Connecticut Natural Gas Inventory Forward Sale Contract is a type of financial agreement entered into by natural gas industry participants in Connecticut. It allows them to buy or sell natural gas inventory at a predetermined price and quantity for future delivery. These contracts are crucial for managing risk associated with price fluctuations and ensuring a stable supply of natural gas. The Connecticut Natural Gas Inventory Forward Sale Contract is primarily used by natural gas producers, utilities, wholesalers, and end-users in the state. It offers them the ability to lock in prices and quantities for a specified period, typically ranging from months to years ahead. This enables participants to hedge against potential price increases or decreases in the future, thus helping mitigate financial uncertainties. The contract includes specific terms and conditions, detailing the agreed-upon sale price, delivery period, quality specifications, and any additional provisions relevant to the transaction. It allows parties to negotiate various terms, depending on their specific needs and market conditions. The contract is legally binding, and failure to comply with its terms may result in financial penalties or other legal ramifications. There are different types of Connecticut Natural Gas Inventory Forward Sale Contracts available to meet the diverse needs of market participants: 1. Fixed Quantity Forward Sale Contract: This type of contract involves the sale or purchase of a specified quantity of natural gas at an agreed-upon price. The quantity remains fixed throughout the agreed delivery period, providing certainty in supply and price. 2. Swing Contract: A swing contract provides flexibility in the quantity of natural gas to be bought or sold within a defined range. The buyer or seller can adjust the delivery quantities to manage potential changes in demand or supply. This type of contract is widely used by utilities to accommodate seasonal demand variations. 3. Options Contracts: Options provide the buyer with the right, but not the obligation, to buy or sell natural gas within a specified period and at predetermined terms. This contract type offers greater flexibility to participants, allowing them to adapt to evolving market conditions. Connecticut Natural Gas Inventory Forward Sale Contracts play a significant role in balancing supply and demand dynamics, promoting market efficiency, and managing price risk for natural gas stakeholders in Connecticut. These contracts enable participants to strategically plan their gas purchases or sales, ensuring a stable and secure supply of this crucial energy resource.

Connecticut Natural Gas Inventory Forward Sale Contract

Description

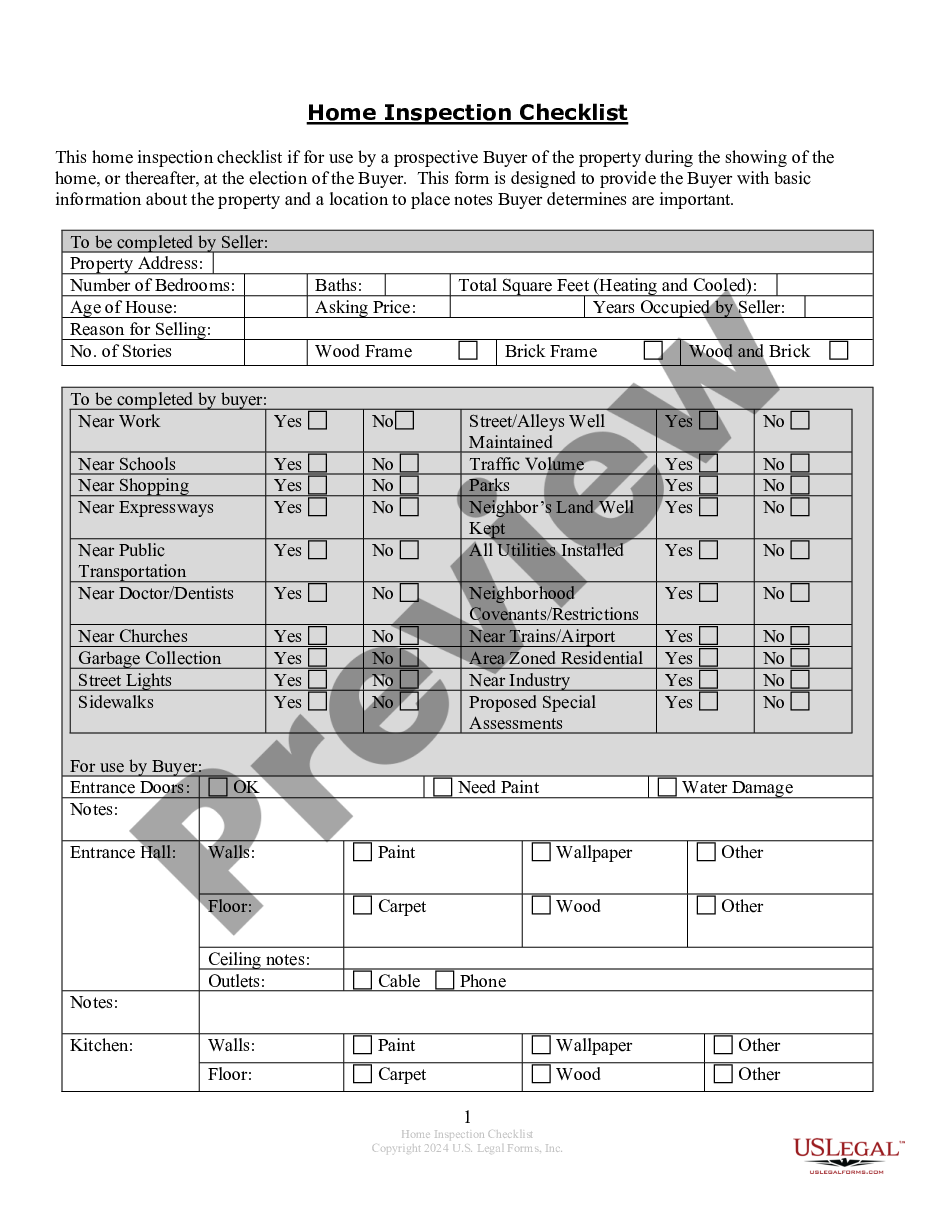

How to fill out Connecticut Natural Gas Inventory Forward Sale Contract?

US Legal Forms - one of the most significant libraries of lawful kinds in the United States - delivers a wide array of lawful papers themes you are able to acquire or produce. Making use of the internet site, you will get a huge number of kinds for organization and personal purposes, sorted by types, says, or keywords and phrases.You can get the most up-to-date types of kinds much like the Connecticut Natural Gas Inventory Forward Sale Contract in seconds.

If you already have a registration, log in and acquire Connecticut Natural Gas Inventory Forward Sale Contract from the US Legal Forms local library. The Down load switch will show up on each and every kind you look at. You get access to all earlier saved kinds in the My Forms tab of the bank account.

If you want to use US Legal Forms the very first time, listed below are basic directions to help you started out:

- Make sure you have chosen the correct kind for your area/region. Select the Preview switch to examine the form`s information. Look at the kind information to actually have chosen the correct kind.

- When the kind doesn`t suit your specifications, use the Look for discipline at the top of the monitor to get the one who does.

- If you are pleased with the form, verify your option by simply clicking the Purchase now switch. Then, choose the prices plan you prefer and offer your accreditations to register for the bank account.

- Process the purchase. Make use of bank card or PayPal bank account to complete the purchase.

- Find the formatting and acquire the form on the gadget.

- Make alterations. Fill out, revise and produce and signal the saved Connecticut Natural Gas Inventory Forward Sale Contract.

Every format you included in your bank account lacks an expiry particular date and is also your own eternally. So, if you want to acquire or produce another duplicate, just go to the My Forms portion and click in the kind you need.

Get access to the Connecticut Natural Gas Inventory Forward Sale Contract with US Legal Forms, the most comprehensive local library of lawful papers themes. Use a huge number of expert and status-certain themes that fulfill your small business or personal needs and specifications.

Form popularity

FAQ

The planting of trees, shrubs and sod are considered to be landscaping services. Landscaping services rendered to new construction, residential real estate, and industrial, commercial or income-producing property are subject to sales and use tax.

GENERAL RULES: The gross receipts from paving, painting or staining, wallpapering, roofing, siding and exterior sheet metal work provided in the renovation and repair of residential property are treated as sales subject to the Sales and Use Taxes Act as of October 1, 1991.

Connecticut building contractors and out-of-state contractors performing services in Connecticut are generally required to collect sales tax on their sales. Moreover, such contractors are required to pay sales or use tax on their purchases.

Tax-exempt goods Some goods are exempt from sales tax under Connecticut law. Examples include bicycle helmets, most non-prepared food items, medicines, and some medical devices and supplies.

Connecticut requires business owners to apply for a sales tax permit online, using the myconneCT online portal. There is a $100 fee, which you must make pay directly from a checking or savings account. Credit cards are not accepted.

There are no additional sales taxes imposed by local jurisdictions in Connecticut. While the general sales and use tax rate is 6.35%, other rates are imposed under Connecticut law as follows: 1%

A contractor's labor is not subject to sales or use tax if performed in conjunction with new construction (with some exceptions), owner-occupied residential property (with some exceptions. Overall, from a sales tax compliance perspective, Connecticut is a fairly easy state in which to comply.

Acts 3, §103 (June Spec. Sess.) treating as sales subject to the sales and use taxes the following renovation and repair services provided to renovation and repair services provided to residential real property: paving, painting or staining, wallpapering, roofing, siding and exterior sheet metal work.