Connecticut Clerical Staff Agreement - Self-Employed Independent Contractor

Description

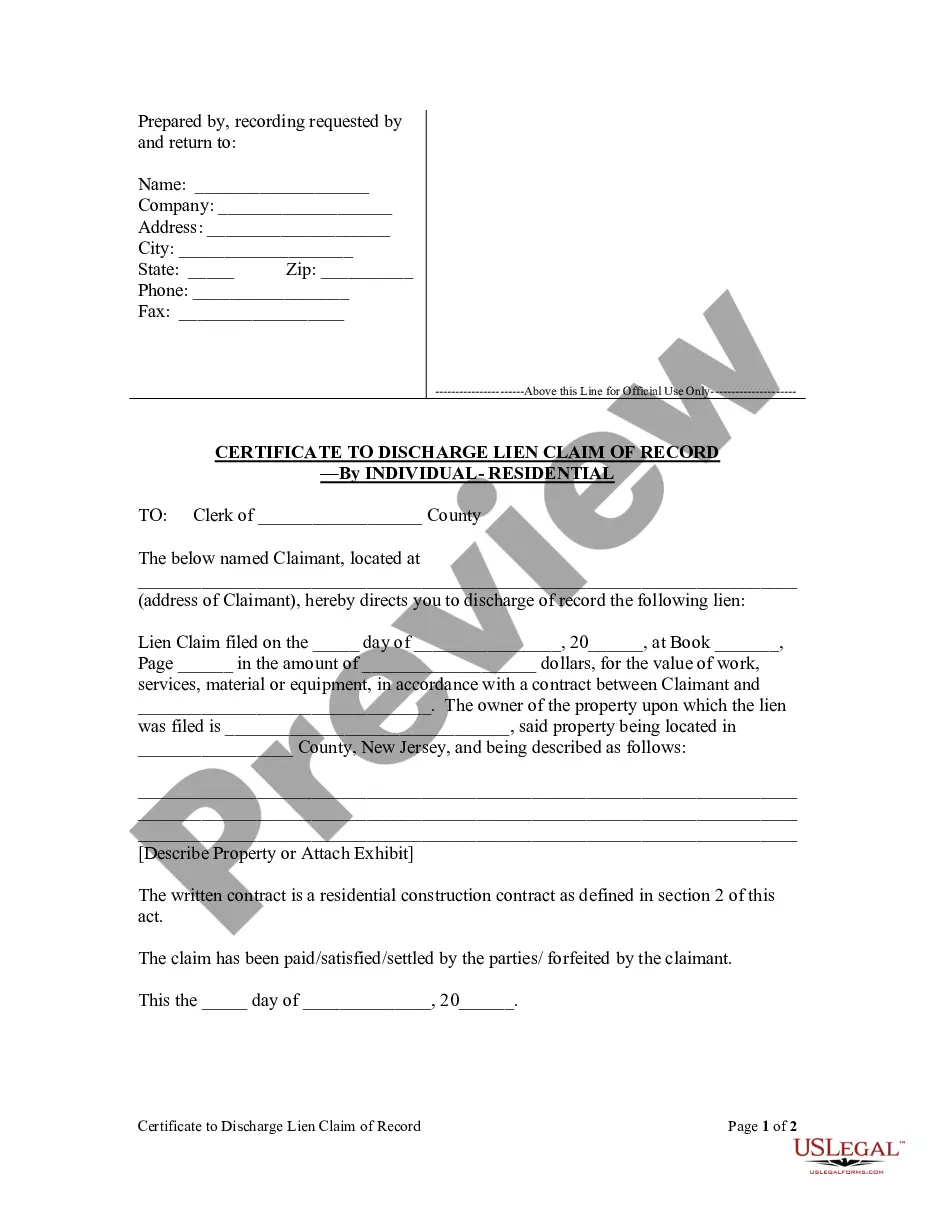

How to fill out Connecticut Clerical Staff Agreement - Self-Employed Independent Contractor?

If you need to complete, obtain, or print out authorized file templates, use US Legal Forms, the biggest collection of authorized forms, that can be found on-line. Take advantage of the site`s easy and handy lookup to find the papers you want. Numerous templates for company and person functions are sorted by categories and claims, or key phrases. Use US Legal Forms to find the Connecticut Clerical Staff Agreement - Self-Employed Independent Contractor in just a number of mouse clicks.

In case you are already a US Legal Forms customer, log in for your account and click the Obtain switch to obtain the Connecticut Clerical Staff Agreement - Self-Employed Independent Contractor. You can even accessibility forms you formerly saved inside the My Forms tab of your account.

If you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape to the proper city/region.

- Step 2. Use the Preview method to look through the form`s articles. Don`t neglect to read the outline.

- Step 3. In case you are unsatisfied with the type, use the Research field on top of the display screen to get other models of the authorized type design.

- Step 4. After you have discovered the shape you want, select the Buy now switch. Select the prices prepare you prefer and add your references to register for the account.

- Step 5. Approach the purchase. You can utilize your credit card or PayPal account to perform the purchase.

- Step 6. Pick the formatting of the authorized type and obtain it on the device.

- Step 7. Comprehensive, change and print out or sign the Connecticut Clerical Staff Agreement - Self-Employed Independent Contractor.

Each authorized file design you purchase is your own property permanently. You may have acces to each and every type you saved within your acccount. Go through the My Forms area and pick a type to print out or obtain once more.

Remain competitive and obtain, and print out the Connecticut Clerical Staff Agreement - Self-Employed Independent Contractor with US Legal Forms. There are many expert and express-distinct forms you can utilize for your personal company or person requires.

Form popularity

FAQ

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

Self-employed people earn a living by working for themselves, not as employees of someone else or as owners (shareholders) of a corporation.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Step 3: Last Employer Self-employed individuals may enter "self-employed" for the last employer's name and include his/her own address and contact information in lieu of the "last employer's address and contact information."

As a freelancer, you also have to manage invoicing and following up on payments. When you work as an independent contractor, you work on an hourly or project-based rate that may vary from client to client or job to job. If you work independently, you have control over setting and negotiating your rates.