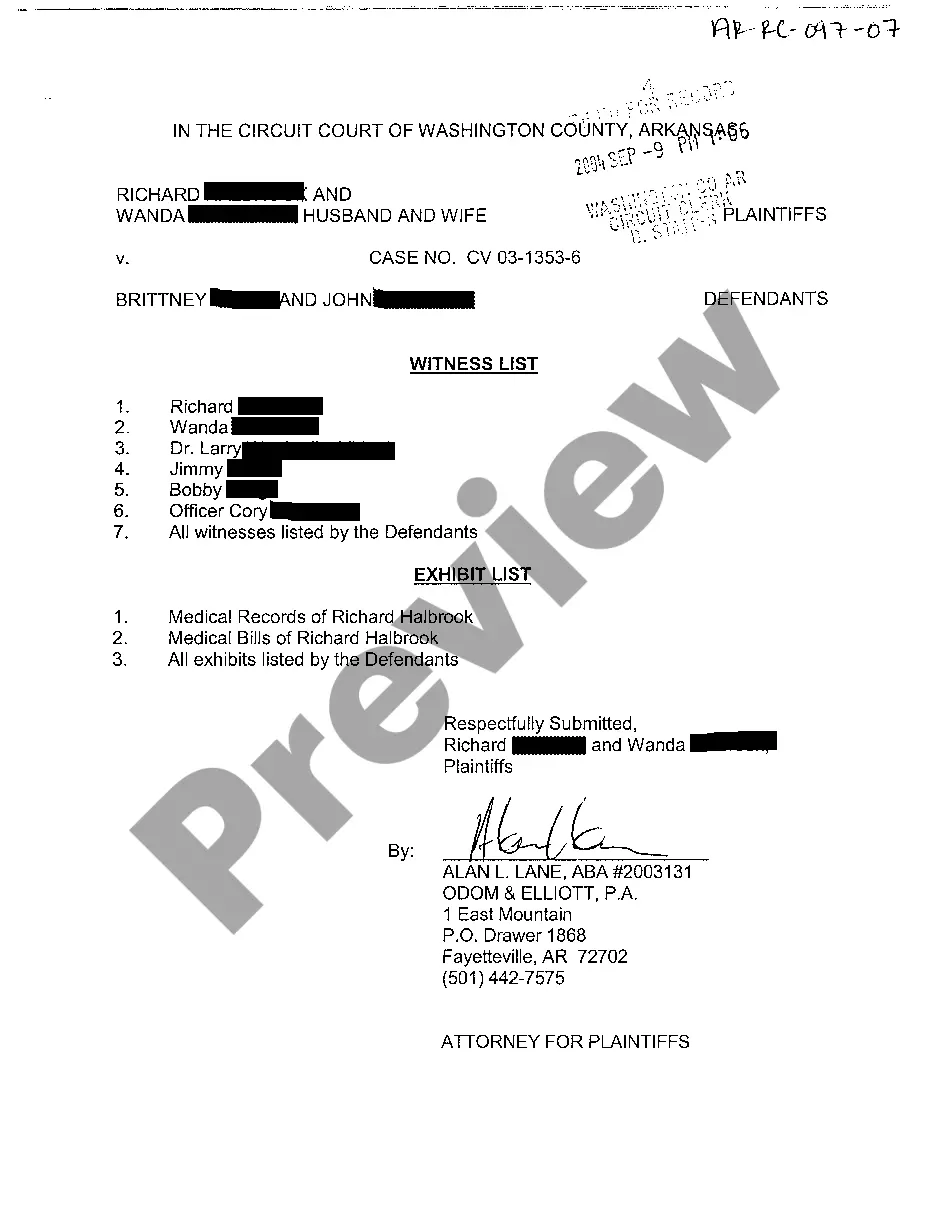

- Take advantage of the Review switch to check the form.

- Read the explanation to actually have chosen the appropriate form.

- If the form is not what you are looking for, make use of the Research industry to get the form that fits your needs and specifications.

- Once you get the correct form, click on Acquire now.

- Pick the rates prepare you need, fill out the desired details to make your bank account, and pay money for the order with your PayPal or charge card.

- Select a practical file file format and down load your backup.

Discover each of the papers layouts you have bought in the My Forms menu. You may get a more backup of Connecticut Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. at any time, if needed. Just select the required form to down load or produce the papers web template.

Use US Legal Forms, by far the most substantial selection of legal forms, to save time and prevent faults. The services delivers professionally manufactured legal papers layouts which can be used for a selection of functions. Generate your account on US Legal Forms and start generating your daily life a little easier.

Form popularity

FAQ

An investment advisor is an individual or a firm that specializes in advising clients on the buying and selling of securities, in exchange for a fee. There are two ways this can happen. First, an investment advisory can offer their services by working directly with their clients to offer investment advice.

While the Advisers Act does not require a written agreement between an advisor and its clients, it contains a handful of requirements regarding the content and parameters of any advisory contract, whether or not it is in written form.

An advisor agreement is a legal document used between a company and an advisor they have hired. The legal agreements outlines the expectations and obligation between the two parties, including the role and responsibilities of the advisor, their compensation, confidentiality, and assignment of work.

Investment advisory contracts are legal documents that outline the relationship between the client and the investment advisor. They provide clear guidelines of what is expected of each party in order for your needs to be met.

An investment agreement will set out the company's obligations and warranties to the investor in return for the funding. The investor will not usually have any input into the company's affairs unless they are also becoming a shareholder.

A Registered Investment Advisor (?RIA?) and an Investment Advisor Representative (?IAR?) are distinctly different. A RIA is the legal entity that is formed to provide advisory services for a fee to clients. The IAR is the individual advisor(s) underneath the RIA that formally deliver the advice.