Connecticut First Meeting Minutes of Shareholders

Description

How to fill out First Meeting Minutes Of Shareholders?

You may commit hrs on the web looking for the lawful record design that fits the federal and state specifications you want. US Legal Forms supplies a huge number of lawful forms which can be examined by experts. You can actually down load or print the Connecticut First Meeting Minutes of Shareholders from our assistance.

If you already possess a US Legal Forms bank account, you can log in and click on the Down load switch. Following that, you can total, revise, print, or indication the Connecticut First Meeting Minutes of Shareholders. Every lawful record design you purchase is yours eternally. To obtain another backup for any acquired kind, visit the My Forms tab and click on the corresponding switch.

If you work with the US Legal Forms site the very first time, stick to the straightforward directions under:

- Initially, be sure that you have chosen the correct record design for the region/metropolis that you pick. See the kind explanation to make sure you have selected the proper kind. If offered, utilize the Review switch to check with the record design at the same time.

- In order to find another edition of the kind, utilize the Look for area to get the design that meets your requirements and specifications.

- When you have located the design you need, click Get now to continue.

- Choose the costs prepare you need, enter your references, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You may use your credit card or PayPal bank account to cover the lawful kind.

- Choose the format of the record and down load it for your system.

- Make modifications for your record if possible. You may total, revise and indication and print Connecticut First Meeting Minutes of Shareholders.

Down load and print a huge number of record templates making use of the US Legal Forms Internet site, which offers the most important collection of lawful forms. Use specialist and status-particular templates to deal with your organization or person requires.

Form popularity

FAQ

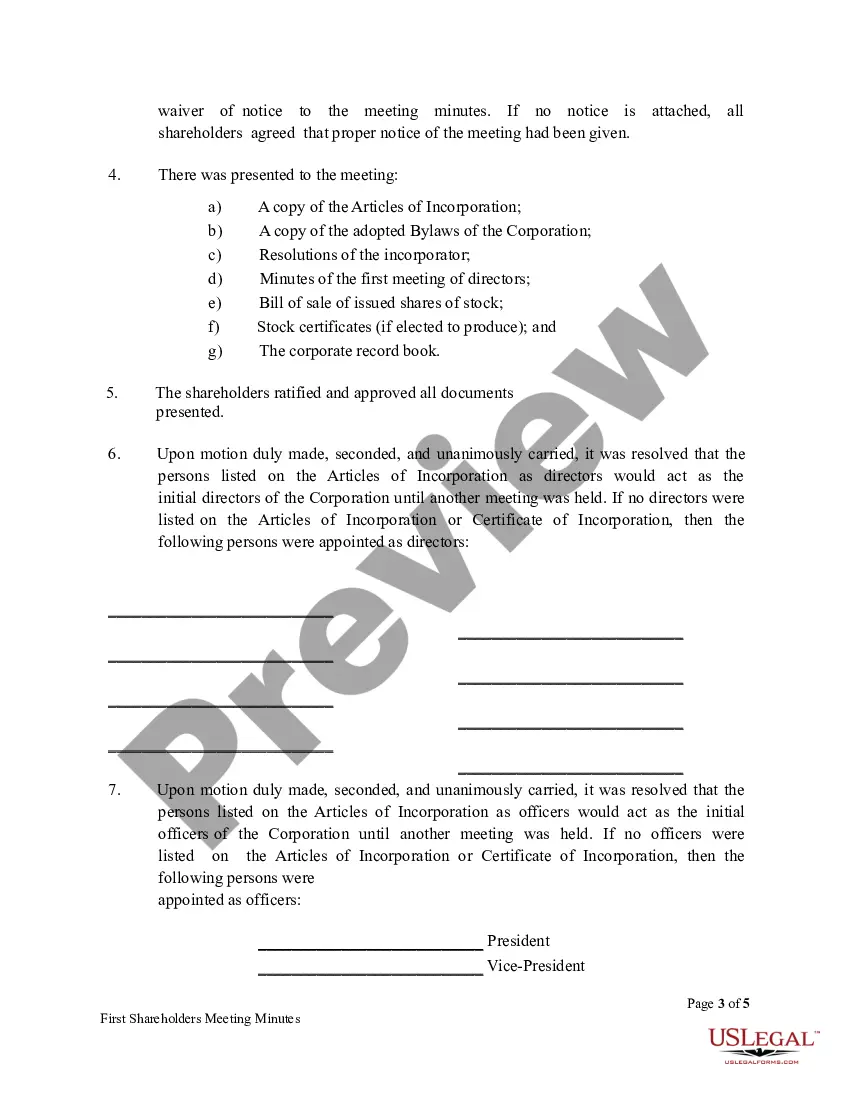

One of the most important topics that a first shareholder meeting goes over is the issuance of shares. The value of shares is agreed upon, the value of any assets being exchanged for shares is agreed upon, and and shareholders are issued shares with a bill of sale or certificate of stock.

How to write meeting minutes reports Make an outline. Prior to the meeting, create an outline by picking or designing a template. ... Include factual information. ... Write down the purpose. ... Record decisions made. ... Add details for the next meeting. ... Be concise. ... Consider recording. ... Edit and proofread.

As for content, in general, your S corporation's meeting minutes should contain the following information: date and place of the meeting. who was present and who was absent from the meeting. details about the matters discussed at the meeting. results of votes taken, if any.

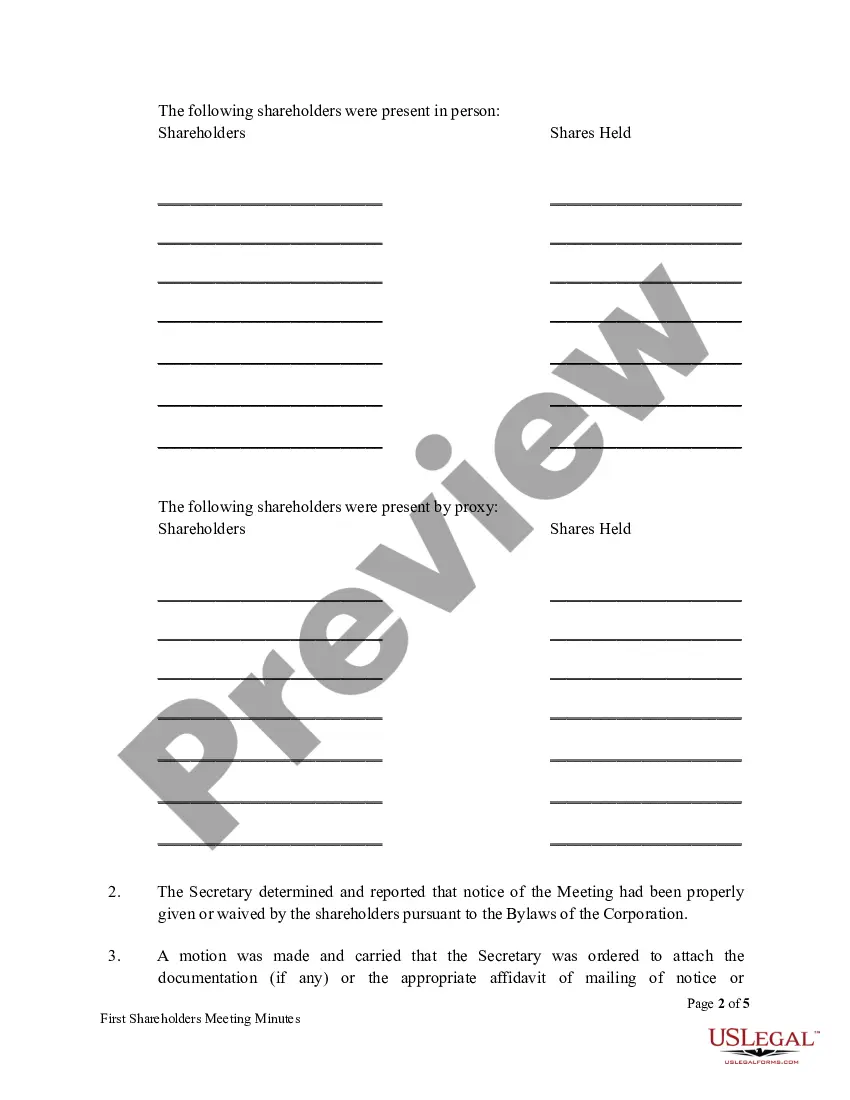

Taking Attendance Prepare a list of shareholders who were present and those who were not present. Take a roll call of all shareholders present in the meeting. Record the names and signatures of the shareholders present in the meeting. Ask for proxies for any shareholders who are not present.

Board of Directors (or ?the Board?) and shareholder minutes and written consents are your official, legal records of what was discussed at Board and shareholder meetings and of their decisions.

What should board of directors first meeting minutes include? Your corporation's first directors meeting typically focuses on initial organizational tasks, including electing officers, setting their salaries, resolving to open a bank account, and ratifying bylaws and actions of the incorporators.

What should be recorded in meeting minutes? The minutes should include corporation details like the name of the corporation and the names of the chairperson and secretary of the meeting. The meeting place and time should also be found somewhere in the minutes, along with the names of the shareholders.