Connecticut Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

How to fill out Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

Are you inside a placement that you will need papers for either business or specific functions nearly every time? There are a lot of legal file themes accessible on the Internet, but finding types you can rely on is not effortless. US Legal Forms offers thousands of develop themes, just like the Connecticut Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on, that happen to be created to satisfy federal and state specifications.

Should you be currently knowledgeable about US Legal Forms internet site and get your account, just log in. Afterward, you may download the Connecticut Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on template.

Should you not have an bank account and need to begin to use US Legal Forms, follow these steps:

- Discover the develop you require and ensure it is for that correct town/region.

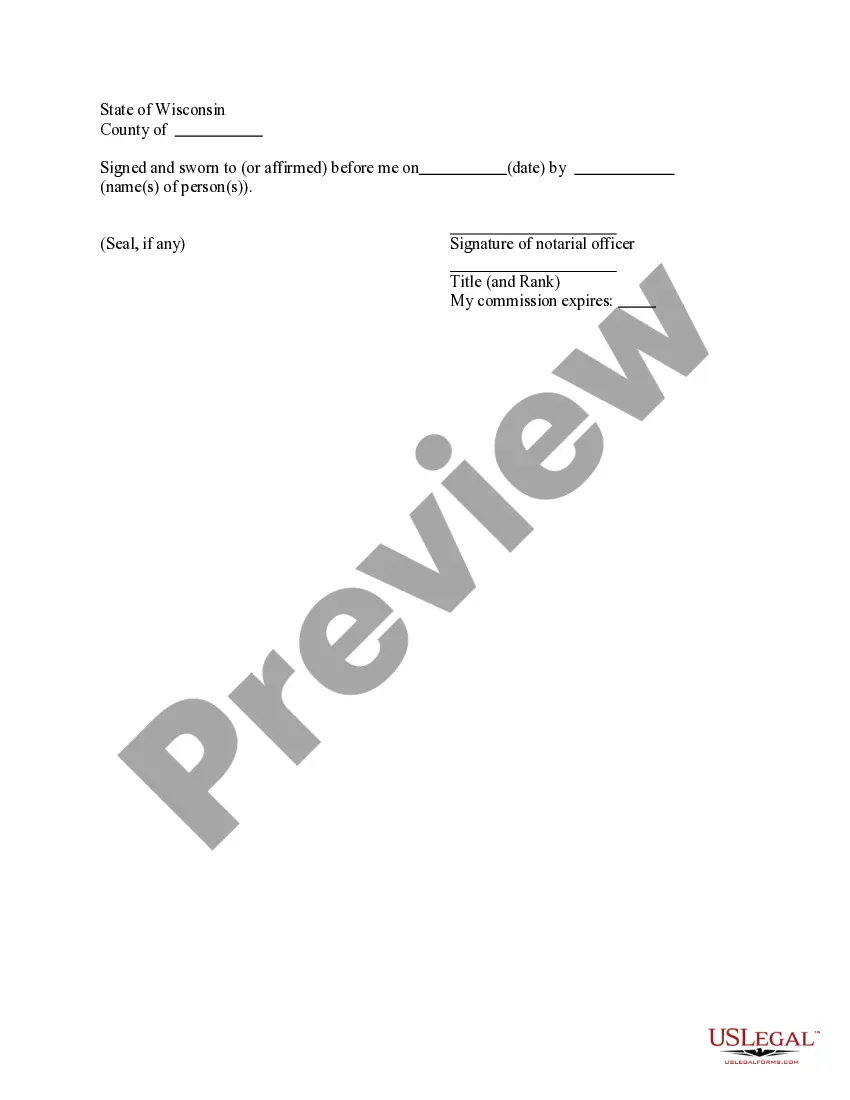

- Make use of the Preview switch to check the form.

- Read the explanation to actually have selected the right develop.

- In case the develop is not what you are seeking, take advantage of the Look for field to get the develop that fits your needs and specifications.

- Whenever you get the correct develop, click Buy now.

- Choose the prices program you need, submit the necessary details to generate your money, and pay money for an order utilizing your PayPal or charge card.

- Decide on a hassle-free document format and download your version.

Find every one of the file themes you might have purchased in the My Forms menus. You can obtain a extra version of Connecticut Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on whenever, if required. Just select the necessary develop to download or produce the file template.

Use US Legal Forms, probably the most comprehensive selection of legal varieties, to save lots of time and steer clear of blunders. The assistance offers skillfully made legal file themes that can be used for a selection of functions. Make your account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

Connecticut Practice Book, Rules of Professional Conduct, Rule 1.15. The Rules of Professional Conduct, Rule 1.15 Safekeeping Property, provides lawyers with a framework for handling their clients' funds. Attorneys are responsible for maintaining and monitoring their clients' trust accounts properly.

(d) A lawyer shall not practice with or in the form of a professional corporation or association authorized to practice law for a profit, if: (1) a nonlawyer owns any interest therein, except that a fiduciary representative of the estate of a lawyer may hold the stock or interest of the lawyer for a reasonable time ...

Rule 5.5(f) of the Rules of Professional Conduct requires non-admitted lawyers who wish to appear in this state to provide legal services in certain matters to give notice to the statewide bar counsel prior to and at the conclusion of the representation and to pay a fee. 2.

Rule 1.10 - Imputation of Conflicts of Interest: General Rule (a) While lawyers are associated in a firm, none of them shall knowingly represent a client when any one of them practicing alone would be prohibited from doing so by Rules 1.7, 1.8(c), or 1.9, unless the prohibition is based on a personal interest of the ...

Rule 7.1. A lawyer shall not make a false or misleading communication about the lawyer or the lawyer's services. A communication is false or misleading if it contains a material misrepresentation of fact or law, or omits a fact necessary to make the statement considered as a whole not materially misleading.

Rule 4.2 of the Rules of Professional Conduct provides that ?[i]n representing a client, a lawyer shall not communicate about the subject of the representation with a party the lawyer knows to be represented by another lawyer in the matter, unless the lawyer has the consent of the other lawyer or is authorized by law ...