Connecticut Deposit Agreement: Explained in Detail A Connecticut Deposit Agreement refers to a contractual arrangement between a depositor and a financial institution in the state of Connecticut. This agreement outlines the terms and conditions that govern the deposit of funds into various banking products offered by these institutions. Whether it's a traditional savings account, a certificate of deposit, or a money market account, the deposit agreement serves as a binding document to protect the rights and interests of both the depositor and the financial institution. The Connecticut Deposit Agreement typically consists of key components such as the account holder's personal information, the type of deposit product selected, deposit amount, interest rates, terms of withdrawal, and any associated fees or charges. It defines the legal responsibilities and rights of both parties involved in the agreement. There are several types of Connecticut Deposit Agreements available to customers, each designed to cater to specific financial needs: 1. Savings Account Deposit Agreement: This type of deposit account allows individuals to securely store money while earning interest. It typically offers easy access to funds, providing individuals with liquidity and a safe place to accumulate savings. 2. Certificate of Deposit (CD) Deposit Agreement: Designed for individuals looking to invest their money for a fixed term, typically ranging from a few months to several years. CD accounts offer higher interest rates compared to savings accounts, but funds are locked in for the specified term. Premature withdrawal usually incurs penalties. 3. Money Market Account (MMA) Deposit Agreement: These accounts combine features of both savings accounts and checking accounts. They typically require a higher initial deposit but also offer higher yields. MMS usually come with limited check-writing capabilities and provide a slightly higher interest rate compared to standard savings accounts. To open a Connecticut Deposit Account, individuals must provide the necessary identification and complete the required application forms. The deposit agreement will be provided by the financial institution, outlining the terms and conditions associated with the selected product. It is crucial that individuals review the entire agreement thoroughly, seeking clarification on any terms or conditions they do not understand. By doing so, customers can make informed decisions regarding their financial goals and ensure that their deposits are handled in accordance with their preferences. In summary, a Connecticut Deposit Agreement is an essential document that serves as a legally binding contract between a depositor and a financial institution. It outlines the terms, conditions, and responsibilities related to depositing funds into various banking products. By understanding the different types of deposit agreements available, individuals can make informed decisions that align with their financial needs and goals.

Connecticut Deposit Agreement

Description

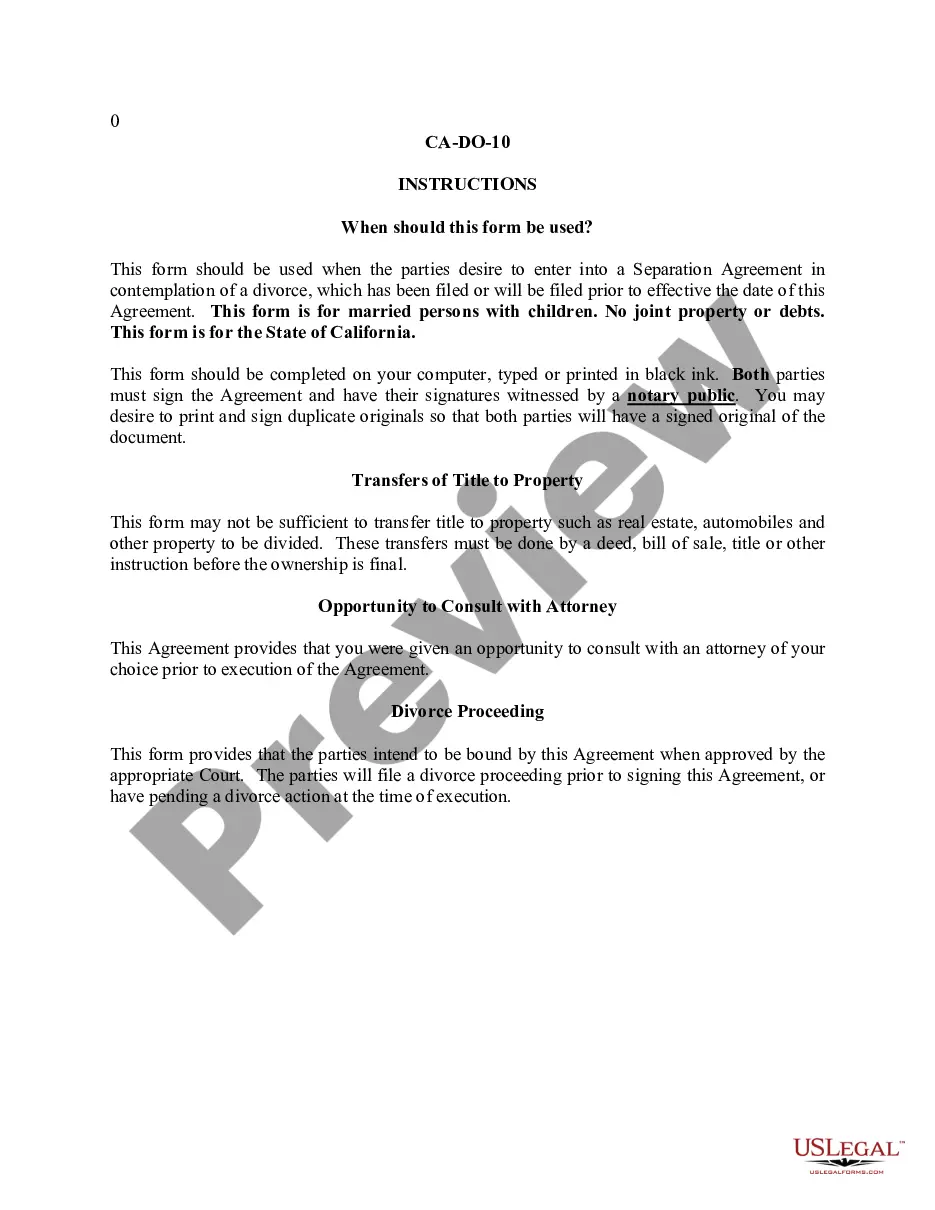

How to fill out Connecticut Deposit Agreement?

You may spend time on the web attempting to find the legal papers web template which fits the state and federal specifications you require. US Legal Forms supplies a huge number of legal kinds which are evaluated by experts. You can easily down load or printing the Connecticut Deposit Agreement from your assistance.

If you already possess a US Legal Forms account, you may log in and click the Download key. After that, you may comprehensive, change, printing, or signal the Connecticut Deposit Agreement. Every single legal papers web template you get is your own property eternally. To obtain an additional duplicate of the bought form, check out the My Forms tab and click the corresponding key.

Should you use the US Legal Forms internet site for the first time, adhere to the straightforward directions beneath:

- Initial, ensure that you have selected the proper papers web template to the county/metropolis of your choosing. Read the form explanation to ensure you have chosen the right form. If offered, make use of the Review key to search through the papers web template too.

- If you want to get an additional model in the form, make use of the Research area to obtain the web template that suits you and specifications.

- When you have identified the web template you need, click on Buy now to carry on.

- Choose the costs program you need, key in your qualifications, and sign up for a free account on US Legal Forms.

- Total the purchase. You may use your Visa or Mastercard or PayPal account to pay for the legal form.

- Choose the file format in the papers and down load it in your system.

- Make alterations in your papers if possible. You may comprehensive, change and signal and printing Connecticut Deposit Agreement.

Download and printing a huge number of papers layouts using the US Legal Forms Internet site, that offers the most important assortment of legal kinds. Use expert and condition-distinct layouts to take on your organization or person demands.

Form popularity

FAQ

UniteCT 80% HUD Area Median Income levels for your town. UniteCT provides rental assistance to qualified Connecticut households. The program will financially support households up to 80% HUD Area Median Income (AMI) levels for Connecticut towns.

Things the landlord must do: Follow all health and safety laws so that the building, apartments, and common areas are safe. Common areas include the driveway, yard, halls, and laundry rooms. Make all repairs needed to keep your apartment safe and livable.

Third, security deposits are subject to state and local laws that regulate how they are held, used, and returned, while rent guarantees are governed by the terms of the agreement between the landlord and the guarantor. Fourth, security deposits are usually refundable, while rent guarantees are usually non-refundable.

How Large A Security Deposit Can A Landlord Require? Landlords can't require more than two months rent as a security deposit. This limit is reduced to one month's rent if a tenant is 62 years of age or older.

How to write a security deposit return letter Landlord's name and contact information. Tenant's name and contact information. Date of the letter. Amount of security deposit being returned to the tenant. Breakdown of any deductions made from the security deposit, including an explanation for each deduction.

The Security Deposit Guarantee Program provides a guarantee to landlords of up to two month's rent instead of an actual payment. THIS IS NOT AN ENTITLEMENT PROGRAM. THIS PROGRAM IS CURRENTLY CLOSED, AVAILABLE ONLY TO INDIVIDUALS AND FAMILIES THAT ARE CHRONICALLY HOMELESS AND MEET PROGRAM CRITERIA.

A bank guarantee is an undertaking from a bank or credit union to guarantee payment of the amount to the landlord. The lease will then give the landlord the right to cash in the bank guarantee without your notice or consent, if you breach the lease terms or damage the property.

How Large A Security Deposit Can A Landlord Require? Landlords can't require more than two months rent as a security deposit. This limit is reduced to one month's rent if a tenant is 62 years of age or older.