Connecticut Electronic Services Form

Description

How to fill out Electronic Services Form?

Are you currently within a situation that you need paperwork for sometimes enterprise or specific purposes virtually every time? There are plenty of legal papers themes available online, but discovering ones you can trust isn`t straightforward. US Legal Forms provides a huge number of kind themes, just like the Connecticut Electronic Services Form, that happen to be composed to fulfill federal and state needs.

In case you are previously knowledgeable about US Legal Forms internet site and also have a free account, basically log in. After that, you are able to download the Connecticut Electronic Services Form template.

If you do not offer an accounts and need to start using US Legal Forms, abide by these steps:

- Get the kind you need and make sure it is for your proper city/state.

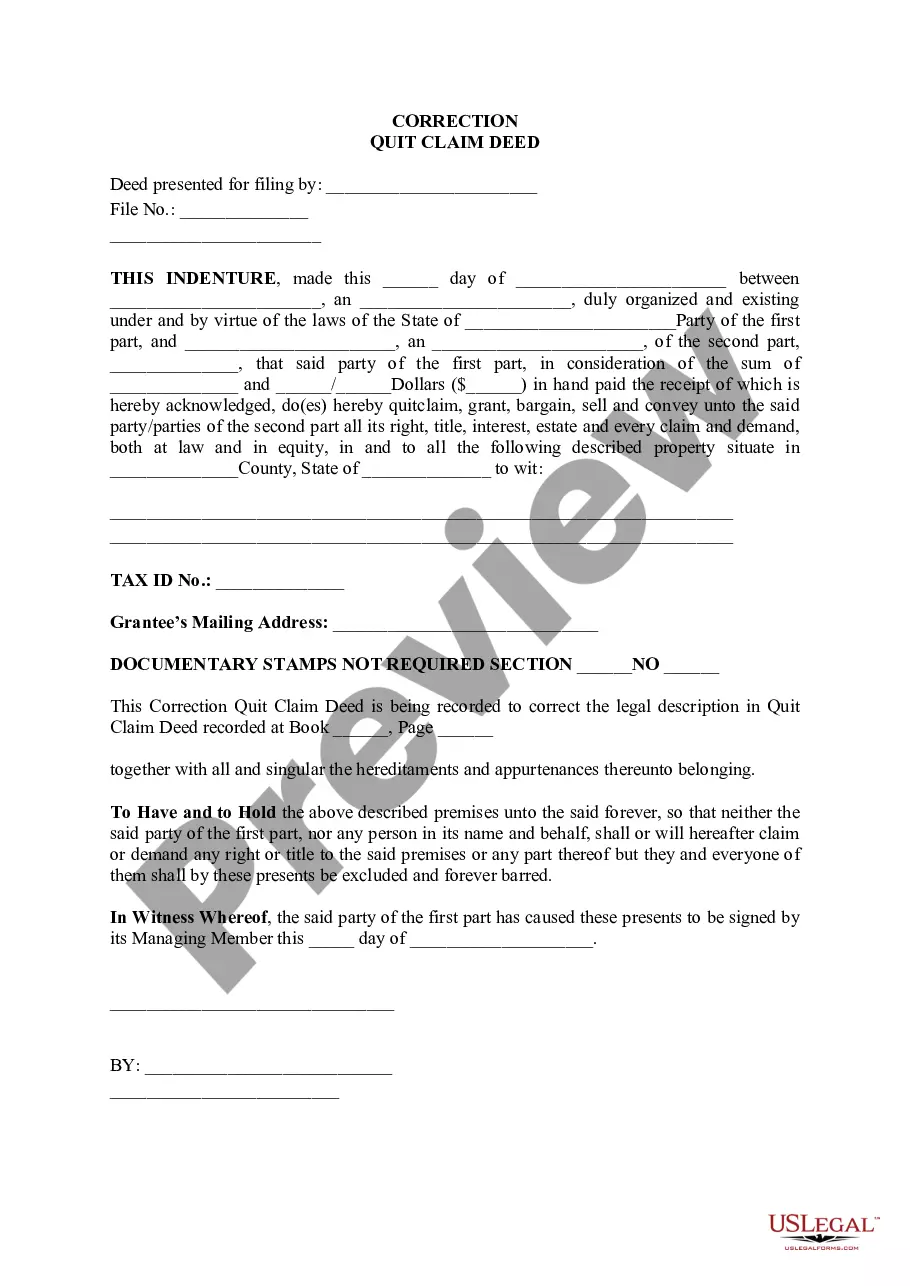

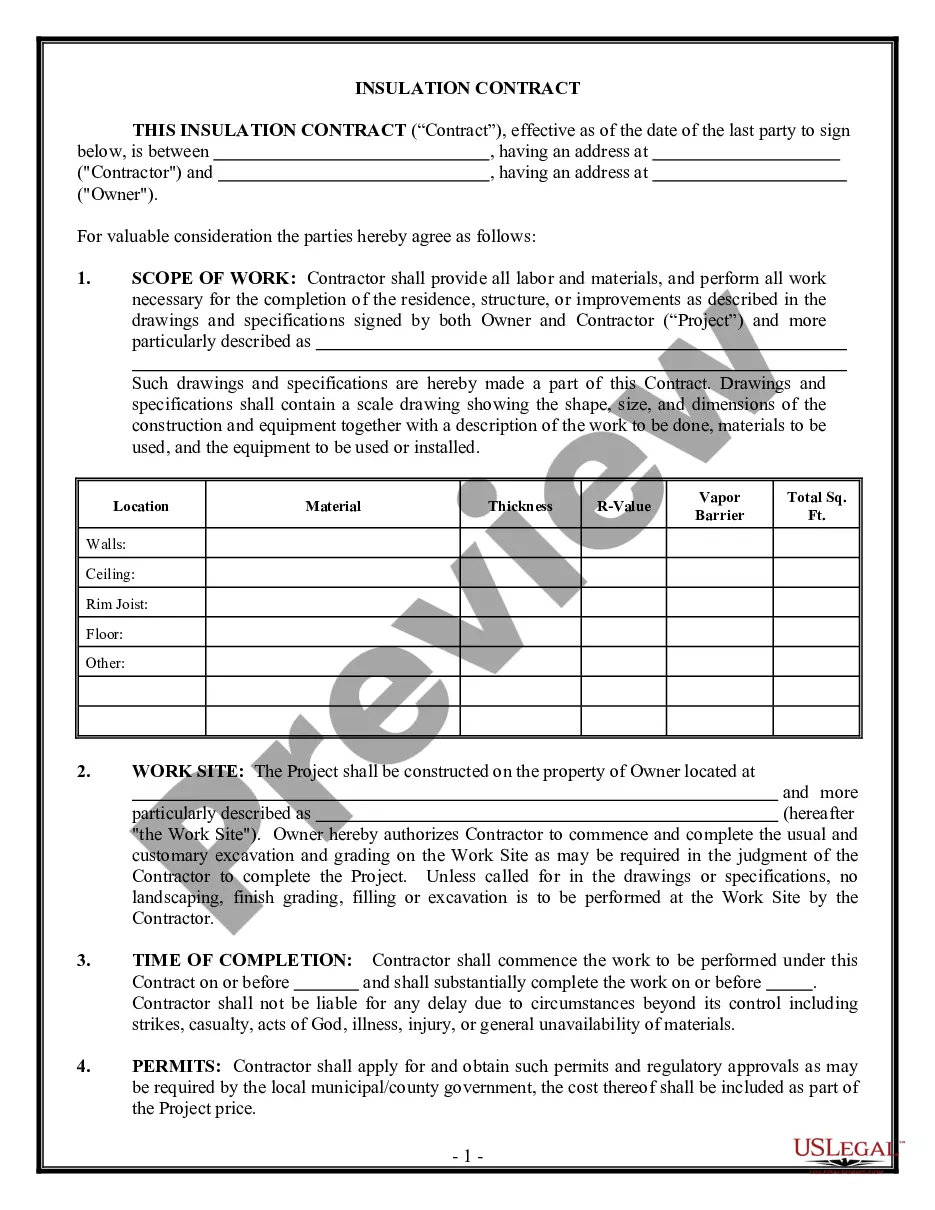

- Use the Review option to examine the form.

- See the explanation to actually have chosen the appropriate kind.

- In the event the kind isn`t what you are searching for, use the Search industry to find the kind that meets your requirements and needs.

- Whenever you discover the proper kind, simply click Buy now.

- Opt for the costs plan you want, complete the required info to generate your account, and purchase an order utilizing your PayPal or charge card.

- Pick a handy document file format and download your duplicate.

Locate all the papers themes you may have bought in the My Forms food selection. You can obtain a further duplicate of Connecticut Electronic Services Form whenever, if possible. Just click on the required kind to download or produce the papers template.

Use US Legal Forms, the most considerable variety of legal forms, in order to save time and steer clear of faults. The assistance provides professionally created legal papers themes that you can use for a range of purposes. Create a free account on US Legal Forms and commence creating your lifestyle a little easier.

Form popularity

FAQ

You may also call the Centralized Services Unit at 860-263-2750. All requests for files must include the name of the case and docket number. Docket numbers may be available on-line at .jud.ct.gov by utilizing the case look-up function. Files should be available within one or two business days.

The United States District Courts for the Second Circuit exercise federal jurisdiction in six districts within the states of Connecticut, New York, and Vermont.

In Connecticut, the judiciary has four general levels. The Probate Court is the lowest court, with a focus on cases involving specific subject matter. The Connecticut Superior Court is the trial court of general jurisdiction. The Connecticut Appellate Court acts as the intermediate appellate court.

The judicial functions of the Branch are concerned with the just disposition of cases at the trial and appellate levels. All judges have the independent, decision-making power to preside over matters in their courtrooms and to determine the outcome of each case before them.

To e-file an appearance in an existing case, follow the steps outlined below. Note: All e-filing transactions will be attributed to the logged-in juris number. Generally, the log-in juris number is the firm juris number for this reason. The individual juris number of the attorney is used to sign documents.

In Connecticut, the judiciary has four general levels. The Probate Court is the lowest court, with a focus on cases involving specific subject matter. The Connecticut Superior Court is the trial court of general jurisdiction. The Connecticut Appellate Court acts as the intermediate appellate court.

The judicial branch decides the constitutionality of federal laws and resolves other disputes about federal laws. However, judges depend on our government's executive branch to enforce court decisions. Courts decide what really happened and what should be done about it.