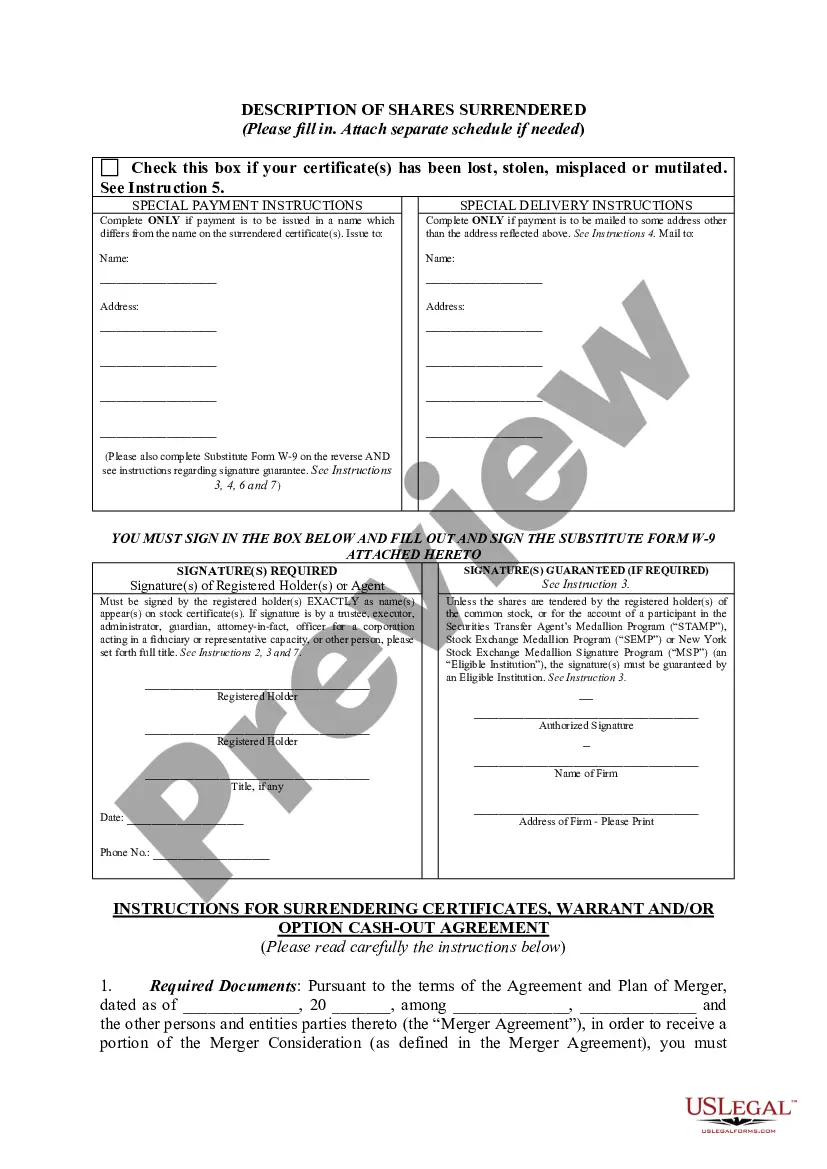

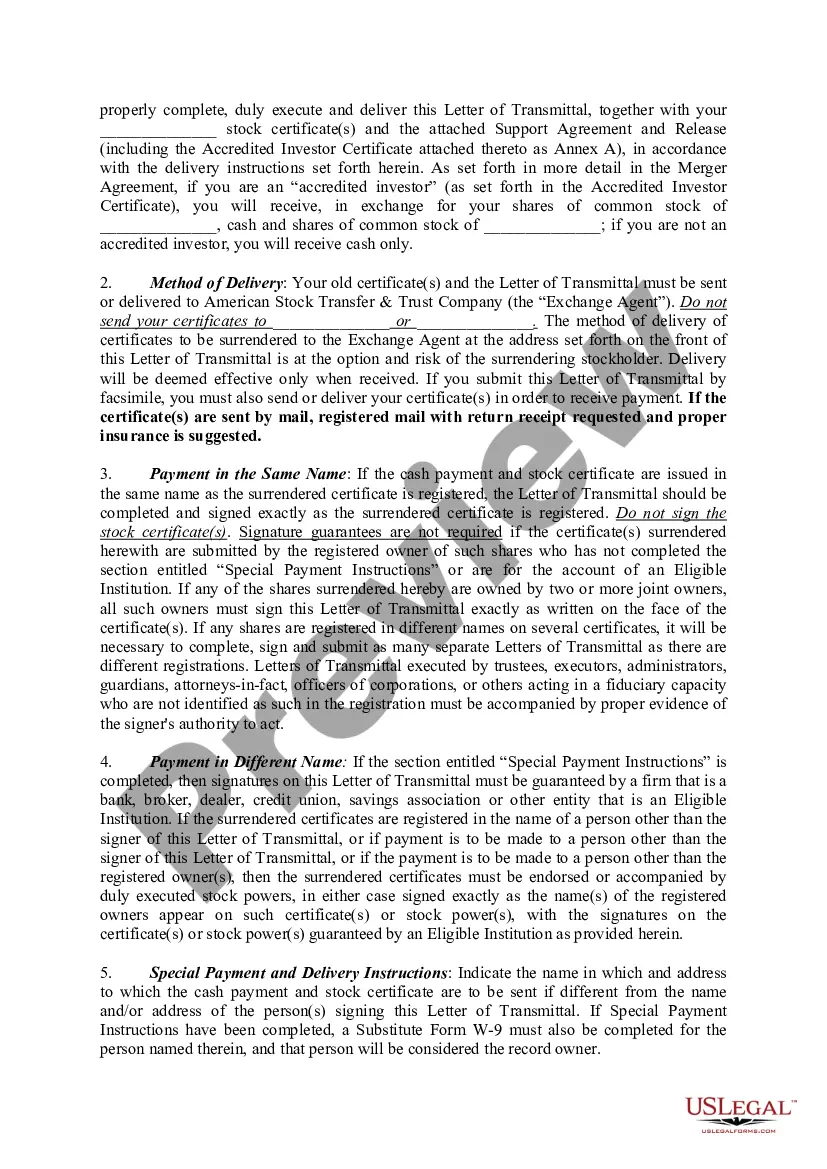

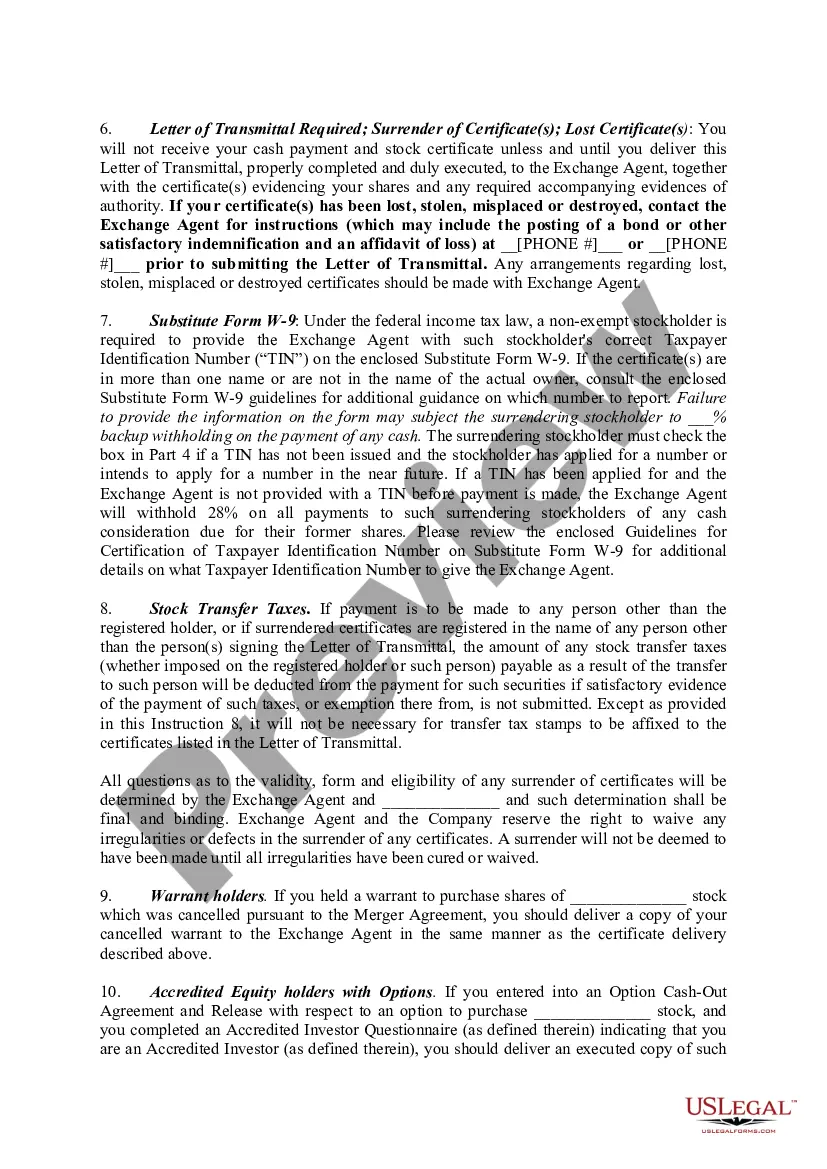

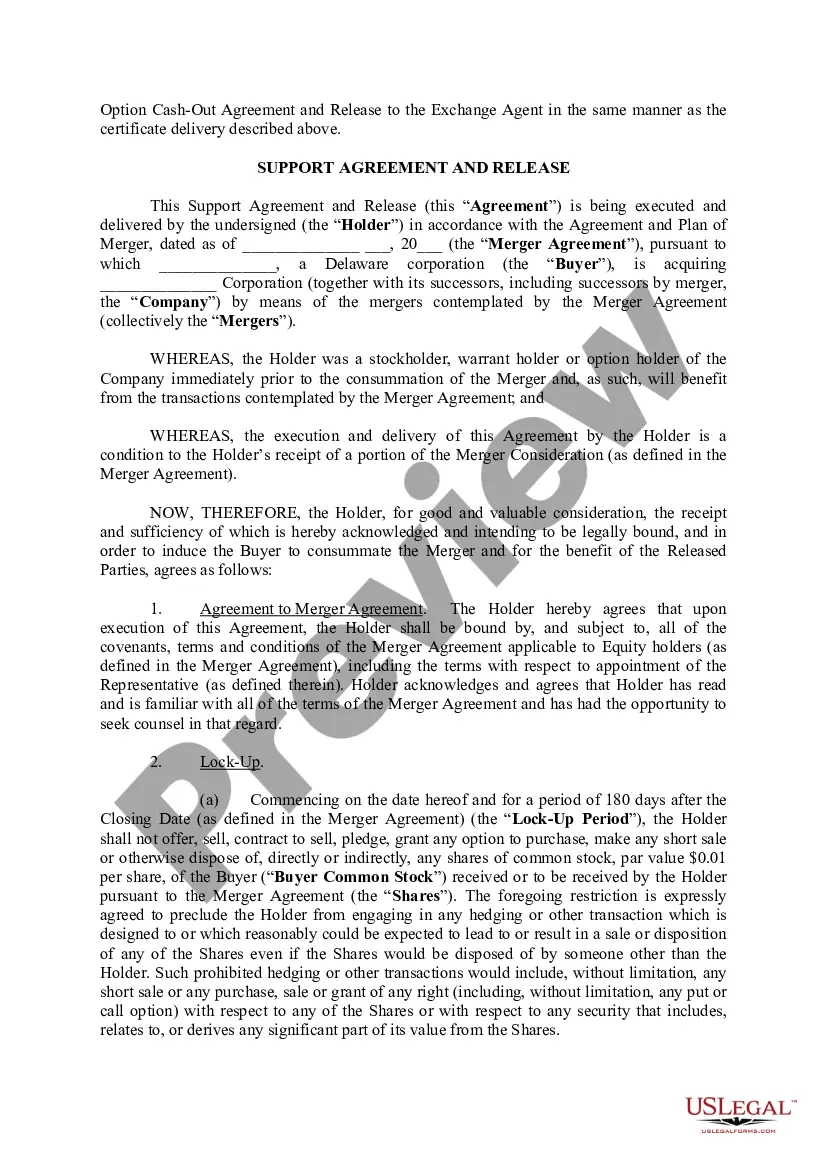

Connecticut Letter of Transmittal to Accompany Certificates of Common Stock is a legal document that facilitates the transfer of common stock certificates between parties. This letter serves as a formal record of the transaction and provides important information related to the transfer process. When preparing a Connecticut Letter of Transmittal to Accompany Certificates of Common Stock, it is essential to include certain keywords and details to ensure its accuracy and validity. Here is a detailed description of the necessary information that should be incorporated into the document: 1. Heading: Start the letter with an appropriate heading, including the company's name, address, and contact information. 2. Date: Provide the exact date when the letter is being issued. 3. Recipient Information: Include the recipient's name, address, and contact details. 4. Introduction: Begin the letter by introducing the purpose and context of the document. Explain that this letter is being submitted to accompany the transfer of common stock certificates. 5. Description of the Stock: Clearly state the name and type of the common stock being transferred, along with any associated symbols or codes. 6. Number of Shares: Specify the number of shares being transferred in numerical form, as well as in written form to avoid any potential confusion. For example, "100 (One Hundred) common stock shares." 7. Certificate Details: Provide a detailed description of the stock certificates accompanying the letter, including their serial numbers, issue dates, and any other relevant identifying information. 8. Letter of Transmittal Purpose: Clearly state that the letter of transmittal serves as a formal request to register and transfer ownership of the specified common stock shares. 9. Required Documents: Outline any additional documents or forms that should be included or attached to the letter, such as a completed stock transfer form or a signature guarantee. 10. Registered Owner Information: Include the name, address, and contact information of the current registered owner of the common stock certificates. 11. New Owner Information: Provide the name, address, and contact information of the intended new owner of the common stock. 12. Authorized Signatures: Include spaces for the current registered owner to sign and date the letter, as well as spaces for any required witness signatures or notarization. 13. Instructions for Delivery: Specify how the common stock certificates should be delivered to the new owner, whether by mail, in person, or through an authorized representative. 14. Contact Information: Reiterate the company's contact information and encourage the recipient to reach out for any questions or concerns. Possible types of Connecticut Letter of Transmittal to Accompany Certificates of Common Stock might include: 1. Dividend Reinvestment Plan (DRIP) Transmittal Letter: Used when transferring common stock certificates as a result of enrolling in a dividend reinvestment plan offered by the company. 2. Inheritance Transmittal Letter: Used when transferring common stock certificates due to the death of a previous owner and the beneficiary asserting their rights. 3. Merger or Acquisition Transmittal Letter: Used when transferring common stock certificates as a result of a merger, acquisition, or other corporate restructuring events. By including the relevant keywords and essential details mentioned above, a Connecticut Letter of Transmittal to Accompany Certificates of Common Stock can accurately document and facilitate the smooth transfer of ownership for common stock certificates.

Connecticut Letter of Transmittal to Accompany Certificates of Common Stock

Description

How to fill out Connecticut Letter Of Transmittal To Accompany Certificates Of Common Stock?

If you wish to complete, obtain, or printing legal document web templates, use US Legal Forms, the biggest variety of legal forms, that can be found online. Utilize the site`s simple and practical look for to obtain the files you will need. A variety of web templates for company and person functions are categorized by groups and says, or key phrases. Use US Legal Forms to obtain the Connecticut Letter of Transmittal to Accompany Certificates of Common Stock in a handful of clicks.

Should you be presently a US Legal Forms customer, log in in your accounts and click on the Download key to get the Connecticut Letter of Transmittal to Accompany Certificates of Common Stock. You may also accessibility forms you previously downloaded within the My Forms tab of your own accounts.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for your correct area/region.

- Step 2. Use the Preview solution to check out the form`s information. Don`t neglect to see the information.

- Step 3. Should you be unsatisfied with all the type, utilize the Search field on top of the display to get other versions of the legal type design.

- Step 4. Once you have identified the form you will need, click the Buy now key. Opt for the pricing strategy you like and put your credentials to sign up to have an accounts.

- Step 5. Approach the transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to accomplish the transaction.

- Step 6. Select the structure of the legal type and obtain it on your product.

- Step 7. Complete, change and printing or sign the Connecticut Letter of Transmittal to Accompany Certificates of Common Stock.

Each and every legal document design you purchase is the one you have forever. You have acces to every single type you downloaded with your acccount. Go through the My Forms segment and choose a type to printing or obtain yet again.

Compete and obtain, and printing the Connecticut Letter of Transmittal to Accompany Certificates of Common Stock with US Legal Forms. There are millions of specialist and status-specific forms you can use for your company or person requirements.

Form popularity

FAQ

In the Stock Transfer Ledger, the names of the shareholders can be listed along with important information such as their places of residence, the time that they gained ownership within the corporation, the number of shares issued, the amount paid for the shares, and the stock certificate number that was distributed (if ... Sample Stock Transfer Ledger | Harvard Business Services Harvard Business Services ? blog ? sample-stock-tr... Harvard Business Services ? blog ? sample-stock-tr...

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal.

In order to cash in the stock, you need to fill out the transfer form on the back of the certificate and have it notarized. Once complete, send the notarized certificate to the transfer agent, who will register the stock to you as owner.

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal. Using stock certificates to help your business grow | .com ? articles ? using-stock-certif... .com ? articles ? using-stock-certif...

How to complete a stock transfer form in 10 Steps 1 Consideration money. ... 2 Full name of Undertaking. ... 3 Full description of Security. ... 4 Number or amount of Shares, Stock or other security. ... 5 Name(s) and address of registered holder(s) ... 6 Signature(s) ... 7 Name(s) and address of person(s) receiving the shares. Stock transfer form J30 template and guide - Inform Direct informdirect.co.uk ? shares ? how-to-compl... informdirect.co.uk ? shares ? how-to-compl...

Key information on a share certificate includes: Certificate number. Company name and registration number. Shareholder name and address. Number of shares owned. Class of shares. Issue date of shares. Amount paid (or treated as paid) on the shares. Share Certificate: Definition, How They Work, and Key Information investopedia.com ? terms ? share-certificate investopedia.com ? terms ? share-certificate

Follow these four steps to help you write an effective transmittal letter: Include the basic header information. Include the basic information at the top left of the corner of the letter. ... Include a greeting. ... Write the body of the transmittal letter. ... End the letter with a brief concluding paragraph.

What is a Letter of Transmittal? A Letter of Transmittal is a form generally used for an exchange of stock and/or cash payment.