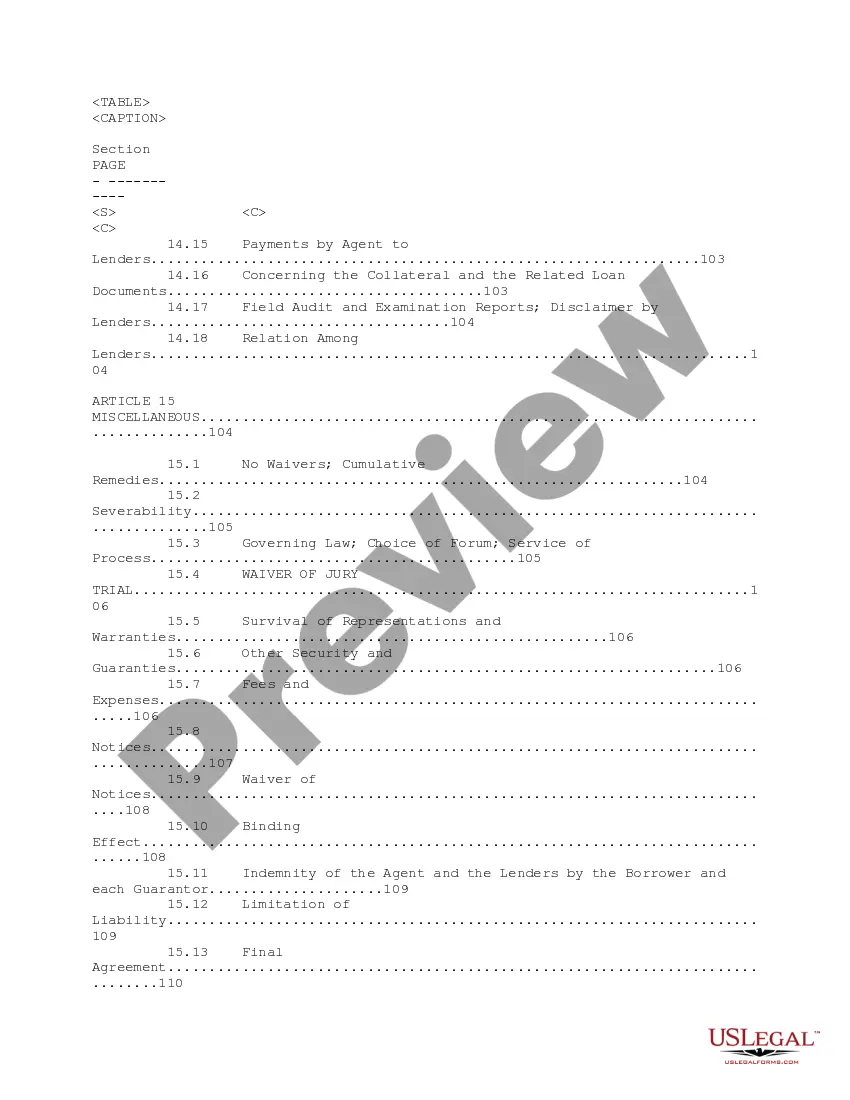

Connecticut Post-Petition Loan and Security Agreement is a legal document that outlines the terms and conditions between various financial institutions and borrowers when providing a revolving line of credit after a bankruptcy petition has been filed in the state of Connecticut. This agreement ensures that the borrower has access to post-petition financing and establishes the security on the loan. Keywords: Connecticut, Post-Petition Loan, Security Agreement, Financial Institutions, revolving line of credit, bankruptcy, borrowers, financing, terms, conditions. Different types of Connecticut Post-Petition Loan and Security Agreements regarding revolving line of credit may include: 1. Connecticut Post-Petition Loan and Security Agreement — Consortium: This type of agreement involves multiple financial institutions collectively providing the revolving line of credit to the borrower. The terms and conditions are shared among the consortium members, and the security on the loan is mutually agreed upon. 2. Connecticut Post-Petition Loan and Security Agreement — Single Lender: In this type of agreement, a single financial institution provides the revolving line of credit to the borrower. The terms and conditions of the loan, as well as the security, are solely determined by the lender. 3. Connecticut Post-Petition Loan and Security Agreement — Parent-Subsidiary: This agreement is executed between a parent company and its subsidiary. The parent company provides the revolving line of credit to support the subsidiary's post-petition financing needs. The terms and conditions, along with the security, are determined by both the parent company and the subsidiary. 4. Connecticut Post-Petition Loan and Security Agreement — Debtor-in-Possession (DIP) Financing: This type of agreement exists when a debtor, who has filed for bankruptcy, seeks financing to continue operations during the bankruptcy proceedings. The revolving line of credit provided by various financial institutions ensures that the debtor-in-possession has access to funds. The terms and conditions, as well as the security, are subject to court approval in this scenario. It is important to note that the specific terms, conditions, and security provisions within each type of Connecticut Post-Petition Loan and Security Agreement may vary depending on the involved parties, financial institutions, and individual circumstances.

Connecticut Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit

Description

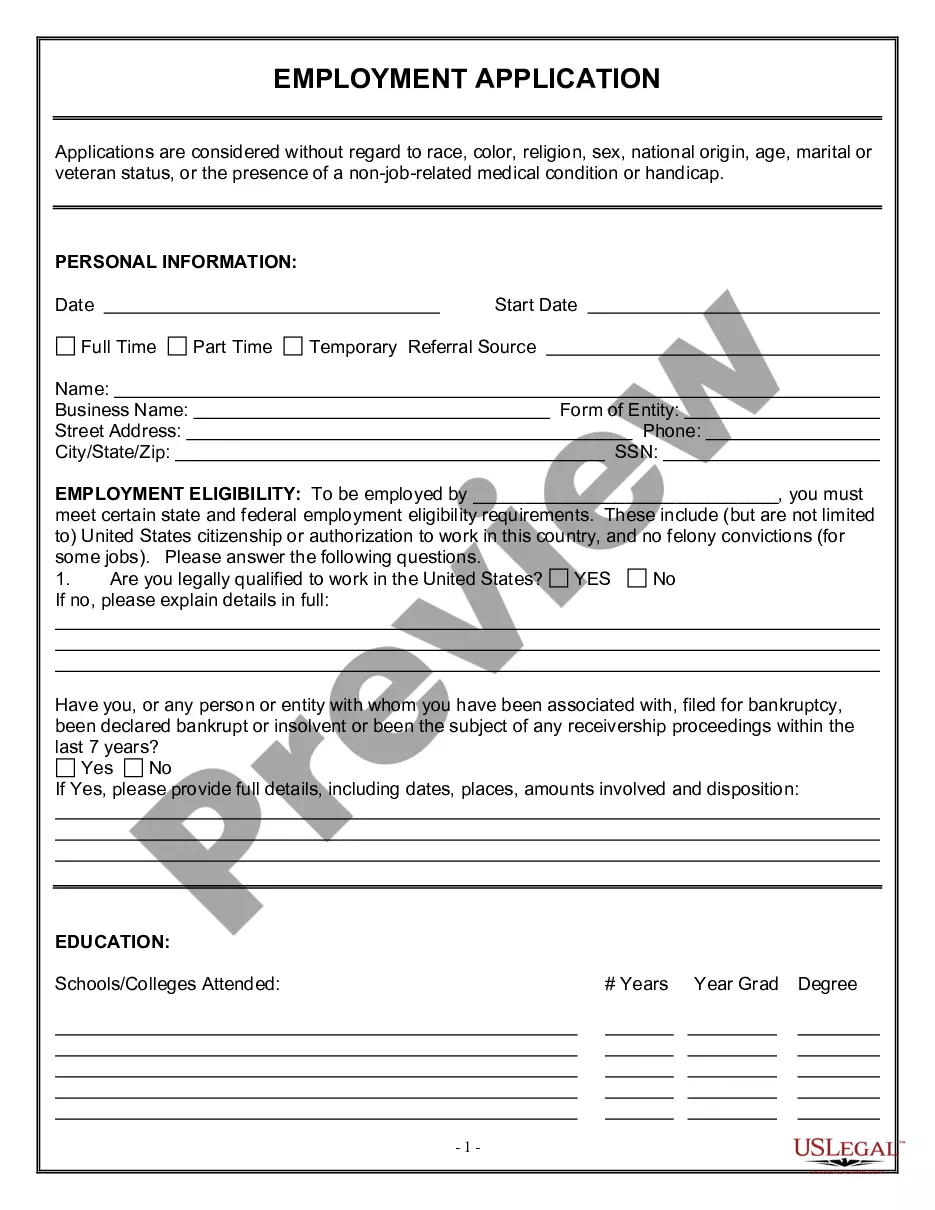

How to fill out Connecticut Post-Petition Loan And Security Agreement Between Various Financial Institutions Regarding Revolving Line Of Credit?

Choosing the best authorized record design can be a struggle. Needless to say, there are tons of themes available on the Internet, but how do you discover the authorized type you require? Use the US Legal Forms internet site. The support offers a large number of themes, like the Connecticut Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit, which can be used for organization and private requirements. Every one of the forms are checked out by specialists and meet up with federal and state requirements.

If you are previously signed up, log in to your bank account and then click the Download switch to find the Connecticut Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit. Make use of your bank account to appear through the authorized forms you have purchased previously. Go to the My Forms tab of your respective bank account and get an additional copy of your record you require.

If you are a fresh consumer of US Legal Forms, listed below are straightforward recommendations that you can comply with:

- Initial, be sure you have chosen the correct type for the metropolis/county. You are able to examine the form using the Review switch and study the form explanation to make certain it will be the right one for you.

- When the type fails to meet up with your preferences, take advantage of the Seach discipline to find the right type.

- Once you are certain that the form is proper, click on the Purchase now switch to find the type.

- Choose the rates program you need and enter the required info. Build your bank account and pay for an order utilizing your PayPal bank account or charge card.

- Opt for the file file format and down load the authorized record design to your product.

- Total, modify and printing and sign the acquired Connecticut Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit.

US Legal Forms will be the largest catalogue of authorized forms in which you can discover a variety of record themes. Use the service to down load expertly-made files that comply with status requirements.

Form popularity

FAQ

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

In both documents, the home loan borrower promises to hand over the title to the property to the lender if the borrower is unable to pay back the loan. This means the mortgage agreement and deed of trust both pledge the property as ?security? or ?collateral? in case the borrower defaults on the loan.

A loan agreement is a formal contract between a borrower and a lender. These counterparties rely on the loan agreement to ensure legal recourse if commitments or obligations are not met. Sections in the contract include loan details, collateral, required reporting, covenants, and default clauses.

Borrowing Agreement means the master borrowing agreement, as amended, entered into between Agent and a Borrower establishing the general terms and conditions governing all Loans to that Borrower.

The Mortgage pledges your home as security for the loan. In some states, the buyer signs a Deed of Trust rather than a mortgage, but both documents serve the same purpose. The Mortgage Note is your promise to repay your loan.

A loan agreement is any written document that memorializes the lending of money. Loan agreements can take several forms. The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed.

The lender This is the person or entity that lends a certain amount of money on credit to an applicant, who is the borrower, who must repay the amount borrowed, plus the interest agreed upon in the contract, within a predetermined time frame.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.