Connecticut Trust Indenture and Agreement between John Naveen and Co., Inc. and Chase Manhattan Bank: The Connecticut Trust Indenture and Agreement between John Naveen and Co., Inc. and Chase Manhattan Bank outlines the terms and conditions for the Naveen Tax Free Unit Trust, Series 1140. This document establishes a legally binding agreement between the two parties involved, ensuring transparency and clarity in managing the trust. Keywords: Trust Indenture, Agreement, John Naveen and Co., Inc., Chase Manhattan Bank, terms and conditions, Naveen Tax Free Unit Trust, Series 1140. The Connecticut Trust Indenture and Agreement between John Naveen and Co., Inc. and Chase Manhattan Bank for the Naveen Tax Free Unit Trust, Series 1140, encompasses several key aspects: 1. Purpose: This section clarifies the overall objective of the trust, which is to provide tax-free income for the trust beneficiaries through investment in municipal bonds. 2. Roles and Responsibilities: The agreement defines the respective roles of John Naveen and Co., Inc. as the investment manager and Chase Manhattan Bank as the trustee. It outlines their duties, including investment decision-making, record-keeping, and reporting requirements. 3. Trust Assets: The document specifies the assets that will be included in the trust, such as municipal bonds issued by municipalities in Connecticut. It further outlines the acquisition, management, and disposition of these assets. 4. Distribution of Income: This section details the distribution mechanism for the tax-free income generated by the trust. It may specify regular distributions, reinvestment options, or any other conditions related to income distribution. 5. Trustee's Rights and Limitations: The agreement outlines the rights and powers of the trustee, including taking legal actions, appointing agents, maintaining accounts, and indemnification. It also defines any restrictions on the trustee's actions, ensuring compliance with applicable laws and regulations. 6. Reporting and Record-keeping: This section establishes the requirements for financial reporting, record-keeping, and auditing procedures. It ensures transparency and accountability between the parties involved. 7. Amendments and Termination: The agreement outlines the conditions under which the trust can be amended or terminated, including the process, majority votes required, and any associated costs. 8. Dispute Resolution: This section details the mechanism for resolving disputes between the parties, including mediation, arbitration, or litigation procedures. Different types of Connecticut Trust Indenture and Agreement may exist for various series of the Naveen Tax Free Unit Trust. Each series may have distinct terms and conditions tailored to its specific investment objectives, asset composition, and geographic focus. It is essential to refer to the specific Trust Indenture and Agreement for Naveen Tax Free Unit Trust, Series 1140, as other series may have different names and characteristics.

Connecticut Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140

Description

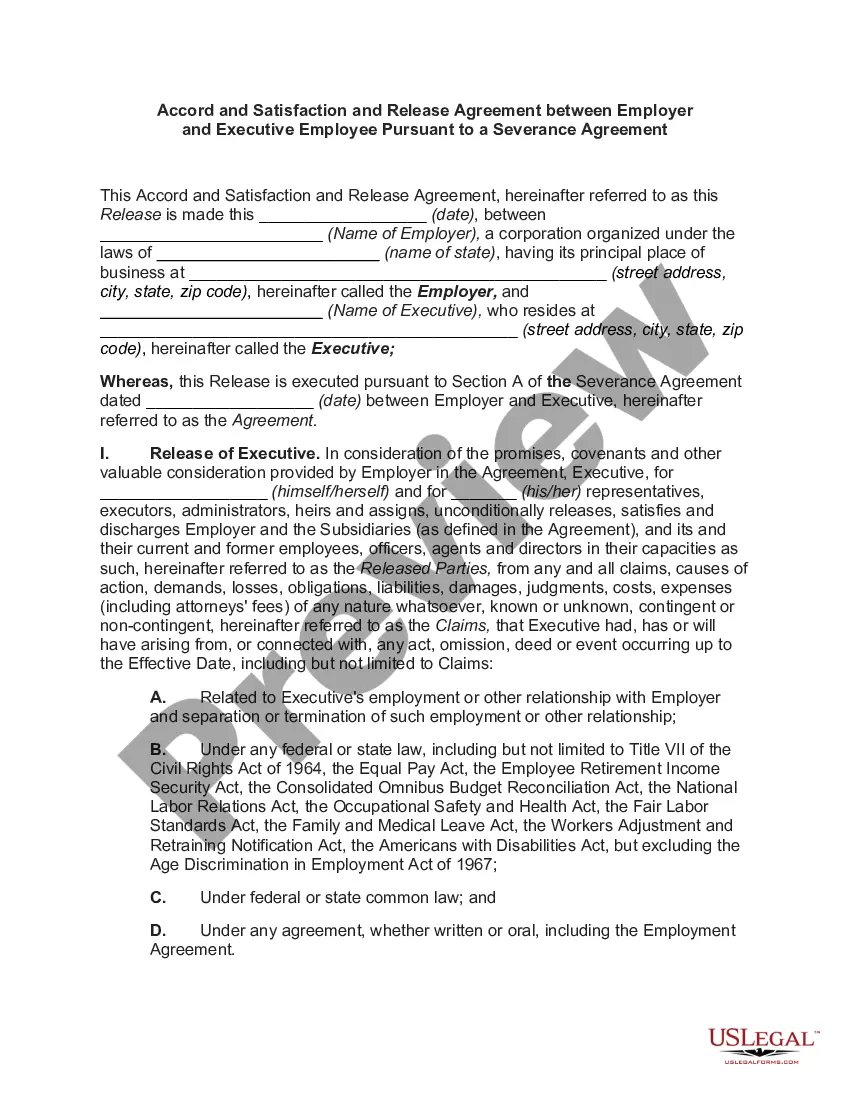

How to fill out Connecticut Trust Indenture And Agreement Between John Nuveen And Co., Inc. And Chase Manhattan Bank Regarding Terms And Conditions For Nuveen Tax Free Unit Trust, Series 1140?

Finding the right legal record design could be a battle. Naturally, there are tons of web templates accessible on the Internet, but how do you find the legal develop you require? Take advantage of the US Legal Forms site. The services offers a huge number of web templates, such as the Connecticut Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140, that can be used for business and private requires. All of the kinds are examined by professionals and meet federal and state demands.

If you are already authorized, log in to the profile and click the Down load button to obtain the Connecticut Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140. Make use of profile to look from the legal kinds you possess ordered previously. Proceed to the My Forms tab of your own profile and acquire an additional backup in the record you require.

If you are a fresh end user of US Legal Forms, here are basic guidelines for you to adhere to:

- Very first, make certain you have selected the proper develop for your personal area/county. You can check out the form using the Review button and browse the form description to guarantee it will be the right one for you.

- If the develop will not meet your requirements, use the Seach discipline to discover the correct develop.

- Once you are certain that the form is acceptable, go through the Get now button to obtain the develop.

- Pick the costs plan you need and type in the necessary details. Design your profile and pay for your order with your PayPal profile or charge card.

- Select the submit format and download the legal record design to the gadget.

- Full, revise and print and indicator the obtained Connecticut Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140.

US Legal Forms will be the greatest collection of legal kinds that you will find numerous record web templates. Take advantage of the company to download professionally-produced papers that adhere to condition demands.