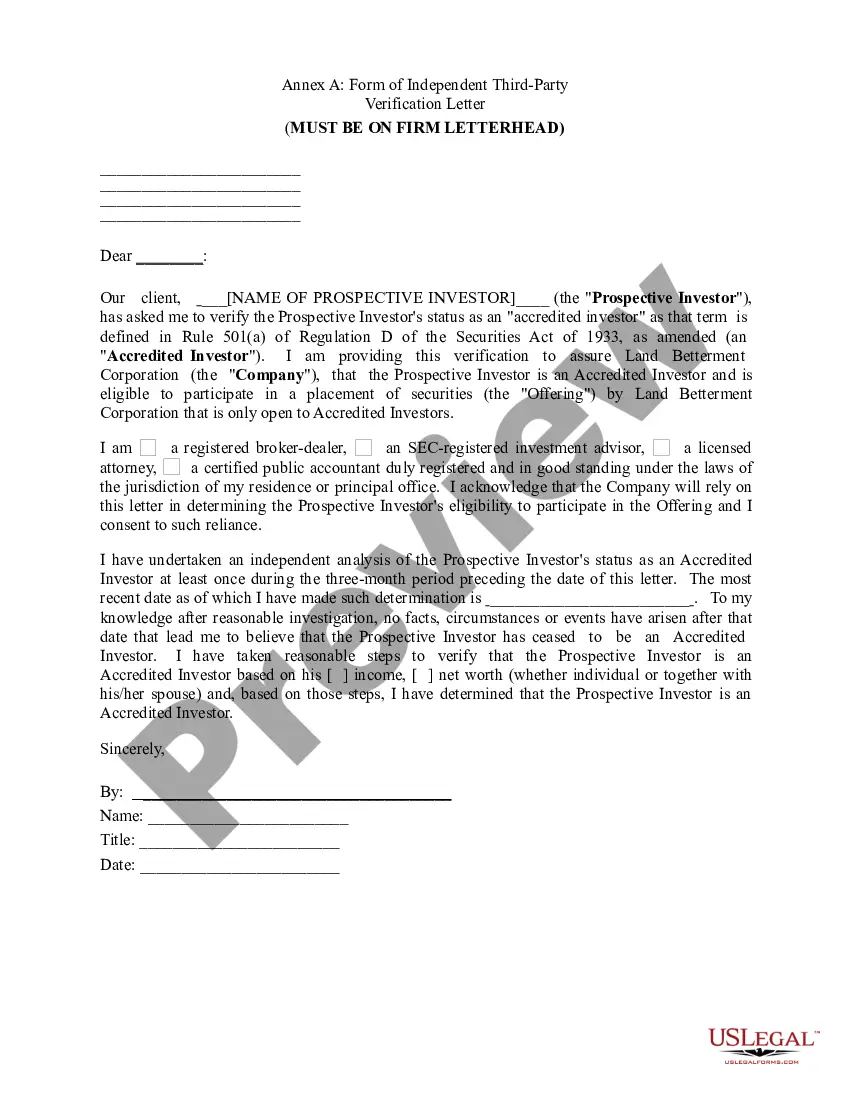

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

Connecticut Accredited Investor Certification Letter is a document used to validate the status of an individual or entity as an accredited investor in the state of Connecticut. This certification letter serves as proof that the recipient meets the eligibility requirements set forth by the Connecticut Department of Banking to participate in certain investment opportunities or securities offerings that are limited to accredited investors. To obtain an Accredited Investor Certification Letter in Connecticut, an individual or entity must meet one of the following criteria: 1. Income Requirement: The certified person should have an annual income of at least $200,000 individually or $300,000 jointly with a spouse, for the past two years, and a reasonable expectation of the same income level in the current year. 2. Net Worth Requirement: The individual's net worth should exceed $1 million (excluding the value of the primary residence). The net worth can be calculated by considering assets such as real estate, cash, investments, and personal property, minus liabilities. 3. Individual Accreditation: Individuals who possess certain professional certifications, licenses, or designations recognized by the Connecticut Department of Banking may also qualify for accredited investor status. Upon meeting the necessary requirements, an individual or entity can request an Accredited Investor Certification Letter from the Connecticut Department of Banking. The letter generally includes the recipient's name, address, contact information, and a formal statement confirming their accredited investor status. This document may be required by investment firms, brokers, or securities issuers to ensure compliance with state regulations and to ascertain the investor's qualification for specific investment opportunities limited to accredited investors. It is important to note that the Connecticut Accredited Investor Certification Letter is valid only in the state of Connecticut and may not hold the same weight or recognition in other jurisdictions or states. Moreover, this certification letter does not provide any guarantees or assurances regarding the financial performance or suitability of specific investment opportunities. Different types of Connecticut Accredited Investor Certification Letters may exist based on the purpose or circumstances of the investor's request. For example, there could be specific certification letters for individual investors, joint investors, or entities such as corporations or partnerships. Despite these potential variations, the fundamental purpose of the certification letter remains consistent — to affirm an individual or entity's accredited investor status in accordance with Connecticut state regulations.