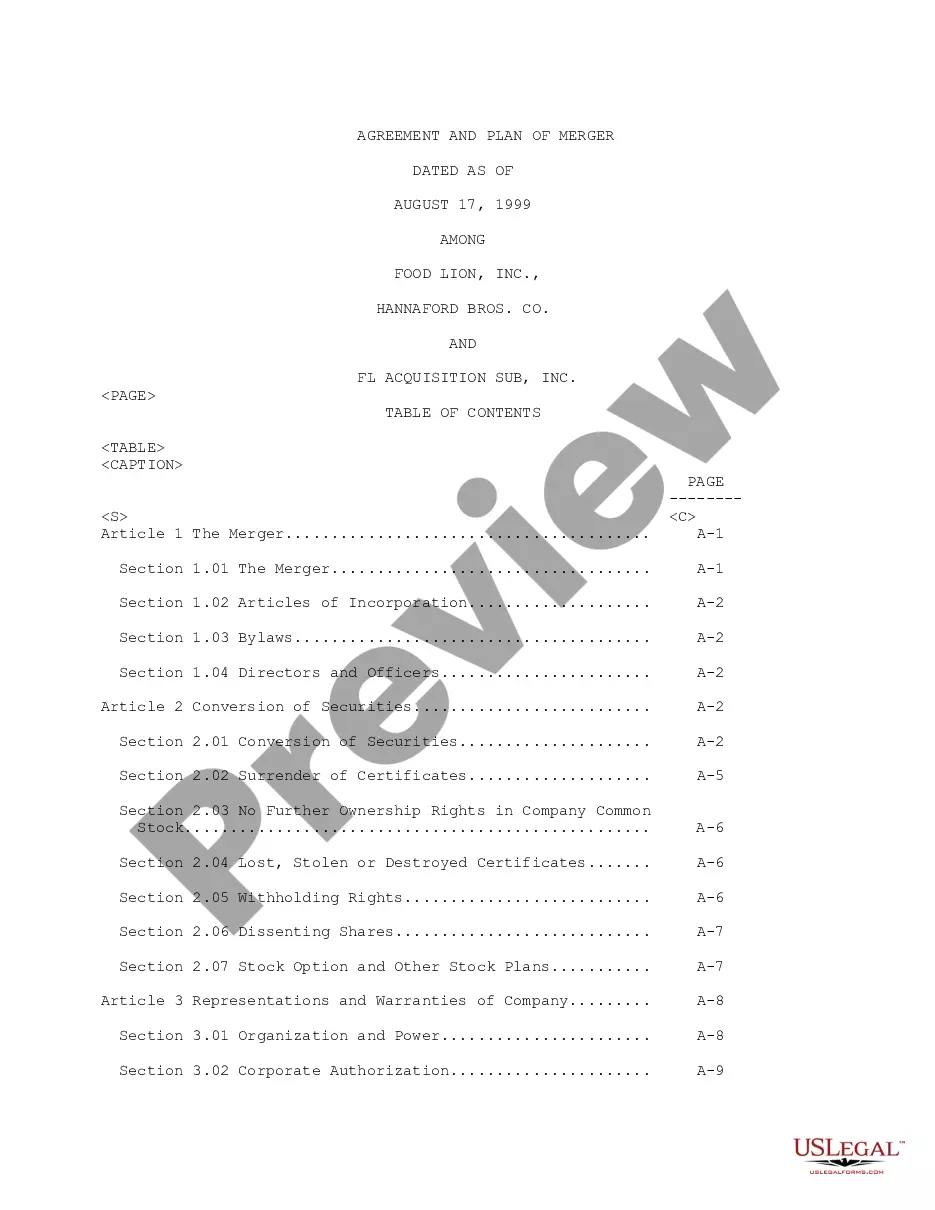

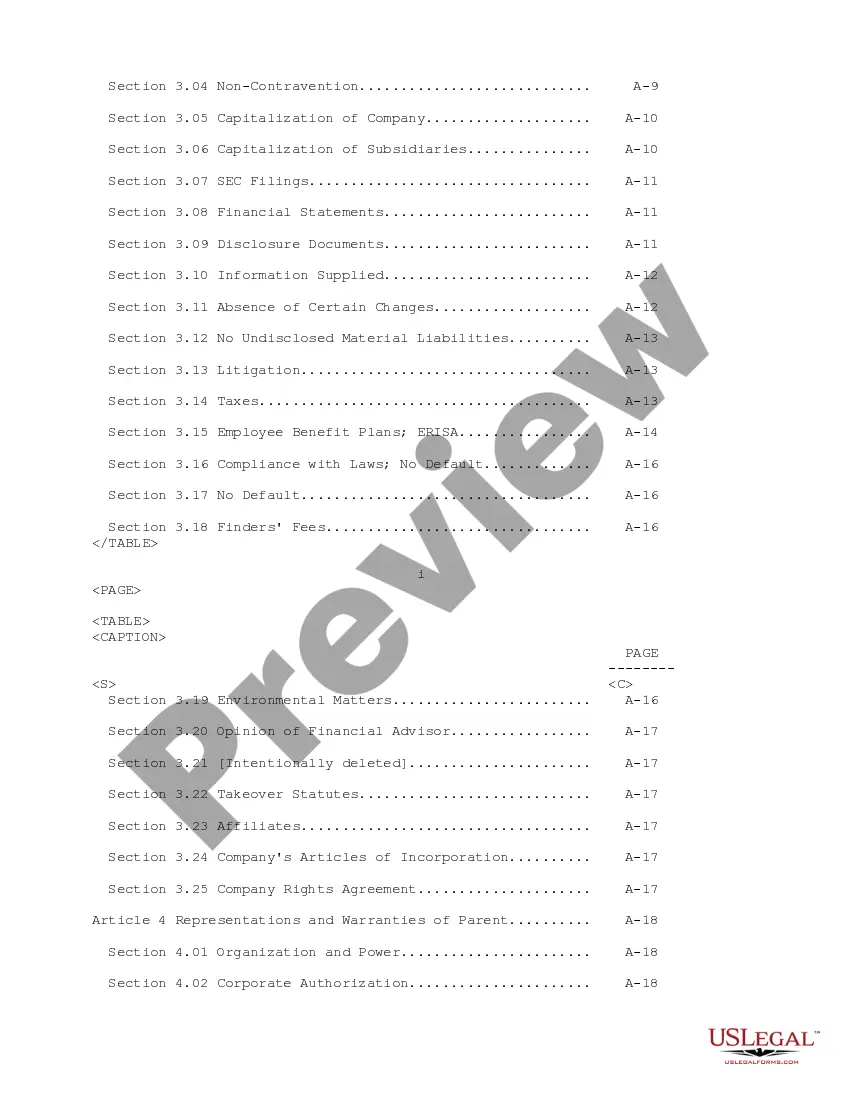

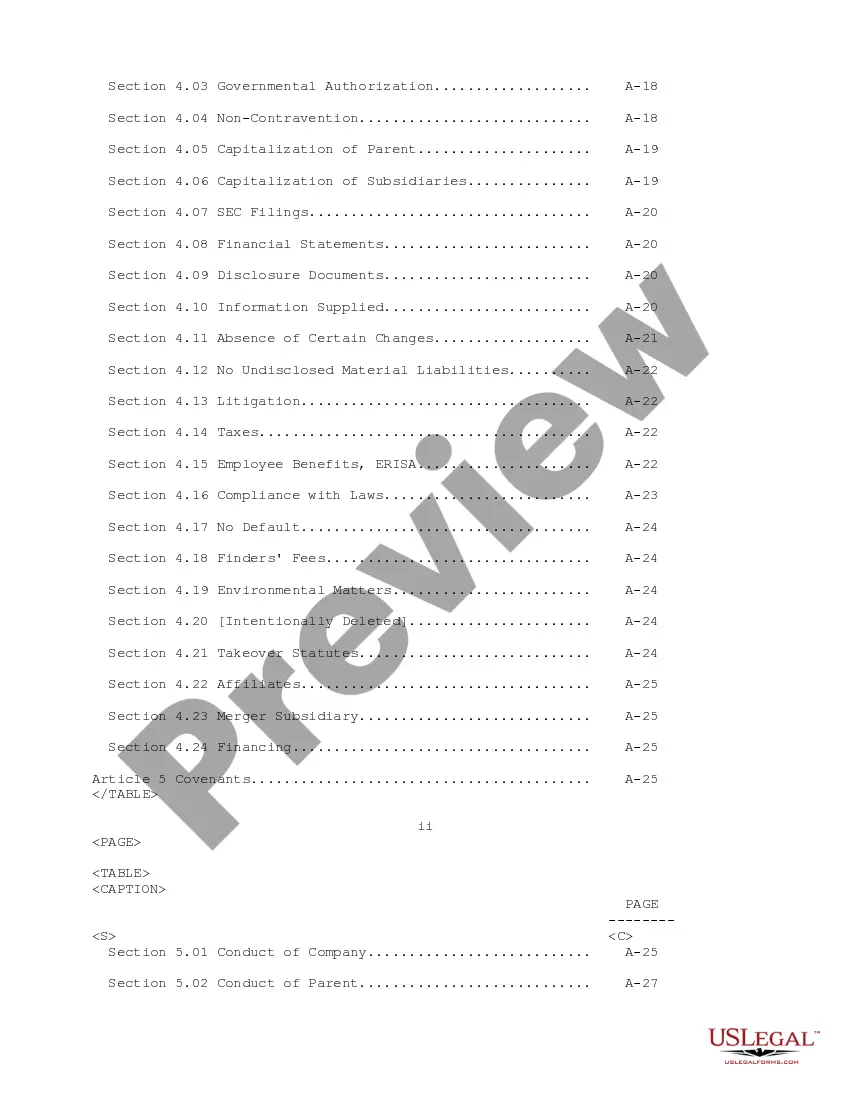

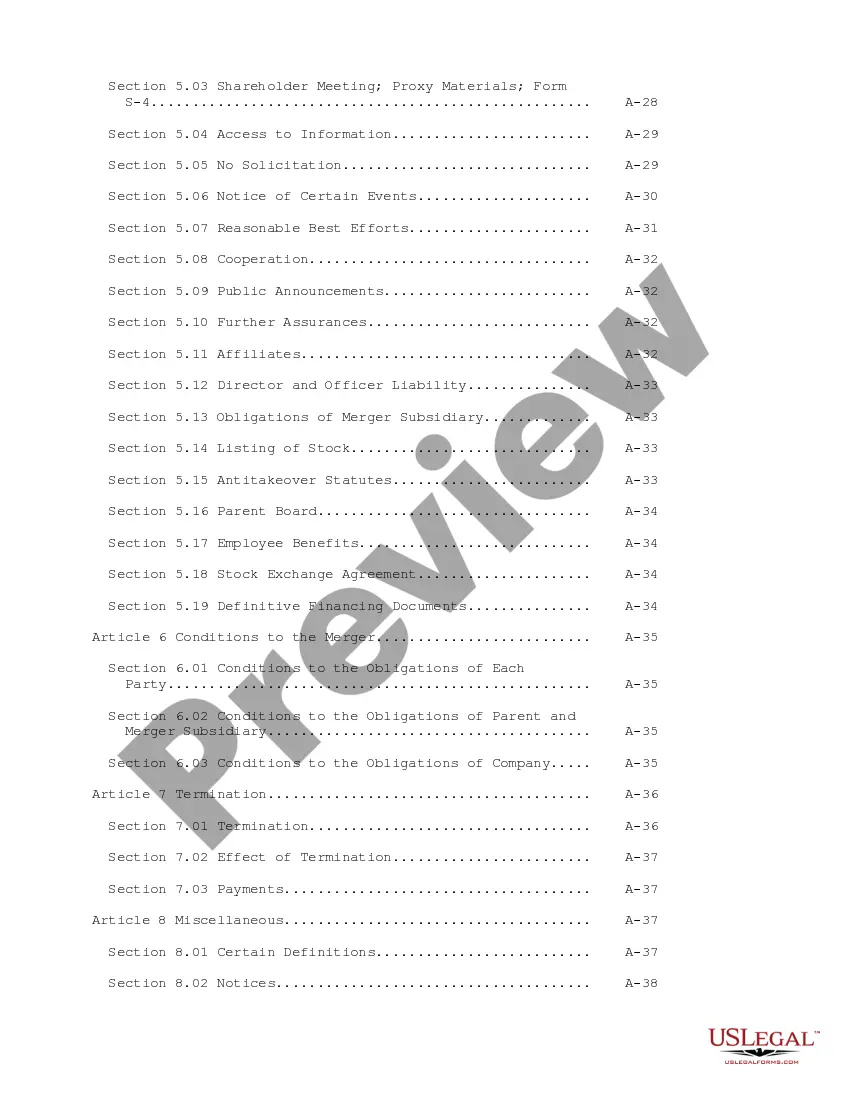

Connecticut Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.

Description

How to fill out Plan Of Merger Between Food Lion, Inc., Hannaford Brothers Company And FL Acquisition Sub, Inc.?

If you need to comprehensive, down load, or produce legitimate document web templates, use US Legal Forms, the biggest variety of legitimate forms, which can be found on-line. Use the site`s simple and practical research to get the paperwork you will need. Numerous web templates for enterprise and individual reasons are categorized by types and claims, or keywords. Use US Legal Forms to get the Connecticut Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. in just a few clicks.

Should you be presently a US Legal Forms consumer, log in in your account and then click the Acquire option to obtain the Connecticut Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.. Also you can entry forms you previously acquired in the My Forms tab of the account.

Should you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape for that right city/nation.

- Step 2. Use the Review method to look over the form`s content. Don`t forget to see the outline.

- Step 3. Should you be not happy using the develop, use the Search area towards the top of the display screen to discover other versions from the legitimate develop design.

- Step 4. When you have located the shape you will need, click the Buy now option. Pick the pricing program you like and include your qualifications to sign up to have an account.

- Step 5. Process the transaction. You can use your bank card or PayPal account to complete the transaction.

- Step 6. Pick the format from the legitimate develop and down load it on your own product.

- Step 7. Comprehensive, revise and produce or sign the Connecticut Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc..

Every single legitimate document design you get is your own property eternally. You may have acces to each develop you acquired within your acccount. Click on the My Forms area and choose a develop to produce or down load again.

Contend and down load, and produce the Connecticut Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. with US Legal Forms. There are millions of expert and status-certain forms you can use for your enterprise or individual requirements.