Connecticut Qualified Investor Certification Application

Description

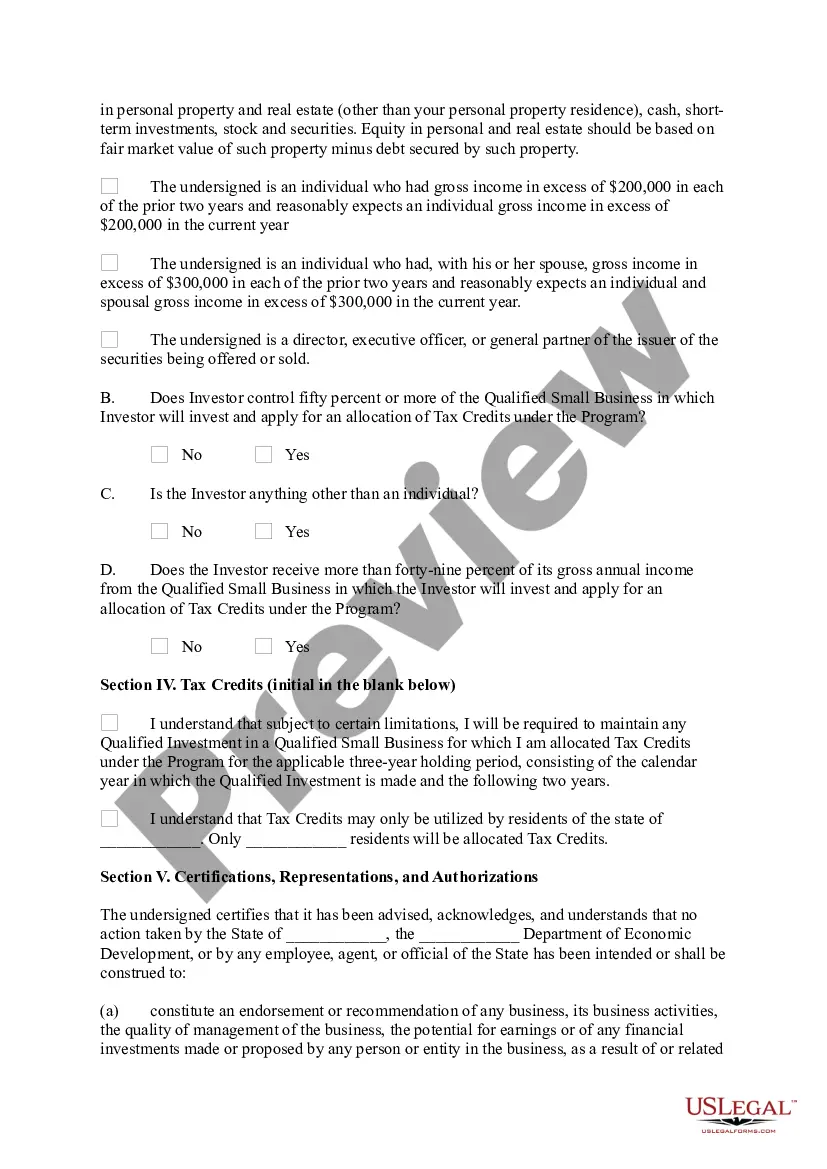

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims."

How to fill out Qualified Investor Certification Application?

Have you been in a placement the place you need to have documents for sometimes organization or specific purposes almost every day time? There are a variety of authorized document layouts available online, but getting ones you can rely is not easy. US Legal Forms gives thousands of type layouts, just like the Connecticut Qualified Investor Certification Application, which are composed to meet state and federal demands.

When you are presently informed about US Legal Forms web site and get a free account, just log in. Afterward, you can obtain the Connecticut Qualified Investor Certification Application design.

Unless you have an accounts and would like to start using US Legal Forms, adopt these measures:

- Discover the type you require and ensure it is to the appropriate city/area.

- Make use of the Preview key to review the shape.

- Browse the information to actually have selected the right type.

- When the type is not what you are searching for, make use of the Look for area to get the type that suits you and demands.

- If you discover the appropriate type, click on Buy now.

- Select the rates plan you would like, fill out the required info to generate your money, and purchase an order using your PayPal or bank card.

- Decide on a hassle-free file file format and obtain your duplicate.

Find each of the document layouts you have bought in the My Forms menus. You can get a additional duplicate of Connecticut Qualified Investor Certification Application at any time, if necessary. Just select the required type to obtain or print the document design.

Use US Legal Forms, one of the most extensive collection of authorized types, to conserve efforts and avoid errors. The assistance gives professionally made authorized document layouts that you can use for a selection of purposes. Generate a free account on US Legal Forms and start making your life easier.

Form popularity

FAQ

The most common tax benefit for angel investors - QSBS There is also a tax benefit for investors who buy qualified small business stock (QSBS) which can help investors shield up to $10 million in capital gains in some circumstances. You can read more about QSBS here. Is angel investing tax deductible? - Kruze Consulting Kruze Consulting ? Blog Kruze Consulting ? Blog

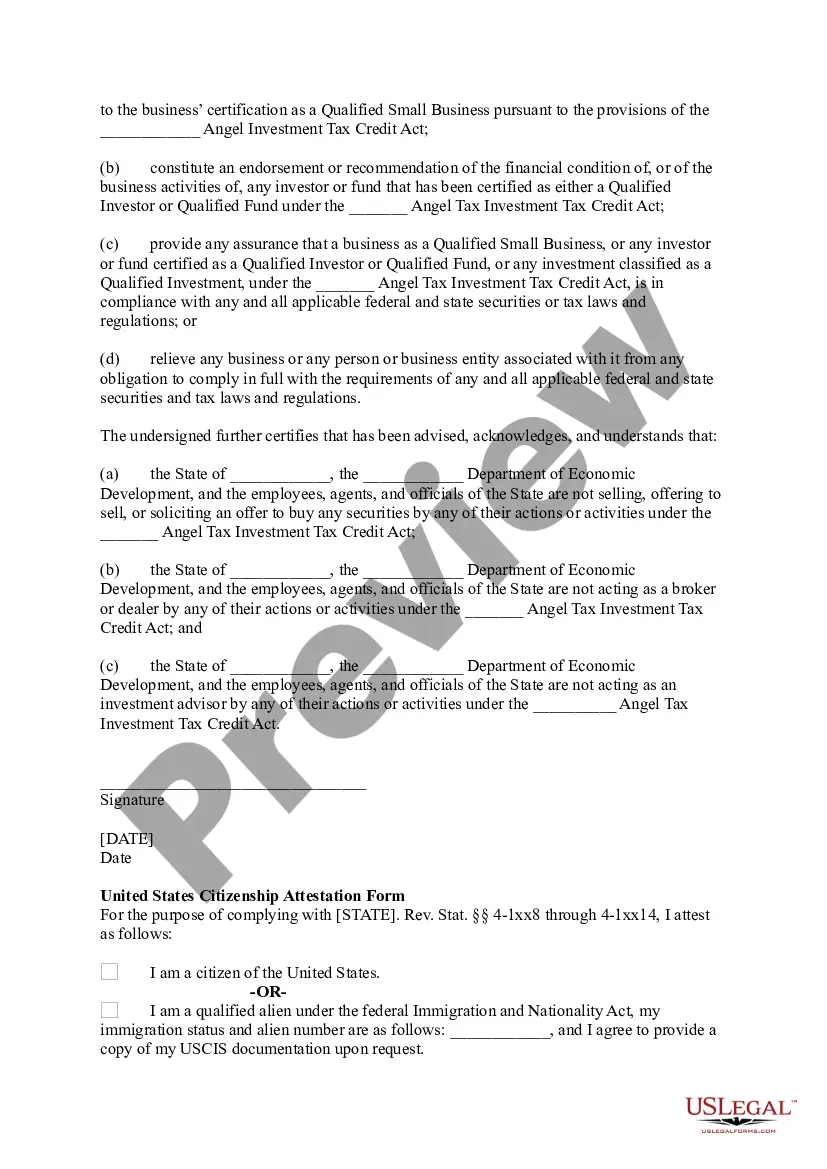

Generally, any person who, for compensation, engages in the business of advising others, either directly or through publications or writings, as to the value of securities or the advisability of investing in, purchasing or selling securities must register as an "investment adviser" with the Connecticut Department of ...

The Angel Investor Tax Credit is: Equal to 25% of an investor's equity investment. Refundable to investors who file personal net income tax. Not refundable for investors filing corporate income tax, franchise tax, taxes on gross premiums or moneys and credits taxes.

Eligible technologies include solar thermal process heat, solar thermal electric, solar water heat, solar space heat, fuel cells, geothermal direct use, biomass, wind, geothermal heat pumps, and others. When & How to Use Investment Tax Credits | The Hartford thehartford.com ? business-tax-credits ? inv... thehartford.com ? business-tax-credits ? inv...

Administered through Connecticut Innovations, this program provides qualified investors with a 25% credit against Connecticut's state income tax when they invest at least $25,000 in qualifying businesses. (See list of those business here.)

Certified Financial Planner (CFP) ? Hold a bachelor's degree, plus 3 years experience. Personal Financial Specialist (PFS) ? Have 75 hours personal financial planning education; also, hold a CPA, which requires a degree, plus 2 years experience.

What is Angel Tax Incentive? Angel Tax Incentive is a new initiative approved by the Government to encourage more early stage investments by the private sector. This incentive hopes to reduce the risks usually associated with early stage investments by giving back in the form of tax exemption to the investors. Angel Tax Incentive - Cradle Fund - Creating ? Leading ? Startups cradle.com.my ? grants ? angel-tax-incentive cradle.com.my ? grants ? angel-tax-incentive

The Angel Investment Tax Credit is a refundable income tax credit meant to encourage investment in small businesses located primarily in Minnesota and in certain industries. Angel Investment Tax Credit | Minnesota Department of ... Minnesota Department of Revenue ? angel-investment-ta... Minnesota Department of Revenue ? angel-investment-ta...