Connecticut Bylaws of Ichargeit. Inc.

Description

How to fill out Bylaws Of Ichargeit. Inc.?

If you wish to complete, obtain, or produce legal document themes, use US Legal Forms, the greatest selection of legal types, which can be found on the web. Take advantage of the site`s simple and convenient search to get the files you want. Various themes for enterprise and person functions are categorized by types and states, or key phrases. Use US Legal Forms to get the Connecticut Bylaws of Ichargeit. Inc. in a number of click throughs.

When you are previously a US Legal Forms customer, log in for your bank account and click the Obtain button to have the Connecticut Bylaws of Ichargeit. Inc.. Also you can entry types you in the past delivered electronically in the My Forms tab of your respective bank account.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have chosen the form for that appropriate metropolis/nation.

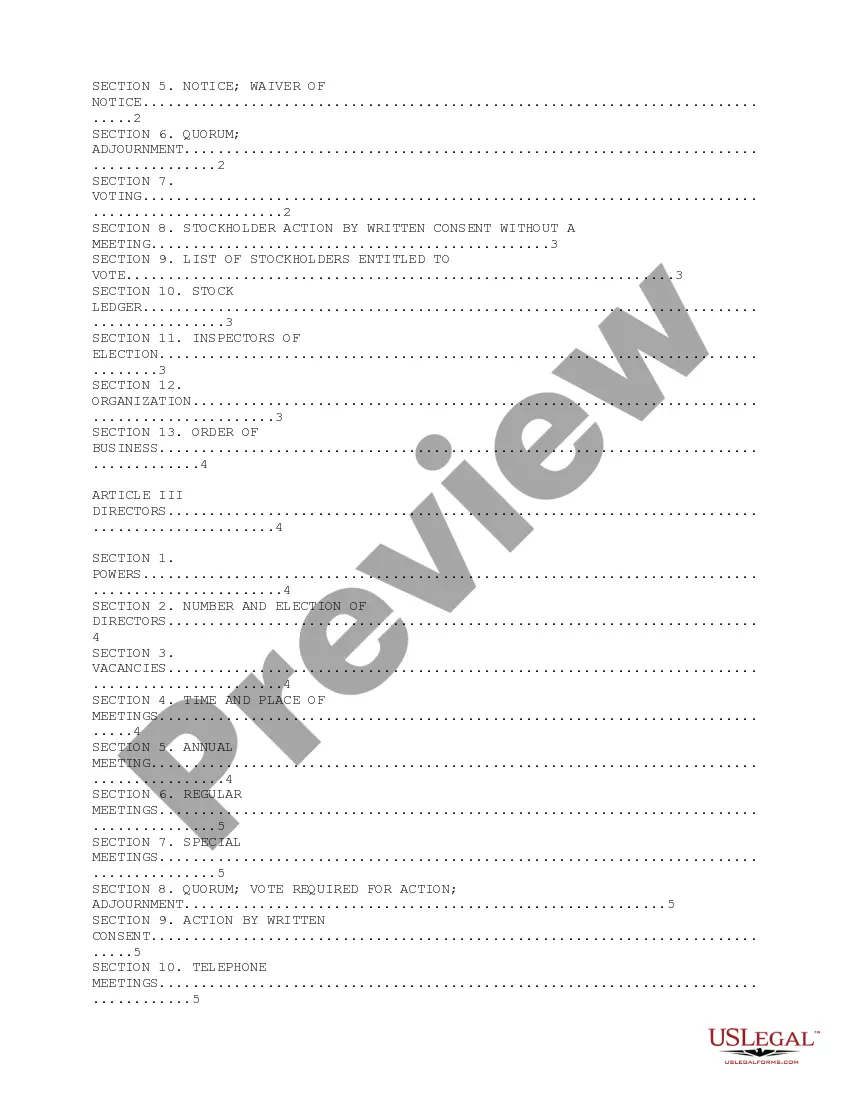

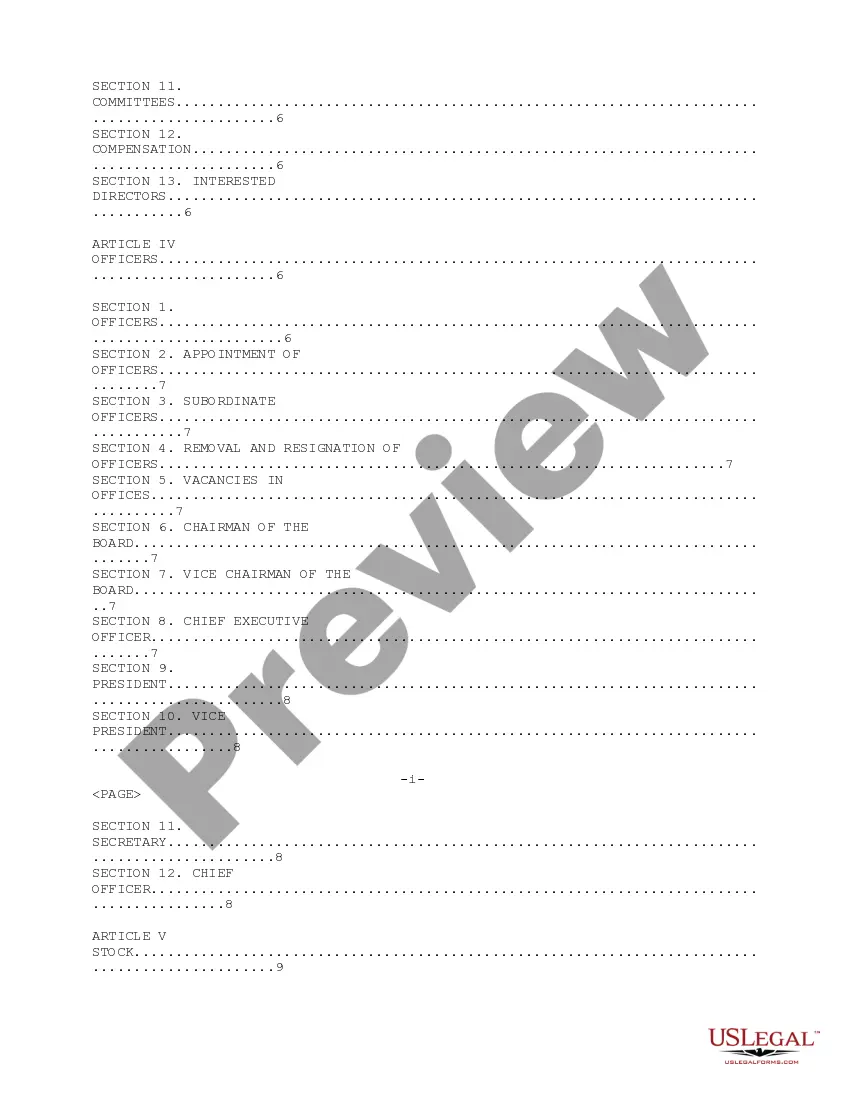

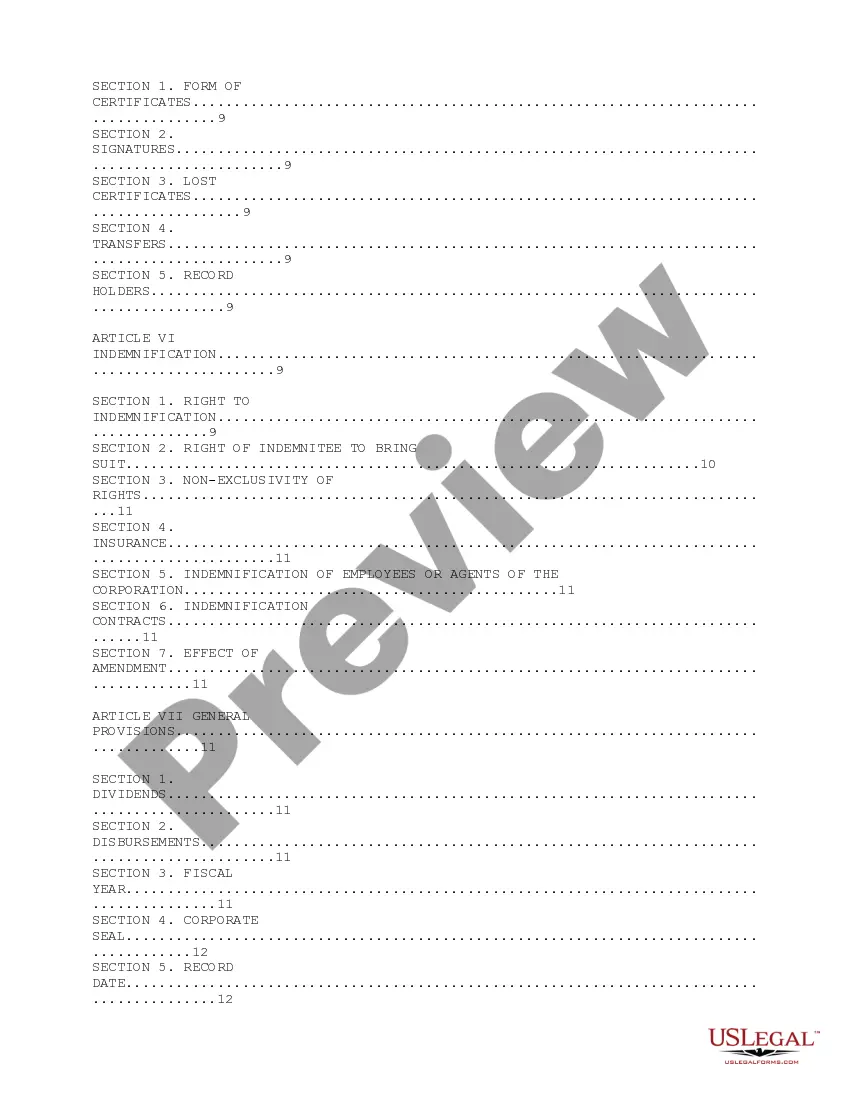

- Step 2. Utilize the Review choice to look through the form`s content. Never forget to see the description.

- Step 3. When you are not satisfied together with the kind, take advantage of the Research field on top of the monitor to locate other models of the legal kind design.

- Step 4. After you have found the form you want, click the Buy now button. Choose the rates program you choose and put your references to register on an bank account.

- Step 5. Method the purchase. You should use your bank card or PayPal bank account to complete the purchase.

- Step 6. Find the formatting of the legal kind and obtain it on the device.

- Step 7. Comprehensive, change and produce or indication the Connecticut Bylaws of Ichargeit. Inc..

Each and every legal document design you purchase is your own property forever. You might have acces to each and every kind you delivered electronically in your acccount. Select the My Forms area and decide on a kind to produce or obtain once again.

Be competitive and obtain, and produce the Connecticut Bylaws of Ichargeit. Inc. with US Legal Forms. There are millions of expert and express-particular types you may use for the enterprise or person requires.

Form popularity

FAQ

A certificate of dissolution form (Form CDRS-1) is available for download from the SOTS website. There is a $50 fee to file the certificate. You can file by mail, fax, or in person.

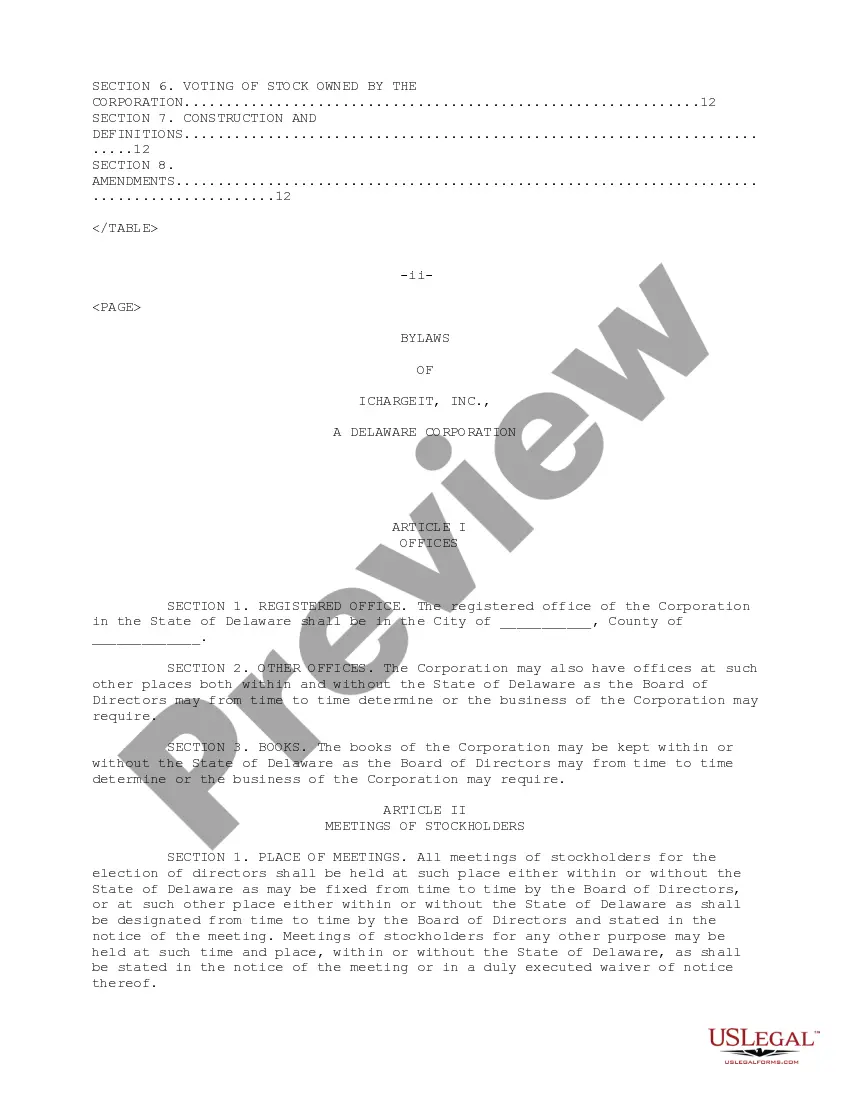

The bylaws of a company are the internal rules that govern how a business is run. They're set out in a formal written document adopted by a corporation's board of directors and summarize important procedures related to decision-making and voting.

To dissolve a Connecticut corporation, you just need to file a Certificate of Dissolution with the Connecticut Secretary of the State, Commercial Recording Division (SOTS). Connecticut has forms available for use but you can draft your own articles of dissolution as long as they contain the required information.

Corporate bylaws are legally required in Connecticut. ing to Connecticut Gen Stat § 33-640, the incorporators or board of directors will adopt initial bylaws. Most of the time, the board of directors adopts bylaws at the first organizational meeting.

The ?dissolution? clause in a nonprofit organization's Articles of Incorporation is one of the key provisions required to qualify for 501(c)(3) status. This language must require that the organization's assets remain dedicated to 501(c)(3) exempt purposes in the event it dissolves.

Section 33-920. - Authority to transact business required. (a) A foreign corporation, other than an insurance, surety or indemnity company, may not transact business in this state until it obtains a certificate of authority from the Secretary of the State.

As required by law, a nonprofit organization that is ceasing existence is required to transfer all remaining assets to another tax-exempt organization or to the government. It is unlawful to give any property away to individuals - including board members, volunteers, staff, or beneficiaries.

The board must vote on and adopt a plan to dissolve. The organization's bylaws and articles of incorporation govern the voting process and adoption of the plan. membership for a vote. A vote of two-thirds in favor of dissolution is needed to continue the process.