Connecticut Plan of Acquisition, also known as the Connecticut Acquisition Plan or the Connecticut Takeover Plan, is a strategic framework formulated by the state of Connecticut to facilitate the acquisition of companies, organizations, or assets within its jurisdiction. This initiative provides a structured approach for entities seeking to expand their operations, increase market presence, or pursue growth opportunities by acquiring businesses or assets in Connecticut. The Connecticut Plan of Acquisition focuses on promoting economic development, job creation, and fostering innovation within the state. It outlines the procedures, regulations, and guidelines that govern the acquisition process to ensure transparency, fairness, and protection of the rights of all involved parties. This comprehensive plan encourages both domestic and international entities to consider Connecticut as an attractive destination for acquisition activities. Key components of the Connecticut Plan of Acquisition include: 1. Legal Framework: The plan establishes a legal basis for acquisitions in Connecticut, encompassing statutes, regulations, and provisions that entities must comply with when engaging in acquisition activities. 2. Financial Incentives: Connecticut offers various financial incentives, such as tax credits, grants, and loans, to encourage acquisitions that contribute to the state's economic growth and job creation. 3. Industry Support: The plan identifies key industries and sectors that the state government aims to develop, thereby encouraging targeted acquisitions in those areas. This support often includes industry-specific incentives, technical assistance, and access to resources and networks. 4. Due Diligence: The Connecticut Plan of Acquisition emphasizes the importance of conducting thorough due diligence, ensuring that potential acquirers have a deep understanding of the legal, financial, operational, and environmental aspects related to the target entity or assets. 5. Regulatory Approvals: The plan addresses the regulatory process associated with acquisitions, including obtaining necessary approvals from relevant state agencies or authorities. This step ensures compliance with state laws, regulations, and industry-specific requirements. 6. Workforce Considerations: The plan highlights the significance of workforce retention and development during acquisitions. It encourages acquirers to make efforts to retain existing employees, provide training and growth opportunities, and comply with labor laws and regulations. 7. Reporting and Compliance: The plan emphasizes the requirement for acquiring entities to report relevant information, financial data, and compliance-related documentation to the state during and after the acquisition process. Different types of acquisitions under the Connecticut Plan of Acquisition can include mergers, asset acquisitions, stock purchases, and takeovers. Each type may involve specific considerations, legal procedures, and compliance requirements tailored to the nature of the acquisition. By implementing the Connecticut Plan of Acquisition, the state aims to enhance its economic competitiveness, attract investment, and create a business-friendly environment that supports growth and innovation. Interested parties can refer to the plan's guidelines and consult with relevant state agencies or legal advisors to navigate the acquisition process effectively and take advantage of the opportunities presented in Connecticut.

Connecticut Plan of Acquisition

Description

How to fill out Connecticut Plan Of Acquisition?

If you wish to comprehensive, down load, or print authorized file web templates, use US Legal Forms, the greatest assortment of authorized kinds, that can be found online. Use the site`s basic and hassle-free research to get the files you need. Numerous web templates for enterprise and specific functions are categorized by categories and claims, or key phrases. Use US Legal Forms to get the Connecticut Plan of Acquisition in a number of clicks.

If you are previously a US Legal Forms consumer, log in to the account and click on the Down load key to get the Connecticut Plan of Acquisition. Also you can gain access to kinds you in the past delivered electronically from the My Forms tab of your own account.

If you use US Legal Forms for the first time, follow the instructions listed below:

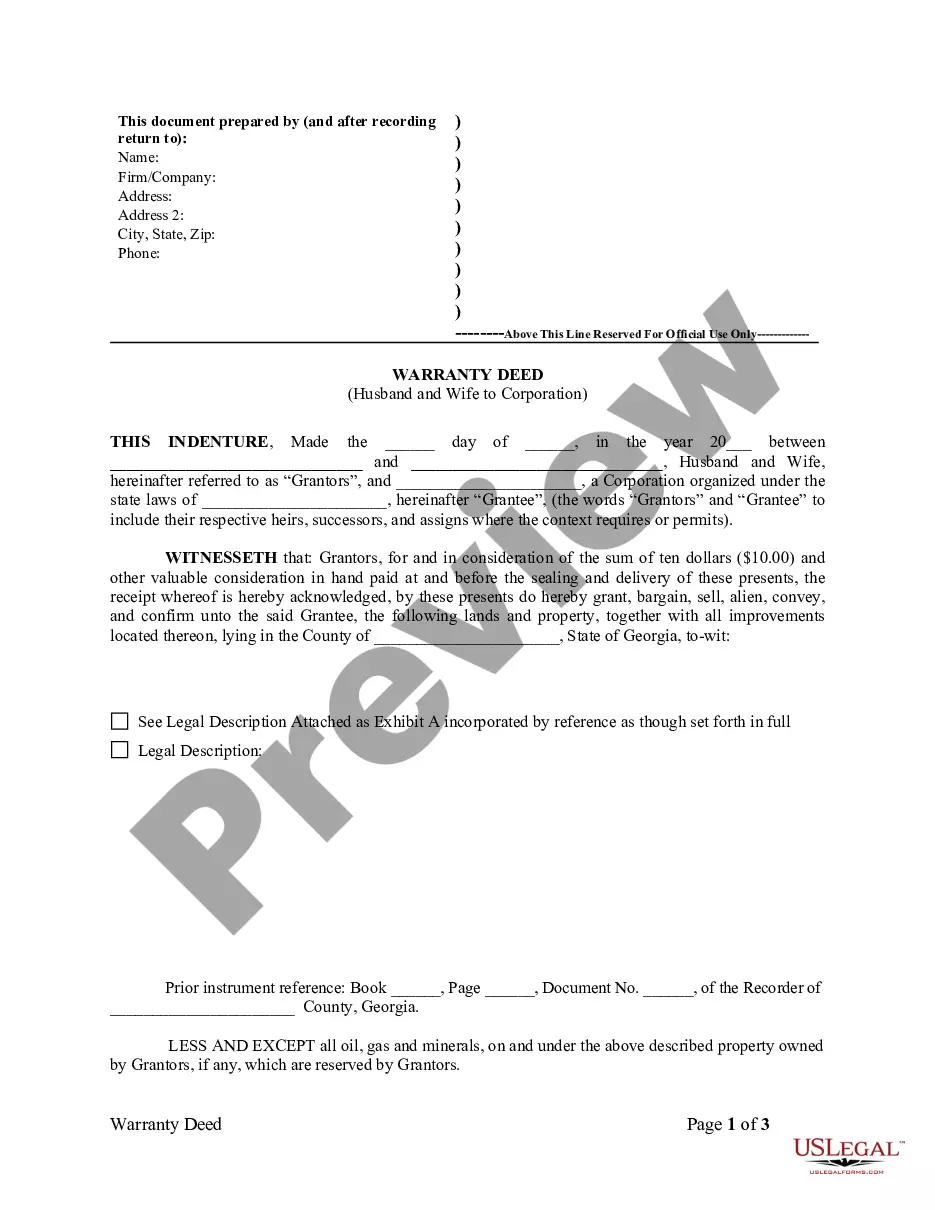

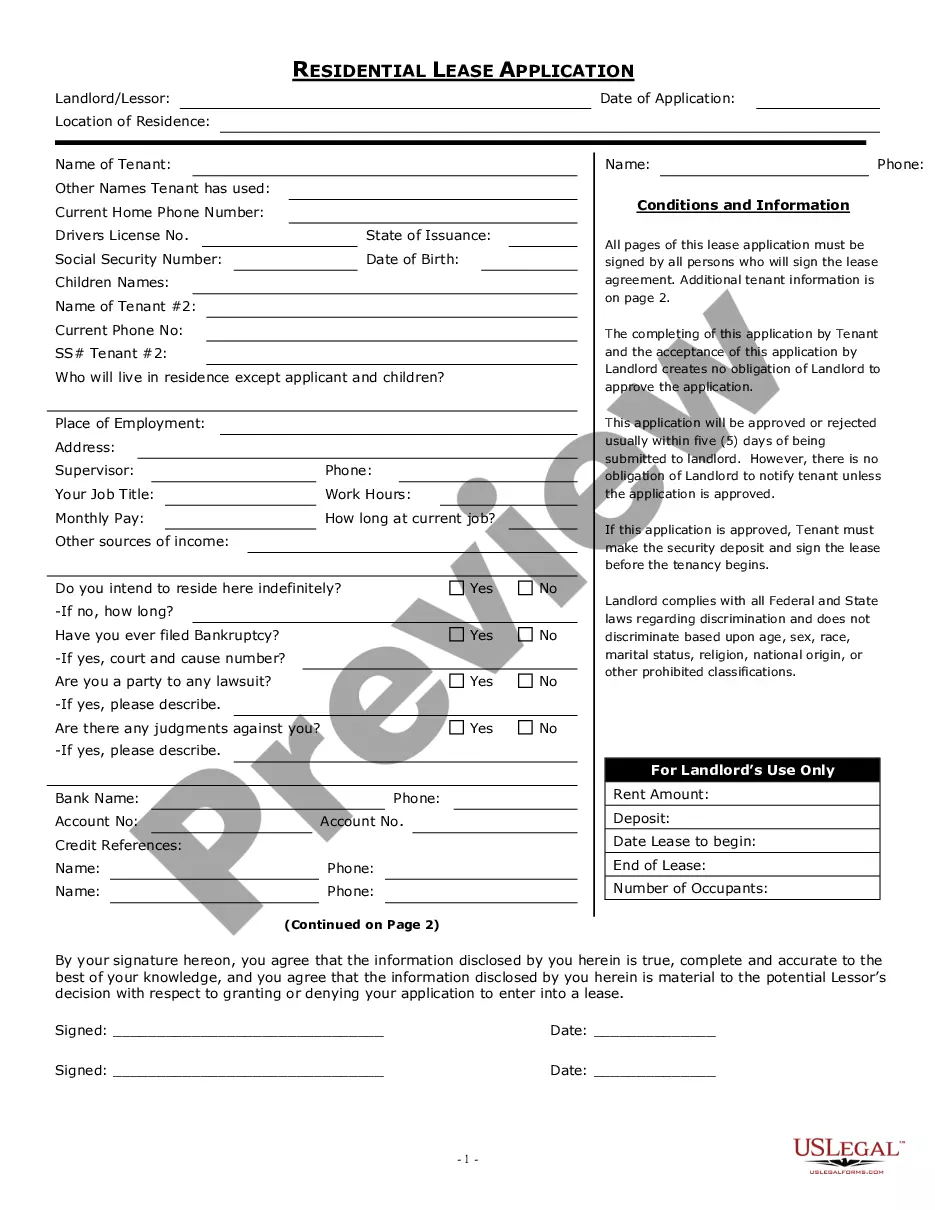

- Step 1. Be sure you have selected the form for that proper town/land.

- Step 2. Utilize the Preview option to look through the form`s content. Never overlook to learn the explanation.

- Step 3. If you are unsatisfied together with the type, utilize the Lookup field towards the top of the screen to discover other versions of the authorized type design.

- Step 4. Upon having discovered the form you need, click on the Acquire now key. Choose the pricing program you prefer and put your credentials to sign up to have an account.

- Step 5. Process the purchase. You may use your credit card or PayPal account to finish the purchase.

- Step 6. Select the file format of the authorized type and down load it on your own system.

- Step 7. Comprehensive, change and print or signal the Connecticut Plan of Acquisition.

Each and every authorized file design you get is yours eternally. You possess acces to each and every type you delivered electronically inside your acccount. Click on the My Forms section and select a type to print or down load once again.

Compete and down load, and print the Connecticut Plan of Acquisition with US Legal Forms. There are millions of specialist and express-certain kinds you can use for your enterprise or specific needs.