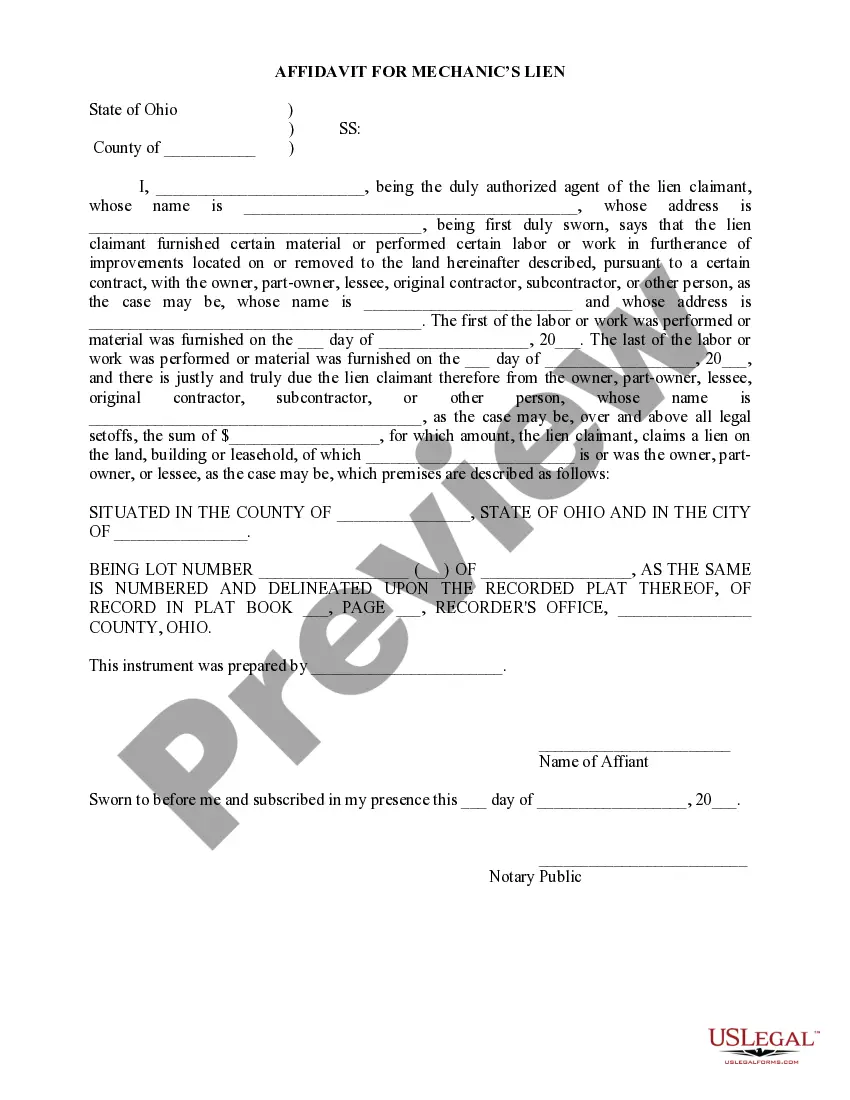

Connecticut Term Sheet — Series Seed Preferred Share for Company is a legally binding agreement commonly used in venture capital financing to outline the terms and conditions for preferred stock investment by investors in a startup or early-stage company based in Connecticut. This term sheet serves as a framework for negotiations between the company and potential investors, setting the stage for a detailed agreement between both parties. Keywords: Connecticut, term sheet, Series Seed, preferred share, company, venture capital financing, startup, early-stage, investors, agreement. In Connecticut, there are different types of term sheets based on investor preferences and the specific needs of the company. Some of these variations include the following: 1. Standard Connecticut Term Sheet — Series Seed Preferred Share: This type of term sheet covers the basic elements of the investment agreement, including the security and structure of preferred shares, investment amount, and valuation of the company. Other key terms may include liquidation preferences, conversion rights, anti-dilution provisions, board representation, and protective provisions. 2. Connecticut Term Sheet — Series Seed Preferred Share witProrateta Rights: This term sheet includes provisions granting investors the right to participate in future fundraising rounds in order to maintain their ownership percentage. Pro rata rights ensure that investors have an opportunity to maintain their equity position in subsequent financing rounds without being diluted by new investors. 3. Connecticut Term Sheet — Series Seed Preferred Share with Board Observer Rights: In this variation of the term sheet, investors are given the right to appoint a non-voting observer to the company's board of directors. This allows the investor to have greater visibility into the company's operations and decision-making processes without having voting rights. 4. Connecticut Term Sheet — Series Seed Preferred Share with Vesting Schedule: This type of term sheet incorporates provisions that establish a vesting schedule for founders and key employees. Vesting refers to the gradual earning of ownership rights over a specific period. It ensures that founders and key employees stay committed to the company and aligns their interests with those of the investors. 5. Connecticut Term Sheet — Series Seed Preferred Share with Drag-Along Rights: Drag-along rights enable the majority shareholders, typically investors, to compel the minority shareholders to participate in a sale or exit of the company. This provision protects investors' interests by ensuring that they can exit the investment if an attractive opportunity arises, even if some minority shareholders might not be willing to sell. It is important to note that the specific terms and provisions of a Connecticut Term Sheet — Series Seed Preferred Share for Company can vary based on the negotiations between the investors and the company. Customization is common to meet the unique needs and circumstances of each particular investment opportunity.

Connecticut Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Connecticut Term Sheet - Series Seed Preferred Share For Company?

US Legal Forms - one of several greatest libraries of legitimate forms in America - provides an array of legitimate papers layouts you may download or produce. Using the web site, you can find a huge number of forms for business and person functions, sorted by categories, claims, or key phrases.You will find the most up-to-date models of forms like the Connecticut Term Sheet - Series Seed Preferred Share for Company in seconds.

If you already possess a registration, log in and download Connecticut Term Sheet - Series Seed Preferred Share for Company through the US Legal Forms library. The Download switch will appear on each and every develop you see. You have accessibility to all in the past downloaded forms inside the My Forms tab of your own profile.

In order to use US Legal Forms the very first time, here are easy directions to obtain began:

- Be sure you have picked out the proper develop for your town/region. Go through the Preview switch to examine the form`s articles. Browse the develop information to ensure that you have chosen the proper develop.

- In the event the develop doesn`t fit your specifications, make use of the Research area on top of the screen to get the one which does.

- In case you are pleased with the shape, confirm your decision by clicking on the Buy now switch. Then, select the pricing program you favor and provide your credentials to register on an profile.

- Procedure the purchase. Use your Visa or Mastercard or PayPal profile to accomplish the purchase.

- Pick the format and download the shape on your own system.

- Make modifications. Complete, edit and produce and signal the downloaded Connecticut Term Sheet - Series Seed Preferred Share for Company.

Every single web template you added to your money does not have an expiration date and is also your own property permanently. So, if you want to download or produce an additional version, just visit the My Forms portion and click on around the develop you will need.

Gain access to the Connecticut Term Sheet - Series Seed Preferred Share for Company with US Legal Forms, the most substantial library of legitimate papers layouts. Use a huge number of professional and express-particular layouts that fulfill your company or person demands and specifications.